Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

Bank of Canada Governor States Debt Levels Make Canada Sensitive to More Rate Hikes

Bank of Canada Governor Stephen Poloz says record high household debt has made the economy far more sensitive to the effects of interest rate hikes than in the past.

The central bank increased its overnight lending rate to 1.25 per cent on Wednesday – the highest level it’s been since 2009 – following rate hikes in July and September.

“We know in our hearts and in our models that the economy will be more sensitive to higher interest rates today than it was 10 years ago,” said Poloz, in an interview with BNN’s Amanda Lang.

“It’s about 50 per cent more sensitive at these levels of debt, we think, than it was before,” he said.

Historically lower interest rates have fueled an almost-insatiable appetite for debt amongst Canadian consumers. According to Statistics Canada, the credit market debt-to-disposable income ratio reached 171.1 per cent in the third quarter of 2017, meaning for every dollar of household disposable income, there is $1.71 worth of debt.

Poloz says the central bank is very much aware of the impact rate hikes could have on the economy and debt-burdened Canadians.

“It’s a force acting on the economy that would prevent us from getting interest rates all the way back to what people consider to be neutral,” said Poloz.

“So yes, a heavily indebted household is a concern. We can do the arithmetic, we have the micro-data, we know,” he said. “So, we’re watching for those signs and people need to be thinking about how will they deal with a higher interest rate at renewal.”

Poloz says that’s why the bank’s monetary policy must remain accommodative, “in order to keep this thing where it is.”

The central bank governor also said high household debt was a key factor in deciding to toughen the mortgage process so that homebuyers would be in a better position to absorb an increase in interest rates.

Even so, the central bank has faced calls to curb Canadians’ appetite for debt.

“When it comes to consumer debt, you know what? We tell people to pay down their debt, we tell them to stop borrowing; but they keep doing it,” said Gareth Watson, director of Richardson GMP’s investment management group, in an interview with BNN Wednesday morning prior to the central bank’s rate decision.

“And they’re going to keep doing it, ’cause if you keep offering them free money – or I should say cheaper money – they’re going to take it.”

Poloz says he doesn’t think Canadians are under any illusions when it comes to debt, and believes as long as people properly prepare themselves for the eventuality of hig

her borrowing costs, then the impact should be somewhat minimal.

“I don’t think Canadians misunderstand debt. And I rarely meet anybody that’s surprised by hearing me say ‘you know interest rates are really low.’ They know.”

He also said people should think about what a 100 or 150 basis point increase in interest rates could mean for their finances.

“If you think about it and prepare for it, then I think it will be okay.”

By Derrick McElheron, BNN.

Interest Rates Prediction

The Bank of Canada’s decision to raise its benchmark rate to 1.25% earlier this week will make renewals a significantly more daunting prospect for mortgage holders, observers warned.

This combination of higher payments and the spectre of even more hikes for the rest of 2018 is but the latest in the apparent gradual demise of the low-rate regime that has long characterized the Canadian market: Even before the BoC decision, 5 of the largest Canadian banks have already hiked 5-year fixed rates 15 basis points to 5.14% last week.

“With the recent rise in rates, we’re now at the point where the average consumer is seeing monthly payments rise at their first renewal, something we haven’t seen on a sustained basis since the early 90s,” North Cove Advisors president Ben Rabidoux said, as quoted by Maclean’s.

Even back in July, the BoC already cautioned that even just a 1-point increase would prove to be a major burden to highly indebted borrowers. For instance, a borrower with a $360,000 mortgage and a gross income of $63,000 would need to pay an additional $180 monthly, representing around 3.5% of income.

Mortgage Professionals Canada chief economist Will Dunning noted that fortunately for those who are planning to renew this year, they are not expected to suffer steep increases in mortgage rates.

“Most renewals will be at similar or slightly higher rates than in 2013,” Dunning stated, noting that about 70% of mortgages in Canada are fixed rate, with most of those coming in 5-year terms. This is because the average rates between 2013 and 2018 so far (3.23% and 3.4%-3.6%, respectively) are not that far from each other.

However, a complicating factor that borrowers should take into account is that rates on credit cards, car loans, and home equity lines of credit could also increase in response.

“The bigger impact will be next year, rather than this year,” TD chief economist Beata Caranci said, adding that the difference between 2014-2019 rates will likely be greater than that in the 2013-2018 period, especially if the BoC tightens further.

Those who will enjoy increased incomes and home equity this year would be able to weather the worst of this, Caranci explained. “The more principle you’ve already paid down in the last five years, the more room you have to negotiate,” she said. “So it should be manageable.” By Ephraim Vecina.

LSTAR Statistics for 2017

A historic year for real estate in 2017

Home sales exceed 11,000 for the first time

London, ON – The London and St. Thomas Association of REALTORS® (LSTAR) announced 2017 marked a historic year for residential real estate, with home sales surpassing 11,000 for the first time since LSTAR began tracking data in 1978. In 2017, a total of 11,203 homes were sold, up 8.0% from 2016.

“Residential sales across the region in 2017 is definitely one for the record books,” said Jim Smith, 2017 LSTAR President. “Looking back, we saw it all last year. London and St. Thomas achieved so many ‘firsts,’ from six consecutive months of record sales to robust out-of-town interest. The real estate activity very much echoed the positive momentum most of the country experienced throughout the year.”

In 2017, the average sales price across London and St. Thomas was $330,037 up 18.0% from 2016. By geographic area, London South was $340,793, up 21.7% from 2016. In London North, average home sales price was $407,801, up 18.1% compared to the previous year, while in London East, it was $258,734, an increase of 16.9%. In St. Thomas, it was $261,481, up 15.2% over 2016.

“In 2018, it will be interesting to see what impact the new mortgage qualification tests will have on the housing market, here in our backyard and across Canada,” Smith said. “This is just one of the reasons why getting in touch with a REALTOR® is so helpful in selling or purchasing a home. REALTORS® are the professional source in guiding you through these changing times.”

St. Thomas saw a total of 901 homes sold in 2017, up 6.8% from 2016. In 2017, there were a total of 14,301 home listings, down 1.2% from 2016. The trend of high demand with low supply continued in 2017, with inventory (called Active Listings) down 35.6% from the previous year.

“It was a wonderful year serving as President of our real estate association,” Smith said. “As we move ahead in 2018, I firmly believe home sales will continue to be strong in our marketplace.”

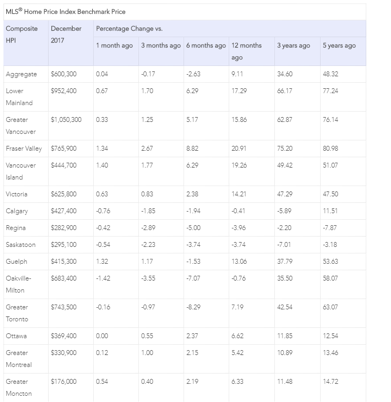

The following table is based on data taken from the CREA National MLS® Report for November 2017 (the latest CREA statistics available). It provides a snapshot of how average home prices in London and St. Thomas compare to other major Ontario and Canadian centres.

|

City

|

Average Sale

|

|

Vancouver

|

$1,081,876

|

|

Toronto

|

$779,693

|

|

Fraser Valley

|

$741,172

|

|

Victoria

|

$684,843

|

|

Hamilton

|

$545,690

|

|

Calgary

|

$450,700

|

|

Kitchener-Waterloo

|

$445,855

|

|

Niagara

|

$389,016

|

|

Ottawa

|

$385,058

|

|

Edmonton

|

$372,911

|

|

London St. Thomas

|

$332,607

|

|

Windsor-Essex

|

$265,565

|

|

CANADA

|

$513,433

|

Canadian Market Face Test of Might

Canada’s real estate market will hit a slow patch in 2018 as tighter mortgage stress tests apply pressure and the impact could be exacerbated if an expected interest rate hike drives buyers to put off their home purchases, economists said earlier this week.

Observers added that further hikes from the Bank of Canada could heap stress onto buyers already combating stricter regulations that were introduced by the Office of the Superintendent of Financial Institutions on January 1 for uninsured mortgages, and elevated 5-year fixed mortgage rates that were pushed up by the CIBC, RBC, and TD banks last week.

“This is the most significant test the market has seen in recent years,” CIBC chief deputy chief economist Benjamin Tal said, as quoted by The Canadian Press.

Tal is expecting a market slowdown to be seen as early as the first quarter as people who were hoping to scoop up homes weigh whether renting or living with family for a bit longer will pay off later in the year, when the country has grown accustomed to the new conditions.

“The big question though is to what extent investors will stop buying,” Tal stated. “That will carry a big effect, but it’s still the biggest unknown.”

The Canadian Real Estate Association slashed its sales forecast for 2018 to predict a 5.3% drop in national sales to 486,600 units this year, shaving about 8,500 units from its previous estimate due to the impact of the stricter mortgage stress tests.

Earlier this week, the association released a report revealing that national home sales rose 4.5% on a month-over-month basis in December, and that the average national home price reached just over $496,500, up 5.7% from one year earlier.

CREA noted that the bounce likely stemmed from buyers scrambling to nab homes before being forced to submit to the uninsured mortgage regulations, which requires would-be homebuyers with a more than 20% down payment to prove they can still service their uninsured mortgage at a qualifying rate of the greater of the contractual mortgage rate plus two percentage points or the five-year benchmark rate published by the Bank of Canada.

“It will be interesting to see if the monthly sales activity continues to rise despite tighter mortgage regulations,” CREA chief economist Gregory Klump said in the report.

The association also shared that the number of homes on the market increased by 3.3% in December from the month before and December home sales were up 4.1% on a year-over-year basis.

The improvements signal that the country is “fully recovering from the slump last summer” when there was a drop in sales before a set of policies introduced by the Ontario government in April produced the desired market slowdown in Toronto during the second and third quarters following a hot first quarter.

“The new OFSI measures and a shift to a rising-state environment should prevent speculative froth from building again, and contain price growth to a reasonable pace for the remainder of the cycle,” BMO Capital Markets senior economist Robert Kavcic predicted in a note. by Ephraim Vecina.

Change of Space for 2018

This week, the Bank of Canada benchmark rate moved to 5.14 from 4.99%. Please ensure you remove previous versions of the “Change of Space” New OSFI Mortgage Rules” from your website, Autopilot, etc. as those documents are showing the older benchmark rate.

In October, the Office of the Superintendent of Financial Institutions Canada (OSFI) published the final version of its Guideline B-20. The revised Guideline, which took effect January 1, 2018, applies to all federally regulated financial institutions.

Overview of Changes effective January 1, 2018:

A new minimum qualifying rate (stress test) for uninsured mortgages will be set

The minimum qualifying rate for uninsured mortgages will be the greater of the five-year benchmark rate published by the BoC or the contractual mortgage rate +2%.

Lenders will be required to enhance their LTV measurement and limits to ensure risk responsiveness

Federally regulated financial institutions must establish and adhere to appropriate LTV ratio limits that are reflective of risk and updated as housing markets and the economic environment evolve.

Restrictions will be placed on certain lending arrangements that are designed, or appear designed to circumvent LTV limits

A federally regulated financial institution is prohibited from arranging with another lender: a mortgage, or a combination of a mortgage and other lending products, in any form that circumvents the institution’s maximum LTV ratio or other limits in its residential mortgage underwriting policy, or any requirements established by law.

Economic Highlights

Data Release: Poloz bumps up borrowing costs, but caution still the word

• The Bank of Canada increased its key monetary policy interest rate by 25bps this morning, to 1.25%.

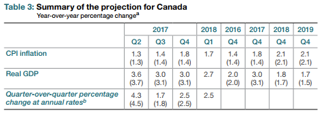

• The decision was accompanied by the latest Monetary Policy Report (MPR), which provided a fresh view of the Bank’s economic outlook. The Bank estimates that growth in 2017 averaged 3.0%, while their outlook for this year has been upgraded slightly, to 2.3%, from 2.1% in October. Growth of 1.6% is projected for 2019, embodying a modest improvement from October’s 1.5% forecast.

• The pace of potential growth remained a key concern for the Bank. It is possible that strong demand may be motivating increased inputs of capital and labour, and the Bank will closely monitor developments on this front. In practical terms, although strong business investment has led the Bank to upgrade the level of potential in 2017, the output gap is judged to be in the -0.25% to +0.75% range, suggesting that economic slack has been effectively absorbed. The Bank acknowledged that labour market slack is being absorbed more quickly than previously anticipated. However, wage data and other measures suggest that, in contrast to an overall lack of spare capacity in the economy, some slack may still remain in labour markets.

• The diminishing slack has made itself felt in core inflation measures. While temporary factors such as energy price swings will generate near-term noise, inflation is expected to trend close to the midpoint of the Bank’s 1% to 3% band over the forecast horizon.

• As always, the MPR assessed the key risks to the economic outlook. Weaker exports are the top risk in light of NAFTA uncertainty and recent imposition of tariffs by the United States. Faster potential output, stronger U.S. growth and more robust consumer spending (paired with rising household debt) were also seen as risks. A “pronounced” drop in home prices in key overheated Canadian markets rounded out the list of concerns.

Key Implications

• In light of an impressive run of labour market data and their latest Business Outlook Survey painting a positive picture, the Bank of Canada was widely expected to hike rates today, and Governor Poloz and company did not disappoint. It has become increasingly clear that emergency level interest rates are no longer warranted. But, while rates look likely to continue to rise, the key question remains “at what pace?”

• Today’s statement and MPR provided some further indication of the answer. Emergency level rates may not be needed, but that doesn’t mean that the Bank is in a rush to continue hiking. NAFTA uncertainty hangs over the outlook, with the Bank explicitly downgrading the outlook for business investment and trade to account for the impact of negotiations. What’s more, despite the positive run of labour market data, wage growth remains weaker than the Bank had expected. Most explicit was the statement that while the outlook will likely “warrant higher interest rates over time, some continued monetary policy accommodation will likely be needed”.

• As such, it remains our base-case view that a gradual pace of tightening is most likely, with the next hike penciled in for July. Data dependency of course means that this is not a lock. Developments in Poloz’s list of areas to watch, including interest rate sensitivity, labour market developments, and inflation dynamics could easily bring the next hike forward, or push it back.

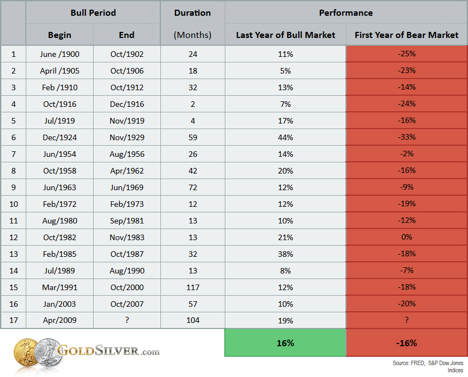

United States

· Not even a looming government shutdown could dampen market optimism this week. More evidence of strong momentum in the economy saw equities gain ground, while Treasuries and the U.S. Dollar continued to fall.

· It remained a coin toss at time of writing whether Congress will reach a funding deal to avert a government shutdown at midnight. If government shuts down, many non-essential services won’t operate, and employees will not be paid.

· For markets, shutdowns have been modest negatives in the past. However, markets rallied in the last three. All told the U.S. economy has very solid momentum heading into 2018. A closure would be a slight hit to growth, but not derail the U.S. expansion.

Canada

· As expected, the Bank of Canada this week raised its key interest rate by 25 basis points, putting the overnight policy rate at 1.25%. However, the decision was accompanied by a dovish tone, justified by the downside risks to the outlook.

· It appears that homebuyers pulled forward purchases into last fall, ahead of the B-20 guidelines that took hold at the start of this year. We anticipate that existing home sales will be dampened by the new guidelines, particularly as the qualifying mortgage rate rises further above 5%.

· All told, the key message from this week’s interest rate decision is that interest rates are headed higher. However, downside risks warrant a gradual pace of increase.

![]()

![]()