Industry & Market Highlights

Bank of Canada lowers overnight rate at second 2020 meeting

The Bank of Canada lowered its target for the overnight rate by 50 basis points to 1.25 percent from 1.75 percent.

This is the first time the benchmark rate has changed since October 24, 2018.

Comparing the Bank’s two most recent statements (today and January 22, 2020), we find several notable new comments:

- It is “becoming clear that the first quarter of 2020 will be weaker than the Bank had expected” when CPI inflation was “stronger than expected”

- While Canada’s economy has been operating close to potential with inflation on target, “the COVID-19 virus is a material negative shock to the Canadian and global outlooks”

- COVID-19 “represents a significant health threat to people in a growing number of countries” and in some regions, business activity has fallen sharply, supply chains have been disrupted, commodity prices have been pulled down and the Canadian dollar has depreciated

- The drop in Canada’s terms of trade, if sustained, will weigh on income growth

- Business investment “does not appear to be recovering as was expected following positive trade policy developments”

- Although markets continue to “function well,” the Bank of Canada will continue to ensure that the Canadian financial system has sufficient liquidity

As a result of its revised near-term outlook, the Bank’s Governing Council noted that it “stands ready” to adjust monetary policy further if required to support economic growth and keep inflation on target.

BoC’s next policy announcement is set for April 15, 2020 and in the ensuing period the Bank’s Governing Council intends to coordinate with other G7 central banks and fiscal authorities as it “closely” monitors economic and financial conditions. We will closely monitor these conditions as well. By First National Financial.

Ontario passes Trust in Real Estate Services Act

The Ontario Government has passed the Trust in Real Estate Service Act, 2019 (TRESA), and was announced at the Ontario Real Estate Association’s REALiTY Conference and AGM by new OREA President Sean Morrison.

The legislation was called back on Wednesday, and the Bill was unanimously passed after its third and final reading. TRESA amends the Real Estate & Business Brokers Act, 2002 (REBBA).

“This is a huge win for our Realtor members, their clients and hardworking Ontarians across the province,” said OREA President Sean Morrison. “Thanks to the Ford Government’s newly passed legislation, Ontario’s homebuyers and sellers can have greater confidence that the Realtor at their side during the largest financial transaction of their life has the highest professional standards, training and modern tools in North America, such as the ability to form personal real estate corporations.”

TRESA is one of the few pieces of legislation in Ontario to receive bi-partisan support following constructive debate in the Legislature led by Minister Lisa Thompson and NDP Consumer Critic Tom Rakocevic and other MPPs.

“By strengthening consumer protection and fixing the broken real estate discipline system, the Government of Ontario is showing Realtors and home buyers and sellers that it is on their side,” said OREA CEO Tim Hudak. “Ontarians deserve the best when it comes to making the biggest financial transaction of their lives and TRESA will make this province the North American leader once again when it comes to a well-regulated real estate market.”

OREA has been advocating for a review of REBBA for over a decade and finally, the Ontario Government has passed this historic piece of legislation.

There are five primary goals in the proposed legislation: enable regulatory changes that would improve consumer protection and choice; improve professionalism among real estate professionals and brokerages through enhanced ethical requirements; update the powers available to RECO to address poor conduct and improve efficiency; create a stronger business environment; and bring legislation and regulations up-to-date and reduce regulatory burden.

Ontario’s real estate rules were nearly 20 years old and this legislation brings the profession into the modern age, Hudak indicated.

OREA will continue to work closely with the Government of Ontario as they develop regulations for the Bill, and work towards enacting the legislation into law. By Kimberly Greene.

Changes to stress test

Minister of Finance Bill Morneau announced changes to the benchmark rate used to determine the minimum qualifying rate for insured mortgages.

Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%. These changes will come into effect on April 6, 2020.

The new benchmark rate will be published on a Wednesday and come into effect the following Monday.

“For many middle-class Canadians, their home is the most important investment they will make in their lifetime. Our government has a responsibility to ensure that investment is protected and to support a stable housing market. The government will continue to monitor the housing market and make changes as appropriate. Reviewing the stress test ensures it is responsive to market conditions,” Morneau said.

The minimum qualifying rate for insured mortgages will now be the greater of the borrower’s contract rate, which is the mortgage interest rate agreed to by the lending institution and the borrower; or the new benchmark rate.

The change comes after a recent review by federal financial agencies, which concluded that the minimum qualifying rate should be more dynamic to better reflect the evolution of market conditions. Overall, the review concluded that mortgage standards are working to ensure that home buyers are able to afford their homes even if interest rates rise, incomes change, or families are faced with unforeseen expenses. This adjustment to the stress test will allow it to be more representative of the mortgage rates offered by lenders and more responsive to market conditions.

The new Benchmark Rate for insured mortgages will be published weekly on the Bank of Canada’s website, and will be based on submitted mortgage insurance application contract rates. If, on any given week, there are any delays in updating the new Benchmark Rate, the previous week’s published Rate will stand until a new Rate is published. By Kimberly Greene.

Who are the winners with the new qualifying interest rate?

Mortgage brokers and homebuyers across Canada got the relief that many of them have been clamouring for: a change in the qualifying interest rate for insured mortgages.

Last week, Minister of Finance Bill Morneau announced changes to the benchmark rate used to determine the minimum qualifying rate for insured mortgages. As of April 6th, that rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

“It’s fantastic news. Borrowers will now have a little more buying power,” said Michelle Campbell, principal mortgage broker at Mortgage District. “It’s definitely a step in the right direction.”

Others, however, are a little slower to rejoice.

“At this time it is too hard to tell – with no idea what the new benchmark rate is going to be, we don’t know if it is just a 10bps or 25bps difference. That difference might increase a borrower’s purchasing power a little but at the same time we will see a potential upswing in increases in prices for the Spring market as well as the perception that the market is hot—which could potentially just mitigate or counteract any potential this change might provide,” said Claire Drage, CEO of the Windrose Group.

The so-called stress test was put into place at a time where the interest rate environment was thought to be rising, and it did effectively put the brakes on the runaway housing markets of Toronto and Vancouver. Given that prices had begun to rise again in Toronto, however, some people question whether or not this is the right time to change it—and whether or not a more regional-specific strategy would had a better effect nationwide.

In fact, Royal LePage President and CEO Phil Soper recently reiterated this point a few weeks ago, calling for housing policy that meeds the varied economies and needs that vary region to region.

Mixed benefits have also been shared by industry analysts.

“Changes are likely to further increase home prices, further stretching affordability and consumer leverage,” RBC Capital Markets analyst Geoffrey Kwan told Bloomberg. “The changes are aimed at the demand side of the equation regarding home ownership, instead of addressing the supply side.”

But buyers aside—it could be that the entities that stand to benefit the most from this change are the companies with the highest gearing to the mortgage market (i.e., Equitable Group, Home Capital, Genworth MI, and First National) as opposed to companies that are more diversified, such as the big banks and regional lenders.

National Bank Financial Analyst Jaeme Gloyn told Bloomberg that the lower qualifying rate should shift part of the mortgage away from private, unregulated lenders back into the regulated mortgage market. Borrowers at least have a choice to get a larger mortgage or at least qualify for one, both of which stimulate the housing market and benefit lenders.

“In the short run, this change will likely help some Canadians who currently do not qualify for mortgage financing get into the housing market,” Cormark Securities Inc. Analyst Meny Grauman told Bloomberg. “However, over time this change is likely to only raise prices given increased marginal demand.”

The move could be a risky one, as household debt continues to rise. In a note to investors, Bank of Montreal economists said that “to the extent the rule change fans some already-hot regions, it might discourage the Bank of Canada from lowering rates.”

The Office of the Superintendent of Financial Institutions (OSFI) said it’s considering a similar change for uninsured mortgages and is seeking input before March 17. By Kimberly Greene.

London area home sales remain at peak levels

Last month, local residential real estate transactions remained at peak levels, with 740 homes trading hands in LSTAR’s jurisdiction – only 22 less than three years ago, when the Association had its best February sales ever.

“Overall, home sales took a leap over the previous month – from 568 to 740, which signals an early start of a busy spring market,” said 2020 LSTAR President Blair Campbell.

Compared to a year ago, the local residential sales activity saw a 23.7% increase, while the overall average home price experienced a 13% surge, rising to $445,535 in February.

“Even though the number of LSTAR new listings grew to 1,034, which is almost on par with the 10-year average, the number of active listings at month end was still much lower than normal. This reflects the strong demand for residential properties in our area,” stated Campbell.

Inventory is another important measure of the balance between sales and the supply of listings. This shows how long it would take to liquidate existing inventories at the current rate of sales activity. At the end of February 2020, there were only 1.8 months of inventory across the entire LSTAR district – the lowest level in the last ten years.

“Looking at the home sales activity in LSTAR’s five main regions, it’s interesting to see that three of them – Elgin County, Middlesex County and Strathroy – had their second best February ever. London witnessed its third best February with 488 home sales, while St. Thomas set a new absolute record for February home sales, with 68,” Campbell noted.

“However, if you will dig deeper into the London statistical figures, you will be surprised to discover that London South’s February home sales reached their highest peak ever. This demonstrates, once again, that real estate is local and that, if you’re looking for real estate information or guidance, a local REALTOR® is your best bet,” Campbell emphasized.

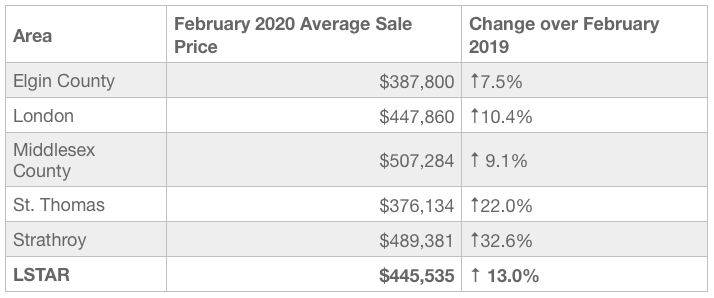

The following table illustrates last month’s average home prices in LSTAR’s main regions and how they compare to the values recorded at the end of February 2019.

“Analyzing average prices in London’s three main geographic areas, it is worth to note that London East saw the biggest year-over-year increase,” Campbell added.

The average home price in London East was $369,094, up 21.8% from last February, while London North saw an increase of only 6.1% over last February, with an average home sales price of $530,042. In London South, the average home price was $437,667 – up 11.5% over February 2019.

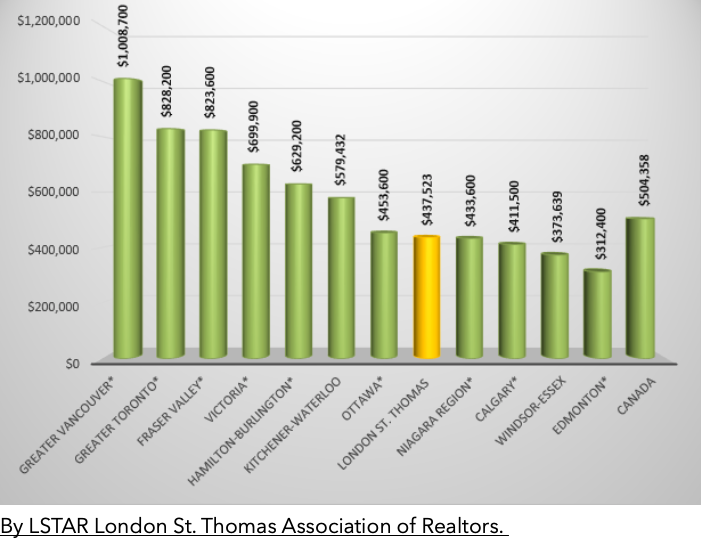

The following chart is based on data taken from the CREA National Price Map for January 2020 (the latest CREA statistics available). It provides a snapshot of how home prices in London and St. Thomas compare to some other major Ontario and Canadian centres.

Toronto approves increase in residential property tax

In a move touted by local leadership as a vital component of a “good, responsible, realistic” budget, the Toronto city council has implemented a 4.24% residential property tax hike for 2020.

The new levy that came with the approval of the city’s $13.5-billion operating budget would mean an estimated $130 in additional expenses for each household this year.

“The budget is balanced in the sense that the revenues meet the expenditures as is required by law. But I believe it is also balanced in the context of balancing all the competing interests and different interests that the city has,” Mayor John Tory said in a news conference earlier this week, as quoted by CBC News.

“I understand that people, in many cases, are finding life stressful on a financial basis today, but together with a modest tax increase, we’re also doing things to try to make their lives more affordable,” Tory added. “It will cost a lot more in the future if we don’t invest in transit and affordable housing and community safety now.”

Housing taxes have been repeatedly put forward as solutions to a wide assortment of market ills, and this has become an especially contentious topic in the higher-end market.

Among the suggestions put forward by city officials is a 3% tax on homes with sales values of $3 million and higher. Councillor Ana Bailao (Ward 9 Davenport) has also called for a policy similar to that of Vancouver’s vacant homes tax – which earned the latter city around $40 million last year alone.

However, Don Kottick of Sotheby’s warned that such a move will only end up discouraging talent from other places.

“I don’t think taxing is the right way to go. We’re already paying more tax than people pay in other countries,” the Sotheby’s CEO told the Toronto Star. “If you keep taxing we’re going to become anti-competitive.”

“At some point people are going to say, ‘Enough is enough.’” By Ephraim Vecina.

Economic Highlights

Interest Rates Nosedive as Bank of Canada cuts rates 50 BPS

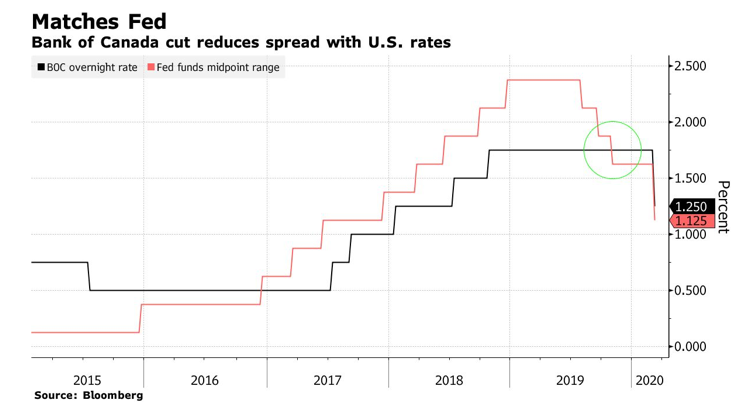

Following the surprise emergency 50 basis point (bp) rate cut by the Fed, the Bank of Canada followed suit and signalled it is poised to do more if necessary. The BoC lowered its target for the overnight rate by 50 bps to 1.25%, suggesting that “the COVID-19 virus is a material negative shock to the Canadian and global outlooks.” This is the first time the Bank has eased monetary policy in four years.

According to the BoC’s press release, “COVID-19 represents a significant health threat to people in a growing number of countries. In consequence, business activity in some regions has fallen sharply, and supply chains have been disrupted. This has pulled down commodity prices, and the Canadian dollar has depreciated. Global markets are reacting to the spread of the virus by repricing risk across a broad set of assets, making financial conditions less accommodative. It is likely that as the virus spreads, business and consumer confidence will deteriorate, further depressing activity.” The press release went on to promise that “as the situation evolves, the Governing Council stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target.”

Moving the full 50 basis points is a powerful message from the Bank of Canada. Particularly given that Governor Poloz has long been bucking the tide of monetary easing by more than 30 central banks around the world, concerned about adding fuel to a red hot housing market, especially in Toronto. Other central banks will no doubt follow, although already-negative interest rates hamper the euro-area and Japan.

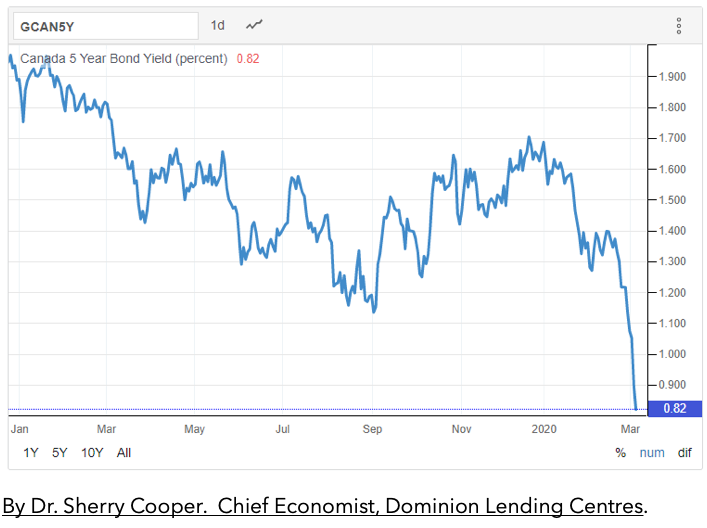

Canadian interest rates, which have been falling rapidly since mid-February, nosedived in response to the Bank’s announcement. The 5-year Government of Canada bond yield plunged to a mere 0.82% (see chart below), about half its level at the start of the year.

Fixed-rate mortgage rates have fallen as well, although not as much as government bond yields. The prime rate, which has been stuck at 3.95% since October 2018 when the Bank of Canada last changed (hiked) its overnight rate, is going to fall, but not by the full 50 bps as the cost of funds for banks has risen with the surge in credit spreads. A cut in the prime rate will lower variable-rate mortgage rates.

Many expect the Fed to cut rates again when it meets later this month at its regularly scheduled policy meeting, and the Canadian central bank is now expected to cut interest rates again in April. Of course, monetary easing does not address supply-chain disruptions or travel cancellations. Easing is meant to flood the system with liquidity and improve consumer and business confidence–just as happened in response to the financial crisis. Expect fiscal stimulus as well in the upcoming federal budget.

All of this will boost housing demand even though reduced travel from China might crimp sales in Vancouver. A potential recession is not good for housing, but lower interest rates certainly fuel what was already a hot spring sales market. Data released today by the Toronto Real Estate Board show that Toronto home prices soared in February, and sales jumped despite low inventories. The number of transactions jumped 46% from February 2019, which was a 10-year sales low as the market struggled with tougher mortgage rules and higher interest rates. February sales were up by about 15% compared to January.

Virus Anxiety and The Canadian Housing Market

As though things weren’t volatile enough, a new wave of virus terror is wreaking havoc on global financial markets. The novel conronavirus, COVID-19, continues to spread causing panic in worldwide stock and bond markets for the seventh day. Share prices have plummetted in Asia, Europe, the U.S. and Canada. The sell-off is fueled mostly by concern that measures to contain the virus will hamper corporate profits and economic growth, and fears that the outbreak could get worse.

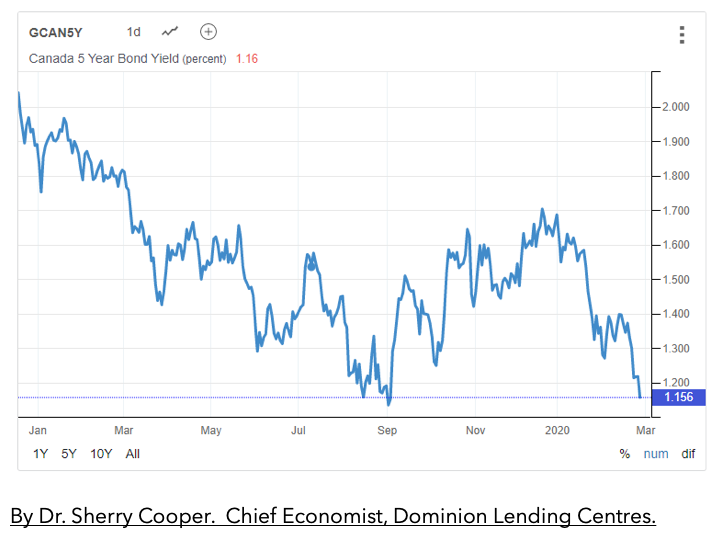

Interest rates are falling sharply, hitting record lows reflecting a movement of cash out of stocks and commodities like oil, into the safer havens of government bonds and gold. In Canada, the 5-year bond yield has fallen to 1.16% this morning, down more than 50 basis points (bps) year-to-date and down 65 bps year-over-year (see chart below). Mortgage rates are closely linked to the 5-year government bond yield, so further downward pressure on mortgage rates is likely. Oil prices have fallen sharply, hitting the Prairie provinces hard. Crude oil WTI prices have fallen to just over US$45.00 a barrel compared to $62.50 earlier this year.

The Canadian dollar has also taken a beating, down to 0.7468 cents US, compared to a high of 0.7712 early this year.

The Canadian economy was already battered as today’s release of fourth-quarter GDP data shows. Statistics Canada reported that the economy came to a near halt in Q4 as exports dropped by the most since 2017 and business investment declined. Household spending was a bright spot–a reflection of a strong labour market and rising wages.

Monthly data for December, also released this morning, came in stronger than expected, showing the economy had some momentum going into 2020 before the coronavirus reared its ugly head.

The weak 0.3% growth in Q4 was expected as a series of temporary factors including a week-long rail strike, manufacturing plant disruptions and pipeline shutdowns slowed growth. Even though December posted an uptick, the first quarter will no doubt be hampered by the rail blockade and now virus-related supply and travel disruptions as well as reduced tourism.

Bottom Line: Panic selling in the stock market is never a good idea. The TSX opened down more 550 points this morning following yesterday’s outage. Trading on Thursday was suspended around 2 PM for technical reasons. None of this is good for psychology or the economy.

The Bank of Canada meets next Wednesday, and clearly, their press release will address these issues. It’s unlikely the Bank will cut rates in response on March 4, but if the economic disruption continues, rate cuts could be coming by mid-year.

The new stress test will be in place on April 6. If rates were at today’s level, the qualifying rate for mortgage borrowers would be more than 40-to-50 basis points lower than today’s level of 5.19%. This will add fuel to an already hot housing market.

![]()

Mortgage Interest Rates

Prime lending has lowered 50 bps is 3.45%. Bank of Canada Benchmark Qualifying rate for mortgage approval is still at 5.19% but changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

Fixed rates are moving down with lower bond yields. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive again.

![]()

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalized your decision when you are certain you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients needs to ensure your best interest is protected. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!