RESIDENTIAL MARKET UPDATE

Industry & Market Highlights

Is coronavirus about to prompt a house price crash?

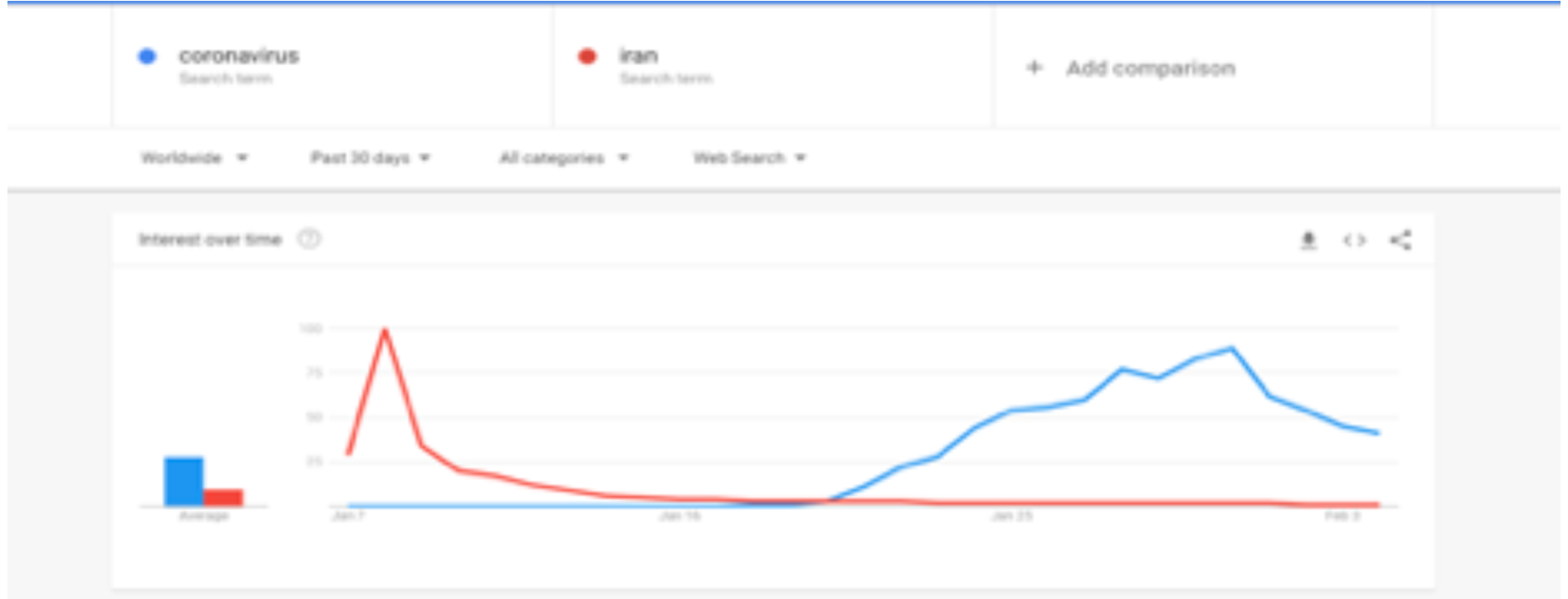

The impact of the COVID-19 coronavirus outbreak is being felt across the world, but what will it do to Canada’s housing market?”

The short answer, of course, is that no one really knows, but the latest assessment of the housing market by RBC Economics suggests that things are about to get rocky.

Senior economist Robert Hogue said that the “light was on” in the housing market in February but that it is “about to be turned off.”

“The world has changed in March,” he wrote in the RBC Monthly Housing Market Update. “And so has the outlook for the Canadian housing market.”

Hogue said that fears of the spread and social distancing are set to decimate house viewings and buyers are likely to take a wait-and-see approach.

Then there’s the impact that Canadians’ investments have suffered from falling asset values. Hogue notes that some homebuyers would be relying on these investments to fund their down payment.

Despite mortgage rates remaining low, especially following recent interest rate cuts and the potential for more, consumer confidence is likely to outrank them.

Sales plunge but what about prices?

Hogue’s outlook is that home sales will plunge in the coming weeks before a rebound at some (undeterminable) point.

But he expects home values nationally to be resilient with tight supply in many markets providing a cushion against correction.

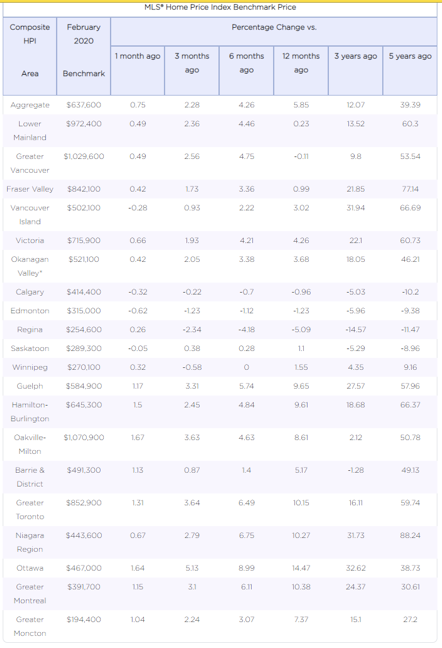

For Toronto, Vancouver, Ottawa, and Montreal, recent price escalations are predicted to cool but there could be tougher conditions for the Prairies where market conditions are softer and the oil price fall will be a further blow. By Steve Randall.

Shock move by Fed over the weekend

For the second time this month, the Federal Reserve cited the deleterious impact created by the coronavirus in announcing a surprise cut to the US federal funds rate, lowering it to a range of 0% to 0.25%.

“The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,” said the central bank’s policymaking Federal Open Market Committee (FOMC) in a statement. “Global financial conditions have also been significantly affected.”

Although the Fed insisted the national economy “came into this challenging period on a strong footing” and the job market remained strong, it also observed that “business fixed investment and exports remained weak” while the energy sector “has come under stress,” ultimately concluding that the “effects of the coronavirus will weigh on economic activity in the near term and pose risks to the economic outlook.”

The Fed is also expected to purchase up to $500 billion in Treasury securities and $200 billion in mortgage-backed securities, returning to the policy of quantitative easing. The FOMC was near-unanimous, with only Cleveland Fed CEO Loretta J. Mester opposing the rate cut.

Mike Fratantoni, senior vice president and chief economist for the Mortgage Brokers Association (MBA), welcomed the announcement and predicted that it will help strengthen the housing market.

“By the end of last week, markets across the board were showing increasing signs of stress, with unprecedented volatility and widening spreads,” he said. “Today’s dramatic action by the Fed, lowering rates to zero, buying Treasuries and MBS, and encouraging banks to go to the discount window, will significantly reduce stress in the system. MBA expects these actions will lower mortgage rates, helping homeowners save money through refinancing, and thereby providing a boost to the broader economy.” By Phil Hall.

Mortgage stress test changes are on hold until further notice

The planned change and review of the mortgage stress test has slipped down the priority list for the Canadian government due to the COVID-19 coronavirus crisis.

Until the outbreak, it was expected that Office of Financial Sanctions Implementation (OFSI) would consider changes after a consultation with stakeholders. It was hoped this would make the rate used to determine affordability for uninsured mortgages more dynamic instead of its current rigidity.

But OSFI said late Friday that, in unison with other government agencies, it was focusing on ensuring the resilience of Canadian financial institutions and the financial system.

“As a result, the benchmark rate as currently published by the Bank of Canada will remain in force until further notice,” OSFI said in a statement.

But it’s not just the review for uninsured mortgages that are affected.

“The Minister of Finance has also announced the suspension of the April 6, 2020 coming into force of the new benchmark rate used to determine the minimum qualifying rate for insured mortgages,” the statement clarified.

Maintaining credit supply

To ensure that Canadian financial institutions have enough liquidity to continue lending, OSFI has also cut its buffer requirements.

The Domestic Stability Buffer, which large financial institutions are required to maintain in case of financial crisis, was due to be 2.25% as of the end of April 2020 but this has been cut to 1% immediately and remain in place for at least 18 months.

The regulator says the release of banks’ funds from the buffer should be used for lending to businesses and households and not for shareholder distributions.

OSFI says that financial institutions’ dividend increases and shareholder buybacks should be halted. By Steve Randall.

Bank of Canada acts to shore up funding liquidity

The Bank of Canada is to help bolster financial stability by injecting liquidity into the funding markets.

In a similar move to the Fed, the BoC is acting to support interbank funding amid concerns about tightening credit resulting from the coronavirus outbreak.

“The Bank of Canada continues to closely monitor global market developments and remains committed to providing liquidity as required to support the functioning of the Canadian financial system,” a BoC statement said late Thursday.

The central bank is increasing the frequency at which it buys government bonds and is also stepping up its bond buybacks program whereby it sells newer bonds for older issues.

This will add billions of dollars into markets.

Along with further expected cuts in interest rates, the bank hopes that the moves will avoid a credit crunch which exacerbated the Great Recession a decade ago.

“In addition to using just the blunt tool of lowering interest rates, they’re trying to help with liquidity in the market,” Ian Pollick, head of rates strategy at CIBC in Toronto told Bloomberg. “They’re just liquefying the system. It’s consistent with moves we saw earlier today with the Fed.”

Federal finance minister Bill Morneau tweeted that “We are seeing volatility in the markets due to COVID-19. In the face of this uncertainty, we will continue to protect the health of Canadians and our economy. I want to tell all Canadians: we have your back.” By Steve Randall.

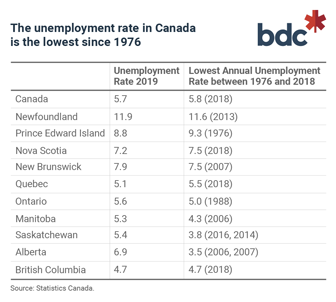

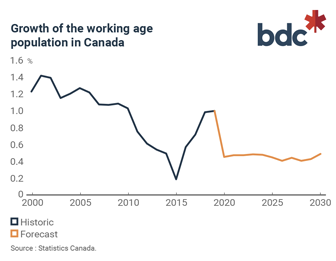

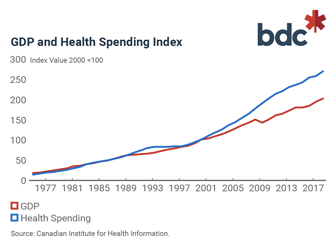

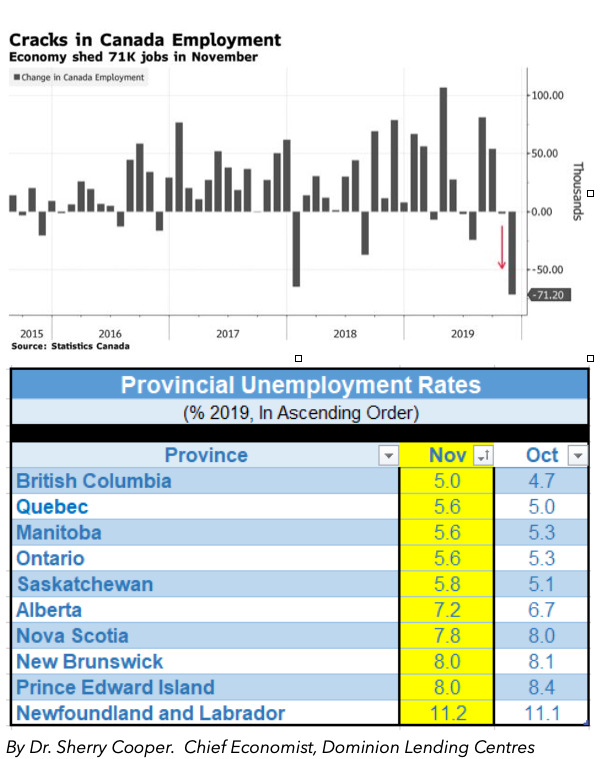

Canadian economy severely tested for another quarter

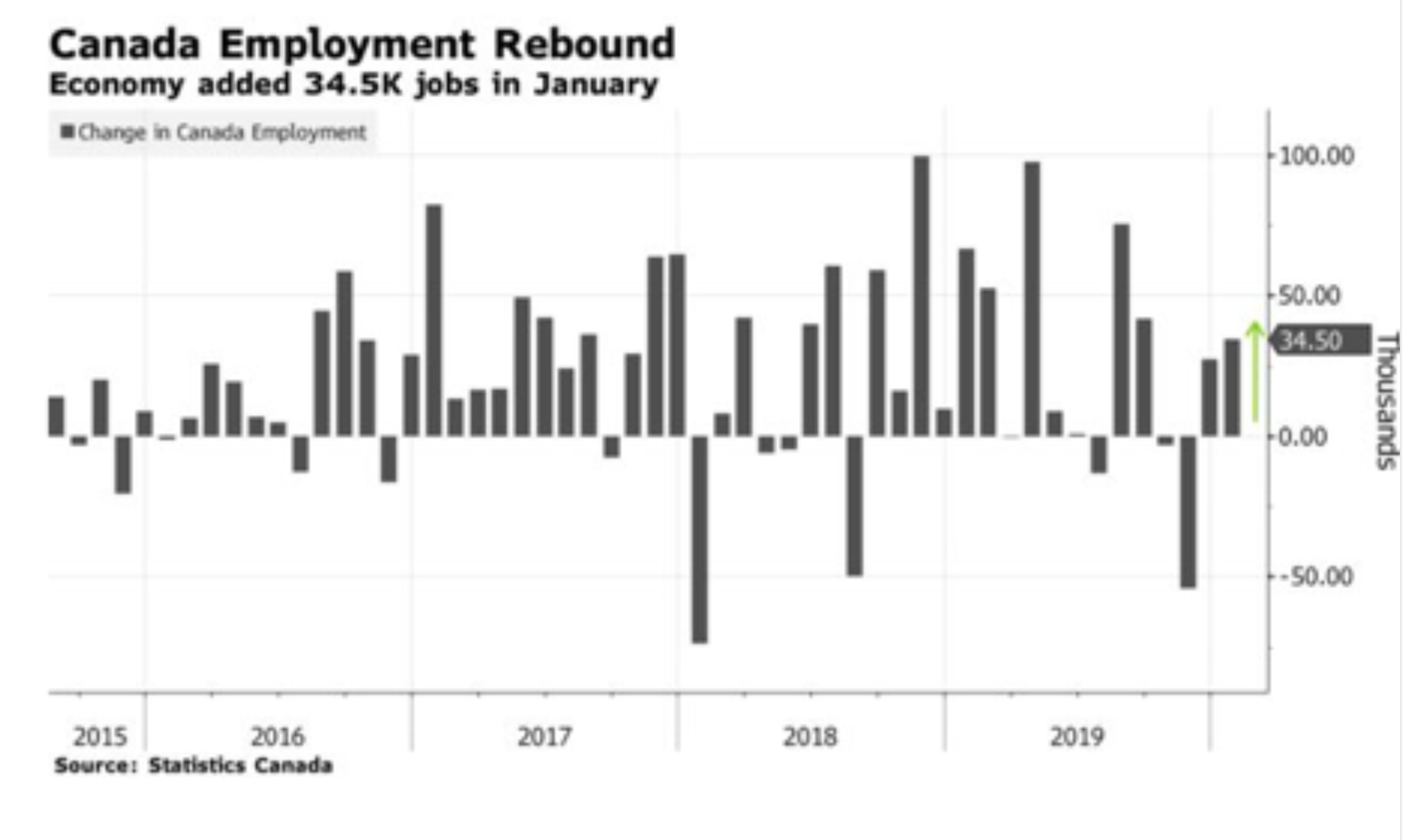

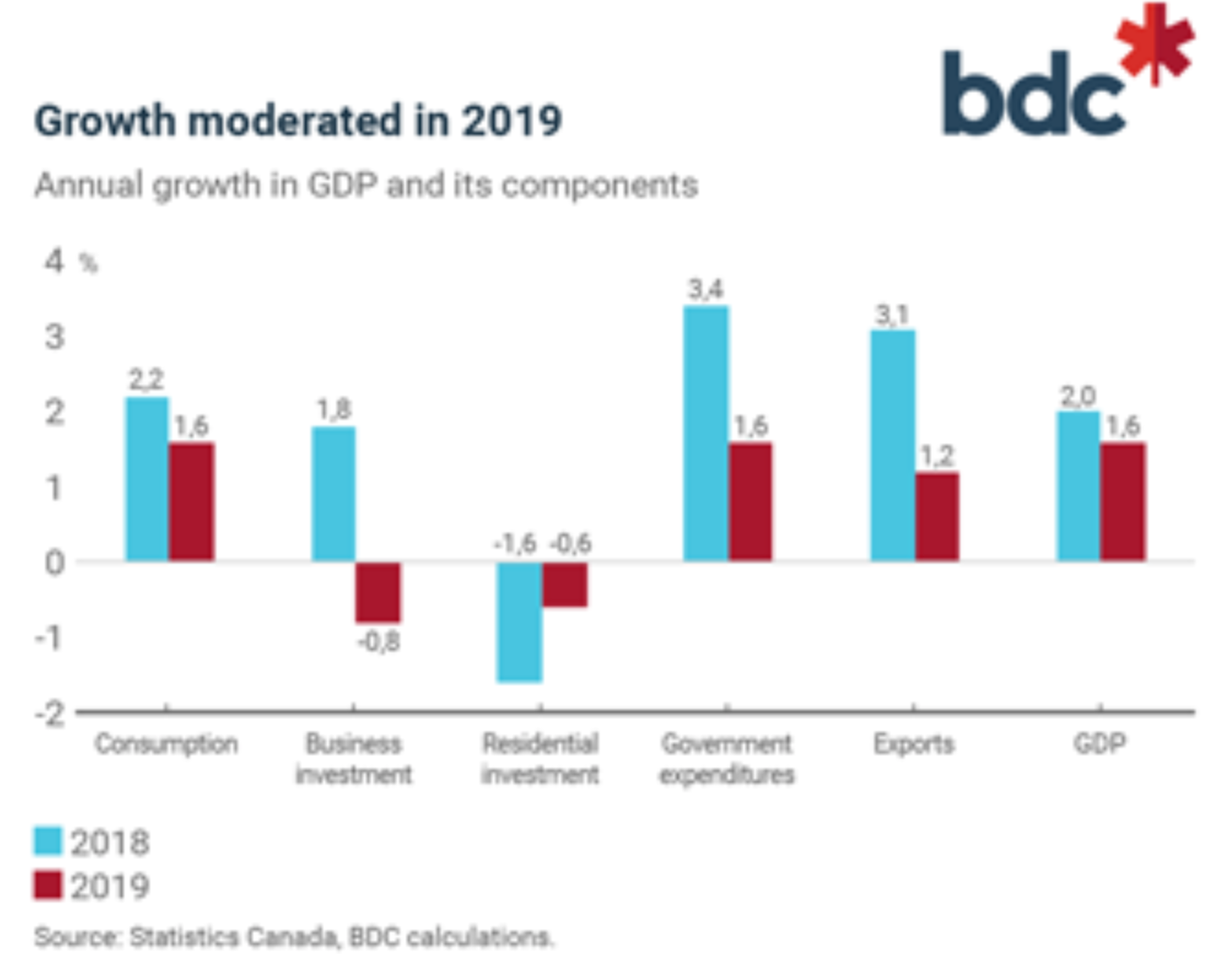

The Canadian economy had a rocky start this year after already showing significant signs of slowing down at the end of 2019. Indeed, economic growth was only 0.3% in the fourth quarter. This poorest performance of the year, while still in line with Bank of Canada forecasts, brought GDP growth to only 1.6% in 2019.

Economic activity was penalized last year by the decline in business and residential investment, by less than 1% each. Consumer and public spending were the driving forces of the economy, although their growth also slowed.

The economic rebound that might have been expected at the start of the year will undoubtedly be delayed. The Canadian economy is not out of the woods and growth will probably continue to be held back by temporary factors, at least in the first quarter.

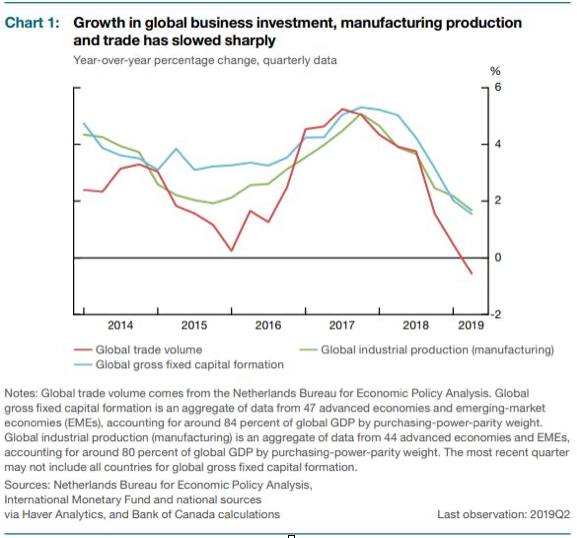

Growth still victim of temporary disruptions

Fears about the coronavirus (Covid-19) are growing and the global pandemic could stifle investment and slow national industrial activity. The impact of the pandemic is already being felt on stock markets, and the Chinese slowdown is hurting many commodities—including oil. Rail blockades have also weakened Canada’s economic growth.

From the coronavirus to a crude oil price war

The coronavirus crisis has affected the oil market. The slowdown in oil demand caused crude oil prices to plunge 35% between early January and early March. At the time, OPEC was expected to intervene to counter the drop in global prices.

At its latest meeting with its partners, however, OPEC did not get Russia to go along with its proposal to withdraw an additional 1.5 million barrels per day from the market in order to rebalance supply and demand and bolster crude prices. In addition, no agreement was reached on extending the current cuts, so as of April 1, 2020, producers will be able to pump as much oil as they want.

In retaliation for Russia’s refusal to cooperate, Saudi Arabia launched a full-scale price war on Monday, March 9, selling its crude for $29.05 per barrel to capture market share from its Russian competitor.

The last crude oil price war occurred in 2014 and plunged Canada into a technical recession. Given its importance to some Canadian provinces and the country terms of trade, the current collapse of crude oil prices will further limit growth this year. The question now is how long this price war can last. To learn about it, check out our article of the month on oil.

Rail blockades to derail the economy?

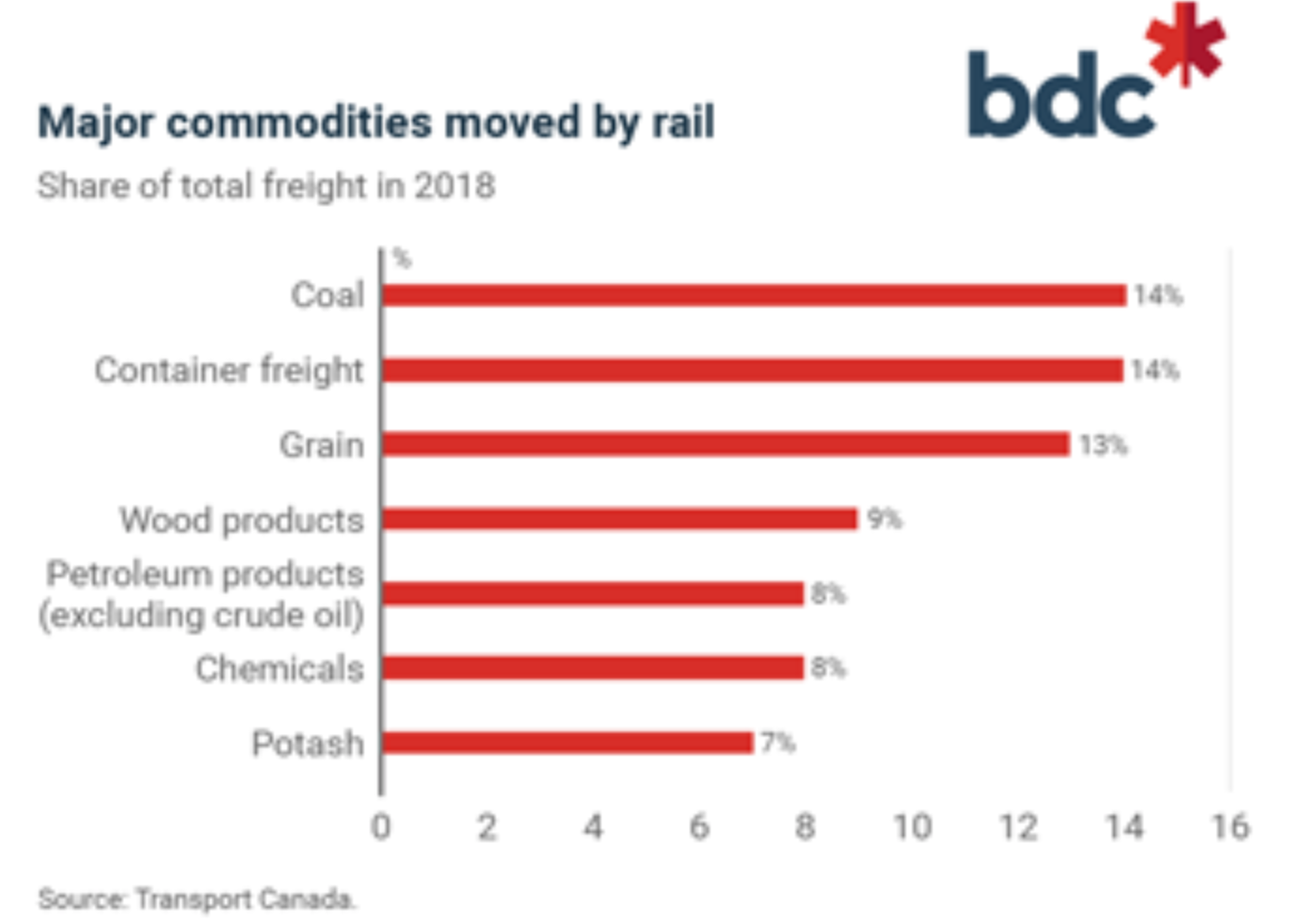

Canada’s rail system is at the heart of the Canadian economy. For this reason, blocking railways that carry freight from coast to coast is yet another obstacle to growth in the first quarter of 2020 at a time when the economy must already cope with disruptions caused by the coronavirus and low oil prices. (For more details, see this month’s featured article). Overseas containers piled up in ports in February, and retailers struggled to get adequate supplies.

Besides the transportation sector, this rail blockage will have an impact on a number of industries. Manufacturing, energy, chemicals, raw materials and agriculture are all affected by the rail shutdown.

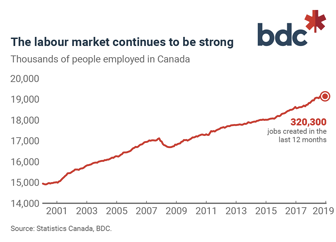

The layoffs announced by companies directly affected by the blockades are proof of their impact on the economy. Canadian National temporarily laid off 450 workers. VIA Rail followed suit with temporary layoffs of nearly 1,000 employees. Despite these economic setbacks, the Canadian economy created more than 30,000 jobs in February.

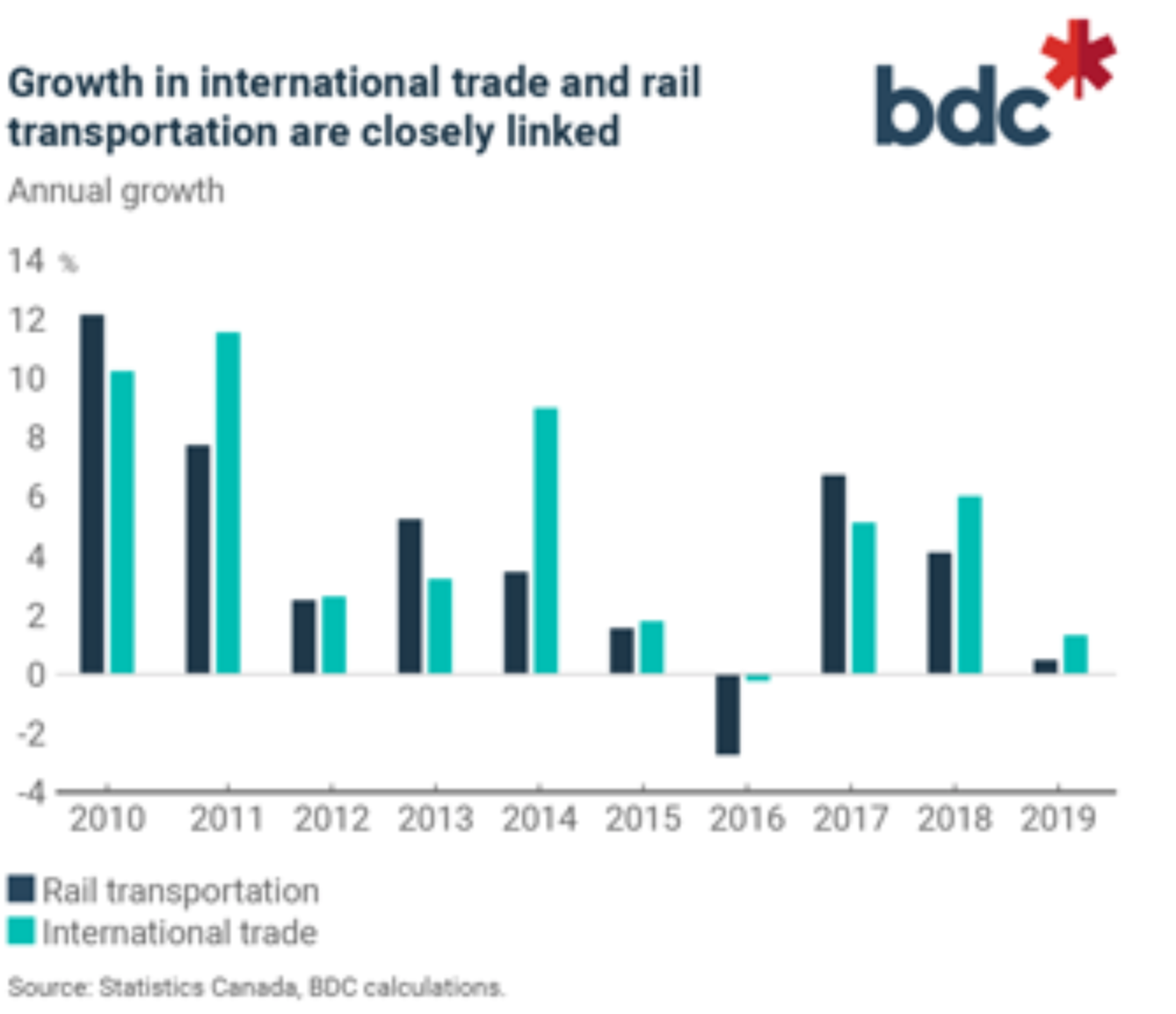

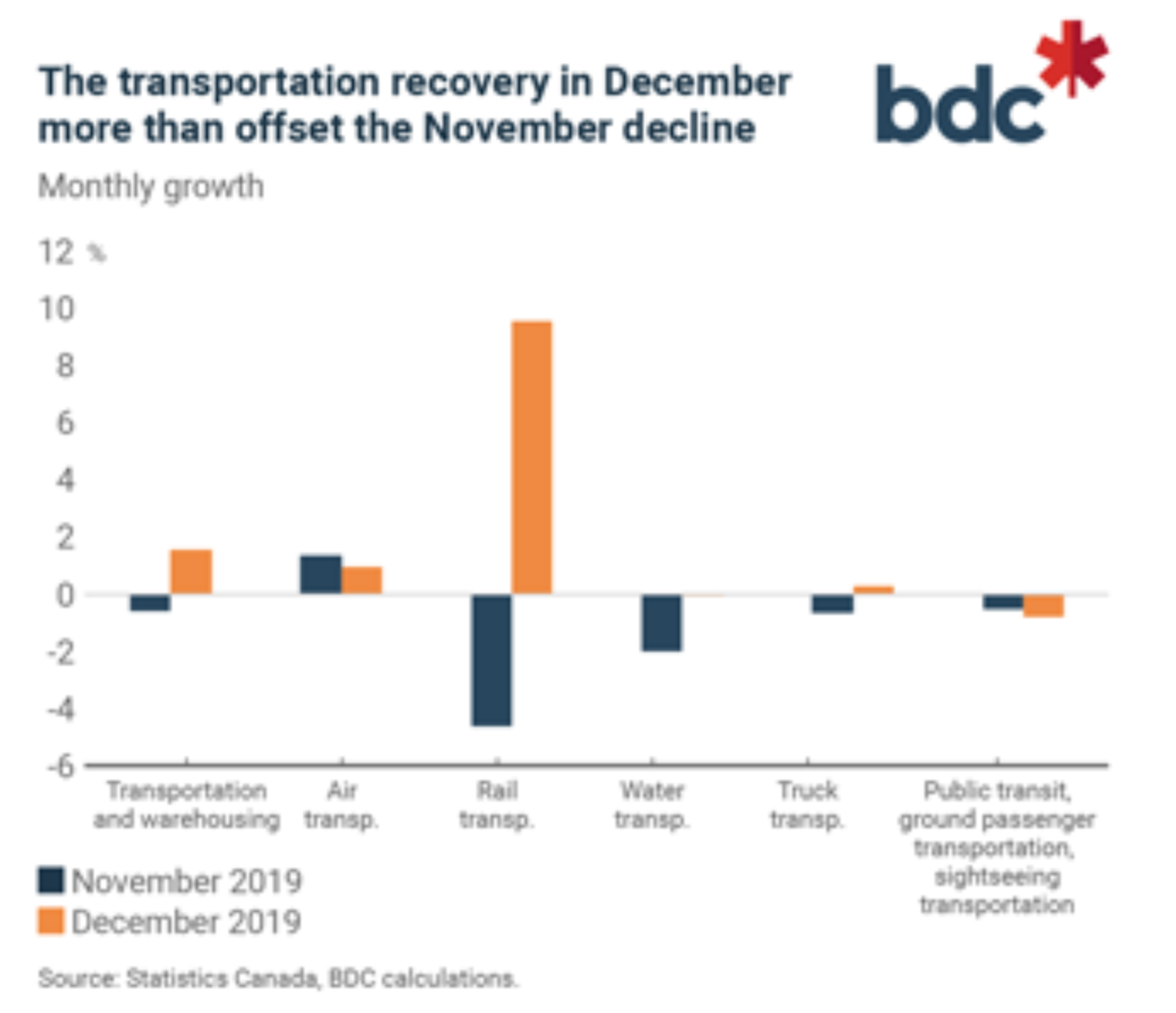

This is the second rail shutdown in just a few months. Last November, when a CN strike partially suspended rail transportation in the country, the GDP generated by the transportation industry fell by 0.6%. This slowdown also coincided with a decline in international trade. The stoppage affected rail shipments and, as a result, both exports and imports.

However, the November drop in GDP from the transportation industry was more than offset by a 1.5% increase in December. The impact of rail was also moderated by increased use of other means of transportation, such as air transport.

This time around, these alternatives could further mitigate the economic impact of the blockades. A number of companies have resorted to trucking for their supplies, and the passenger air transportation network has partially compensated for the closure of a few key routes. Indeed, Porter Airlines reported that demand for its Montreal-Ottawa-Toronto flights rose strongly. However, these two options remain significantly more expensive than rail transportation for both businesses and travellers.

]

]

By BDC Business Development Bank of Canada.

Canada’s housing starts down in February

Last month saw a decline in housing starts, according to new data form the Canada Mortgage and Housing Corporation (CMHC).

The seasonally adjusted annual rate (SAAR) of housing starts totaled 210,069 units in February, a 1.9% decline from the 214,031 units recorded in January. Urban starts were also down by 1.9% from 203,220 units in January to 199,304 units in February. Within the urban sector, multiple urban starts fell by 6.1% to 146,072 units while single-detached urban starts increased by 11.9% to 53,232 units. Rural starts were estimated at a seasonally adjusted annual rate of 10,765 units.

The SAAR measurement of housing starts has seesawed over the past few months: January saw an 8.8% increase from December, but December recorded a 3% decline from November.

“The national trend in housing starts declined in February, driven by lower-trending multi-unit starts.” said Bob Dugan, CMHC’s chief economist. “Single and multi-unit starts in Toronto both trended lower, while activity in Montréal declined due to lower-trending multi-unit starts. This offset a slight up-tick in Vancouver, which follows four consecutive declines in that CMA.”

Among the provinces, Saskatchewan recorded the steepest percentage decline in month-over-month housing starts, toppling from 3,270 units in January to 1,966 in February, a 40% fall. Quebec had the second greatest percentage decline during that period, with 44,991 in February compared to 73,304 in January, a 39 percent plummet.

On the flip side, Nova Scotia recorded the greatest percentage increase between the months: a 227% leap from the 2,378 housing starts in January to 7,771 in February. Prince Edward Island also recorded a three-digit percentage upswing, rising 163% from 429 housing starts in January to 1,127 last month.

Among the nation’s major metropolitan areas, Guelph recorded the steepest percentage decline with an 80% drop from 667 housing starts in January to 133 last month. Saguenay recorded the second steepest drop, with a 72% plunge to 313 housing starts in February from 1,117 in January.

The major metropolitan areas that saw the most vibrant activity in housing starts during the year’s first two months included Halifax (a 340% increase form 1,319 in January to 5,800 in February), Windsor (a 331% spike from January’s 264 total to 1,137 in February) and Hamilton (a 307% rise from 1,734 in January to 7,061 in February).

The CMHC data follows a recently published report by Altus Group that found total housing starts in Canada during the 2010s were virtually identical to the previous decade. According to Altus Group’s data, housing starts reached 201,000 units on an average by the end of the 2010s, tying for the second-best decade ever recorded, after the 1970s. The decade recorded the lowest volume of housing starts in 2013, with just under 188,000 units, while the highest starts of the decade were recorded in 2017 at 220,000 units. The 2010s were also the strongest decade ever for apartment starts, with around 92,000 apartment units being started and most of the focus being given to condominium apartments developments.

“In general, the 2010s were not a very volatile period for annual total housing starts at the Canada-wide level,” the report stated. “In fact, it was the least volatile of any of the past six decades for annual total housing starts.” By Phil Hall.

Economic Highlights

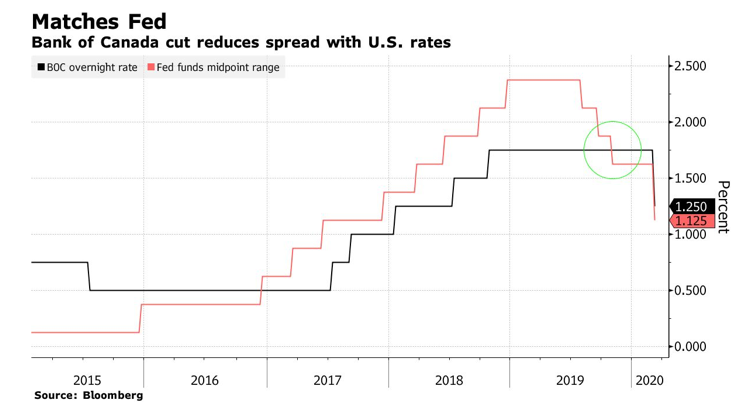

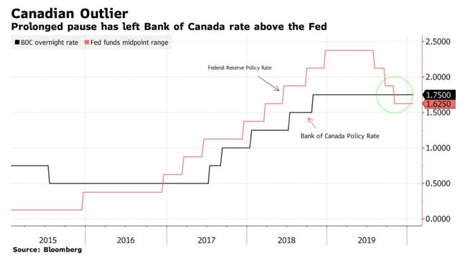

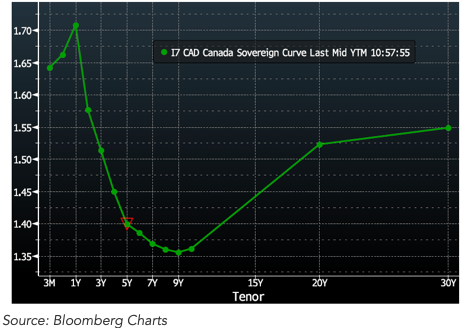

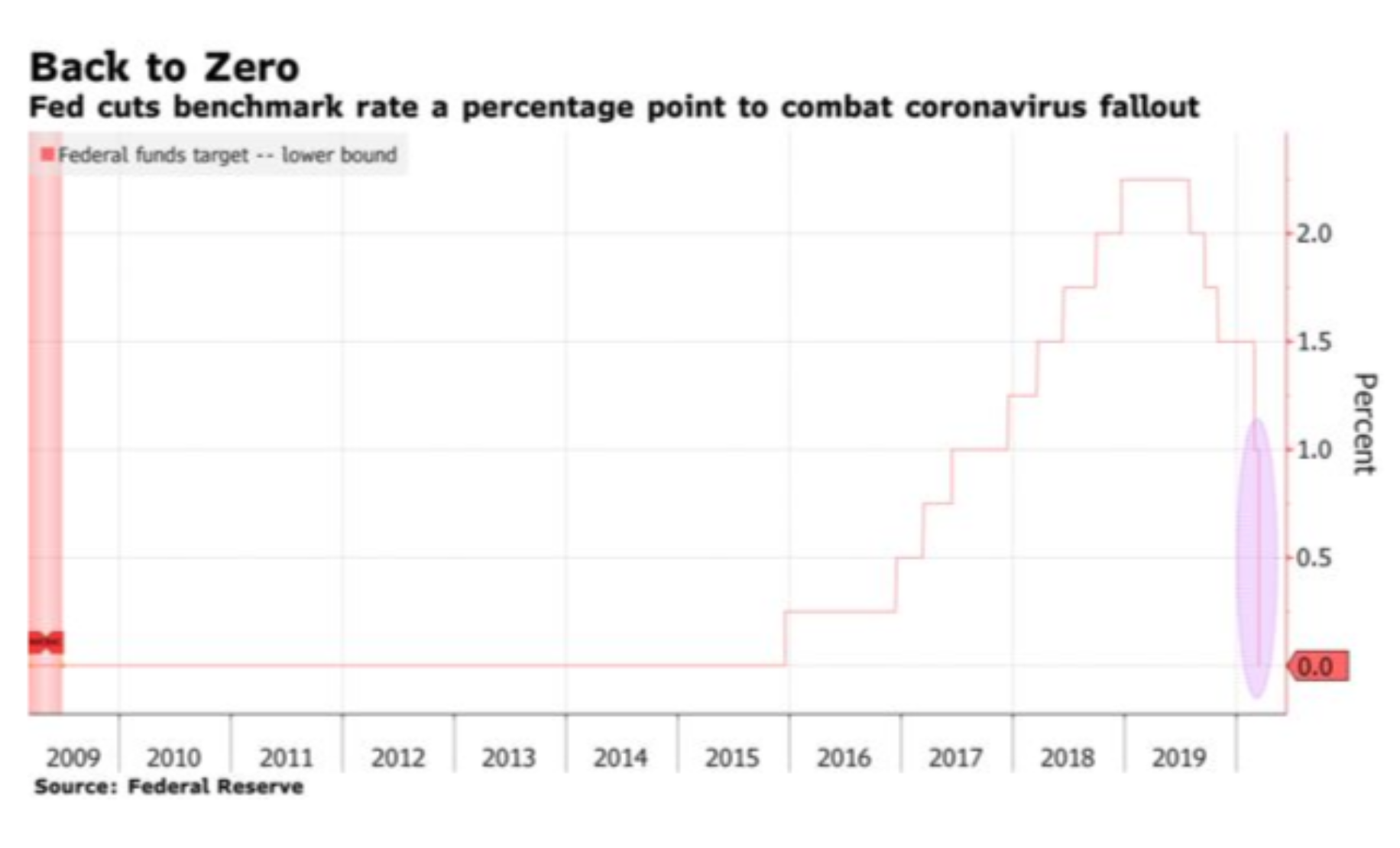

Fed Cuts Overnight Rate One Percentage Point But Markets Plummet

In an unprecedented Sunday afternoon meeting, the US Federal Reserve cut their key policy rate by 100 basis points (bps) to a level of 0%-to-0.25% (see chart below). Also, the Committee announced increased access to the discount window where the Fed makes loans to banks. The Fed is the lender-of-last-resort and is signalling that it will provide liquidity wherever needed. As well, with interest rates already so low, the Fed is well aware that rate cuts can only do so much. Thus, they are returning to quantitative easing–the buying of large volumes of U.S. government Treasury bills and bonds as well as mortgage-backed securities (MBS), to inject liquidity into the financial system.

The Treasury and US MBS markets are usually the deepest, most liquid markets in the world. But over the past two weeks, liquidity has dried up. Financial instability has risen sharply with the high level of volatility. Banks have experienced significant withdrawals as consumers are hoarding cash like everything else. The cost of funds to banks has risen sharply because of the enhanced perception of risk. With the collapse in oil prices, banks exposed to the oil sector are building up reserves for nonperforming loans. As businesses everywhere in nearly every sector shutdown, the risk of delinquencies rises further. Consumers who are housebound spend less money, and those who are freelancers or hourly wage earners might not get paid. Moreover, the shuttering of schools puts an added burden on parents who have no other daycare options for their kids.

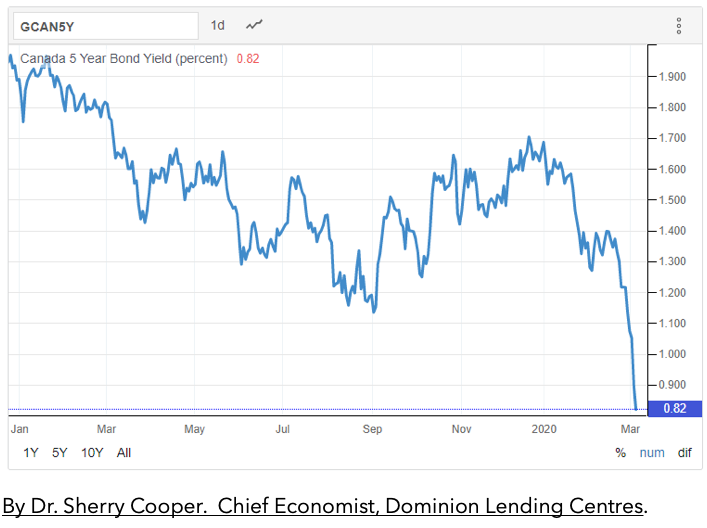

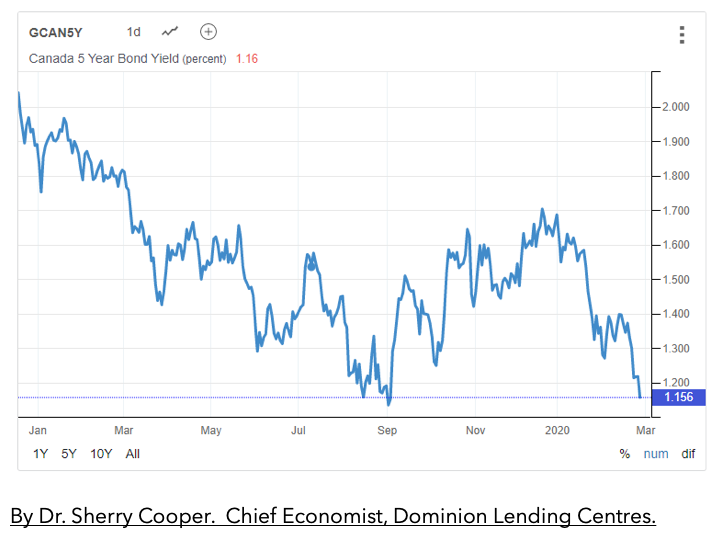

All of this disruption, which according to the Center for Disease Control, could last months–the CDC recommended yesterday the shutdown of meetings of more than 50 people for eight weeks–has led to rising concern about the riskiness of banks. Bank shares have plummeted, and the yields on bank bonds have surged. Besides, banks and other mortgage lenders are fearful of being inundated with requests for refinancing, especially in the US, where penalties for breaking a mortgage are much lower than in Canada. Because of the refinancing surge in the US, the price of MBSs has fallen sharply, raising their yields and making the market highly illiquid.

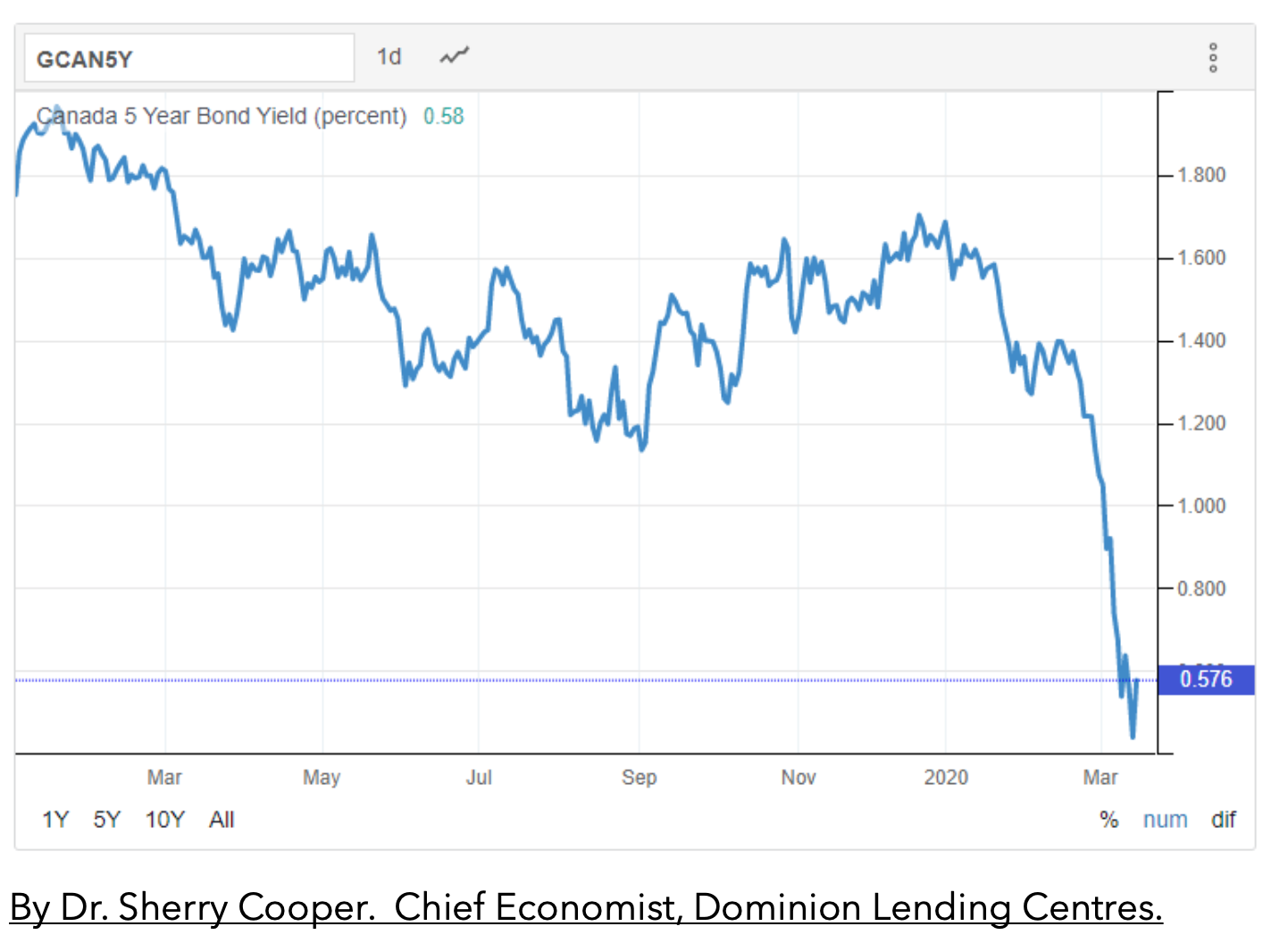

The rising risk premiums, likely recession and illiquidity are causing banks in Canada and the US to raise some mortgage rates. Lenders are tightening the discount off the prime rate on variable-rate mortgage loans. Some fixed rates have edged higher as well. Such spread widening between mortgage rates and government yields happened during the financial crisis. Bank balance sheets will expand as troubled businesses and consumers extend their borrowings on their open lines of credit. Many will be unable to make timely interest payments. Loan loss reserves, already climbing, will rise further. Liquid deposits will be depleted as many are forced to live off of savings while shying away from selling stocks at markedly depressed prices.

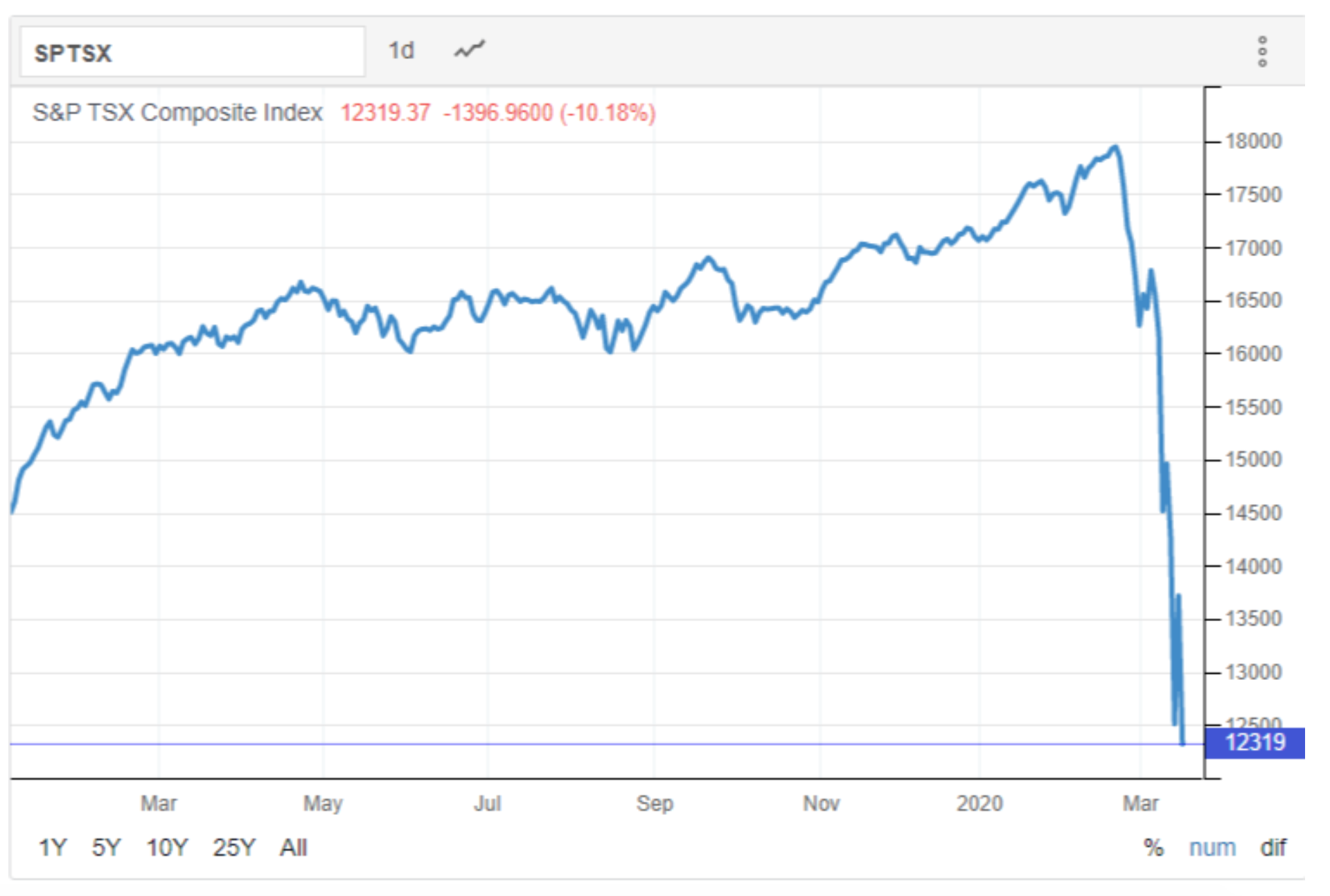

These are not normal times. The Fed’s actions did nothing to calm markets. Indeed, stocks and bond yields plummeted in overnight trade, and the stock markets opened sharply lower in North America. The S&P 500 opened down over 8% while the TSX opened down 11%, triggering a circuit-breaker time out. This is the third time in a week the circuit breaker has hit. The TSX is down roughly 35% from its recent high (see chart below). The S&P 500 is down over 20%. The relative underperfomance of the Canadian stock market reflects our out-sized representation of the energy sector. The two weakest sectors in the TSX are the energy and financial sectors.

The world knows that the Fed and other central banks are running out of ammunition. Governor Powell said yesterday that he would not take the key fed funds rate into negative territory but instead would use “forward guidance” and asset purchases (quantitative easing) going forward.

The good news is that the banks are highly capitalized and much more resilient than during the financial crisis. Central banks since that time have put in place measures to monitor financial stability. Last Friday, the Canadian Office of the Superintendent of Financial Institutions (OSFI) reduced the capital requirements for Canadian banks to free up $300 billion for banks to support troubled borrowers. OSFI warned against the use of these funds to buy back stocks or raise dividends.

OSFI also suspended the proposed revision in the qualifying mortgage rate slated to begin April 6. The posted mortgage rate, published weekly by the Bank of Canada, will remain the qualifying mortgage rate. It is currently 5.19%, but it is expected to fall this week to around 4.95%.

But in these extraordinary times, there is a loss of confidence in the financial system. Some are calling for a full shutdown of the stock markets–but imagine the panic if no one could sell assets. There would truly be a run on the banks. Now is not a time to panic.

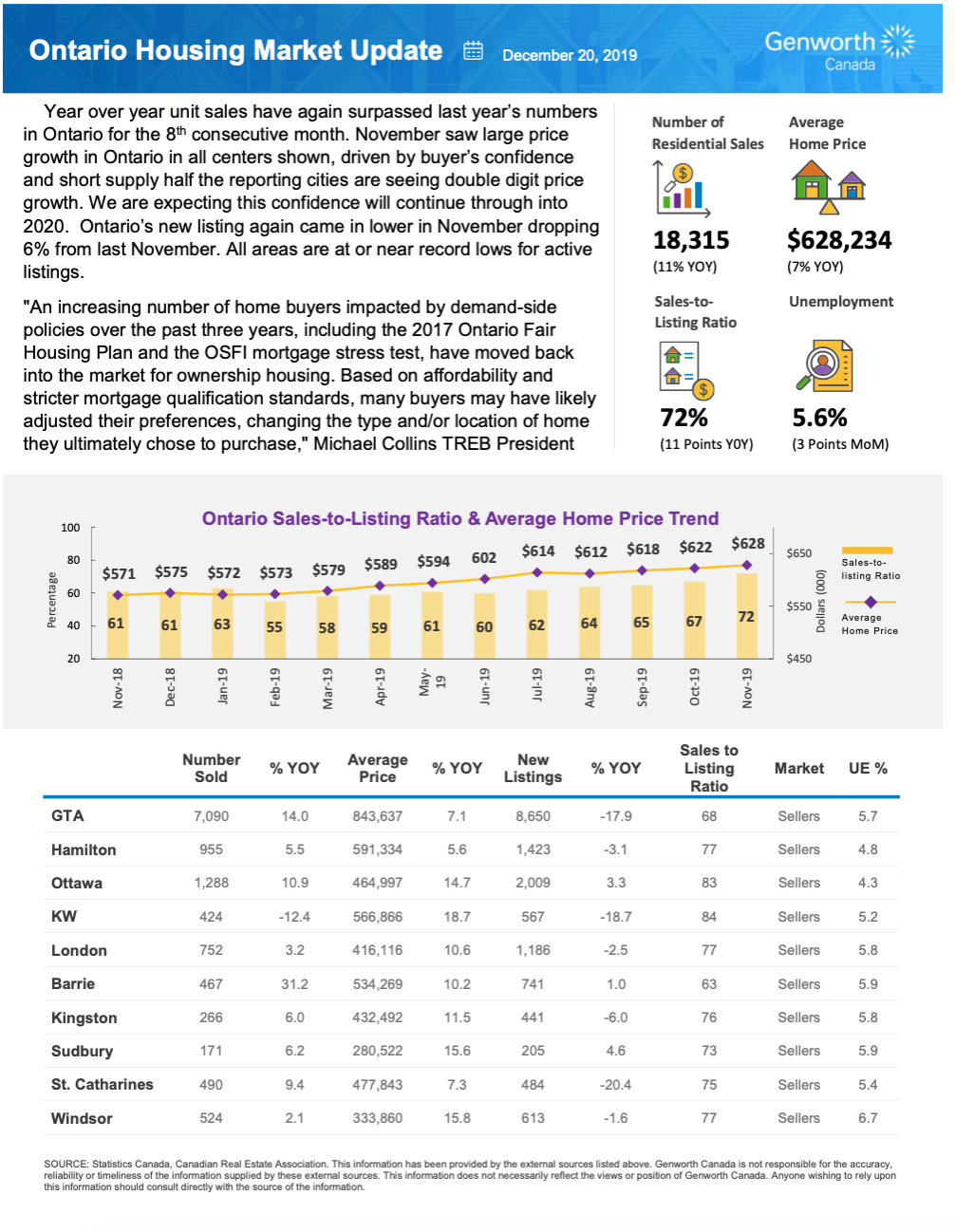

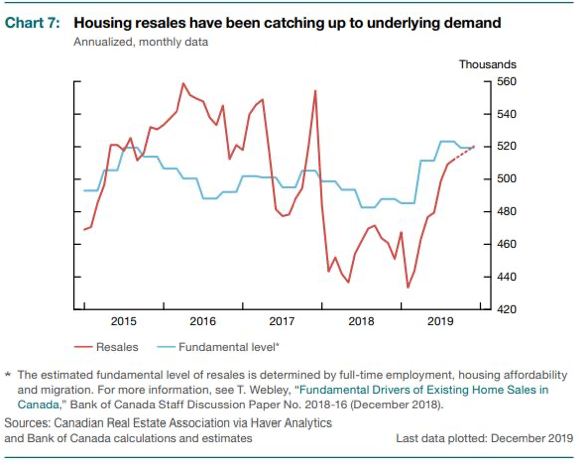

The Canadian Housing Market

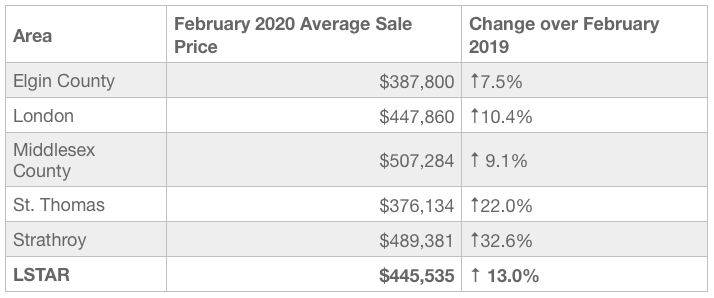

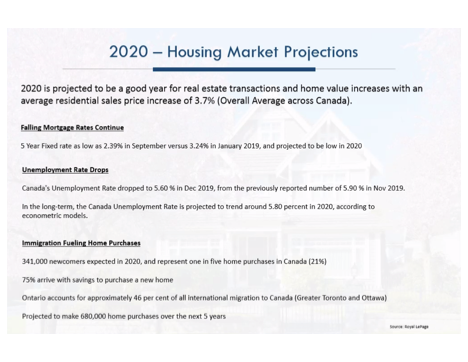

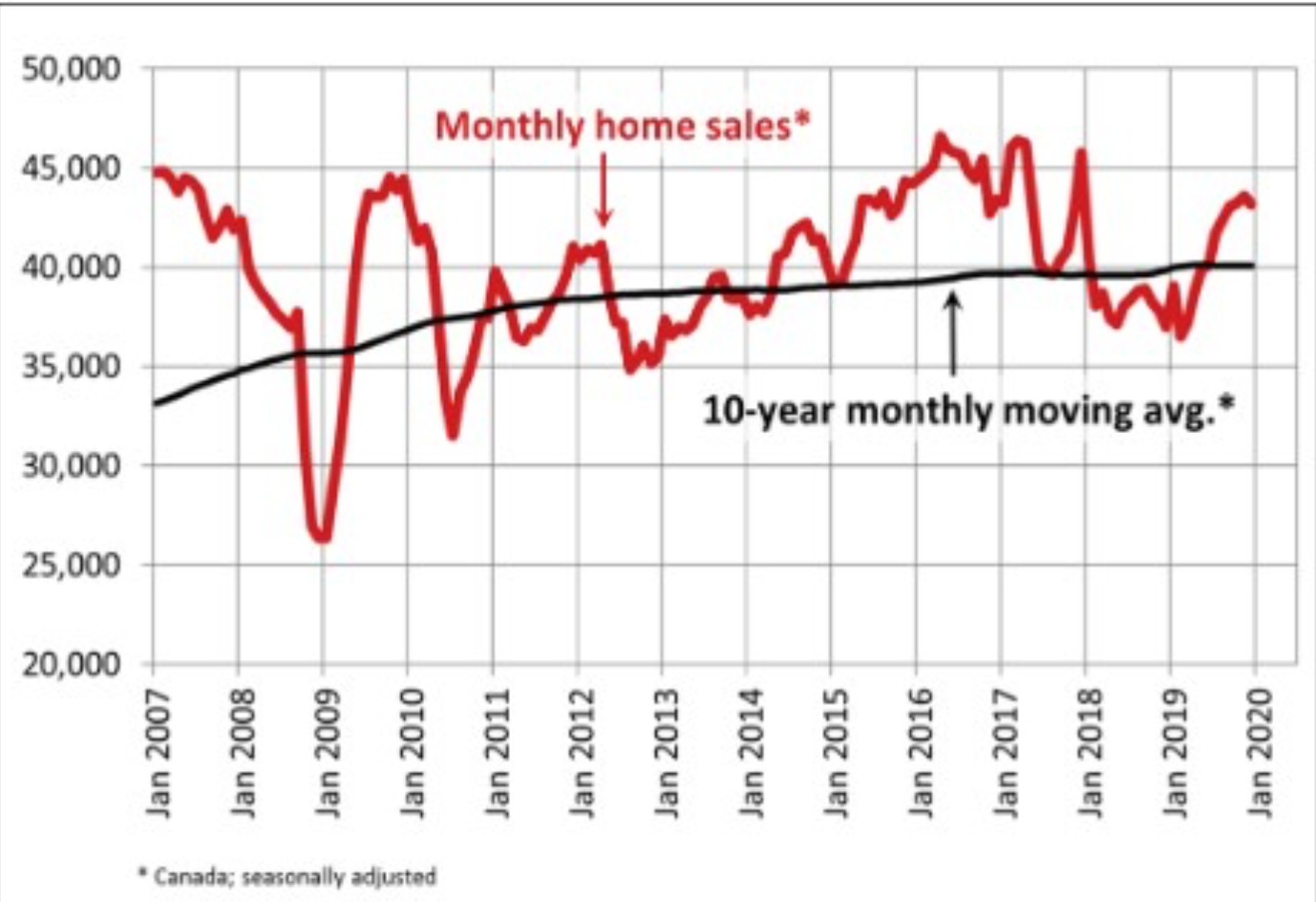

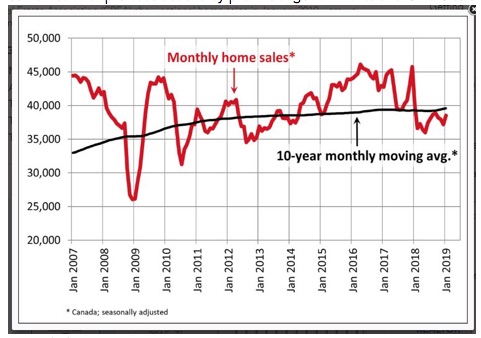

The Canadian Real Estate Association announced this morning that home sales recorded over the Canadian MLS Systems rose 5.9% in February, marking one of the more substantial month-over-month gains of the past decade. Actual (not seasonally adjusted) sales activity stood 26.9% above year-ago levels–keeping in mind that activity was quite weak one year ago. February 2019 marked a decade-low for the month, so a good part of the significant y-o-y gain reflects low levels of activity recorded at the time. February 2020 also benefited from an additional day due to the leap year.

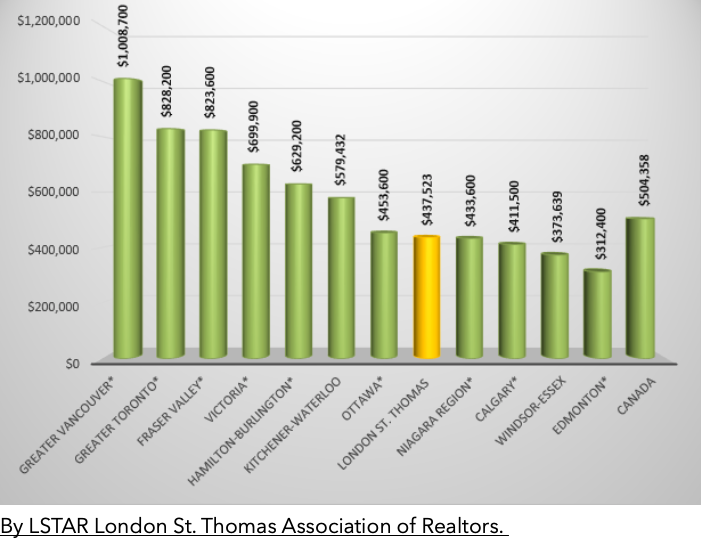

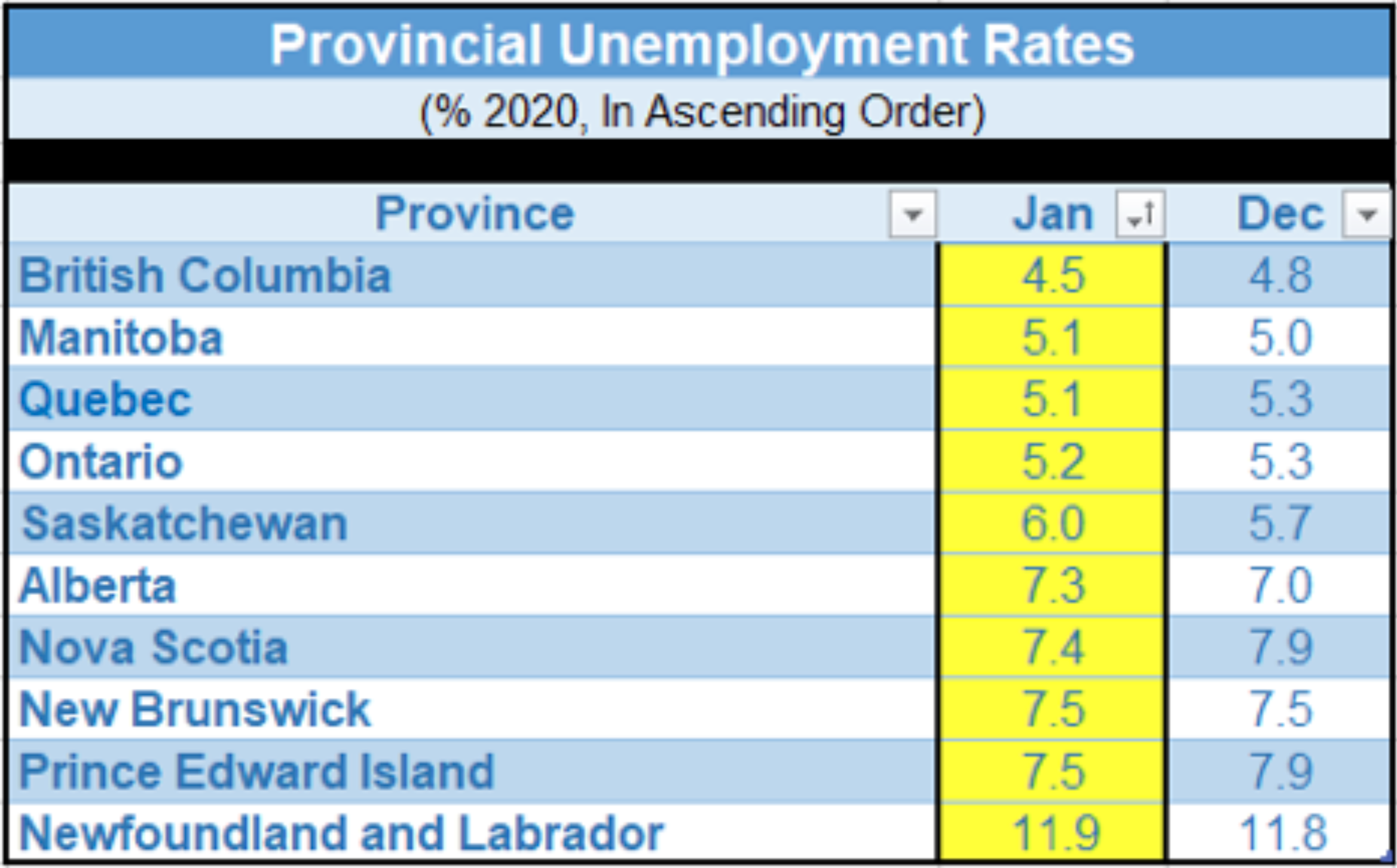

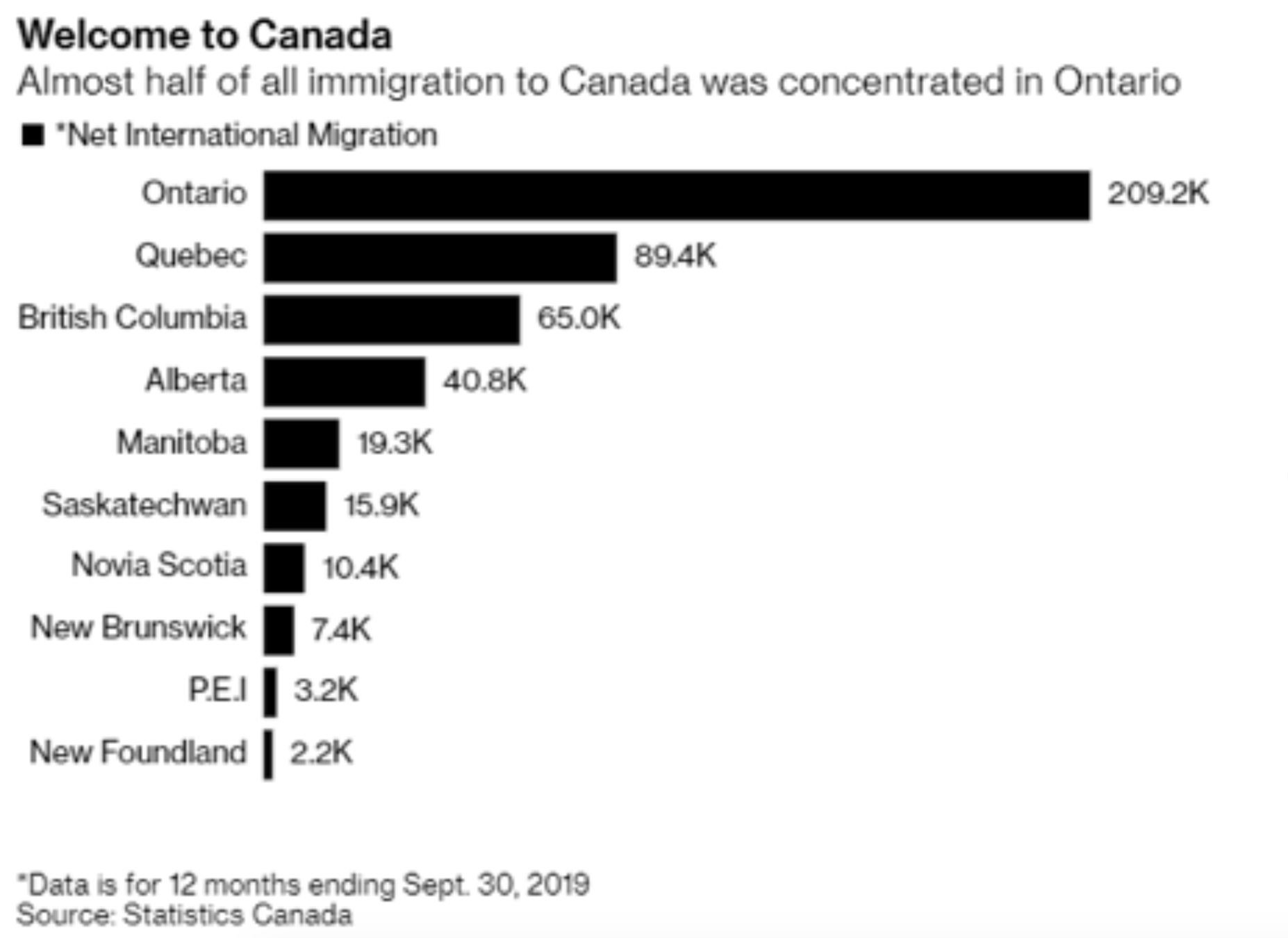

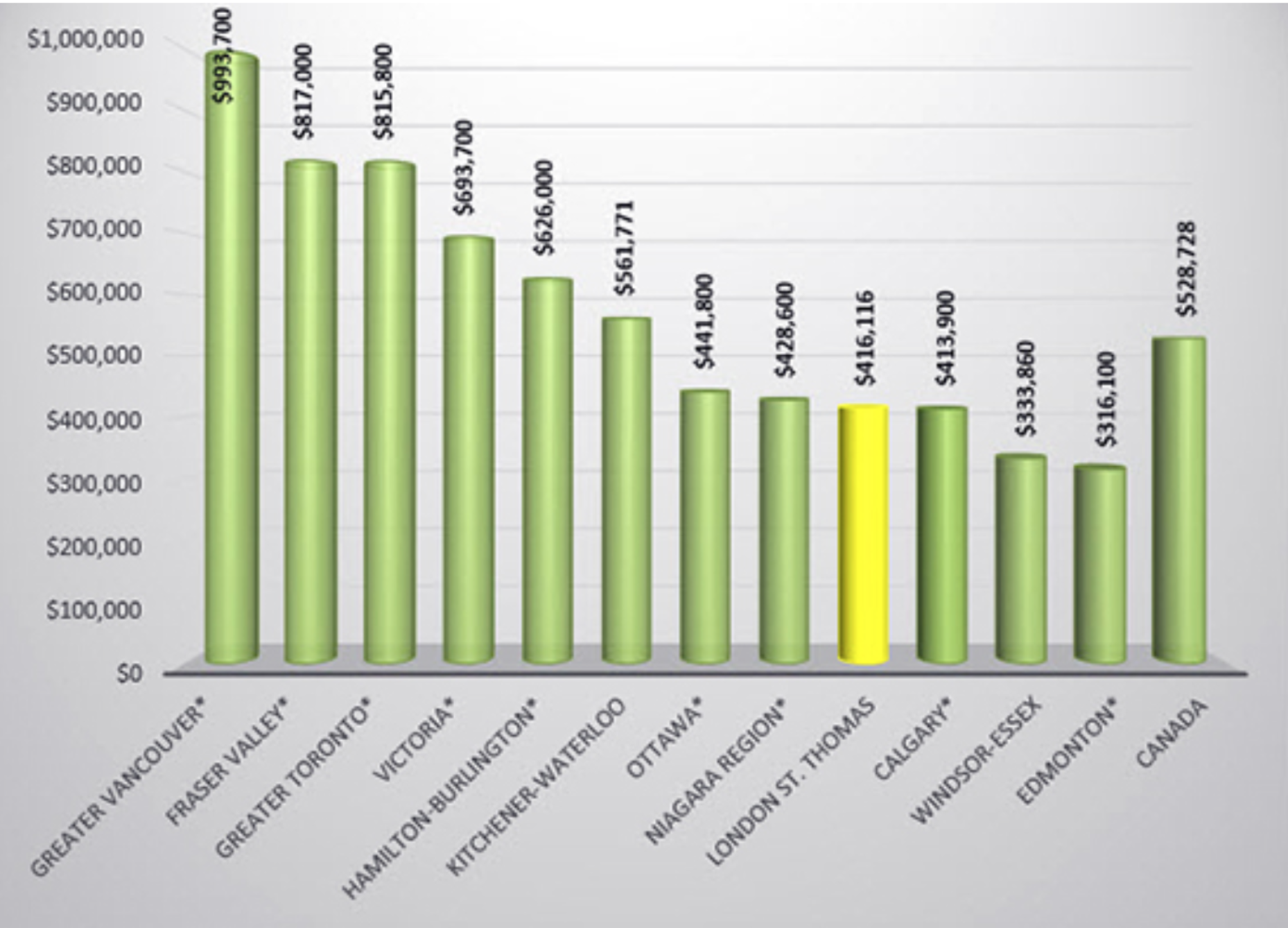

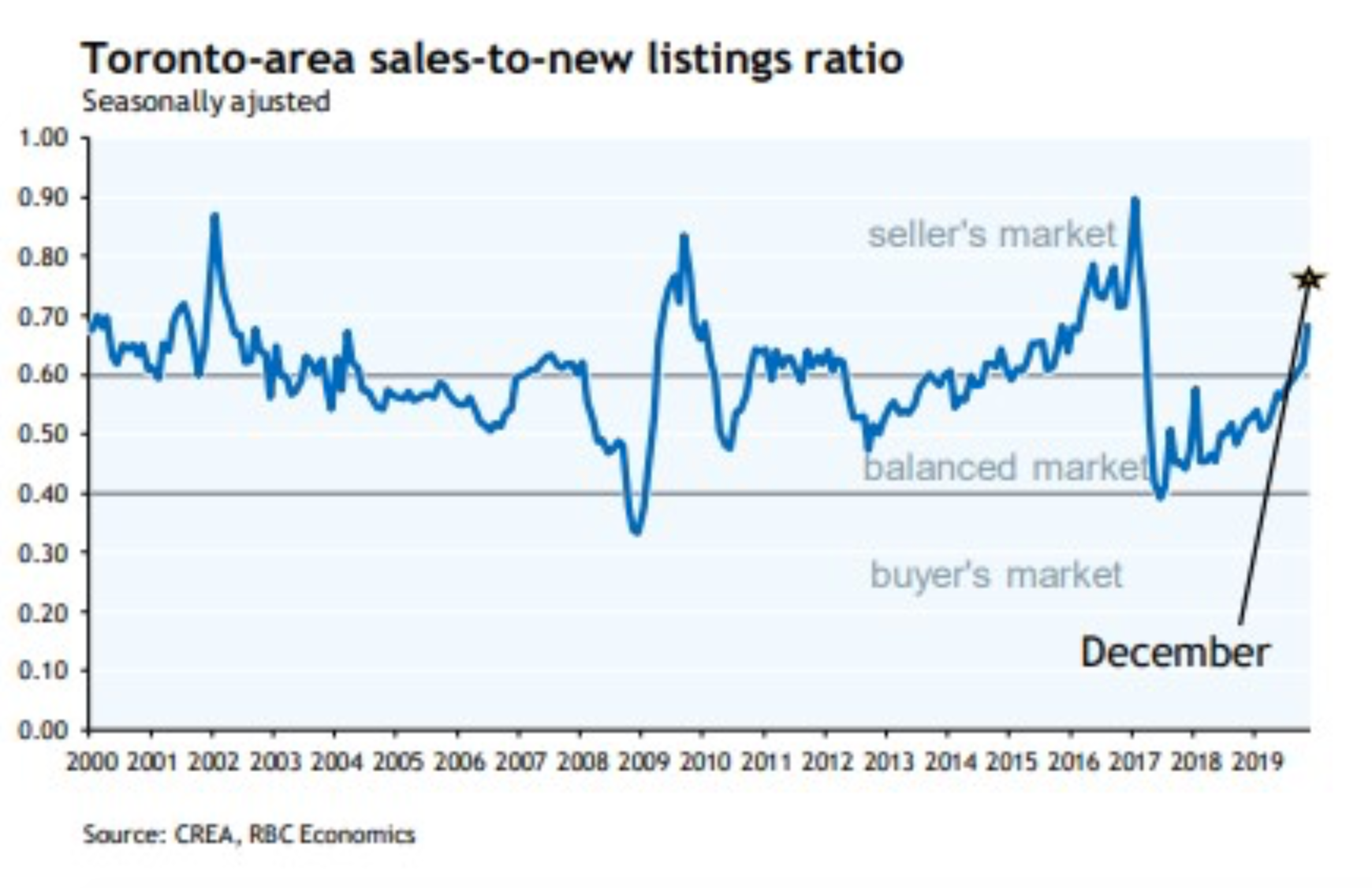

The CREA President, Jason Stephen, said, “Home prices are accelerating in markets where listings are in increasingly short supply, specifically in Ontario, Quebec and the Maritimes which together account for about two-thirds of national sales activity. Meanwhile, ample supply across the Prairies and in Newfoundland and Labrador means increased competition among sellers.”

The number of newly listed homes jumped 7.3% in February compared to January, more than erasing the declines of late last year. New supply gains were posted in some large markets, including the Fraser Valley, Calgary, Edmonton, the GTA, Hamilton-Burlington, Kitchener-Waterloo, Windsor-Essex, Ottawa and Montreal.

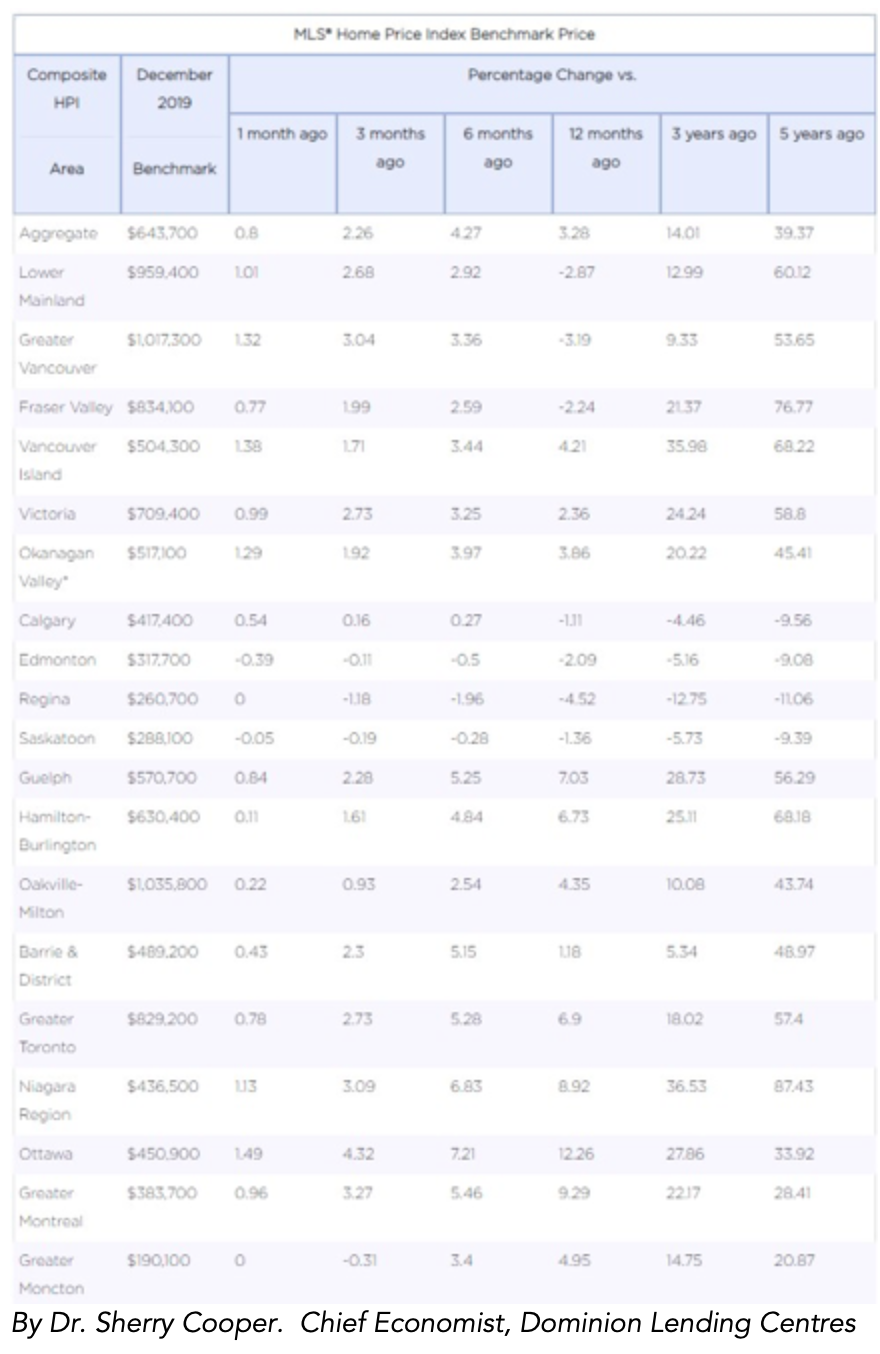

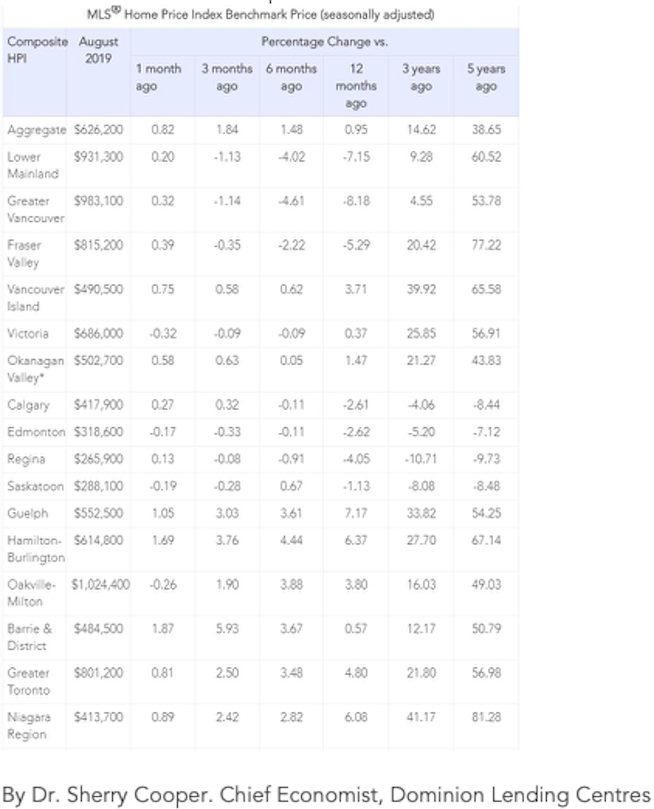

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.7% in February 2020 compared to January, marking its ninth consecutive monthly gain. The actual (not seasonally adjusted) national average price for homes sold in February 2020 was around $540,000, up 15.2% from the same month the previous year. See the table below for the regional move in prices.

But this is old news, particularly given all that has happened in the past two weeks. What comes next for the housing market? That depends on the course of the pandemic. Lower interest rates would typically be great news for the housing market, particularly for first-time homebuyers. But social distancing is hardly consistent with open houses and home shopping.

Moreover, volatility and instability reduce consumer confidence. Buyers that parked their downpayment savings in the stock markets have lost nearly a third of their money on paper. And how many sellers want a trail of strangers wandering through their homes during the pandemic. So the housing market, like everything else, is likely going to slow over the near term.

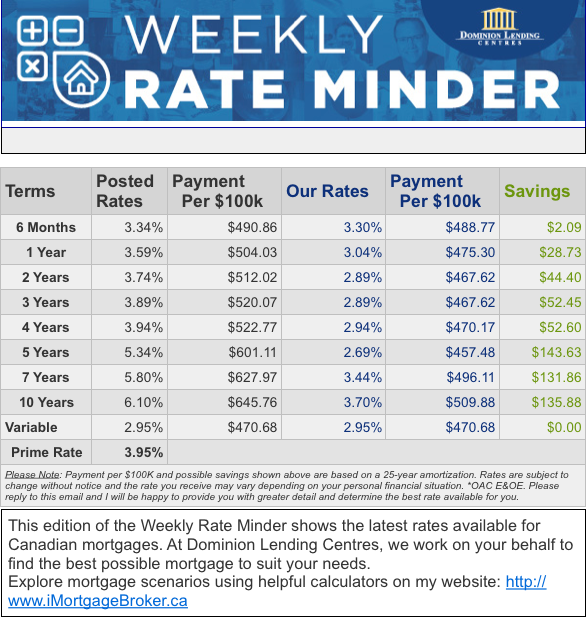

The Bank of Canada is hopeful that its rate cuts will stabilize the housing market from what might have otherwise been a substantial shutdown. Lower rates will filter through to lower monthly payments for floating-rate mortgage borrowers. Expect the Bank to cut rates again to near-zero levels, following in the footsteps of the Fed. So far, as of this writing, the Canadian banks have not responded to Friday’s BoC rate cut. The prime rate went down a full 50 bps on March 5 after the Bank cut its key rate by that amount on March 4. But so far, the Big-Six banks have not responded to the 75 bps cut three days ago.

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

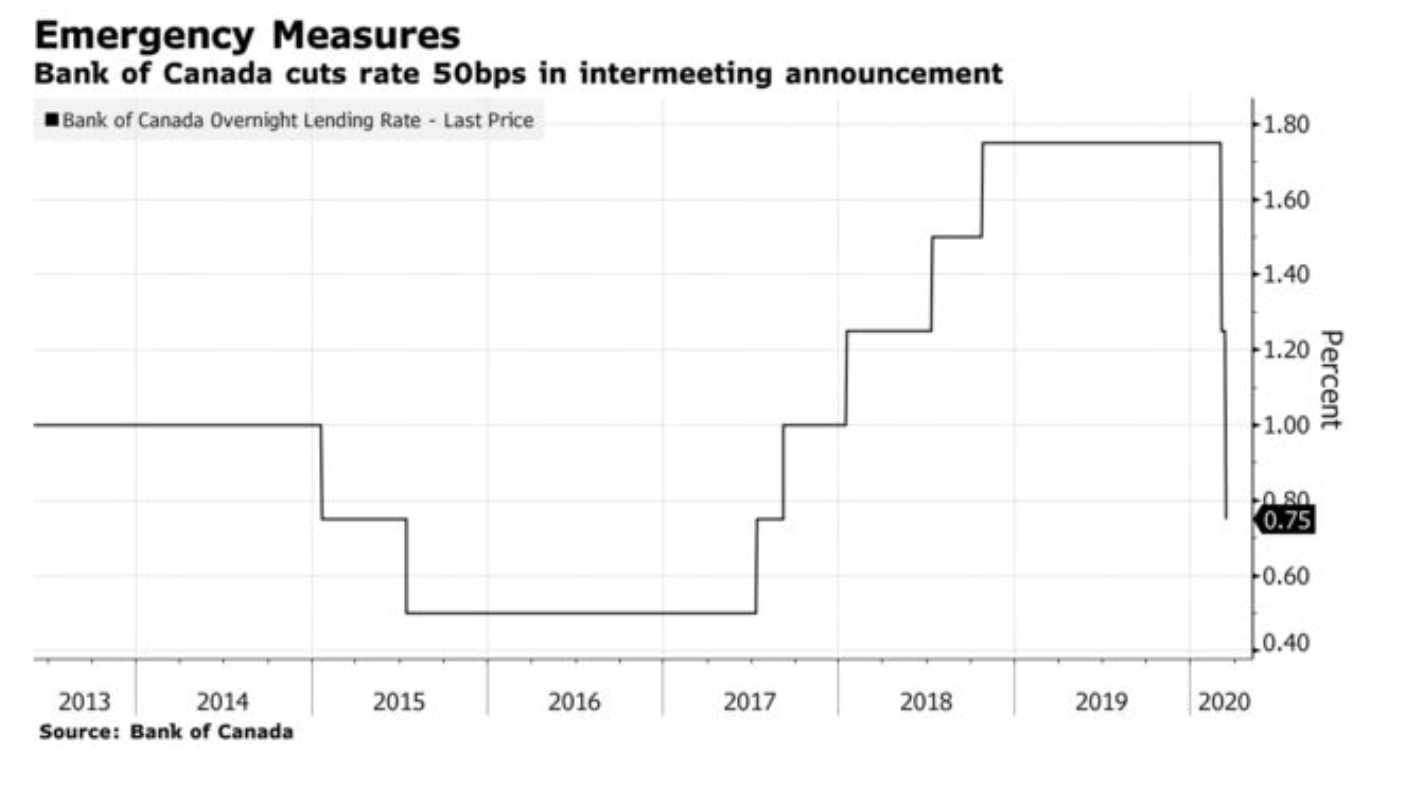

Residential Market Commentary – Coronavirus treatment has side effects

The Coronavirus and the broader economic concerns around the world have seen the Bank of Canada make two, 50 basis point cuts in its benchmark interest rate in the last two weeks. It now stands at 0.75%. And it is very likely to go lower.

The emergency rate cut on Sunday that dropped the U.S. Federal Reserve rate to, essentially, zero all but guarantees the Bank of Canada will cut rates further. Market watchers predict the overnight rate will drop to 0.25%, and that could happen at any time.

The cuts are part of a larger tool kit of measures being unpacked to support the broader economy as the Coronavirus pandemic spreads. One of the tools that will not be used, though, is the easing of the mortgage stress test. And there are mixed reactions to what all this means for the housing market.

The most predictable reaction is: hot markets will get even hotter. Lower interest rates tend to improve affordability and draw more buyers into the market. Given the tight supply of housing across the country, though, it seems certain there will be renewed price acceleration.

Commenting on the first 50 bps cut made on March 4th, Phil Soper, CEO of real estate giant Royal LePage speculated it could act as a “relief valve” for overheated markets which have seen a lot of “pent-up” demand. In an interview with the Financial Post he was not explicit about how the relief valve would work, but he hinted at a possible increase in housing supply.

On Friday the 13th, during the announcement of the emergency 50 bps cut, Bank of Canada Governor Stephen Poloz made it clear the BoC’s concerns about the housing market have been overtaken by worries about the Coronavirus. But, during the announcement of the March 4th cut, Poloz said that move could help stabilize the housing market. He cited declining consumer confidence in the overall economy as a factor that could have led to a housing market slump.

However, those same consumers could just as easily stay away. Social distancing, self-isolation and fears of a recession could see purchasers putting their buying plans on hold. The stock market plunge has stymied many people who were working to build their down payment through investments.

The potential decline in buyers and forecasts of a recession already have some sellers rethinking their plans. An absence of multiple offers and fears that the value of their property may be declining could delay plans to sell, or even see properties taken off the market, further tightening supply. By First National Financial.

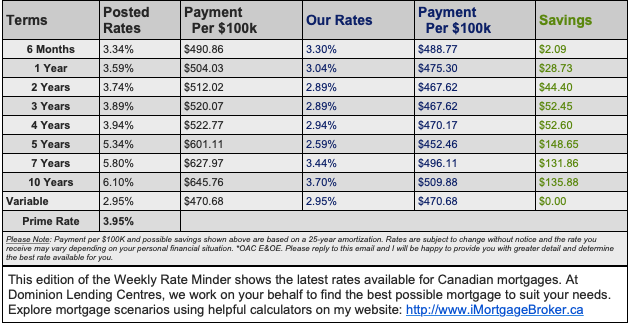

Mortgage Update – Mortgage Broker London

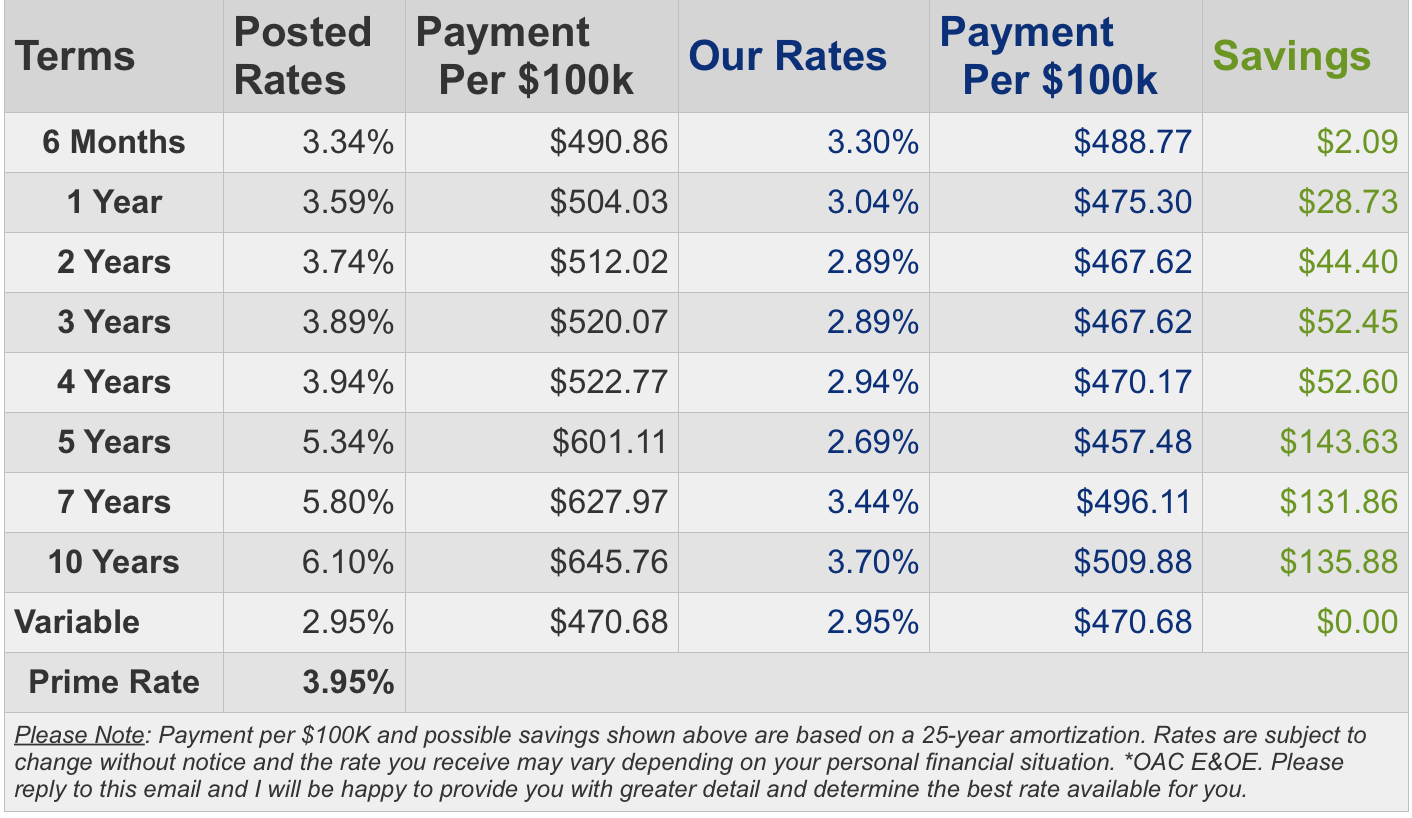

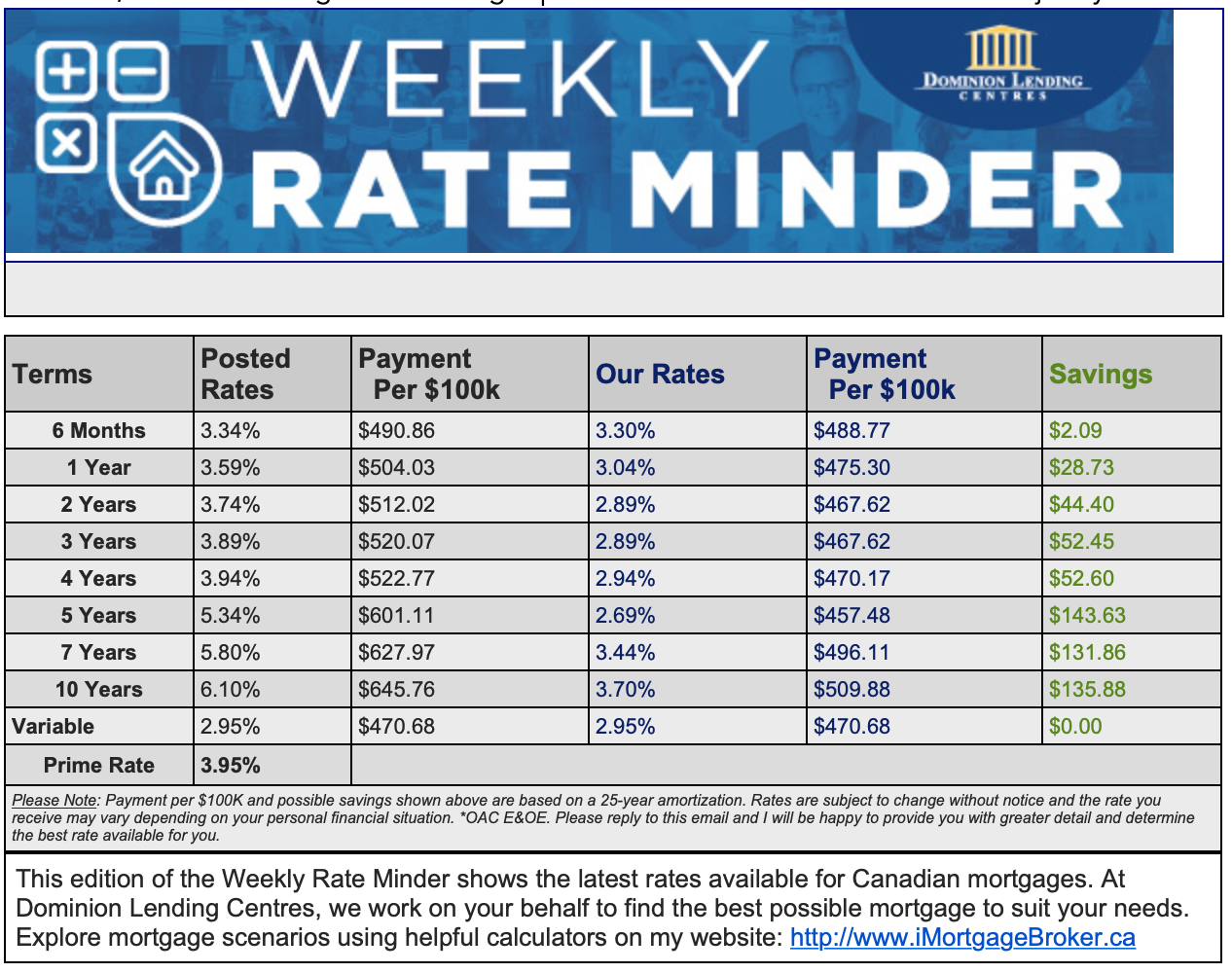

Mortgage Interest Rates

The Bank of Canada today lowered its target for the overnight rate by 50 basis points to ¾ percent, effective Monday, March 16, 2020. The Bank Rate is correspondingly 1 percent and the deposit rate is ½ percent. Prime lending has lowered an additional 50 bps is 2.95%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Some Banks/Lenders have followed suit and made announcements of dropping their Prime lending rate in correlative response. Bank of Canada Benchmark Qualifying rate for mortgage approval is still at 5.19% but changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

Fixed rates halted moving down further due to the sever market volatility. Some lenders started increasing interest rates due to liquidity concerns. Lenders have started cutting back on the deep discounts offered by some for variable rates making adjustable variable rate mortgages less desirable.

View rates Here – and be sure to contact us for a quote as rates are moving faster than can be updated.

Mortgage Update – Mortgage Broker London

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Here at iMortgageBroker, we love looking after our clients needs to ensure your best interest is protected. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

For Continued Updates on The COVID-19 Pandemic, please click below:

Middlesex Health Unit

https://www.healthunit.com/news/novel-coronavirus

Ontario Health

https://www.ontario.ca/page/2019-novel-coronavirus

Government Canada Public Health

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

World Health Organization:

https://www.who.int/emergencies/diseases/novel-coronavirus-2019

Factual Statistics Coronavirus COVID-19 Global Cases

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6