Industry & Market Highlights

Trudeau announces new emergency programme for workers who lost work from COVID-19

Prime Minister Justin Trudeau has announced the federal government is launching the Canada Emergency Response Benefit, a new programme that will provide $2,000 a month for four months to individuals who lost their work as a result of the COVID-19 pandemic.

Speaking outside of his residence where he is self-quarantining with his family, Trudeau acknowledged the dilemma facing Canadians trying to process mounting bills without a steady income, noting that “far too many Canadians are having these tough conversations about their finances and their future.”

With nearly 1 million people applying for employment insurance last week, Trudeau stated the new programme is in the process of being set up.

“An application portal will launch as quickly as possible and people should start receiving money as soon as 10 days of applying,” he said.

The programme will replace a pair of initiatives, the Emergency Care Benefit and the Emergency Support Benefit, that were announced last week. Trudeau said the decision to combine the two earlier programmes into a new endeavour was done “in order to streamline the process.” By Phil Hall.

Canada’s COVID-19 Economic Response Plan: Support for Canadians and Businesses

The Government of Canada announced Canada’s COVID-19 Economic Response Plan: Support for Canadians and Businesses.

1. The Government will waive the one-week waiting period for EI for those individuals in imposed quarantine. This is effective March 15, 2020. No medical certificate will be required to access the EI sickness benefits.

2. The Government announced the Emergency Care Benefit to provide up to $900 bi-weekly, for up to 15 weeks. This will be administrated by Canada Revenue Agency. Support will be provided to:

Workers including the self-employed, who are quarantined or sick with COVID-19 but do not qualify for EI sickness benefits.

Workers, including the self-employed, who are taking care of a family member who is sick with COVIC-19 such as an elderly parent, but do not qualify for EI sickness benefits.

Parents with children who require care or supervision due to school closures, and are unable to earn employment income, irrespective of whether they qualify for EI or not.

Application for the Benefit will be available in April 2020. Canadians will be required to attest that they meet the eligibility requirements and they will need to re-attest every two weeks to reconfirm their eligibility.

3. The Government introduced an Emergency Support Benefit which will be delivered by Canada Revenue Agency to support workers who are not eligible for EI and who are facing unemployment.

4.The Government is going to implement an EI Work Sharing Program which will provide EI benefits to workers who agree to reduce their normal working hours as a result of developments beyond the control of their employers, by extending the eligibility of such agreements to 76 weeks, easing eligibility requirements and streamlining the application process.

5. For low- and modest-income families, the Government is going to increase the Goods and Services Tax credit (GSTC) for the month of May. It will double the maximum annual GSTC payments for 2020. The average boost to income for those benefiting will be close to $400 for single individuals and $600 for couples.

6. The Government is also going to assist families with children by increasing the Canada Child Benefit (CCB) payment amounts for 2020 by $300 per child. These families will receive an extra $300 per child as part of their May payment.

7. The Bank of Canada and the Canada Mortgage and Housing Corporation are putting tools in place to ensure that Canadians do not lose their homes during this difficult time. The important thing to remember is that if you are having difficulty paying your mortgage due to losing your job due to COVID or illness due to COVID please call your lender and discuss this with them.

https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-economic-response-plan-support-for-canadians-and-businesses.html

Ontario Orders Shutdown Of All Non-Essential Businesses

Ontario Premier Doug Ford ordered the closure Monday of all non-essential businesses in the province to help curb the spread of COVID-19.

It will take effect Tuesday at 11:59 p.m. and will last for at least 14 days.

“This is not the time for half measures,” Ford said. “This decision was not made lightly and the gravity of this order does not escape me.”

The full list of businesses that will be allowed to stay open will be released Tuesday, but Ontarians will still have access to groceries and medications, and their power and telecommunications will continue to run, Ford said.

Find the list HERE. https://www.ontario.ca/page/list-essential-workplaces

Ontario reported 78 new COVID-19 cases Monday — the largest increase in a day so far — bringing the provincial total to 503. That number includes six deaths and eight cases that have fully resolved.

At least six of the new cases are hospitalized, including a woman in her 30s, a man in his 40s, two people in their 50s and two people in their 70s.

In Ontario there are currently 23 people hospitalized due to COVID-19, said Ontario’s associate chief medical officer of health, and 26 of the positive cases have been health-care workers.

The vast majority of Ontario’s positive cases are people who have travelled, but about 17 per cent have no history of travel or being in close contact with another confirmed case, said Dr. Barbara Yaffe.

“I think it’s fair to say that yes in some small percentage of cases…there may be some local transmission of COVID-19,” she said.

“The number of positives is going up every day. It’s going up more and more. We know that we’re not able to test everybody yet…when we’re looking at the number of cases, it’s not the complete number of cases.”

The new non-essential business order follows last week’s declaration of a state of emergency, which ordered the closure of all facilities providing indoor recreation programs, all public libraries, all private schools, all licensed childcare centres, all theatres, cinemas and concert venues, and all bars and restaurants except to provide takeout food and delivery.

Ontario also previously ordered public schools closed until April 5, but Ford said Monday that kids won’t be going back to school on April 6.

“We’ve seen global economies grind to a halt,” Ford said. “We’ve seen health-care systems overwhelmed and we’ve seen heartache and loss and we’ve seen countries lose this battle. I’ll tell you, we in Ontario will not follow in those footsteps. We will not lose this battle. We will get ahead of this.”

An economic update being introduced Wednesday by the finance minister in lieu of a full budget will include compensation for businesses, Ford said.

Non-essential businesses can certainly operate remotely, with staff working from home, but the province doesn’t want people gathering in their facilities, Ford said. Bylaw and police enforcement are on the table, Ford and the solicitor general said, but resources for that are scarce.

“It’s absolutely critical that the people listen to the orders,” Ford said. “Again, we can’t be knocking on every single business of this province checking on them. They have a responsibility.”

The government also announced Ontario has 58 dedicated COVID-19 assessment centres running, well up from the 38 Ford said were open just a few days ago.

Since Sunday, more than 1,950 people received negative test results, while more than 8,000 people are still awaiting their results. Ontario is now doing more than 3,000 tests per day and hopes to be at 5,000 soon.

Ontario has also enhanced its COVID-19 self-assessment tool, making it interactive and allowing the province to gather data from it.

The new tool takes users through a series of questions about their symptoms and will help them determine if they are likely to have COVID-19 and what to do.

Health Minister Christine Elliott said in a statement that the tool will give the province real-time data on the number of people who are told to seek care, self-isolate or monitor for symptoms, as well as where in the province they live.

People calling Telehealth Ontario have reported long waits, but Elliott said the service now has more than 2,000 lines running, up from about 400 before the pandemic.

Ford also announced Monday that Ontario is providing a $200-million funding boost for social services, including shelters, food banks, emergency services, charities and non-profits. Money is set to go to municipalities and social service agencies, and will help those organizations hire additional staff and operate using social distancing.

“Organizations across the province are doing critical work right now to help vulnerable Ontarians and these funds will allow them to directly help those who need it most,” Ford said in a statement.

The funding will also go toward an expanded emergency assistance program for people on welfare to help cover food, rent, informal childcare arrangements and other services. By Allison Jones, The Canadian Press.

Dyer: COVID-19 won’t change world forever, but it will change a lot for a long time

They teach you in journalism school never to use the phrase, “X has changed the world forever.” Or at least they should. COVID-19 is certainly not going to change the world forever, but it is going to change quite a few things, in some cases for a long time. Here’s nine of them, in no particular order.

1. The clean air over China’s cities in the last month, thanks to an almost total shutdown of big sources of pollution, has saved 20 times as many Chinese lives as COVID-19 has taken. (Air pollution kills about 1.1 million people a year in China.) People will remember this when the filthy air comes back, and want something done about it. India, too.

2. Online shopping already was slowly killing retail shops. Lockdowns will force tens of millions who rarely or never shop online to do it all the time. (Yes, all the websites are crashed or booked until mid-April now, but there will be lots of time to scale them up to meet demand.) Once customers get used to shopping online, most won’t go back, so retail jobs will disappear twice as fast.

3. Not so radical a change with restaurants, but basically the same story: more takeouts and home deliveries, fewer bums in seats. Habits will change, and a lot of people won’t come back afterward. Food sold out the door generates much less cash flow than food served at the table, and half of servers’ jobs are gone. There will be a severe cull of restaurants.

4. Once it becomes clear that “remote working” actually works for most jobs, it will start to seem normal for people not to go in to work most days. So a steep drop in commuting, lower greenhouse-gas emissions and eventually a lot of empty office space in city centres.

5. There will be a recession, of course, but it probably won’t be as bad or as long as the one after the financial crash of 2008. It isn’t a market collapse costing people their jobs this time — a virus made them stop working, and governments are doing far more than ever before to sustain working people through what probably will be a long siege. When the virus is tamed and they can return to work, the work (in most cases) still will be there. There also will be a few trillion dollars of extra debt.

6. Don’t worry about the debt. Banks always have created as much money as the government requires. Put too much money into the economy and you’ll cause inflation, which is bad, but just replacing what people ordinarily would be earning so the economy doesn’t seize up is good.

So President Macron can tell the French that no business, however small, will be allowed to go bankrupt. Prime Minister Johnson can tell Britons the government will pay them 80 per cent of their normal income, up to the equivalent of $3,000 a month, if their work has vanished. And President Trump can talk about sprinkling “helicopter money” on the grateful masses.

7. What is being revealed here is a deeper truth: “Austerity” — cutting back on the welfare state to “balance the budget” — is a political and ideological choice, not an economic necessity. What governments are moving into, willy-nilly, is a basic income guaranteed by the state.

Just for the duration of the crisis, they say, and it’s not quite a Universal Basic Income, but that idea is now firmly on the table.

8. Collective action and government protection for the old and the poor no longer will be viewed as dangerous radicalism, even in the U.S. Welfare states were built all over the developed world after the Second World War. They will be expanded after the Plague ends.

Indeed, if Joe Biden were to drop out of the presidential race tomorrow for health reasons, Bernie Sanders would stand a fair chance of beating Trump in November.

9. Decisive action on the climate crisis will become possible (though not guaranteed), because we will have learned “business as usual” is not sacred. If we have to change the way we do business, we can.

So it’s an ill wind that blows no good (a saying that was already old when John Heywood first catalogued it in 1546). Some of the anticipated changes are definitely good, but we are going to pay an enormous price in lives and in loss for these benefits. It could have been dealt with a lot better.

And the West should learn a little humility. Taiwan, South Korea and China (after the early fumble) have handled this crisis far better than Europe and North America. These are already more dead in Italy than in China, and America, Britain, France and Germany certainly will follow suit.

By Gwynne Dyer, an independent journalist based in London, England.

COVID-19 OREA Ontario Real Estate Association

COVID-19 is the fastest moving, most dramatic issue I have seen in my lifetime. That means that governments make quick decisions, and all the implications are not immediately clear.

As you know, the Ontario Government ordered most workplaces to close-down effective Tuesday, March 24, at 11:59 p.m. This measure is to prevent the spread of COVID-19.

The Government has created a list of 75 “essential” services, which are businesses that are allowed to stay open, including “Land registration services, and real estate agent services and moving services.”

I have received many questions from Members on this announcement, and we are still gathering information from the Government, but here’s what I can tell you.

Why was “real estate” deemed essential?

We asked for the essential service designation and for the Land Registry Office to stay open because there are thousands of transactions in Ontario right now that have yet to close officially. Every one of them is different.

While some may not require the help of a REALTOR® to close, others will. OREA was concerned that if REALTORS® were not permitted to support these transactions, those families and businesses could have been left high and dry.

Many other professional services appear in the essential list, including banking, lawyers, and accountants. Shutting down these sectors completely, like real estate, could have had huge unintended consequences for consumers and a damaging domino impact on other deals.

What does this all mean?

It does NOT mean business as usual.

ALL REALTORS® should stop face-to-face business, including open houses, in-person showings, and maintaining agents and public office hours.

The Government gave the “essential” label to real estate to permit transactions to close – NOT to allow our Members to carry on with normal business practices during a crisis. All Members should be moving to remote work – full stop.

What about showings involving tenants?

No REALTOR® should, during this State of Emergency, participate in a face-to-face showing, especially of a tenanted property. Legally, the Residential Tenancies Act may permit showings, but for obvious health and safety reasons, these showings need to stop. Instead, I encourage you to work with your clients who are landlords to show these properties virtually.

These are challenging and unprecedented times. We all have an obligation to do what’s right to keep our families, colleagues, and communities safe. We are working with officials to get more information on the impacts of the State of Emergency declaration and will communicate it to all Members when we have it. By Sean Morrison, OREA President.

Government of Canada Announces Additional Measures to Support Continued Lending to Canadian Consumers and Businesses

The Government of Canada is taking immediate and significant action to support Canadian individuals and businesses facing financial hardship as a result of the economic impacts of the global COVID-19 outbreak.

Today, Minister of Finance Bill Morneau announced amendments to mortgage insurance eligibility criteria, set out in regulations made under the National Housing Act and Protection of Residential Mortgage or Hypothecary Insurance Act. These changes will help provide stable funding and liquidity to financial institutions and mortgage lenders and support continued lending to Canadian businesses and consumers.

This announcement is in support of Canada Mortgage and Housing Corporation’s (CMHC) March 16, 2020 launch of a $50 billion Insured Mortgage Purchase Program (IMPP) and CMHC’s March 20, 2020 announcement on program details. The amendments allow mortgage lenders to pool previously uninsured mortgages into National Housing Act Mortgage-Backed Securities (NHA MBS) for CMHC to purchase these securities through the IMPP. The impact of this measure will provide financial institutions with more liquidity. This, in turn, will allow financial institutions to continue lending to businesses as well as individuals, while assisting customers who face hardship and need flexibility, on a case by case basis.

This program builds on other measures announced by the government and Bank of Canada to support liquidity and credit to businesses and borrowers in these extraordinary times. These actions are an important part of Canada’s COVID-19 Economic Response Plan.

To complement the IMPP, the Minister of Finance is announcing today that the eligibility criteria for portfolio insurance are being temporarily relaxed to help mortgage lenders access the IMPP. This will allow previously uninsured mortgage loans that were funded before March 20, 2020, to be eligible for mortgage insurance and to be included in future NHA MBS issuance.

Effective March 24, 2020, the following low loan-to-value mortgages funded prior to the date of this announcement, March 20, 2020, are eligible for government-guaranteed insurance:

Low loan-to-value mortgages with a maximum amortization term up to 30 years commencing from when the loan was funded.

Low loan-to-value mortgages whose purpose includes the purchase of a property, subsequent renewal of such a loan, or refinancing.

All other eligibility criteria for government-guaranteed insurance will continue to apply to these mortgages. The above amendments will remain in force until December 31, 2020, at which time the eligibility criteria will revert to the existing rules. The Minister of Finance reserves the right to make amendments prior to this date, should circumstances change.

These changes will not apply to low loan-to-value mortgage loans funded on or after March 20, 2020. The other existing criteria which apply for transactional mortgage insurance will remain unchanged.

Quote

“These are extraordinary times and we are taking extraordinary measures. As a result of this measure, banks and lenders will have more liquidity—which, in turn, will enable them to work on a case by case basis with Canadian businesses and individuals who face hardship at this time. A co-ordinated approach is critical for making sure our economy remains strong and stable. The government will do whatever it takes to support Canadians and we are prepared to take further action as necessary to meet the challenges ahead.”

– Bill Morneau, Minister of Finance

Quick facts

Federal statutes require federally regulated lenders to obtain mortgage default insurance (“mortgage insurance”) for homebuyers who make a down payment of less than 20 per cent of the property purchase price, known as “high loan-to-value” or “high-ratio” insurance. Lenders also have the option to purchase mortgage insurance for homebuyers who make a down payment of at least 20 per cent of the property purchase price, known as “low-ratio” insurance because the loan amounts are generally low in relation to the value of the home.

Under the IMPP, CMHC will purchase insured mortgages in the form of National Housing Act Mortgage-Backed Securities—a securitization product that pools insured mortgages for resale as marketable securities.

In summary: New Emergency Liquidity Measure: The government has just made major amendments to “allow mortgage lenders to pool previously uninsured mortgages into National Housing Act Mortgage-Backed Securities (NHA MBS) for CMHC to purchase these securities through the recently announced Insured Mortgage Purchase Program. This includes mortgages for refinances and those with 30-year amortizations, both of which are presently excluded from government-sponsored securitization. To qualify, the mortgages must have closed before March 20, 2020 and be default insured by the lender. In other words, new refinances and amortizations over 30 years still cannot benefit from government-backed insurance and securitization. Although, we suspect that may change if funding markets deteriorate. The government says, “The above amendments will remain in force until December 31, 2020, at which time the eligibility criteria will revert to the existing rules. ” CMHC says it’s “also ready to expand the issuance of Canada Mortgage Bonds.”

Link to the article here.

Consumer confidence takes a beating from COVID-19

Canadian consumer confidence has noticeably declined over the past four weeks, as registered by the Bloomberg Nanos Confidence Index.

This was particularly apparent in the area of long-term financial health and economic expectations, which stood at 54.29 as of the latest reading on March 13. This was lower than the 12-month high of 59.06, the 2020 running average of 56.15, and the 56.90 level four weeks prior.

The report emphasized that the Index is currently on “a negative trajectory” – a fear shared by observers such as Scott Terrio, who recently warned of the national insolvency rate swelling if the coronavirus outbreak does not abate soon.

The manager of consumer insolvency at Hoyes, Michalos & Associates added that the 17.5% annual increase in Ontario’s insolvencies last January will likely be dwarfed in the near future.

“I think 20% estimates will be drastically low if this drags on for months,” Terrio told BNN Bloomberg. “This [virus impact] is now drastically out of control.”

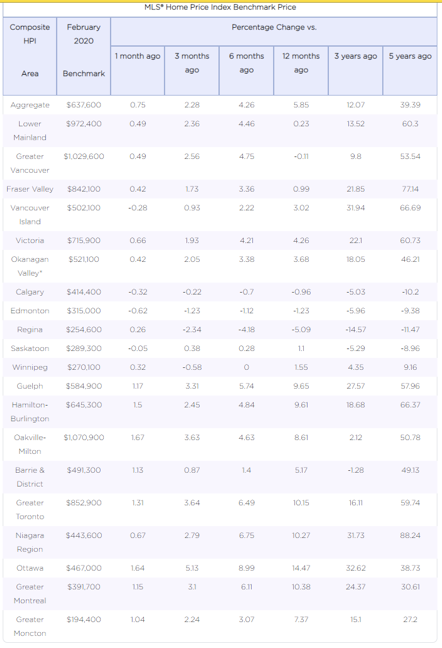

The Bloomberg Nanos study further found that confidence in real estate prices experienced a steep drop to 49.76. This was in stark contrast to the 55.61 reading just four weeks before.

Expectations surrounding personal finances and job security fared better, with the Index at 58.81 compared to the 58.19 the month prior. By Ephraim Vecina.

Canadians have become much less interested in buying homes

COVID-19 has reverberated across all segments of Canadian society and has become particularly acute in the housing sector.

Open houses and inauguration events have fallen out of favour, amid the imposition of policies like social distancing and isolation.

Interest in buying homes across Canada has also substantially plummeted over the past few weeks, if new data from residential information portal Point2 Homes is any indication.

“The outbreak has shattered seasonality, transforming the spring months, which was normally the time when the housing market was starting to pick up speed, into a period of anxious down time,” Point2 Homes stated in its analysis. “Much of the activity associated with homebuying and home selling is simply on hold, as people and institutions alike are trying to see where the pandemic is headed.”

The decline in home searches made through the portal reached as much as 32% by March 16. The downward trend has been clear, with an 8% drop registered on March 11, a 20% decrease on March 12, and a 24% plunge on March 13.

And the impact upon Canadian housing does not stop there, as the societal effects of the disease are likely to change some aspects of the homebuying and selling business permanently.

“There certainly could be long-lasting impacts in terms of shifts in preferences for location and even features of homes,” according to Jim Clayton, director of the Brookfield Centre in Real Estate & Infrastructure at York University’s Schulich School of Business.

“Some people may be more hesitant about being part of a crowd and hence avoid mass/public transit. The work, and learn, from home revolution that many have been calling for over the past decade could become much more of a reality and may change how and where people want to live”. By Ephraim Vecina.

Calls Intensify for Freeze on Housing Costs

The recent announcement by the nation’s six largest banks that they are offering six-month deferrals on mortgage payments to help homeowners impacted by the COVID-19 outbreak is bringing a new call for financial assistance for the nation’s renters.

Marva Burnett, president of the Association of Community Organizations for Reform Now (ACORN) Canada, called on the federal government to put a temporary moratorium on rent that would mirror the aid homeowners are getting.

“ACORN thinks the government should put the rent freeze on, a total rent freeze,” Burnett said in an interview with CTVNews.ca. “The people who are going to suffer the most are the renters, the lower-income people of Canada.”

Burnett added that the temporary freeze concept should also be applied to instalment loans and payday lending.

“All these things need to be taken into consideration because it’s mostly upper-income people that have a mortgage, lower-income people have instalment loans to pay,” she said.

Calls for a national freeze on both mortgage and rental payments to assist Canadians struggling during the ongoing pandemic were recently made by the British Columbia Government and Service Employees’ Union (BCGEU) and United Steelworkers, while an independent petition on Change.org seeking these freezes has collected approximately 540,000 signatures as of Friday evening.

To date, the federal and provincial governments have not acknowledged calls for any type of freeze on housing expenses. Prime Minister Justin Trudeau’s $27 billion proposal for direct financial support to Canadians could be used by renters to pay their landlords, but the proposal did not include a moratorium on evictions. British Columbia announced a freeze on evictions on March 19, but that only covered tenants in subsidized and affordable housing, while Ontario had its own freeze announced the same day covering both residential and commercial properties.

“We don’t want you to worry about your job. We also don’t want you to worry about how you’re going to make rent this month,” said Ontario Premier Doug Ford. “That’s why I’ve directed that all eviction orders be suspended until further notice. We want to make sure you and your family can stay in your home during this difficult time. So, you can put your health and the health of others first.” By Phil Hall.

Resellers will have difficulty navigating the pandemic

Flippers will likely have it worse amid the COVID-19 outbreak, London agent Joyce Byrne warned.

This is because they will probably end up with an unsellable property – a seemingly impossible notion less than a month prior.

“A week-and-a-half ago we were listing houses, showing houses, selling houses. We were not worried about Lysol wipes,” Byrne told CTV News in an interview. “I had a listing and I had the property sold, but the person who bought the property had to go back and sell the house. So their agent is probably talking to them about how they’re going to market their current property now.”

The pandemic has proven to be a punishing environment for home sellers, who are left with less than optimal choices.

“Maybe they soften their price, maybe they open themselves up to conditional offers. Maybe they’ll be open to accepting something with a home inspection or other financing conditions attached,” Byrne said.

Compounding the situation is that brokers have been mandated to observe federal directives regarding the virulent disease. Among these are significantly limited office hours and stringent social distancing rules.

In a recent report, The Conference Board of Canada expressed optimism that Canadians’ purchasing power would recover somewhat, as the national economy will gain some lost ground with 2.5% growth by 2021. This will come after a projected 2.7% decline in Q2 2020.

“Despite the fact that the global economy is currently shaken at its core, we expect to see growth resume in the third quarter, meaning that the economy will avoid a technical recession,” according to Matthew Stewart, director economic forecasting at The Conference Board of Canada.

However, Stewart hastened to add that “due to the unpredictability of the coronavirus, there are still huge downside risks to the outlook.” By Ephraim Vecina.

Mortgage Update – Mortgage Broker London

Economic Highlights

The Special Economic Impact of Pandemics – Expect effects to be massive in ways that differ from other disasters

Public health officials are telling Americans to avoid face-to-face contact, including the commute to—and working in—one’s job location, in the hopes of subduing the coronavirus outbreak. As necessary as those steps might be from a medical standpoint, there’s a flipside to huddling up and avoiding the outside world for the foreseeable future: Large swaths of the economy are grinding to a halt. And because this is a global pandemic, the same thing is happening virtually all over the world.

Indeed, the more the SARS-CoV-2 virus spreads around the globe—there are more than 300,000 cases of the related COVID-19 disease, as of this writing—the greater the concern over not just our health, but our livelihoods.

Just how big an impact can a pandemic like COVID-19 have on the global economy? Researchers suggest that it will likely be significant, especially if the virus is not contained quickly.

Key Takeaways

• While the economic impact of a pandemic may not be long-lasting if the underlying cause is contained quickly, it can be powerful enough to shutter some businesses and lead to sharp spikes in unemployment.

• The biggest pandemic in modern history was the Spanish Flu of 1918-1919, during which many service-based businesses suffered double-digit losses.

• Government interventions, such as sending money directly to households, may have less impact when stores are closed and people are fearful of even receiving packages at their door.

• The advent of a pandemic is a good time for workers to shore up their emergency funds and make sure they’re prepared for a possible job loss.

The Interconnected Economy

With millions of people in the United States and around the world in a virtual lockdown, a ripple effect throughout the economy is inevitable.

Certainly, specific industries bear the brunt of the damage. Shops and restaurants start to empty out, if not close their doors altogether. Non-essential travel slows down, curtailing revenue for not just airlines and cruise-ship operators, but smaller businesses that rely on tourism revenue. The list goes on.

However, those employed in seemingly unrelated industries can also feel the secondary effects of social distancing. For example, manufacturers—especially those outside the medical field—may see fewer orders as shopping slows down. Banks may have to absorb more loan defaults as a portion of its customer base loses work. And oil companies see prices plummet as investors sense weaker demand.

The fear of the unknown can only exacerbate these economic impacts. That means even individuals and families with ostensibly stable employment may start to limit purchases in case the financial aftershock isn’t able to be contained.

Measuring the Effect of a Pandemic

Every pandemic is unique, which makes predicting the repercussions of any crisis more educated guesswork than science. What’s more, there simply aren’t many recent examples that compare to the worst-case estimates of something like COVID-19. For example, the H1N1 flu of 2009 was widespread, but not as deadly; the Centers for Disease Control estimate there were 60 million cases in the U.S., resulting in fewer than 13,000 deaths.2

The closest comparison in modern times occurred more than a century ago, when the so-called “Spanish Flu”—caused by a different strain of H1N1 virus—ravaged the globe from 1918 to 1919. According to CDC estimates, roughly 500 million people were taken ill with the disease, which ultimately took the lives of about 50 million worldwide.3

Economic data from the early 20th century is scarce. However, an analysis by the Federal Reserve Bank of St. Louis estimated that a lot of businesses, particularly service- and entertainment-oriented ones, “suffered double-digit losses in revenue.” 4 If there’s a silver lining, it’s that the economic disruption appears to have been short-lived, as the underlying health emergency subsided in 1919.

How does the current pandemic compare? Given the number of likely unreported cases, the true mortality rate of the virus that causes COVID-19 may not be known for some time. Based on available live data at the time of this writing, the crude mortality rate was slightly over 4%, making the reach of this pandemic a vital health concern.5 A group of researchers from the University of Hong Kong and Harvard wrote in the journal Nature that as many as one-quarter to one-half of the world’s population is likely to contract the virus, “absent drastic control measures or a vaccine.”6

The Impact of COVID-19

While experts can estimate what the economic fallout from a pandemic such as the coronavirus will be, the precise impact will vary based on how many people are affected, how severely it hits, and which societal interventions are necessary to contain its spread.

Back in 2005, a World Bank official predicted that a global influenza pandemic, for example, could kill tens of millions of people and cause $800 billion in economic losses.7 The impact of the current crisis, of course, won’t be clear for some time.

Financial projections for COVID-19 run the gamut. The Organization for Economic Cooperation and Development, an entity with 36 member countries, estimated earlier this month that a long-lasting and severe coronavirus pandemic that spreads throughout Asia, Europe and North America—a situation that seems more likely by the week—could cut the global growth rate to 1.5-percent in 2020. That’s roughly half the growth the world economy would otherwise achieve.8

A separate analysis by the consulting firm McKinsey & Company offers a similar outlook. Its research suggests that a more severe COVID-19 pandemic, in which city and suburban residents would have to significantly change their work habits and otherwise distance themselves socially for six to eight weeks, could cut global GDP in half, to between 1% percent and 1.5%.9

Increasingly, those projections look too rosy for the situation that’s now unfolding. Already, roughly 1 in 3 Americans are being ordered to stay indoors, creating a huge drag on consumer demand and worker productivity.10 Goldman Sachs estimates that as many as 2.25 million Americans will make their initial filing for unemployment benefits this week, a roughly eight-fold increase from last week.11

The chief U.S. economist for Oxford Economics, Greg Daco, told the New York Times last week that a recession is all but inevitable. He estimates that GDP will sink 0.4% in the first quarter before plunging 12% in the second quarter. Goldman Sachs offered an even more dire estimate, suggesting a second-quarter decline of 24%.12

A century ago, the economic toll from the Spanish Flu was not particularly long-lasting. However, no one can say for certain whether that will be the case this time around. Certainly, the more effective governments in the U.S. and abroad are in facilitating medical care and reducing the rate of transmission, the more muted the economic impact will be.

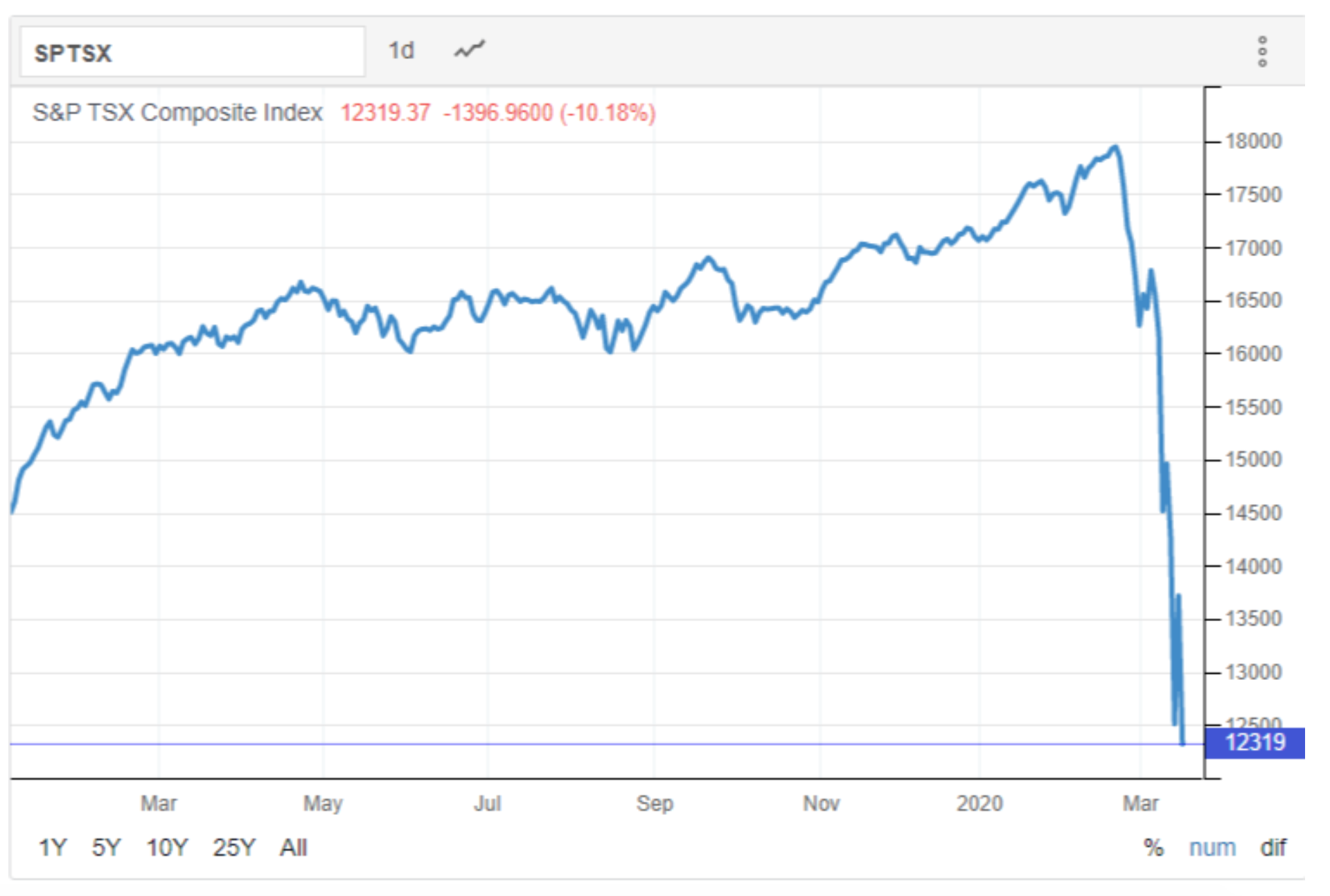

Clearly, investors see economic turmoil as an inescapable reality right now, with the S&P 500 index falling to a 3-year low as of last week.13

Last week, the investment bank Goldman Sachs predicted a staggering 24% drop in second-quarter output this year.

Can Government Intervention Help?

In an ideal scenario, legislatures and central banks would use the power of the purse to help mitigate an economic crisis. But those measures may prove less effective during a pandemic.

For example, efforts to open up the Treasury and send money directly to households might help individuals who have lost their job or seen their working hours reduced. But some experts argue that the impact is muted if many of the individuals receiving the funds can’t spend it—after all, many shops and restaurants are closed.

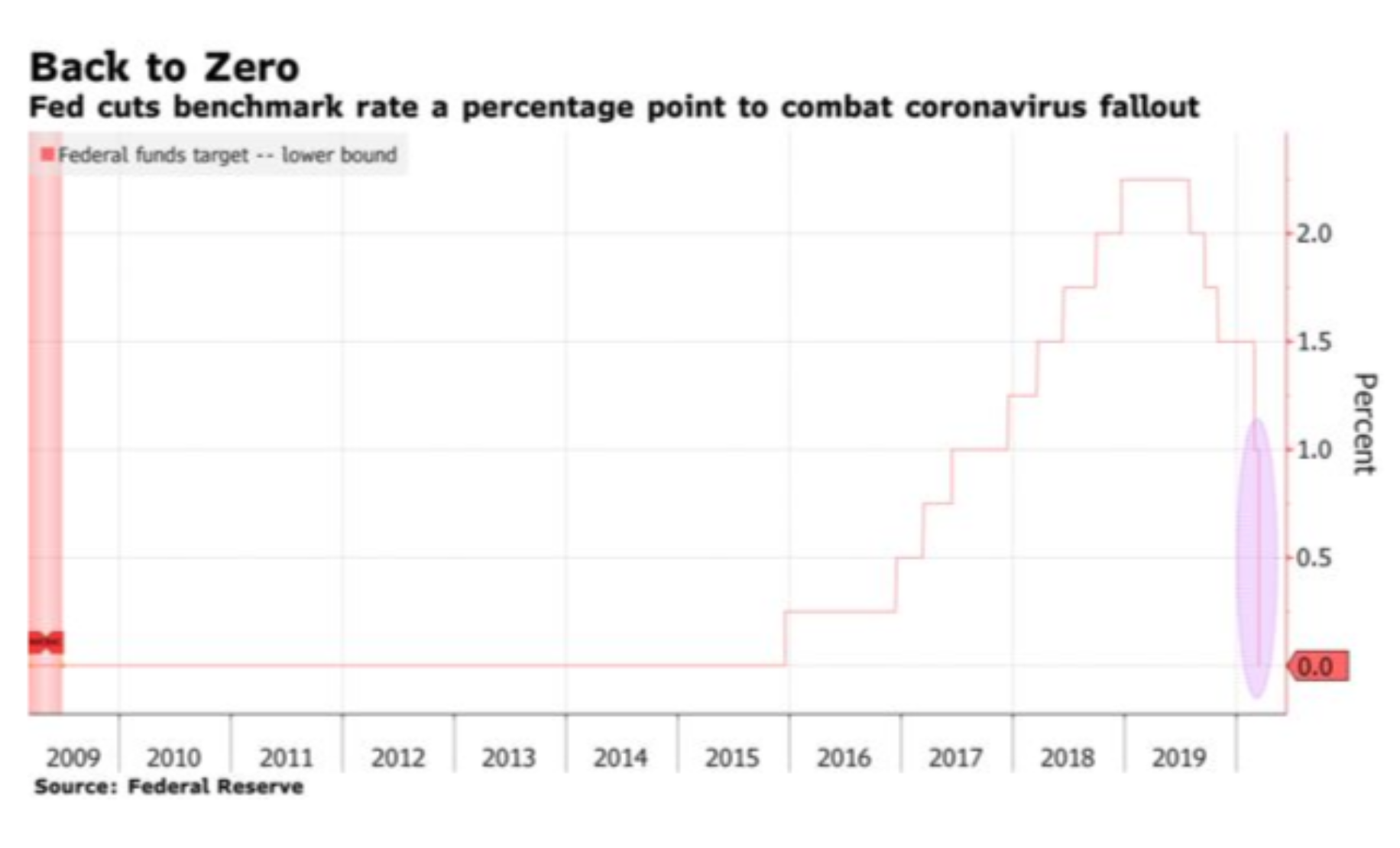

And interest rate cuts, intended to boost liquidity at a time when money is tight, may lose some of their potency when rates are already conspicuously low. The Fed slashed a key rate to zero last week, giving it precious little room to maneuver. “More interest-rate cuts into deep-red territory might help stock markets, but they also could trigger a run on cash,” wrote Hans-Werner Sinn, president of the Ifo Institute for Economic Research, in The Guardian this week.

Those aren’t the only devices that governments have in their toolkit, however. They can, for example, activate short-term financing mechanisms that help businesses stay afloat and retain workers during the healthcare crisis. And they can bolster unemployment insurance and provide other safety nets that keep the most vulnerable residents from losing their homes or going hungry.

Most important, perhaps, government leaders can help ensure that hospitals get the vital resources they need to treat patients and protect doctors and nurses. They can also work with the private sector to ensure that testing is readily available, something that has to date hampered efforts to contain the coronavirus in U.S. Indeed, some experts believe the best economic medicine that the public sector can provide is a quick resolution to the underlying health threat. “Anything that slows the rate of spread of the virus is the best kind of stimulus,” Austan Goolsbee, the former chair of the Council of Economic Advisers, told NPR this month.

Preparing Yourself Financially

While pandemics can cause significant economic damage, at least in the short term, there are steps individuals can pursue to protect themselves as much as possible. Here are a few of the measures you might consider as a pandemic takes hold:

- Don’t obsess over your 401(k). Your investment statements are going to look very ugly for a while. But when it comes to long-term investing, it’s usually better to stay the course. By selling off your holdings, you’re locking in losses, which means you won’t benefit from an eventual recovery. For those with short memories, it only took a few short years for the market to rebound from the stock market collapse of 2008.

- Build up your emergency fund. Conventional wisdom dictates that you should have three to six months’ worth of expenses readily available in your bank account at all times. A pandemic is one of the scenarios for which they’re intended. So if you’re a little short of the mark, now’s the time to build up your reserve if you can—you never know if you might need it.

- Dust off your résumé. With less demand, some businesses aren’t going to be able to keep their entire staff on payroll. If you work in a hard-hit industry, now might be the time to start looking at other job opportunities. Start connecting with people who might be able to aid your job search and make sure your résumé is in good shape.

- Reach out to lenders. Those who have already seen their incomes drop as a result of a pandemic might find it hard to pay their mortgage, rent, or student loans. Since so many people are going to be affected, lenders and landlords may be more willing to accommodate you than they otherwise would. The worst thing you can do when you miss a payment is keep your creditors in the dark.

The Bottom Line

As governments around the world limit the mobility of their people, most experts agree that a significant drop in economic output is inevitable. The more successful countries are at keeping the rate of infection in check, the smaller that impact will be. In the meantime, individuals can help themselves not only by social distancing, but by analyzing their financial situation and planning for the worst. By Daniel Kurt, Investopedia.

Forecast: Extended social distancing could cost 330,000 jobs

If social distancing continues for several months, the cost to the economy and labour force would be sizeable.

That’s according to a new alternate scenario forecast from the Conference Board of Canada which looks at the impact of social distancing continuing until the end of August in both Canada and the United States.

It concludes that, rather than its baseline scenario of 0.3% growth in Canada’s real GDP this year, there would be a 1.1% contraction. Job losses would be more than 330,000 over the second and third quarters, and unemployment would rise to 7.7%.

“These are extraordinary times. Canadian leaders, business owners and households are facing unprecedented uncertainty, said Pedro Antunes, Chief Economist at The Conference Board of Canada. “If this scenario holds true, we can expect a deeper and longer-lasting hit to the Canadian economy. Still, governments have acted swiftly to mitigate health and economic impacts, once COVID-19 is contained, the economy will rebound.”

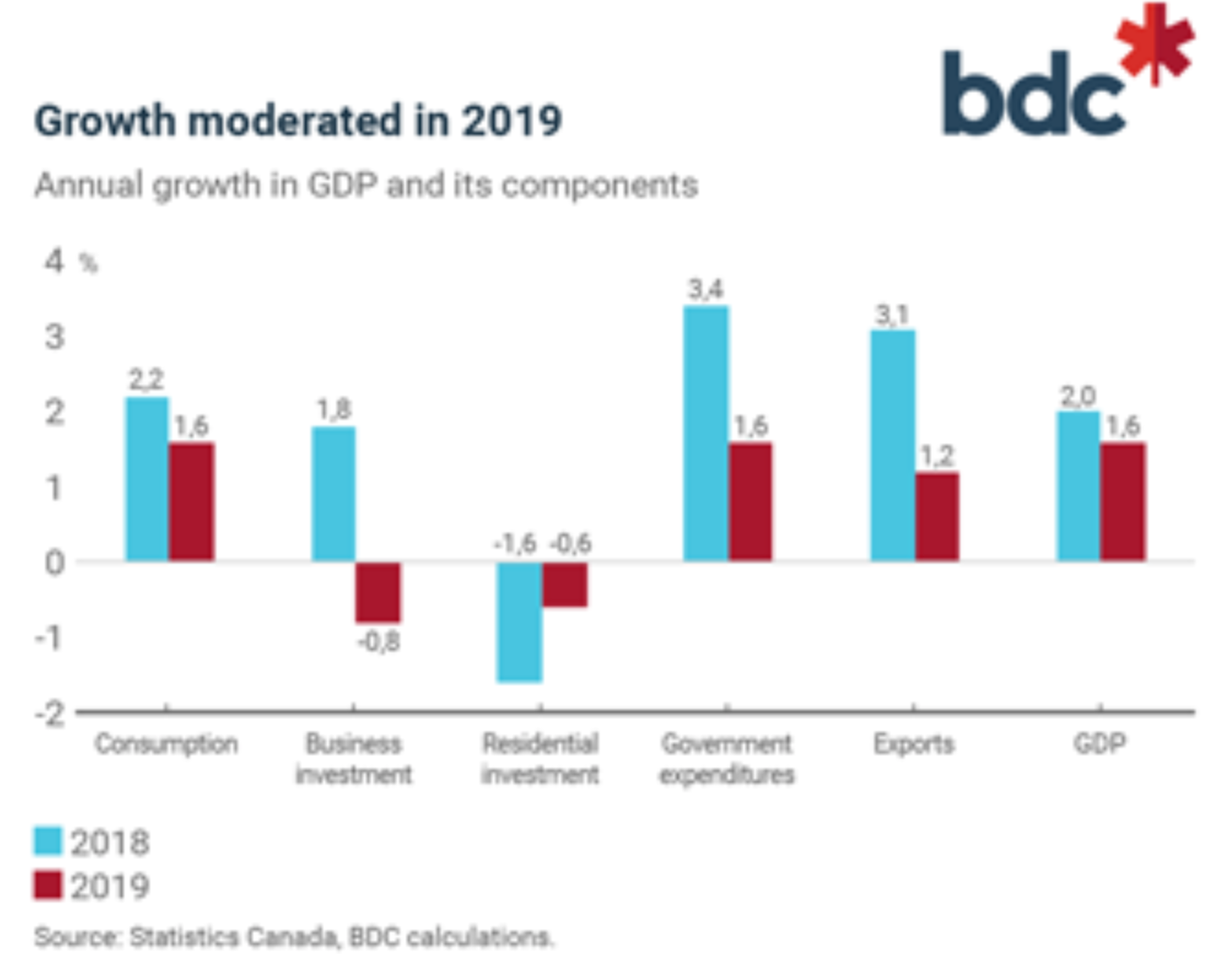

Assuming a consumer-led recession in the US, with real GDP also down 1.1%, the diminished demand from Canada’s most important trading partner means real exports of goods and services would decline by 2.1% in 2020. By Steve Randall.

Almost one million Canadians have filed jobless claims

Along with the daily reports of the health impact of the COVID-19 coronavirus pandemic, come figures highlighting its economic effects.

Bloomberg is reporting that the number of Canadian jobless claims is heading towards one million, including the 500,000 already announced by the prime minister, along with a surge of claims made over the weekend.

The unnamed source cited a not-yet-public figure of 920,000 claims for employment insurance benefits. The previous record claims in one week was 499,200 in 1957.

And this is just the beginning.

Bombardier said Tuesday that it was laying-off more than 12,000 workers – they will be on unpaid leave – effective immediately and continuing until at least April 12.

For households that are living paycheque to paycheque, the loss of work for even a week can be financially devastating.

Frightening outlook for oil

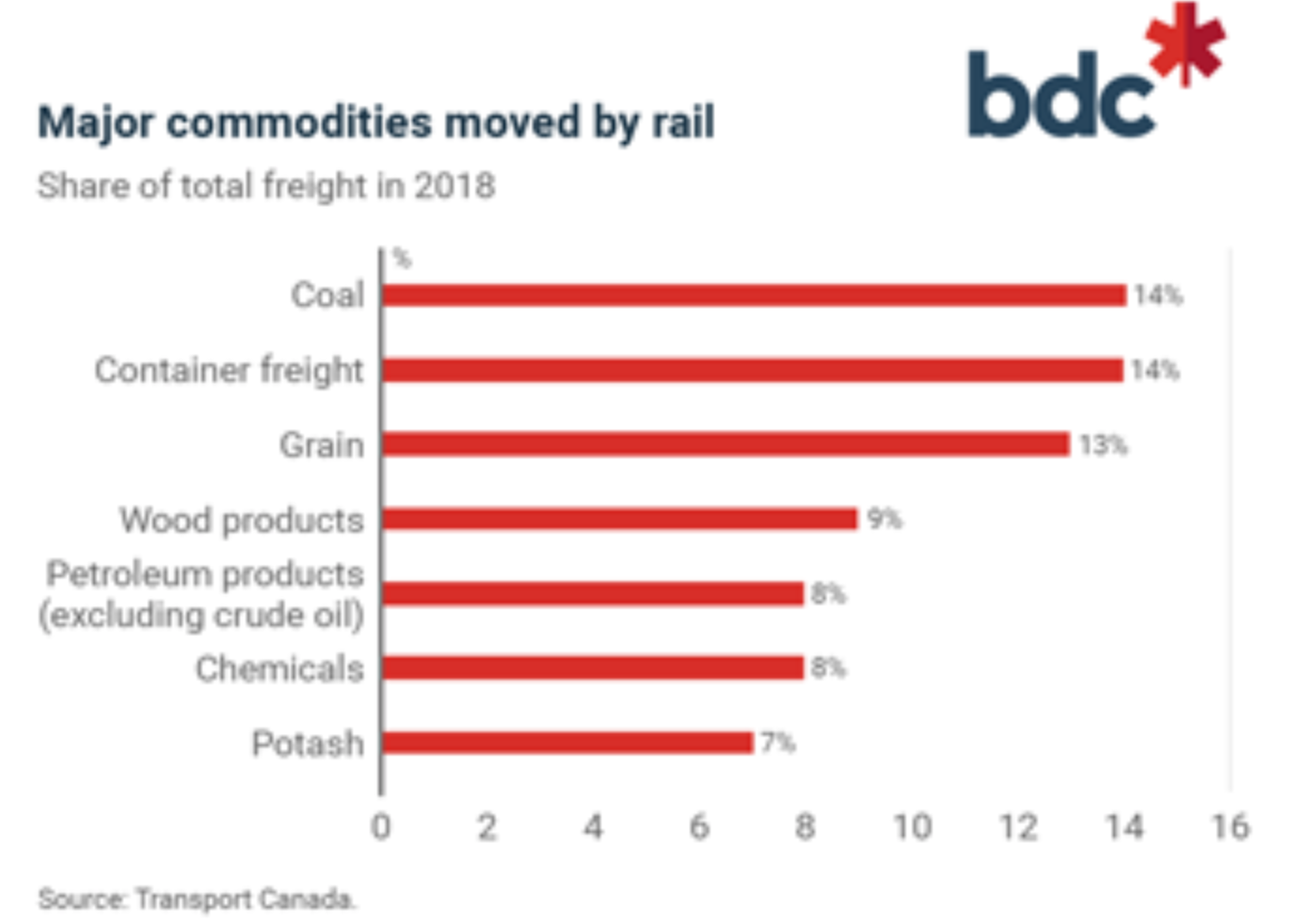

The Canadian oilsands is also bracing for a hit as the price of oil falls significantly – Western Canada Select heavy oil was trading at just $8.90 Tuesday – the energy industry is already making deep cost cuts.

University of Calgary School of Public Policy fellow Richard Masson told the Financial Post that the heavily-leveraged sector will have to shed jobs.

“As people continue to cut budgets, there’s no choice but to cut staff and mothball rigs and all that makes your debt covenants loom larger,” Masson said. “There’s no way to raise new money. There’s no place to get new business. It’s very, very frightening.” By Steve Randall.

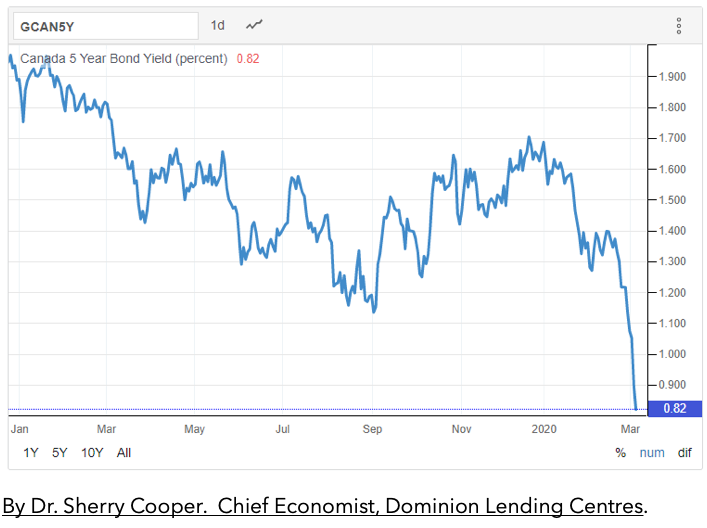

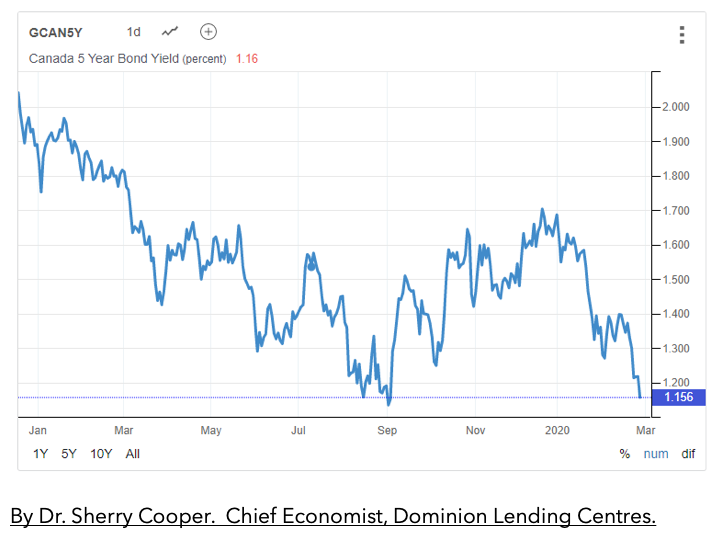

Mortgage Interest Rates

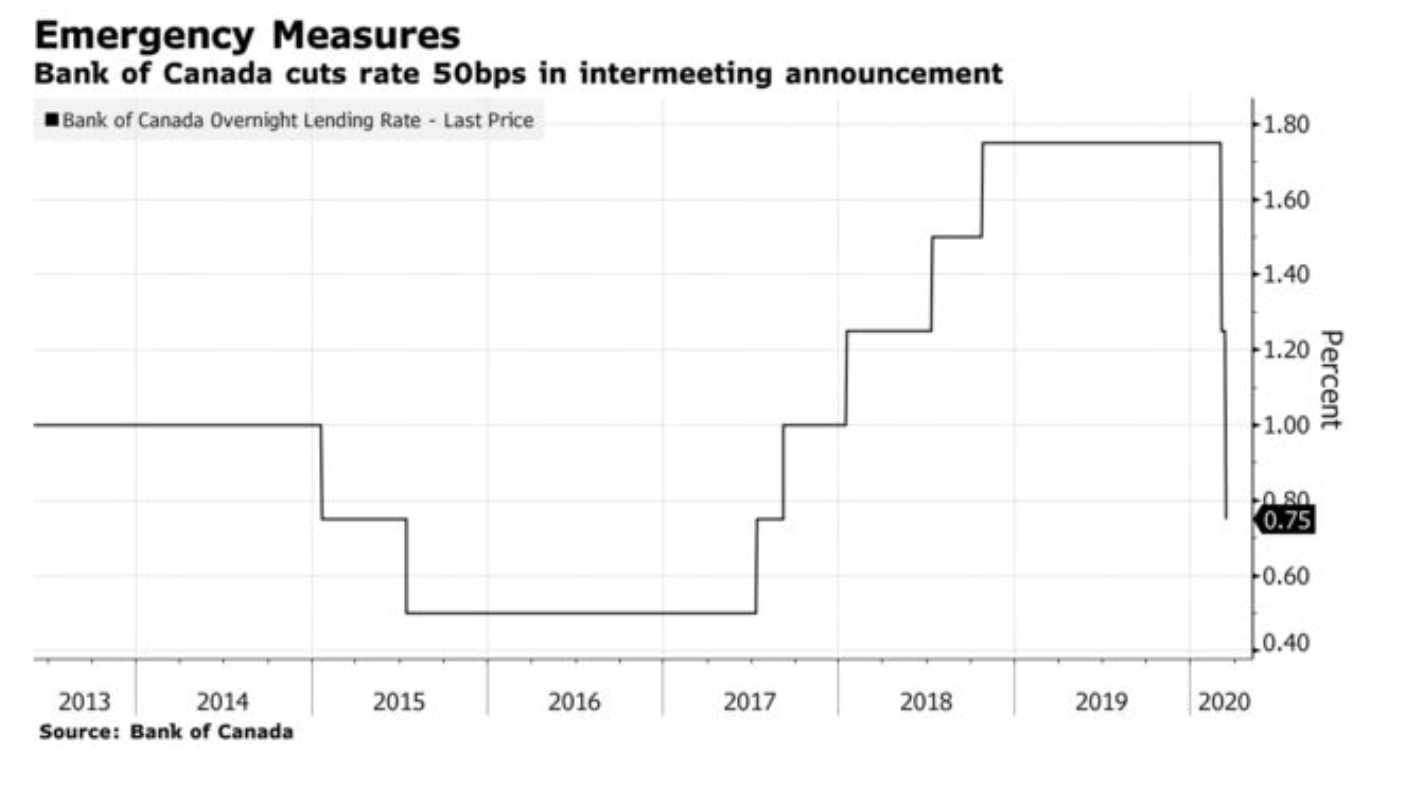

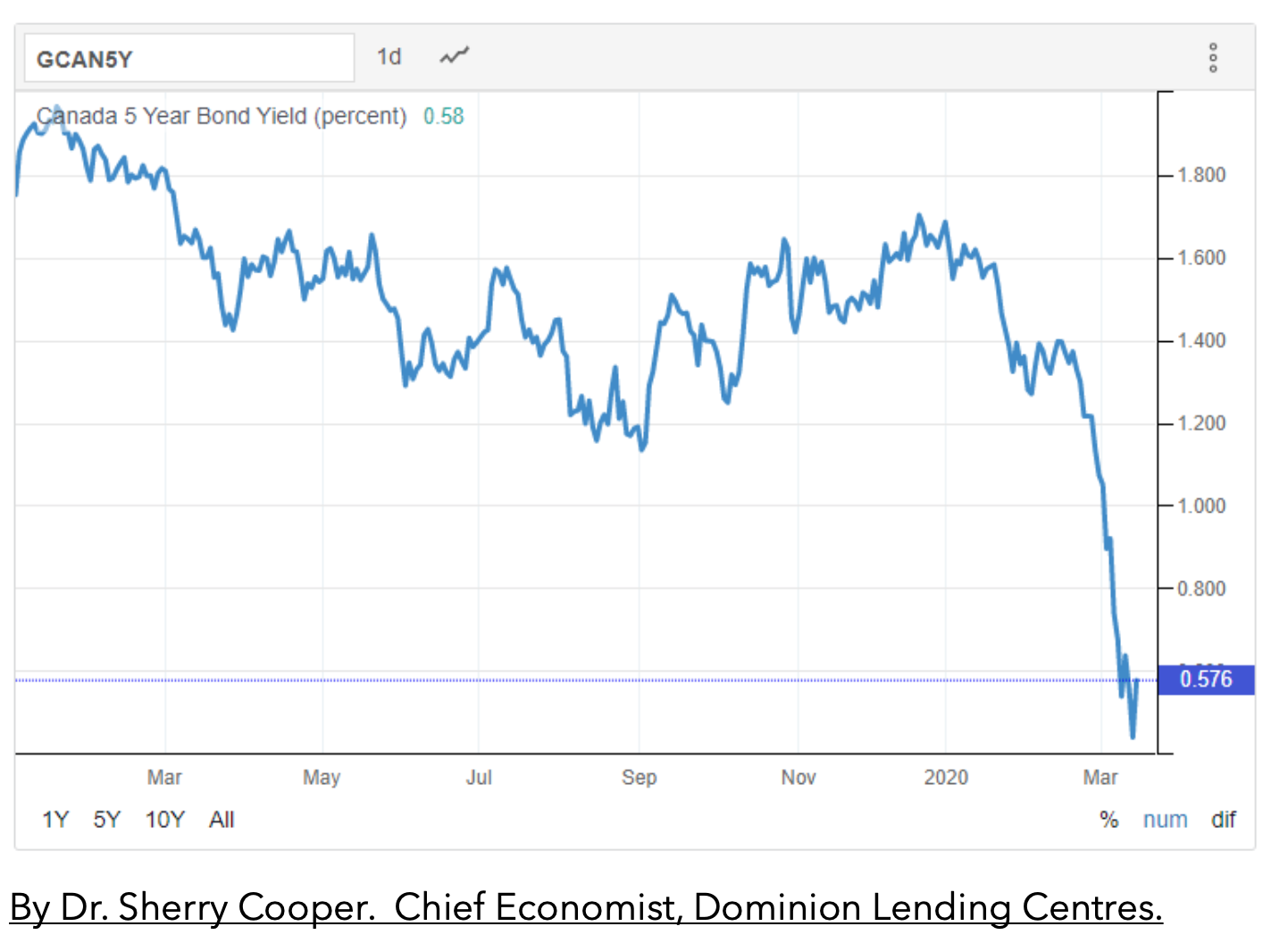

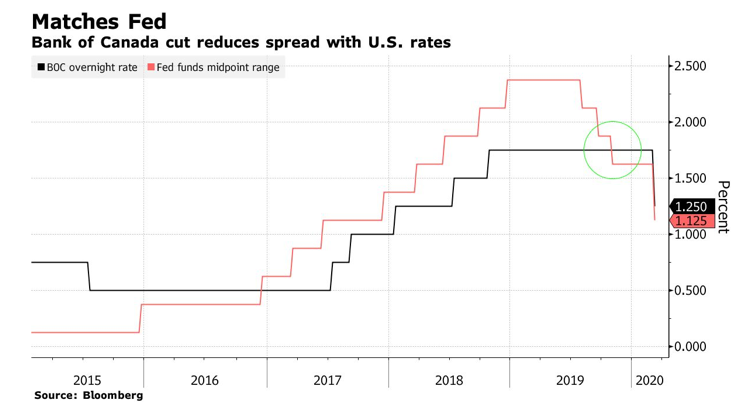

The Bank of Canada’s target overnight rate is 0.75%. Prime lending rate is 2.95%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval lowered to 5.04% but changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

Banks/Lenders started raising fixed rates due to market volatility and and liquidity concerns. Discounts on variable rates have also been reduced. Bond markets are not operating as normal and lenders cost for hedging funds has become more expensive also affecting rates.

View rates Here – and be sure to contact us for a quote as rates are moving faster than can be updated.

![]()

Your Mortgage

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options and the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

For Continued Updates on The COVID-19 Pandemic, please visit:

Middlesex Health Unit

https://www.healthunit.com/news/novel-coronavirus

Ontario Health

https://www.ontario.ca/page/2019-novel-coronavirus

Government Canada Public Health

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

World Health Organization:

https://www.who.int/emergencies/diseases/novel-coronavirus-2019

Factual Statistics Coronavirus COVID-19 Global Cases

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

]

]