Industry & Market Highlights

Residential Market Commentary – Jobs up. Rates steady

The Canadian economy just keeps playing into the hands of the Bank of Canada as the central bank continues to resist pressures to trim interest rates.

The latest jobs report has given the Bank yet more ammunition to defend its position. The December figures showed a nice recovery following the sharp drop in November. The economy netted 35,200 additional jobs last month and the unemployment rate dropped three basis points to 5.6%. Virtually all of the gains came in full-time employment in the private sector. The number of part-time positions fell by 3,200 and the public sector shed more than 21,000 jobs.

For all of 2019 Canada added more than 320,000 jobs: 283,000 full-time and 37,500 part-time. Most of that was in the first half of the year. Some market watchers see the slowdown through the second half of 2019 as an indicator that big, job growth numbers will likely diminish for 2020. This could be a sign that slack in the labour market is tightening-up.

None the less, on-going job growth and low unemployment support the Bank of Canada’s stance that the economy remains relatively resilient, despite globe headwinds, and rate cuts are unnecessary.

The next rate setting and Monetary Policy Report are due on January 22nd. By First National Financial LP.

Residential Market Commentary – 2020 foresight

The New Year is here, we are heading into a new decade and by most accounts all is right in Canada’s housing market.

2019 has been a turnaround year in the industry, particularly through the second half. The Canadian Real Estate Association, the big realtors and the Canada Mortgage and Housing Corporation all expect an ongoing recovery through 2020. But each has its own interpretation of “recovery”.

CREA’s early projections for the coming year forecast a 9% increase in sales activity to 530,000 units with a 6% increase in the national average cost of a home to $531,000. However, the association says the price increase will be driven by a lack of supply. New listings sagged in the second half of 2019 and CREA expects that trend to continue.

Re/Max and Royal LePage see prices rising by 3.7% and 3.2% respectively. Both firms say homebuyers, especially millennials, have adjusted to the government “stress test” and are coming back to the market after stepping to the sidelines back in 2018.

CMHC measures the recovery in terms of the market falling in line with economic fundamentals. Its concerns with overvaluation and rampant price acceleration are easing especially for the hot markets of Toronto and Vancouver. The agency says the current outlook “does not imply that overvaluation and/or price acceleration … will necessarily worsen”. But with ongoing, ultra-low interest rates, and the prospect of a Bank of Canada rate cut sometime in 2020 there is no implication there will be an improvement either. By First National Financial.

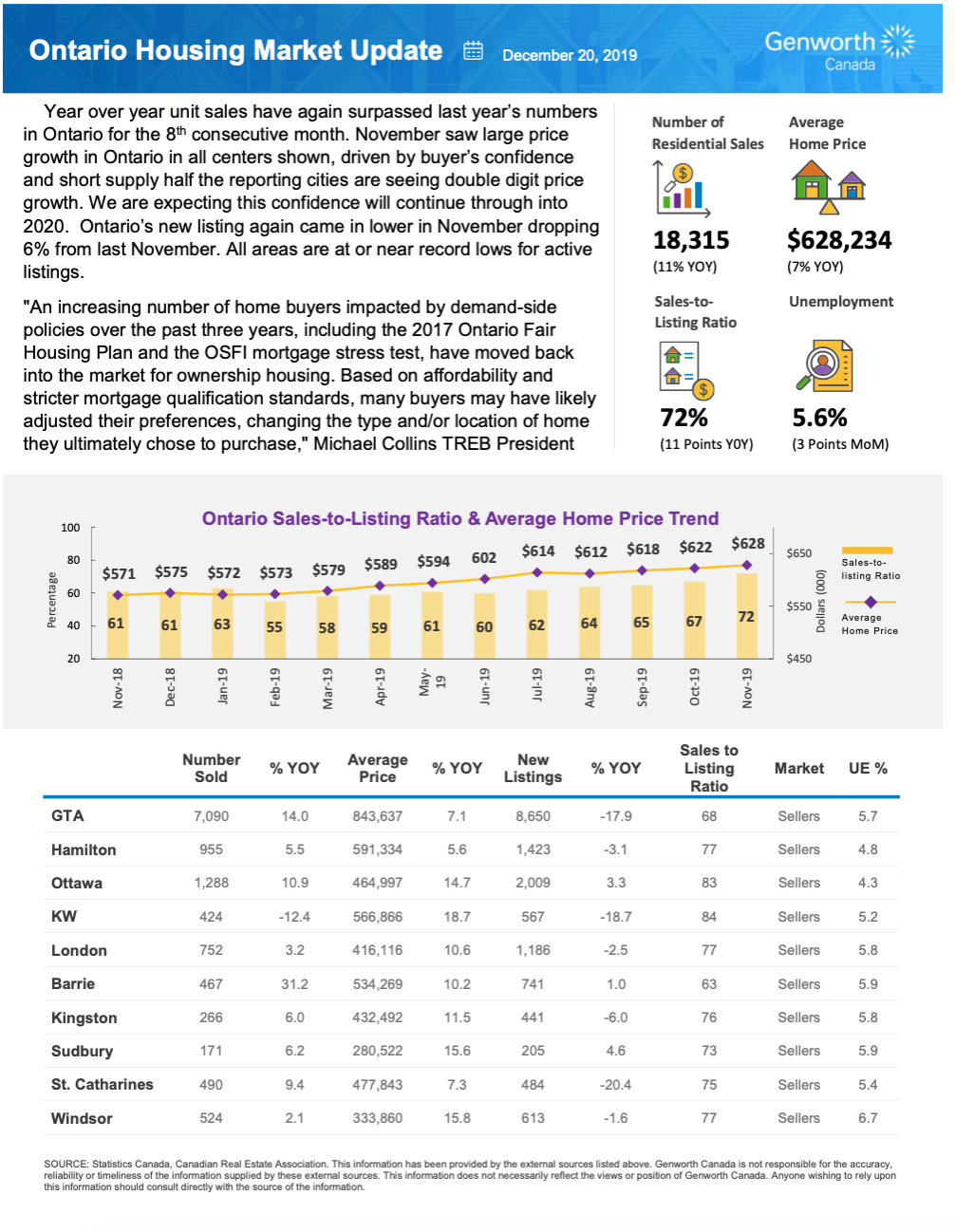

Ontario Housing Market Update by Genworth

Merix Financial shared the December 2019 Regional Risk Reports courtesy of our partners at Genworth Canada. XXX. View the full report for your province here.

LSTAR News Release for December 2019 – The Third Best Year in the History of LSTAR

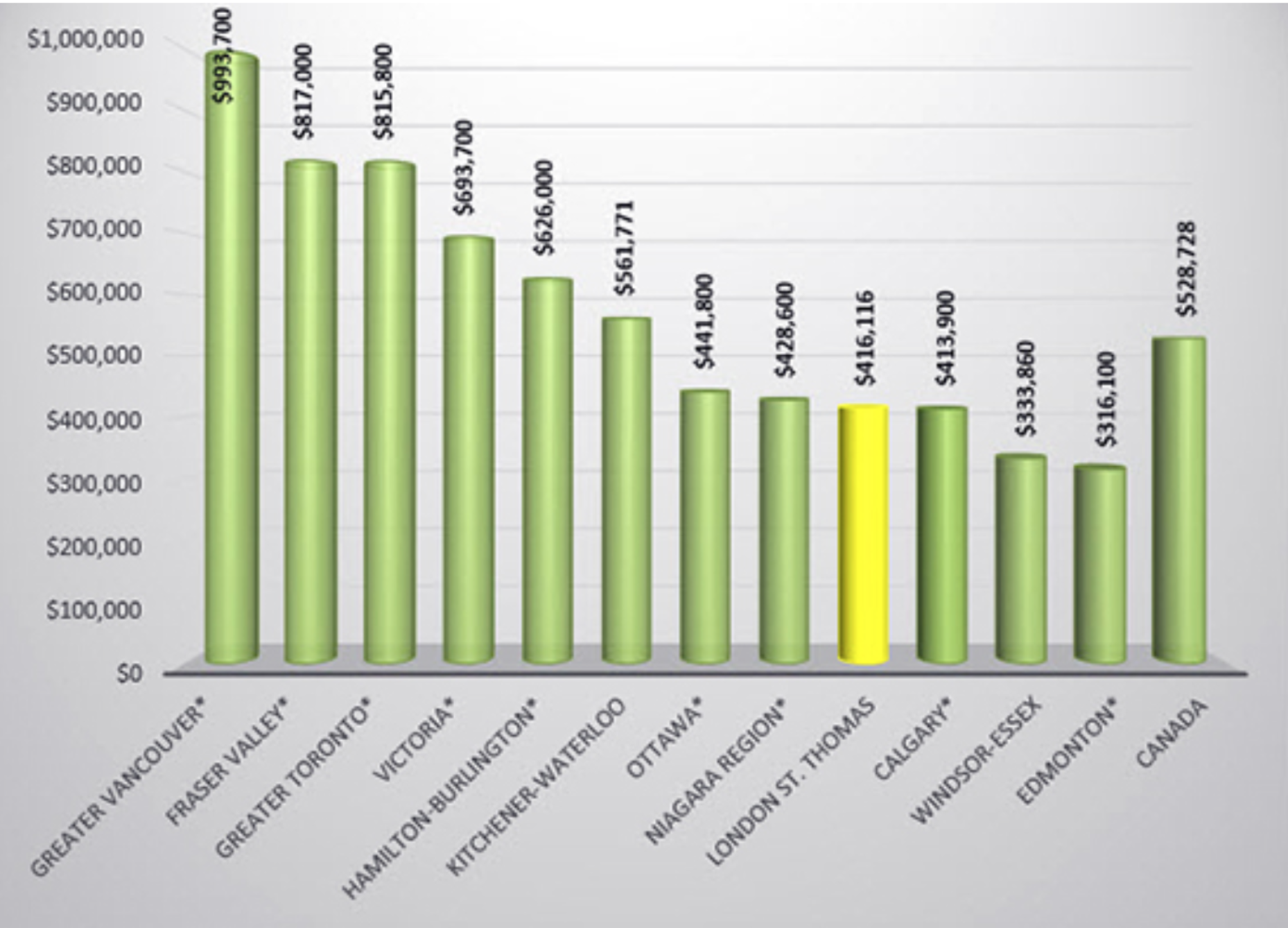

2019 proved to be not only a solid year for real estate in the London-St Thomas area, but also the third best year for sales activity since the Association began tracking its performance back in 1978.

469 homes traded hands in LSTAR’s jurisdiction in December, which brings the total number of 2019 residential transactions recorded via MLS® to 10,125 – up 3.4% over 2018. This is only the third time that sales surpassed 10,000 units. It happened for the first time in 2016 and then again in 2017, a record year with more than 11,000 home resales.

“For the local REALTORS®, 2019 started strong and continued on the same note, with three monthly records in July, October and November,” said 2019 LSTAR President Earl Taylor. “For the most part of the year, LSTAR’s overall sales-to-new-listings ratio hovered around the 70% mark. However, toward the end of the year its value jumped significantly, to reach 110.1%. This means that Sellers have the upper hand in home sales negotiations here. It also speaks to the high buyer demand and the lack of local housing supply,” Taylor explained.

Overall, the December average home price was $426,539, up 15.1% compared to December 2018. The year-to-date average home price in LSTAR’s jurisdiction sits at $409,858.

Looking at London’s three main geographic areas, the average home price in London East was $356,065, up 25.4% from last December.

In London South (which includes data from the west side of the city), the average home sales price was $454,455, up 7.9% compared to the previous year, while London North saw an increase of 20.8% over last December, with an average home sales price of $515,958.

The following chart is based on data taken from the CREA National Price Map for December 2019 (the latest CREA statistics available). It provides a snapshot of how home prices in London and St. Thomas compare to some other major Ontario and Canadian centres.

Canadian buyers increasingly worried about qualifying for mortgage

Ninety-two percent of Canadians see at least one barrier to home ownership, and two of the top concerns are related to the mortgage process, according to a recent survey from Zillow and Ipsos.

Canadians report feeling pressured by stricter mortgage regulations that went into effect in 2018 and Zillow’s survey found that 56% of Canadians see qualifying for a mortgage as a barrier to home ownership—a six-point increase from 2018. This concern rises to 64% for consumers who recently purchased a home, likely linked to the impending mortgage regulation changes at the time of their home search.

New and stricter mortgage requirements took effect in January 2018 with the addition of a stress test, requiring borrowers to qualify under a higher rate. The rule only applies to newly originated mortgages and is designed to prevent borrowers from taking on more debt than they can handle if interest rates go up. Since its passing, buyers’ worries are growing according to the survey. Half of Canadians (51%) say they are specifically concerned that stricter rules will prevent them from qualifying for a mortgage, up five points since 2018.

Steve Garganis, lead mortgage planner with Mortgage Architects in Mississauga, said that the concerns have risen due to more information flowing to consumers.

“Canadians are surprised to learn that even a large down payment won’t guarantee you a mortgage approval. Got 30%, 40%, 50%, 60% down payment and great credit? Guess what? You still may not qualify for a mortgage. This is ridiculous, in my opinion,” Garganis said. “Those of us with years of experience in risk mitigation and credit adjudication know that if you have a large down payment, the chances of default are slim and none. Chances of any loss to the lender is nil.”

Younger home shoppers also feel the weight of the law. Sixty-nine percent of younger home shoppers, those between 18-34 years old, are concerned about qualifying for a mortgage under the stricter guidelines. This worry is also present for current renters who may be considering the purchase of their first home: 66% express concerns about mortgage qualification under stricter guidelines.

This despite a recent CMHC survey that found homebuyers were overwhelmingly in favour of the stress test, agreeing that the measure would help prevent Canadians from shouldering mortgages that they couldn’t afford.

Garganis added that more Canadians are being forced back to the six big banks, as smaller lenders now have more costs in raising funds to lend. This results in Canadians paying more than they should.

Most people have heard the buzz word “stress test” but don’t really know what it means or know the specifics of what it did, said Jeff Evans, mortgage broker with Canada Innovative Financial in Richmond, B.C. He thinks that the higher qualifying standard is “quite unreasonable,” and that the government has “taken a hatchet to anything to do with helping the average Canadian to own a home.”

Evans says that Canadians have a right to be concerned, although there’s no sign of their concerns hampering their desire to purchase a home.

“Life has gone on. They qualify for less, the market has gone down primarily because of the changes the government has made, so it’s starting to get more affordable again and people are gradually coming into the market as it becomes more affordable, “Evans said.

Other perceived barriers to home ownership include coming up with a down payment (66%), debt (56%), lack of job security (47%), property taxes (46%), not being in a position to settle down (15%), or not being enough homes for sale (13%). Only 8% of Canadians claim not to see any barriers to owning a home. By Kimberly Greene.

Weak New Listings Slow Canadian Home Sales as Prices Continue to Rise

Statistics released today by the Canadian Real Estate Association (CREA) show that national existing-home sales dipped between November and December owing to a dearth of new listings, especially in the GTA.

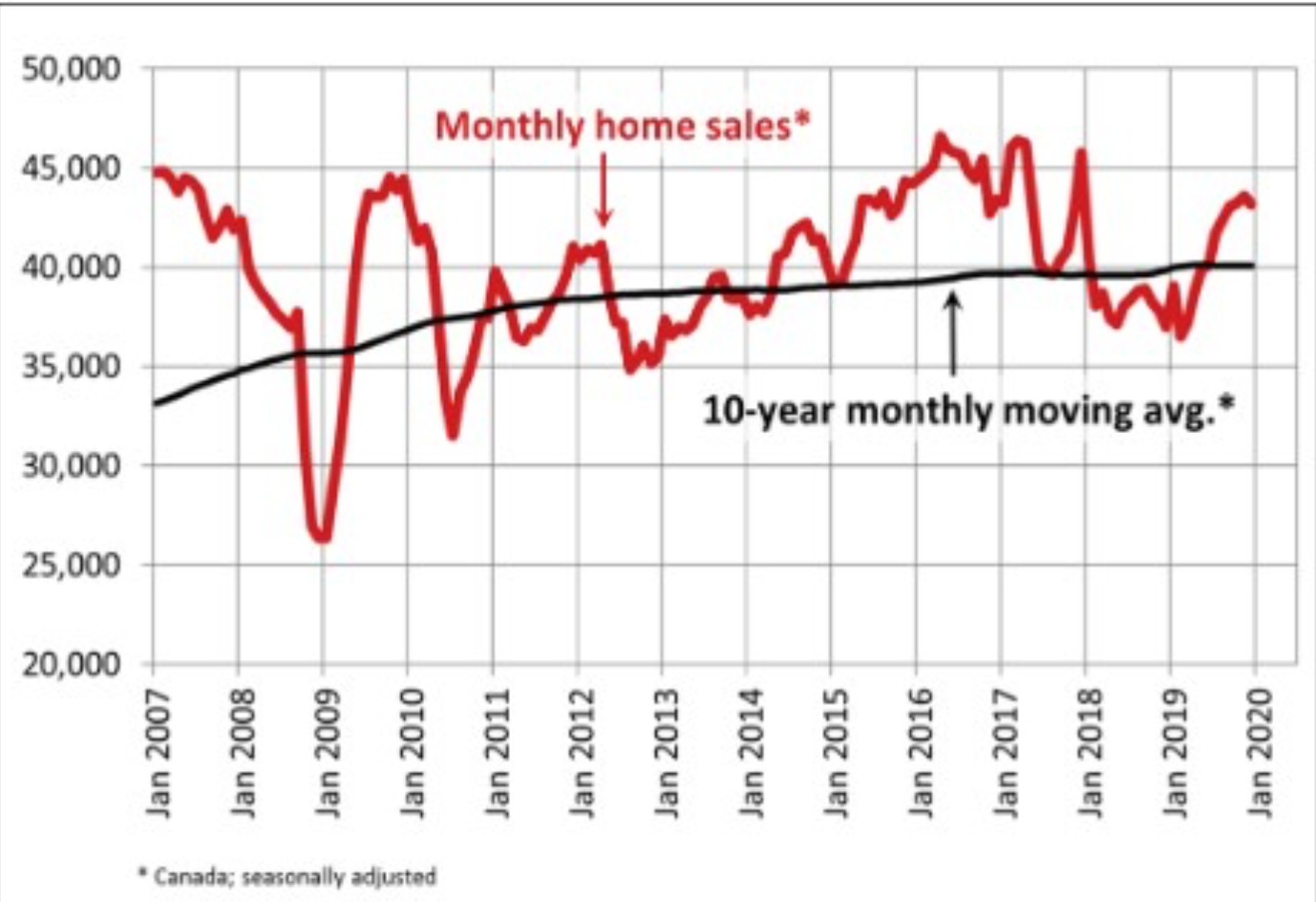

National home sales edged down 0.9% in the final month of 2019, ending a streak of monthly gains that began last March. Activity is now about 18% above the six-year low reached in February 2019 but ends the year about 7% below the peak recorded in 2016 and 2017 (see chart below).

There was an almost even split between the number of local markets where activity rose and those where it declined, with higher sales in the Lower Mainland of British Columbia, Calgary and Montreal offsetting declines in the Greater Toronto Area (GTA) and Ottawa.

Actual (not seasonally adjusted) activity was up 22.7% compared to the quiet month of December in 2018. Transactions surpassed year-ago levels across most of Canada, including all of the largest urban markets.

The December decline in home sales is not a sign of weakness but is instead the result of diminishing supply. Excess demand continues to push up prices in most regions of Canada. Demand has been boosted by low interest rates, strong population growth and strong labour markets that have triggered significant gains in household incomes. Mitigating this, in part, is the mortgage stress-test, which continues to sideline some potential buyers.

According to Gregory Klump, CREA’s Chief Economist, “The momentum for home price gains picked up as last year came to a close. If the recent past is prelude, then price trends in British Columbia, the GTA, Ottawa and Montreal look set to lift the national result this year, despite the continuation of a weak pricing environment among housing markets across the Prairie region.”

New Listings

The number of newly listed homes slid a further 1.8% in December following a 2.7% decline the month before, leaving supply close to its lowest level in a decade.

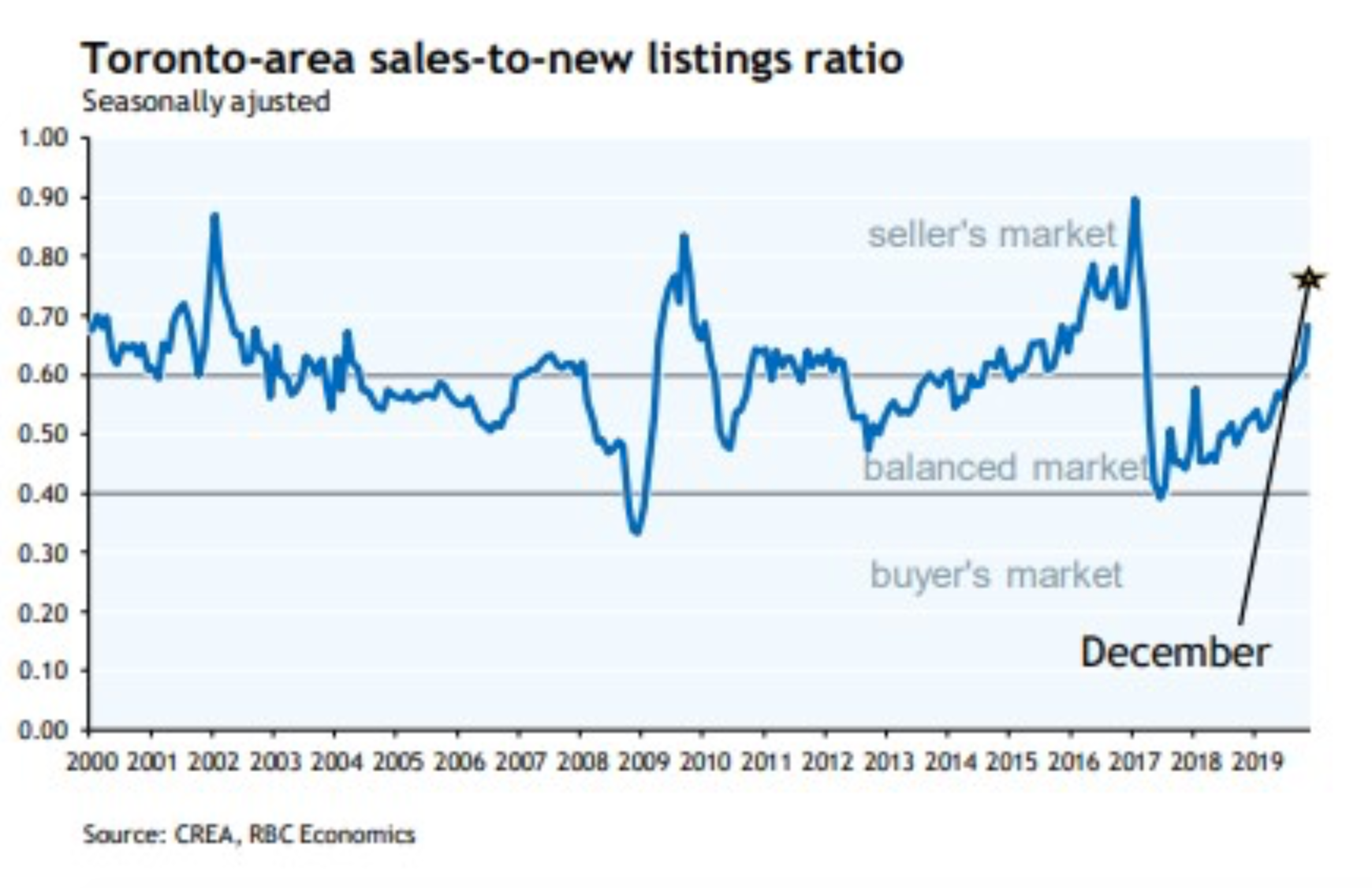

Slightly higher sales and a drop in new listings further tightened the national sales-to-new listings ratio to 66.3%, which is well above the long-term average of 53.7%. If current trends continue, the balance between supply and demand makes further home price gains likely.

December’s drop was driven mainly by fewer new listings in the GTA and Ottawa–the same markets most responsible for the decline in sales. Listings available for purchase are now running at a 12-year low. The number of housing markets with a shortage of listings is on the rise; should current trends persist, fewer available listings will likely increasingly weigh on sales activity.

With new listings having declined by more than sales, the national sales-to-new listings ratio further tightened to 66.9% in December 2019 – the highest reading since the spring of 2004. The long-term average for this measure of housing market balance is 53.7%. Price gains appear poised to accelerate in 2020.

Considering the degree and duration to which market balance readings are above or below their long-term averages is the best way of gauging whether local housing market conditions favour buyers or sellers. Market balance measures that are within one standard deviation of their long-term average are generally consistent with balanced market conditions.

Based on a comparison of the sales-to-new listings ratio with the long-term average, just over half of all local markets were in balanced market territory in December 2019. That list still includes Greater Vancouver (GVA) but no longer consists of the GTA, where market balance favours sellers in purchase negotiations (see chart below). By contrast, an oversupply of homes relative to demand across much of Alberta and Saskatchewan means sales negotiations remain tilted in favour of buyers. Meanwhile, an ongoing shortage of homes available for purchase across most of Ontario, Quebec and the Maritime provinces means sellers there hold the upper hand in sales negotiations.

The number of months of inventory is another important measure of the balance between sales and the supply of listings. It represents how long it would take to liquidate current inventories at the current rate of sales activity. There were 4.2 months of inventory on a national basis at the end of December 2019 – the lowest level recorded since the summer of 2007. This measure of market balance has been falling further below its long-term average of 5.3 months. While still within balanced market territory, its current reading suggests that sales negotiations are becoming increasingly tilted in favour of sellers.

There remain significant and increasing disparities in housing market activity across regions of Canada. The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers ample choice in these regions. By contrast, the measure is running well below long-term averages in Ontario, Quebec and Maritime provinces, resulting in increased competition among buyers for listings and providing fertile ground for price gains. The measure is still within balanced market territory in British Columbia but is becoming increasingly tilted in favour of sellers.

Home Prices

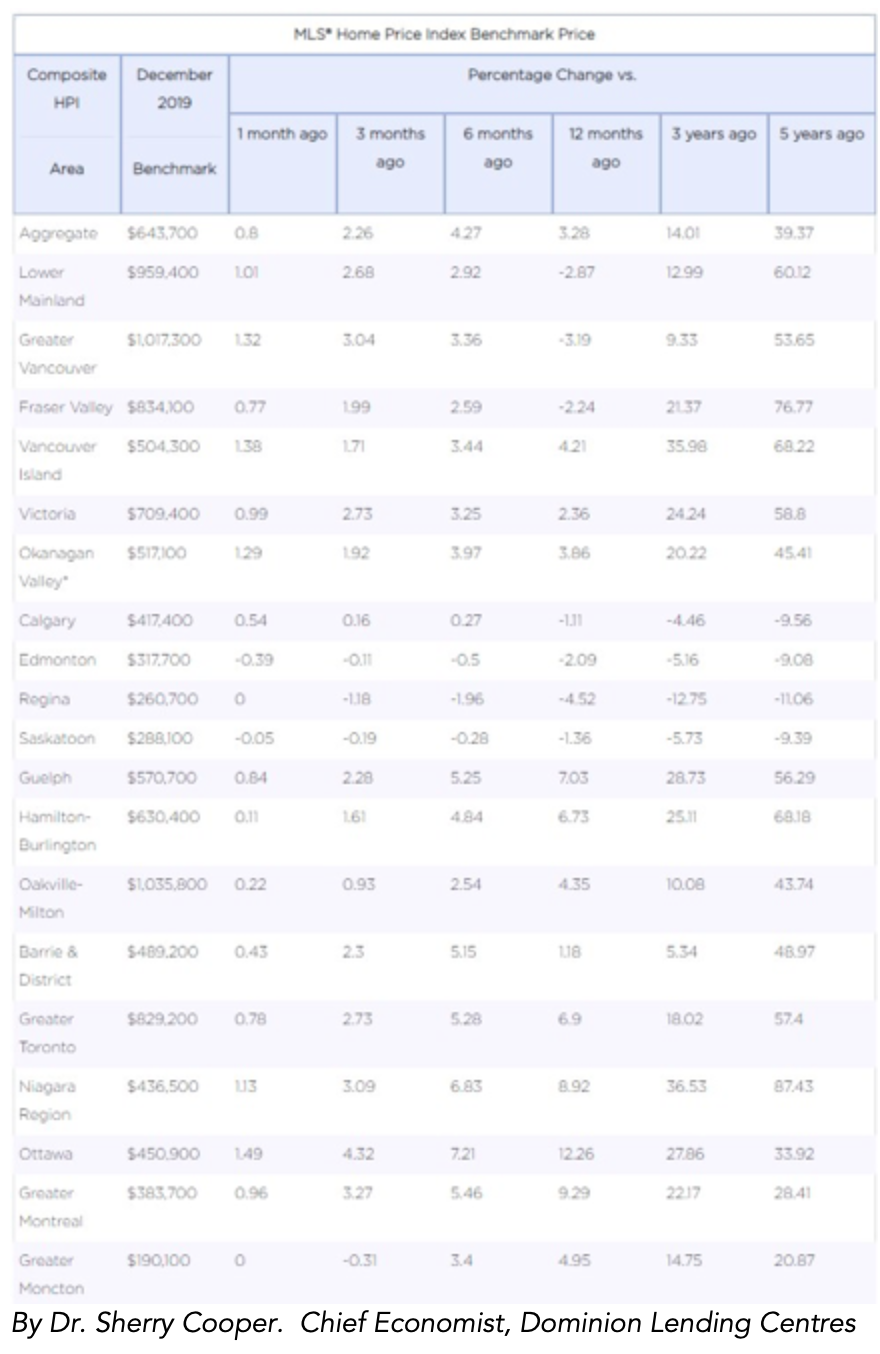

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8%, marking its seventh consecutive monthly gain. It is now up nationally 4.7% from last year’s lowest point posted in May. The MLS® HPI in December was up from the previous month in 14 of the 18 markets tracked by the index. ( see table below).

Home price trends have generally been stabilizing in the Prairies in recent months following lengthy declines but are clearly on the rise again in British Columbia and Ontario’s Greater Golden Horseshoe (GGH). Further east, price growth in Ottawa and Montreal has been ongoing for some time and strengthened toward the end of 2019.

Comparing home prices to year-ago levels yields considerable variations across the country, although for the most part has been regionally split along east/west lines, with declines in the Lower Mainland and major Prairie markets and gains in central and eastern Canada.

The actual (not seasonally adjusted) Aggregate Composite MLS® (HPI) rose 3.4% y-o-y in December 2019, the biggest year-over-year gain since March 2018.

Home prices in Greater Vancouver (-3.1%) and the Fraser Valley (-2%) remain below year-ago levels, but declines are shrinking. Elsewhere in British Columbia, home prices logged y-o-y increases in the Okanagan Valley (+4.2%), Victoria (+2.3%) and elsewhere on Vancouver Island (+4.2%). Calgary, Edmonton and Saskatoon posted y-o-y price declines of around -1% to -2%, while the gap has widened to -4.6% in Regina.

In Ontario, home price growth has re-accelerated well above consumer price inflation across most of the GGH. Meanwhile, price gains in recent years have continued uninterrupted in Ottawa, Montreal and Moncton.

All benchmark home categories tracked by the index accelerated further into positive territory on a y-o-y basis. One-storey single-family home prices posted the most significant increase (3.6%) followed closely by apartment units (3.4%) and two-storey single-family homes (3.3%). Townhouse/row unit prices climbed a slightly more modest 2.7% compared to December 2018.

The actual (not seasonally adjusted) national average price for homes sold in December 2019 was around $517,000, up 9.6% from the same month the previous year.

The national average price is heavily skewed by sales in the GVA and GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts more than $117,000 from the national average price, trimming it to around $400,000 and reducing the y-o-y gain to 6.7%.

Economic Highlights

Capital Market Update. Market Commentary: A review of the latest employment numbers, rates and more

Welcome to the 2020 edition of your favourite market commentary. A lot has happened in the last couple weeks, but I made a New Year’s resolution to not live in the past. So, I probably won’t cover any of it.

See? 2020 is already off to a great start. It really helps when you set achievable goals.

Rates

Where are rates headed these days? That’s a good question. So, if you find out let me know. What I do know is that the current 5-year GoC bond is yielding 1.61% and the 10-year is yielding 1.60%. There’s still a slight inversion in the 5-10 area of our yield curve (also known as the belly). The 30-year GoC is currently yielding 1.71%. The 5 and 10s are about 6 bps higher than a week ago and only 2 bps higher than this time in December. Maybe we didn’t miss much after all.

On the credit curve, 5-year Canada Mortgage Bond’s are currently yielding 1.88% and 10-year CMB’s are yielding 1.96%. That’s about 2 bps wider in the 5-year from a month ago and unchanged from a month ago for the 10-year. Compared to the same time last year, the 5-year is 41 bps lower and the 10-year is 52 bps lower. What I am trying to get across is that it’s still a very good time to be a borrower in the Canadian real estate market. Talk to your favourite First National originator today.

Economic News

After November’s UGLY employment number of -71.2K jobs, all eyes were on December’s employment numbers this morning. If you recall, that number also left us with a 0.4 bp rise in the unemployment rate, the worst reading in a decade.

So how did December do? Much better. Canadian jobs came in at +35.2K and the unemployment rate retraced 0.3% of the November increase (unemployment rate is now 5.6%). The underlying details were mostly positive, with the hiring coming in full-time employment and roughly split between the goods (+15.7K) and services(+19.4K) sector. Remember, if the gain was only in seasonal and part-time work in services that would not be nearly as positive. I say mostly positive because wage growth, the bane of the Canadian economy, had a larger than expected slowdown. Wage growth was expected to be 4.4% year-over-year and the number came in at 3.8%. The 3.8% wage growth number is still a strong number. I mean its higher than the inflation rate, but have you seen the prices of organic CBD-infused kombucha drinks recently? It’s absurd. How are millennials supposed to live?

Bank of Canada

It’s been a while since we spoke about our favourite central bank. The big news was that the Governor, Stephen Poloz, will be stepping down this year. If you’re interested in applying, you can do so at the link below. Just don’t use me as a referral –https://econjobmarket.org/positions/6410.

Speaking of our soon to be ex-Governor, Mr. Poloz gave a speech yesterday in which he covered a variety of topics including: inter-provincial free trade, data dependency, labour and housing. Overall, he wasn’t in the cheeriest mood with housing being of concern for the BOC with real estate expectations adding froth and increasing household debt levels. On the global trade side, Poloz noted that although there’s still much uncertainty, damage from the global trade conflict is likely to be permanent. Of note to me, he also spoke about the “outrageous” lack of internal free trade in Canada. I would have to agree. Everyone knows beer is cheaper at Quebec Costco’s.

Overall, the market is looking to July for the next rate cut by the Bank of Canada. If you’re a betting person, those odds are sitting at 35%.

Finally, I almost forgot that brevity was another of my New Year’s resolutions. See you on the flip side. By Andrew Masliwec, Analyst, Capital Markets, First National Financial.

Mortgage Update – Mortgage Broker London

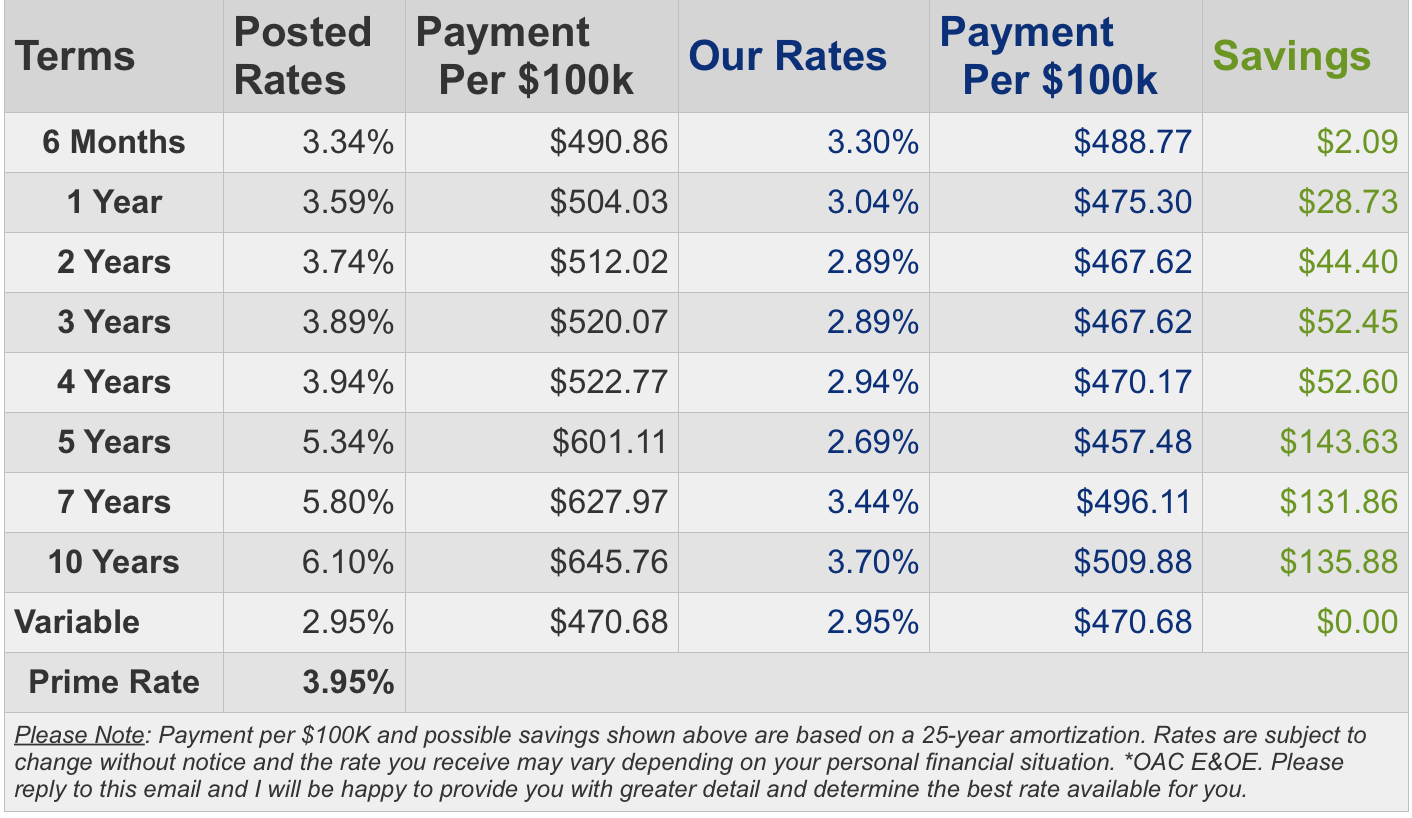

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.19%. Fixed rates are holding steady. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Mortgage Update – Mortgage Broker London