Industry & Market Highlights

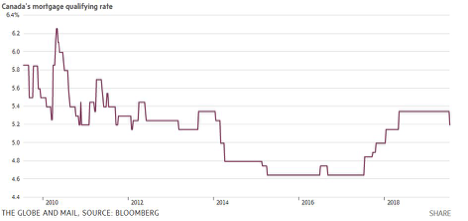

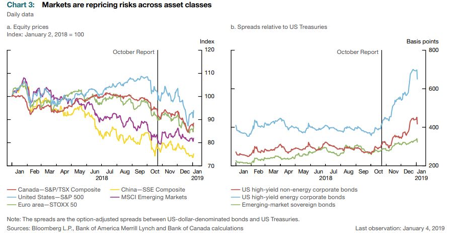

Rate hike disappears over the horizon

The likelihood of a Bank of Canada interest rate increase appears to be getting pushed further and further beyond the horizon.

The Bank is expected to remain on the sidelines again this week when it makes its scheduled rate announcement on Wednesday.

A recent survey by Reuters suggests economists have had a significant change of heart about the Bank’s plans. Just last month forecasters were calling for quarter-point increase in the third quarter with another hike next year. Now the betting is for no change until early 2020. There is virtually no expectation there will any rate cut before the end of next year.

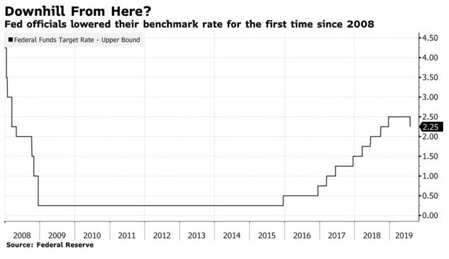

The findings put the Bank of Canada in line with the U.S. Federal Reserve and other major central banks. World economies have hit a soft spot largely due to trade uncertainties between China and the United States. Canada is also being affected by depressed oil prices and a slowdown in the housing market.

Market watchers will be paying close attention to the Monetary Policy Report that comes with this week’s BoC rate setting. Realtors and mortgage lenders have been pressuring for some loosening of the B20 stress test to allow some life back into the market. The odds are against the Bank advocating for any easing. Canadian households are still carrying record high debt loads and there are growing expectations of a recession within the next two years. By First National Financial.

New realities have home buyers adjusting

Canadian home buyers continue to accept and adjust to the new realities of the market, but that doesn’t mean they are happy about it.

A home ownership survey conducted earlier this year suggests nearly 40% of homeowners see themselves as being (or having been) “house poor”. That means they are spending more than 30% of their total income on housing; mortgage, taxes, utilities and maintenance. More than 90% of the respondents say that kind of money stress could have mental health effects. While 51% say they would not put themselves in that position, just about all of the other half, 47%, say it would be worth the sacrifice.

This represents an opportunity for brokers who can provide practical advice, tailored to the needs of their clients. Being available and providing information in real time goes a long way to easing anxiety and tensions for a home buyer.

The survey also shows signs that home buyers may be polarizing between those who believe they can go it alone and those who feel they are going to require financial help. The number of buyers who feel they can go solo is 32%. The number planning to get help from family is 28%. The traditional model of buying a home with a partner or spouse has seen a decline, down to 42% compared to 49% in 2017.

The survey finds a full two-thirds of Canadians believe it is better to own than to rent. By First National Financial.

Bond yield inversion: the case for calm

Anyone who has been watching knows that bond yields are falling and taking fixed rate mortgages with them. The recent economic slowdown in both Canada and the U.S. has pushed down yields on five year government bonds on both sides of the border. Those yields are used as the basis for setting interest rates on fixed mortgages.

An economic indicator known as the yield curve is has been getting a lot of attention lately. The curve tracks the difference in the yields of short-term and long-term bonds. Short-term can be as little as three months while long-term is 10 years or more.

Market watchers use the yield curve as a way to judge investor optimism about the future. Long-term bonds traditionally offer better yields than short-term bonds. The greater the difference between the short-end and the long-end of the curve, the greater the optimism about the future.

Occasionally though things get turned around and the yield curve “inverts”, with short-term bonds offering better yields than long-term. Much is being made of this right now because it has happened, in both Canada and the United States, and it is widely viewed as bad news.

In the U.S., bond yield inversions have routinely been followed by a recession, in about a year. But, like so much of what has happened over the past decade, this time is different. Economists are nearly unanimous in downplaying the risk. They point out that the inversion was not big enough and did not last long enough to trigger any alarms. They also remind us that any possible recession will not happen overnight and is still a year away – plenty of time for action or a correction. By First National Financial.

Ottawa to strengthen National Housing Strategy

The federal government announced Thursday that it is adding more strength to the National Housing Strategy.

The right to adequate housing for all Canadians will be supported by several key initiatives:

- Requiring the adoption and maintenance of a National Housing Strategy (NHS), that prioritizes the housing needs of the most vulnerable and requires regular reporting to Parliament on progress toward the Strategy’s goals and outcomes.

- Establishing a National Housing Council with diverse representation, including persons with lived experience of housing need and homelessness. The Council, supported by CMHC, will provide advice to the Minister on questions related to the NHS with the aim of improving housing outcomes.

- Creating a Federal Housing Advocate, supported by the Canadian Human Rights Commission, to identify systemic housing issues facing individuals and households belonging to vulnerable groups, and provide an annual report to the Minister with recommended measures, which will be tabled in Parliament.

“Through the National Housing Strategy, more middle-class Canadians – and people working hard to join it – will find safe, accessible and affordable homes. Our proposed human rights-based approach to housing, as well as the resource centre, will help strengthen the National Housing Strategy, ensuring that it delivers concrete results for the benefit of all Canadians,” said Jean-Yves Duclos, Minister of Families, Children and Social Development and Minister Responsible for Canada Mortgage and Housing Corporation.

Resource centre

Also announced, is a new resource centre from CMHC which will be managed by the Community Housing Transformation Centre to build a strong and resilient community housing sector.

CHTC will receive $68.6 million for administering the resource centre and two important initiatives under the NHS:

- A Sector Transformation Fund to provide non-repayable contributions that support building a strong and resilient community housing sector.

- A Community-Based Tenant Initiative to provide contributions to local organizations whose purpose is to assist people in housing need, support tenants in accessing information on housing options, and encourage better participation in housing decisions that affect them.

“When CMHC held public consultations to develop the Strategy, we heard that Canadians believe everyone deserves to have the dignity of a home. The most promising way to sustain this approach for future generations is to protect it through legislation. Enshrining the need for a National Housing Strategy in law inherently acknowledges the value of a coordinated approach, a shared vision and real accountability. It is a way to bring housing and “rights” closer together. This idea really is central to our thinking at CMHC: housing matters,” said Evan Siddall, President and Chief Executive Officer Canada Mortgage and Housing Corporation. By Steve Randall.

Ontario Real Estate Association Releases 28 Reform Recommendations

Levelling the playing field with builders and developers, eliminating unlicensed real estate “consultants” and getting rid of “bully offers” top the list of reforms that the Ontario Real Estate Association (OREA) is recommending to the provincial government.

OREA’s recommendations also include creating an education program for potential real estate professionals that requires more in-class training and specialization in areas like condominiums, industrial and rural or waterfront properties.

OREA says there is currently a two-tier system of consumer protection that exempts builders and developers from having to follow the rules that all real estate salespeople in Ontario must follow when trading in real estate. Real estate auctions, although rare, are also exempt from the protections.

The association is also demanding removal of the grey area in the legislation that allows unlicensed real estate “consultants” to operate in Ontario.

On the topic of bully or pre-emptive offers, “If a home listing includes an offer date, that’s the date on which all offers should be considered; an offer made before that date should not be allowed,” says Karen Cox, OREA president. “This will ensure that all interested buyers of a particular home get a fair shot at making an offer. For sellers, it means they will have a chance to work with their Realtor to carefully and thoughtfully consider all offers without feeling like they are in a pressure cooker.”

The recommendations also suggest eliminating escalation clauses, a provision that a buyer can use to beat competing offers by automatically topping any better offer with a previously stipulated amount.

“A clause that allows a buyer to automatically bump all other offers out of the running in a multiple offer situation makes for a very uneven playing field,” says Cox. “Further, for the escalation clause to kick-in, a Realtor must reveal private financial information such as the highest offer on a home to the buyer using the clause, which violates the Realtor Code of Ethics. Eliminating contradictory rules like this will strengthen consumer confidence in the province’s real estate market.”

In transactions where real estate salespeople are caught breaching the act that regulates real estate in the province, OREA is calling for a process called disgorgement, which would force rule breakers to pay back any income they made by unethical means.

Also among OREA’s recommendations:

- Provide the option for a more transparent offer process.

- Give The Real Estate Council of Ontario (RECO) the authority to proactively investigate the worst offenders and kick people who break the rules out of the profession. When an individual’s license is revoked, implement a “cooling off” period of at least two years before the offending individual can reapply for registration. All applicants with violent criminal convictions or fraudulent convictions defined under Section 380 of the Canadian Criminal Code within the last 10 years should be denied the privilege of working in real estate, with no right of appeal, says OREA.

- RECO should be granted authority to establish administrative monetary penalties, or fines under $2,000, for a range of regulatory violations as an intermediary disciplinary

- Ontario still does not allow salespeople and brokers from operating their businesses through professional corporations. OREA is calling for fair tax treatment for Realtors.

- Amend legislation to permit specialty licensing classes for commercial, agricultural, condominium and other forms of real estate.

- Replace the term “salesperson” with “agent” and replace the term “registrant” with “licensee”.

By REMonline.com

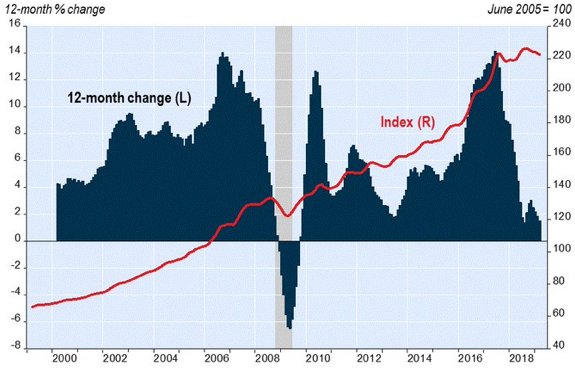

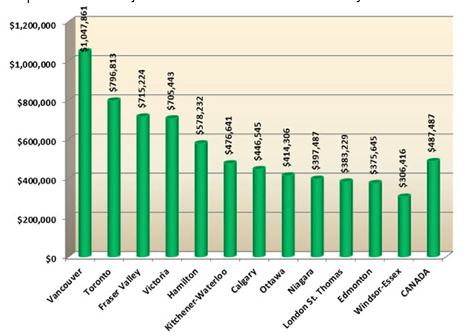

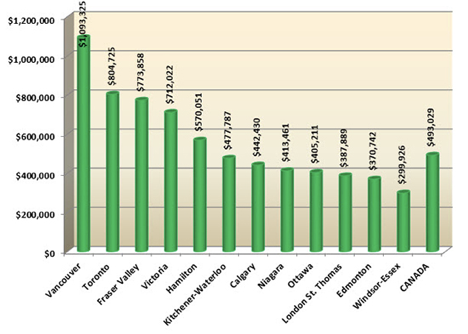

National House Price Index

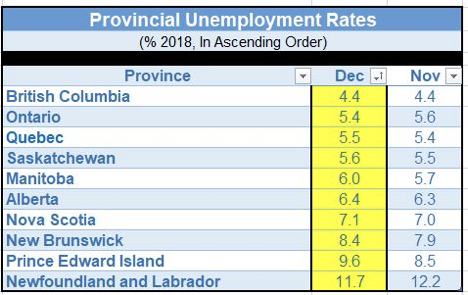

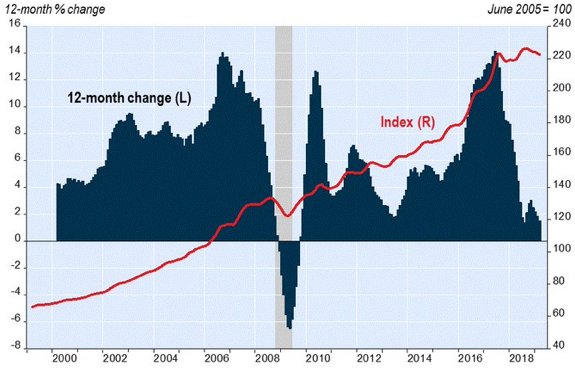

Canada’s home prices continued their downward trend last month according to a leading measure.

The Teranet-National Composite House Price Index was down 0.3% in March compared to the previous month, marking its first decline for any March in its 20-year history with the exception of the 2009 recession.

The sixth monthly decline meant a cumulative drop of 1.7% across the surveyed markets.

Indexes were down month-over-month in seven of the 11 metropolitan markets surveyed – Ottawa-Gatineau (−1.5%), Victoria (−1.1%), Vancouver (−0.5%), Calgary (−0.5%), Toronto (−0.3%), Winnipeg (−0.3%) and Hamilton (−0.1%). Four markets were up: Halifax (0.8%), Quebec City (0.5%), Edmonton (0.4%) and Montreal (0.1%).

Many of these markets have been showing declining prices for many months; including Calgary for nine (-3.7% cumulative), Vancouver for eight (-4.3%), Victoria for six (-3.5%).

Montreal by contrast has only seen one decline in the past 12 months (with a 5.5% cumulative gain) and Halifax has advanced in each of the past five months (+2%).

The index shows a percentage movement in house prices with indices’ base value of 100 in June 2005. For example, an index value of 130 means that home prices have increased 30% since June 2005.

No collapse

The declining trend is not a sign that house prices are in free fall.

“In Toronto, Canada’s largest real estate market, apartment prices have been up for 17 consecutive months, while prices of other types of dwellings declined only 1.4% over the last 6 months. In Vancouver, the most expensive market, employment growing 2.9% in Q1 on a y/y basis should limit further home price declines,” the report says.

View image on Twitter

Teranet Tweets

@teranet_social

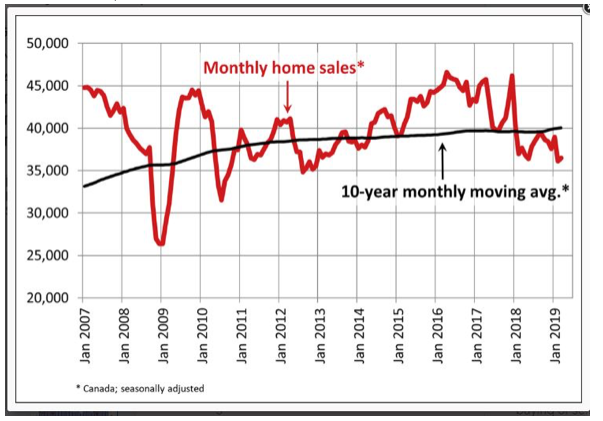

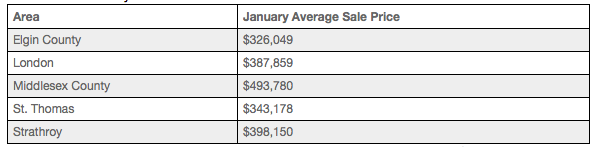

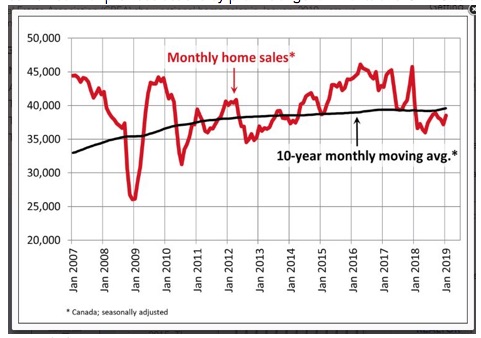

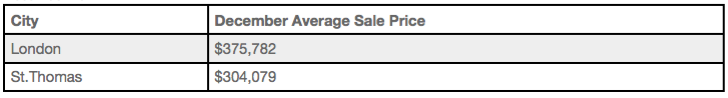

March Home Sales Rebound From Dismal February Showing

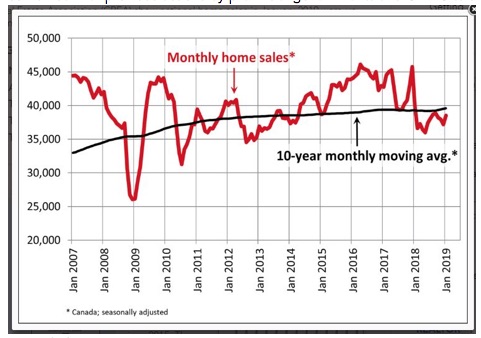

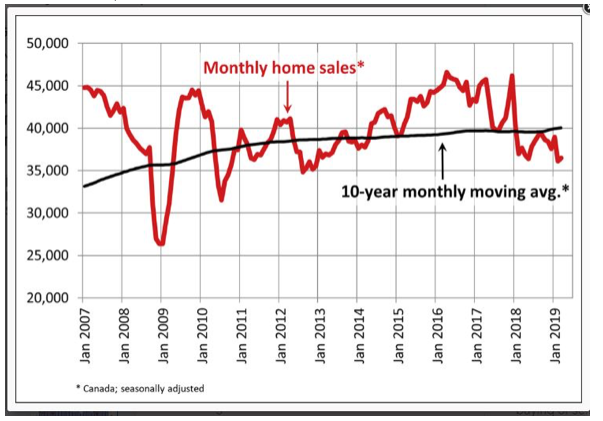

Statistics released Monday by the Canadian Real Estate Association (CREA) show that national home sales edged higher in March following the sharp decline in storm-struck February. Overall, however, housing activity remains considerably below historical norms.

Home sales rose 0.9% nationally while the benchmark price rose 0.8%. While this is an improvement from the very poor showing in February, both sales and prices were down from a year earlier as homebuyers grapple with stricter mortgage rules and provincial actions, especially in British Columbia, to slow the housing market.

There was an even split between the number of markets where sales rose from the previous month and those where they fell. Among Canada’s larger cities, activity improved in Victoria, the Greater Toronto Area (GTA), Oakville-Milton and Ottawa, whereas it declined in Greater Vancouver, Edmonton, Regina, Saskatoon, London and St. Thomas, Sudbury and Quebec City.

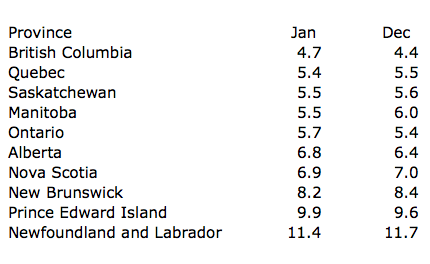

On a year-over-year (y/y) basis, sales fell 4.6% nationally to its weakest level for the month since 2013. Existing home sales were also almost 12% below their 10-year average for the month of March (see chart below). Notably, home sales in B.C., Alberta and Saskatchewan were more than a whopping 20% below their 10-year average for the month. The slump is getting deeper in Vancouver, Calgary and Edmonton. All three markets saw further sales and price declines in March. Demand-supply conditions in Vancouver are now the weakest since the 2008-09 recession. By contrast, activity is running well-above average in Quebec and New Brunswick.

There was a slight pick-up in Toronto, yet the 1.8% sales gain recorded last month reversed just a fraction of the outsized 9.0% drop in weather-weakened February. A sixth consecutive decline in new listings in Toronto might have been a restraining factor.

Activity rebounded in Ottawa, while it was flat in Montreal. Both markets, along with Halifax, still boast the tightest demand-supply conditions in Canada. Benchmark prices there continue to track higher at solid rates.

“It will be some time before policy measures announced in the recent Federal Budget designed to help first-time homebuyers take effect,” said Jason Stephen, CREA’s President. “In the meantime, many prospective homebuyers remain sidelined by the mortgage stress-test to varying degrees depending on where they are looking to buy.”

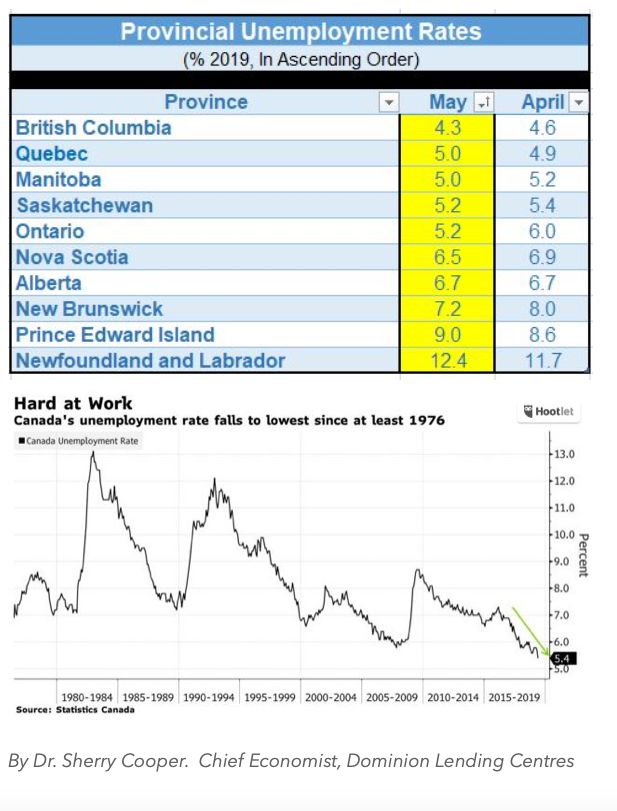

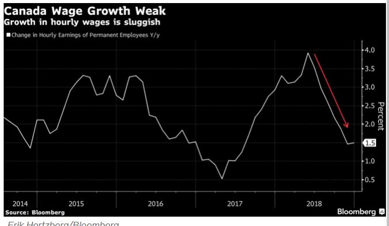

“March results suggest local market trends are largely in a holding pattern,” said Gregory Klump, CREA’s Chief Economist. “While the mortgage stress test has made access to home financing more challenging, the good news is that continuing job growth remains supportive for housing demand and should eventually translate into stronger home sales activity pending a reduction in household indebtedness,” he added.

New Listings

The number of newly listed homes rose 2.1% in March. New supply rose in about two-thirds of all local markets, led by Winnipeg, Regina, Victoria and elsewhere on Vancouver Island. By contrast, new listings declined in the GTA, Ottawa and Halifax-Dartmouth.

With new listings having improved more than sales, the national sales-to-new listings ratio eased to 54.2% from 54.9% in February. This measure of market balance has largely remained close to its long-term average of 53.5% since early 2018.

Based on a comparison of the sales-to-new listings ratio with the long-term average, two-thirds of all local markets were in balanced market territory in March 2019.

There were 5.6 months of inventory on a national basis at the end of March 2019, in line with the February reading and one of the highest levels for the measure in the last three-and-a-half years. Still, it is only slightly above its long-term average of 5.3 months.

Housing market balance varies significantly by region. The number of months of inventory has swollen far above its long-term average in Prairie provinces and Newfoundland & Labrador; as a result, homebuyers there have an ample choice of listings available for purchase. By contrast, the measure remains well below its long-term average in Ontario and the Maritime provinces.

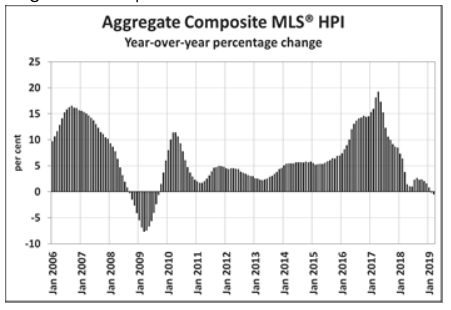

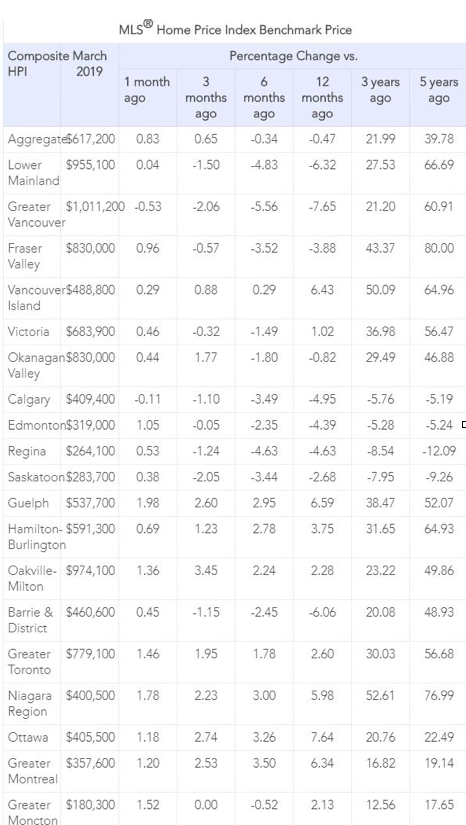

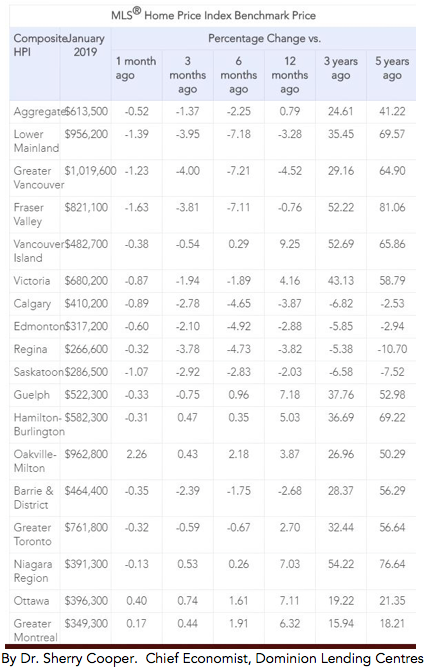

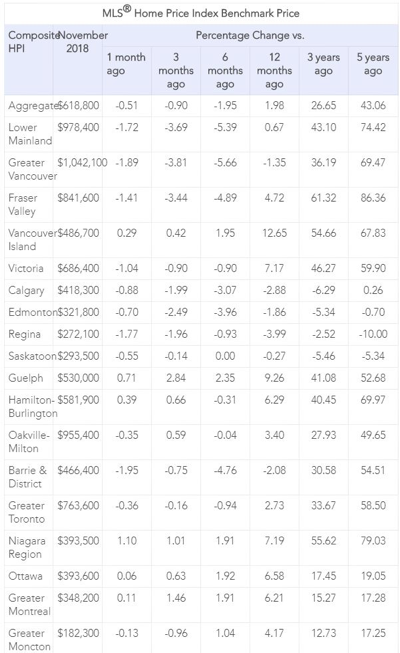

Home Prices

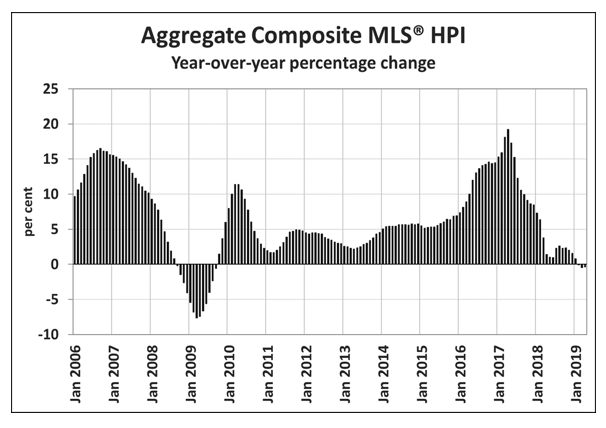

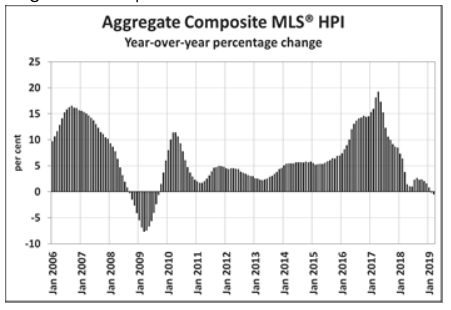

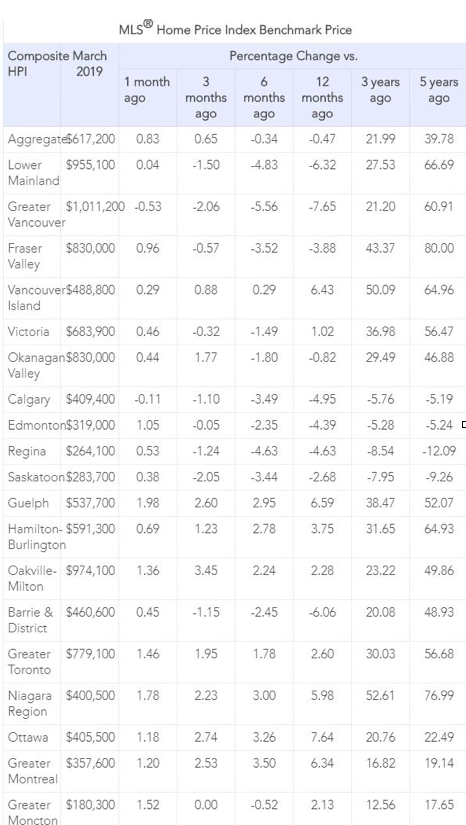

The Aggregate Composite MLS® Home Price Index (MLS® HPI) declined by 0.5% y/y in March 2019. It last posted a y/y decline of similar magnitude in September 2009.

Among benchmark property categories tracked by the index, condo apartment units were the only one to post a y/y price gain in March 2019 (+1.1%), while townhouse/row unit prices were little changed from March 2018 (-0.2%). By comparison, one and two-storey single-family home prices were down by 1.8% and 0.8% y/y respectively.

Trends continue to vary widely among the 18 housing markets tracked by the MLS® HPI. Results remain mixed in British Columbia, with prices down on a y/y basis in Greater Vancouver (-7.7%) and the Fraser Valley (-3.9%). Prices also dipped slightly below year-ago levels in the Okanagan Valley (-0.8%). By contrast, prices rose by 1% in Victoria and by 6.4% elsewhere on Vancouver Island.

Among Greater Golden Horseshoe housing markets tracked by the index, MLS® HPI benchmark home prices were up from year-ago levels in Guelph (+6.6%), the Niagara Region (+6.0%), Hamilton-Burlington (+3.7%) the GTA (+2.6%) and Oakville-Milton (+2.3%). By contrast, home prices in Barrie and District held below year-ago levels (-6.1%).

Across the Prairies, supply remains historically elevated relative to sales and home prices remain below year-ago levels. Benchmark prices were down by 4.9% in Calgary, 4.4% in Edmonton, 4.6% in Regina and 2.7% in Saskatoon. The home pricing environment will likely remain weak in these cities until demand and supply become more balanced.

Home prices rose 7.6% y/y in Ottawa (led by a 10.4% increase in townhouse/row unit prices), 6.3% in Greater Montreal (led by an 8.1% increase in apartment unit prices) and 2.1% in Greater Moncton (led by a 12.9% increase in apartment unit prices). (Table below).

Bottom Line:

The absence of a sharp snapback in activity at the beginning of the all-important spring season in March clearly points to the mortgage stress test, market-cooling measures in BC, economic uncertainty in Alberta and stretched affordability as continuing to exert significant restraint on homebuyer demand. The bad weather’s effect on February sales may have been limited after all. This means that the spring season may not have much upside to offer this year. In coming months, the recent declines in mortgage rates should ease the stress test for some buyers and we will see if first-time home buyers decide to put their plans on hold until more details on the federal government’s First-Time Home Buyer Incentive become available.

It has become increasingly apparent that the taxes levied in Vancouver targetting foreign buyers, empty homes, and high-end properties have sent Vancouver’s luxury housing market reeling. Prices in West Vancouver, one of Canada’s richest neighbourhoods, are down 17% from their 2016 peak. The slowdown is broadening: home sales in March were the weakest since the financial crisis as the benchmark prices fell 8.5% from their record last June. Bloomberg News published the following story today:

“It’s become more costly to both buy and own expensive homes (in Vancouver), particularly for non-resident investors and foreigners. To get a sense of the impact from the municipal, provincial and federal measures, take as a hypothetical example, the province’s most valuable property: the C$73.12 million ($55 million) house belonging to Vancouver-based Lululemon Athletica Inc. founder Chip Wilson. A foreign purchaser of the home who leaves the property empty for much of the year would end up paying as much as C$20.8 million in taxes as follows:

Taxes on purchase:

- Foreign buyers’ tax of 20%: C$14.6 million surcharge on top of the sales price

- Property transfer tax rate climbs to 5% on most expensive homes: C$3.7 million

Ownership taxes:

- Municipal vacancy tax of 1% on assessed value: C$731,200 a year

- Provincial speculation and vacancy tax, 2% of assessed value: C$1.46 million a year

- Provincial luxury home tax known as the additional school tax of 0.2% to 0.4% of assessed value: C$278,480 a year

Additional government moves:

Federal rules tightening mortgage lending made it harder to obtain larger mortgages and harder for foreign buyers to borrow

Proposed legislation will expose anonymous Vancouver property owners in a public registry to stymie tax evasion, fraud and money laundering.”

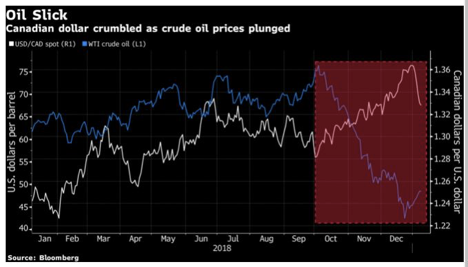

It is not surprising, therefore, that Asian investment–a stalwart part of the Vancouver real estate market for decades–has dropped sharply. “Chinese investors are retreating globally following government restrictions on capital outflows in 2016. In Vancouver, Asian investment dropped off even more last year due in part to a series of new taxes instituted by the government, including a speculation and wealth tax on homes. The province has also proposed a bill to expose hidden landowners — both residential and commercial — and failure to disclose may result in a fine of C$100,000 or 15% of the property’s assessed value, whichever is greater. This is apparently already driving away some investors.” Bloomberg News has reported that at least some Chinese money is being diverted from the Vancouver market to Toronto as shown in the following Bloomberg chart.

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

Realtors & Short Term Rentals

Last week, the Travel Industry Council of Ontario (TICO) and Real Estate Council of Ontario (RECO) confirmed the right of real estate brokerages to transact short-term rental properties.

Another advocacy win for REALTORS®.

Thanks to this ruling, our members will not have to register as travel agents in order to transact vacation properties provided they do it through their brokerage – saving members thousands of dollars in costs and dozens of hours taking courses/passing exams!

Going forward, OREA will be working with Minister Bill Walker and his team to address the issue for the long-term as part of the Province’s updates to REBBA.

Read OREA’s statement here.

Read the RECO bulletin here.

Read the TICO bulletin here.

Economic Highlights

Bank of Canada maintains overnight rate target at 1 ¾ per cent

The Bank of Canada today maintained its target for the overnight rate at 1 ¾ per cent. The Bank Rate is correspondingly 2 per cent and the deposit rate is 1 ½ per cent.

Monetary Policy Report – April 2019

The Bank’s new forecast calls for real economic growth of 1.2 per cent this year, 2.1 per cent next year and 2.0 per cent in 2021.

IMF’s predictions regarding the economy are too optimistic

The International Monetary Fund’s predictions of the Canadian economy’s prospects for next year are far more optimistic than what is warranted by current figures, Deloitte Canada chief economist Craig Alexander stated.

In its latest outlook, the IMF pulled back its growth estimate for Canada to 1.5% this year, down from the 1.9% forecast in January.

However, Alexander contested the IMF’s prediction of a Canadian recovery of 1.9% in 2020, which will accompany an expected global growth of 3.6% that year.

“They’re too optimistic,” he told the Financial Post. “The reality is that many people’s expectations of what represents good growth are actually too high.”

The economist projected that Canadian GDP will grow by 1.3% in 2019, and then only a miniscule gain to 1.5% in 2020.

An important factor working through the market is the steadily increasing overall debt level, which has hobbled the purchasing power of a significant proportion of consumers, Alexander explained. The latter aspect is especially apparent in the precipitous decline of large retail and real estate purchases.

Moreover, businesses have by and large adapted conservative investment strategies for the time being, mainly due to global turmoil in financial markets. A long-term goal of surviving in this environment should push Canada to make its tax and regulatory regimes conducive to further competition and investment, Alexander stressed.

Earlier this month, Bank of Canada Governor Stephen Poloz assured that Canada’s economic slowdown will ultimately be a fleeting state of affairs. He cited modest economic growth at the beginning of the year, along with a flexible exchange rate, as elements buttressing the nation’s fundamentals.

“There are challenges in the Canadian and global economies that we need to manage, but there are clear signs that Canada is adjusting to the challenges,” Poloz said. “Recent economic data have been generally consistent with our expectation that the period of below-potential growth will prove to be temporary.” By Ephraim Vecina.

BoC gov’s decision today likely to lead to ‘prolonged pause’

BoC governor Stephen Poloz will most likely set the stage for a lengthy pause on interest rate hikes today, according to analysts surveyed by Bloomberg.

The benchmark overnight rate is expected to stay at 1.75%, amid the more troubling impacts of a sustained economic slowdown aggravated by slower global growth and a cross-Pacific trade war.

Such a decision would be the fourth consecutive hold by the bank.

“The Bank of Canada is still one of the most hawkish central banks globally, and I expect Governor Poloz is going to want to maintain some optionality [to raise rates],” Manulife Asset Management head of macroeconomic strategy Frances Donald said, noting that this stance will give the central bank the tools that it will need to stave off “another borrowing binge.”

“Full capitulation like we’ve seen from the Federal Reserve or the European Central Bank in my view is unlikely,” Donald added.

Earlier this month, Poloz asserted that the Canadian economy will still benefit from the boost that low borrowing costs can provide, considering the current environment of global economic uncertainty.

“That is why we said at our last interest rate announcement in March that the economic outlook continues to warrant a policy interest rate that is below the neutral range to help the economy work through this downshift in growth and keep inflation close to target,” Poloz stated back then, as quoted by BNN Bloomberg.

“There are challenges in the Canadian and global economies that we need to manage, but there are clear signs that Canada is adjusting to the challenges… “Recent economic data have been generally consistent with our expectation that the period of below-potential growth will prove to be temporary.” By Ephraim Vecina.

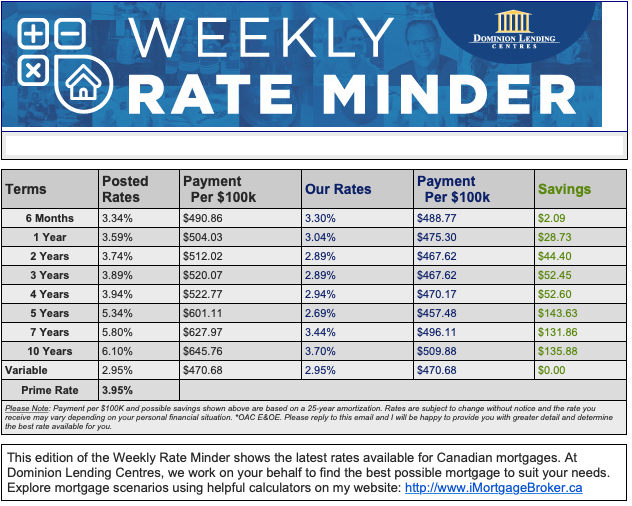

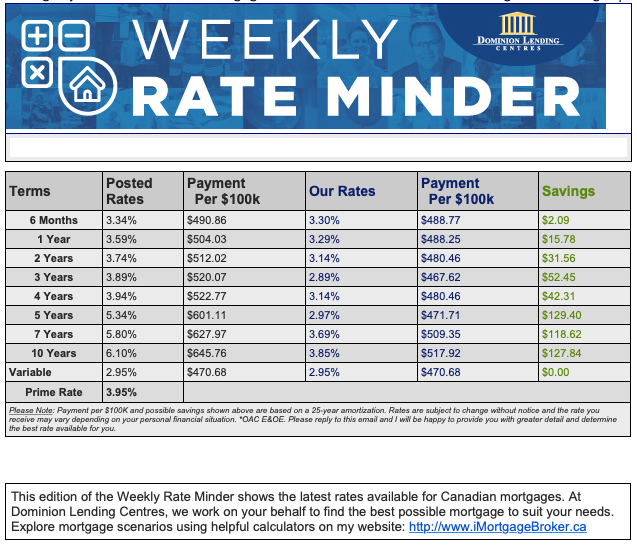

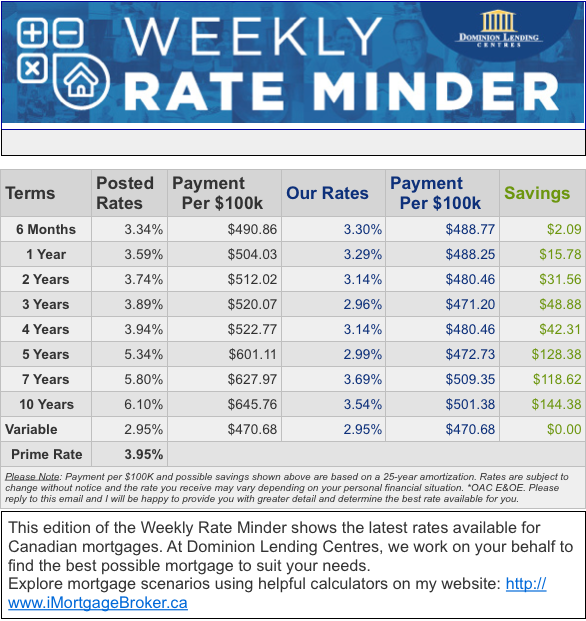

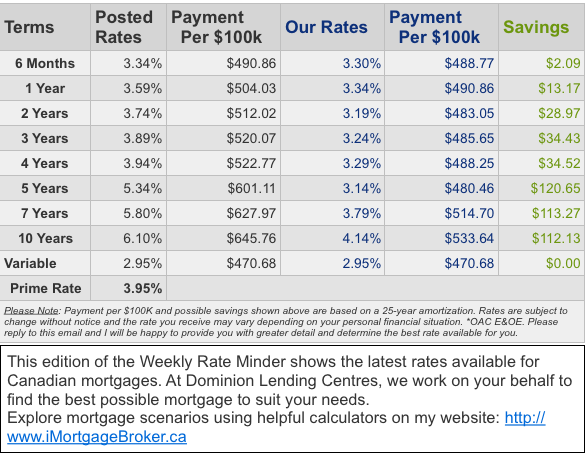

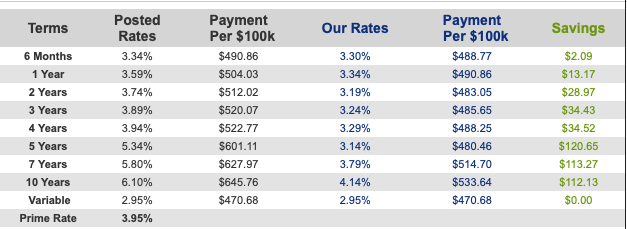

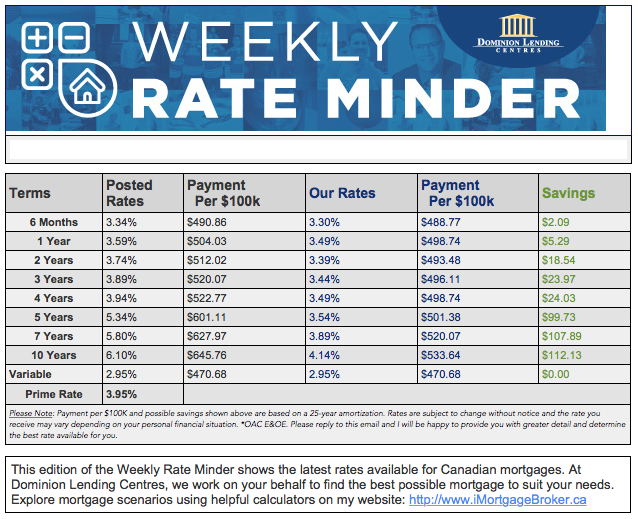

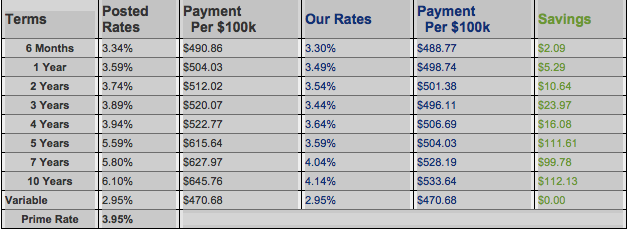

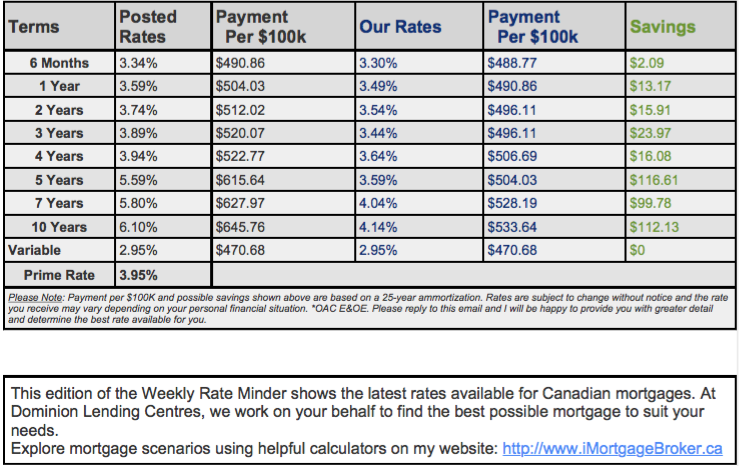

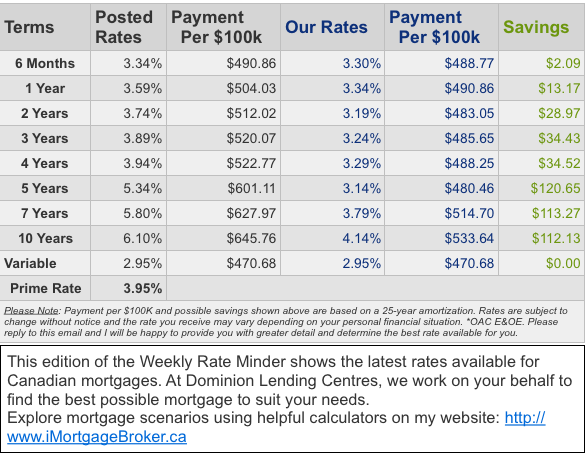

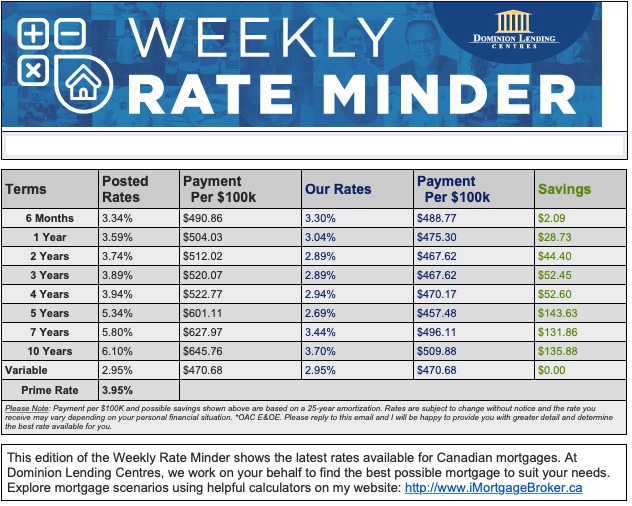

Mortgage Interest Rates

No change to Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates have dropped between 5-10 basis points in the last two weeks. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not significant enough spread between the fixed and variable to justify the risk for most.

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- Poloz Poised to Put Bank of Canada on Pause: Decision Day Guide (Bloomberg)

- Household Debt Leaves Canadians ‘Maxed Out’ With No Plan For Repayment: Survey (Huffington Post)

- Vancouver home prices are going to fall further this year (Livabl)

- Canada needs to crack down on real estate money laundering (Livabl)

- What $250,000 will buy in four Canadian cities (Maclean’s)

- London Real Estate Market Full Steam Ahead (Point2Homes)

- Realtors oppose mandatory sharing of offers among competing home buyers (The Star)

- What Does the Future Hold for the Mortgage Stress Test? (Point2Homes)

- ‘Disappointing’ Canadian housing market is set to pick up this year (Livabl)

- Canada’s housing market remains sluggish despite March rebound (BNN Bloomberg)

- Average house price fell 1.8 per cent to $481,745, CREA says (CTV)

- Here’s how the Canadian government could be more generous to struggling first-time homebuyers (Livabl)

- Why house prices are unlikely to rise any time soon (Maclean’s)

- Canada’s Cannabis Industry Pushing Up House Prices In Certain Places: Report (Huffington Post)

- No, a weak stretch doesn’t mean Canada’s housing market is collapsing (Livabl)

- Despite price drop, Toronto slated to come back hard (Canadian Real Estate Wealth)

- Ontario Budget 2019 – Industry Overview (Mortgage Professionals Canada participates in exclusive lockup)

- Liberals Use Budget Bill To Legislate ‘Right To Housing’ In Canada (Huffington Post)

- Canadian developers could be building more new homes right now. Here’s why they’re waiting (Livabl)

- Edmonton remains a top affordability hub (Canadian Real Estate Wealth)

- This is what ‘affordable’ looks like across Canada’s housing market (Daily Hive)

- Ottawa is actually Canada’s hottest housing market in new global ranking (Livabl)

- Cannabis production is pushing home prices higher in Canadian pot-boom towns (Livabl)

- These are the best times of the year to buy and sell a home (Livabl)

- Baby Boomers’ Impact on Canadian Real Estate (Canadian Real Estate Wealth)

- Real Estate: What $500,000 will buy in five Canadian cities (Maclean’s)

- Home prices have been rising in this Canadian market for 49 straight months (Livabl)

- Toronto’s 2-bedroom condo rent just climbed to nearly $3,000 a month (Livabl)

- Montreal price growth continues outpacing other top markets (Canadian Real Estate Wealth)

- Majority of Canadians Say It’s Better to Own than Rent (Canadian Mortgage Trends)

- Pace of Canadian housing starts up in March on seasonally adjusted basis: CMHC (CTV)

- Canadian homebuilding rebounds from an early deep freeze (The Star)

- Canadian housing demand is one thing Millennials can’t be blamed for killing (Livabl)

- Chinese Real-Estate Investors Wary of Vancouver Head to Toronto (Bloomberg)

- Update on CMHC’s First-Time Home Buyers Incentive (Canadian Mortgage Trends)

- Majority of Canadians believe it’s better to own than to rent a home, poll finds (Toronto Star)

- How do you stop developers from cancelling condos? Buyers, lawyers and builders weigh in (Toronto Star)

- Canada’s Risky Housing Market Has Traded Places With The U.S., IMF Says (Huffington Post)

- Feds defend new homebuyer program after fierce criticism that it won’t help anyone in Toronto (Livabl)

- Canadian incomes aren’t growing fast enough, and that’s a problem for Canada’s housing market (Livabl)

- Growing pains only just begin for Toronto (Canadian Real Estate Wealth)

- Survey reveals housing market off to a sluggish start (Canadian Real Estate Wealth)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.

![]()

![]()