Industry & Market Highlights

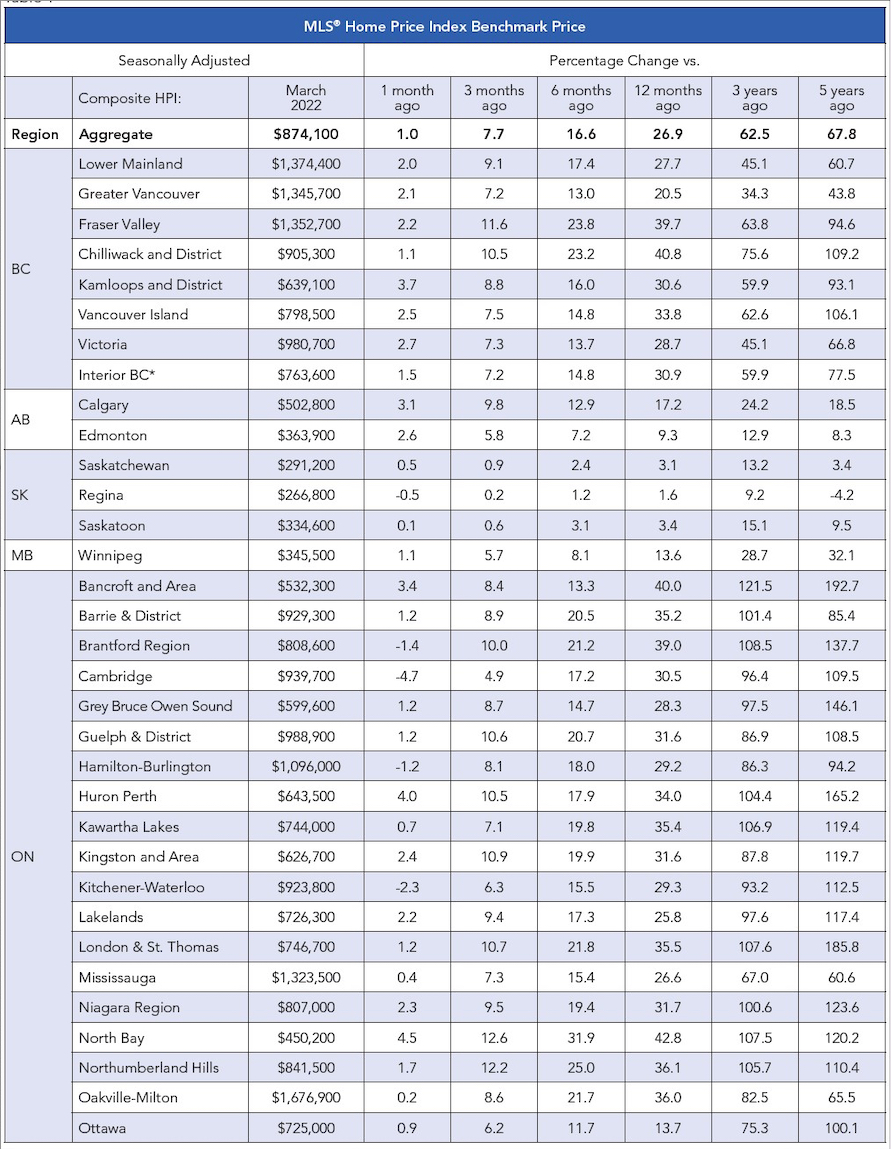

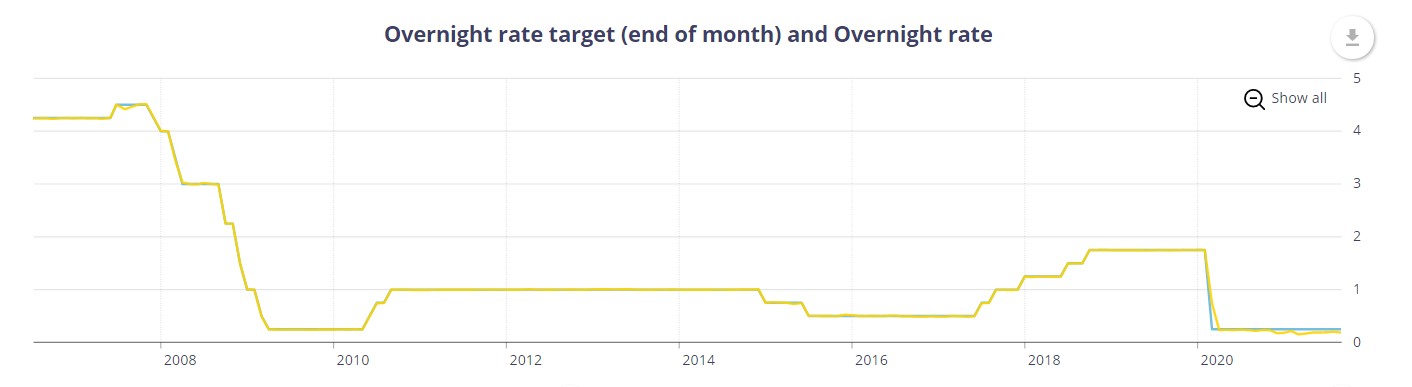

Surge in outstanding residential mortgage credit’: CMHC sees risk of delinquencies jumping

Canadians piled on mortgage debt even as COVID-19 forced the country into lockdowns, and Canada Mortgage and Housing Corporation (CHMC) worries many will eventually struggle to keep up with payments.

The national housing agency says total outstanding mortgage debt accelerated at the beginning of 2020 and into the first months of COVID-19 lockdowns in April and May. CMHC says the jump followed a relatively stable period in 2019.

”We observed a surge in outstanding residential mortgage credit in the first five months of 2020.

“This mortgage credit acceleration is a result of an increase in newly extended mortgages, given residential property sales were up late last year and early this year, and a record number of homeowners deferring their mortgage payments from impacts of pandemic-related economic shutdowns,” said Tania Bourassa-Ochoa, senior specialist, housing research at CHMC.

CMHC says six-month deferrals, offered in response to the pandemic, have resulted in 760,000 deferred or skipped mortgage payments across chartered banks. It estimates $1 billion per month has been deferred.

As the deferral period ends, CMHC says there is a higher risk of mortgage delinquencies in the third and fourth quarters.

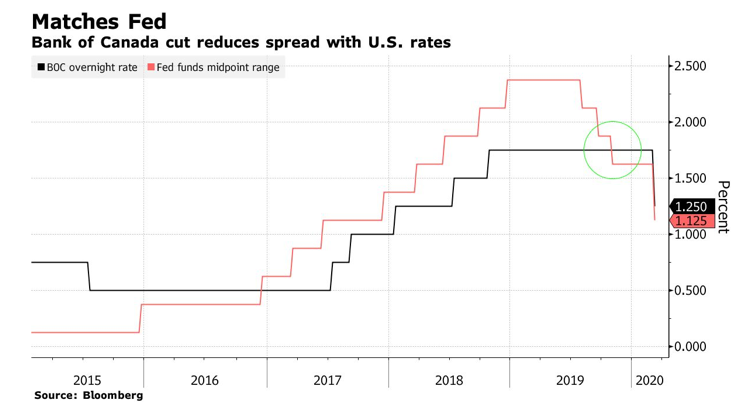

It also says a string of interest rate cuts by the Bank of Canada has sparked an increased interest in variable rate mortgages.

Uninsured mortgages are getting more popular too and 63 per cent of mortgages from chartered banks were uninsured.

By Jessy Bains, Yahoo Finance Canada. Follow him on Twitter @jessysbains.

Five reasons Canadians have little reason to fear a housing crash

Whether they take place during a pandemic-fuelled recession or during a period of sustained economic expansion, record-shattering home sales in Canada always seem to be accompanied by the same phenomenon: talk of the country’s “inevitable” housing crash.

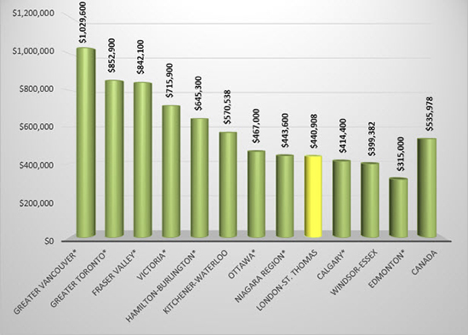

Questioning the logic of homebuyers who engage in wild bidding wars in the midst of historic job losses is hardly unreasonable, but saying that behaviour will trigger a catastrophic fall in home prices, like the 18 percent decline projected as a potential outcome by the Canada Mortgage and Housing Corporation in May, is a train of thought Nick Kyprianou, president of RiverRock Mortgage Investment Corporation, is encouraging Canadians to abandon.

Talk of a crash in home prices has been persistent since CMHC first floated its dire 18 percent figure, even though neither CMHC nor any other housing authority, lender or brokerage has provided any evidence or metrics that tie current market activity or the economic slide caused by COVID-19 to plummeting home prices. And yet, the spectre of an 18 percent decline persists, hanging over the market like the reaper’s scythe, just waiting to harvest the souls and credit ratings of unfortunate Canadians.

Kyprianou is another market-watcher who can’t fathom the CMHC’s projection. His theory is that, in determining its absolute, institution-destroying, worst-case scenario as part of its annual report to the Office of the Superintendent of Financial Institutions, CMHC may have concluded that its own breaking point would come if home prices shrank by 18 percent.

“I think [CMHC CEO Evan Siddall] just spouted off the worst-case scenario,” Kyprianou says. “Well, the chance of the worst-case scenario is so remote, everything has to line-up perfectly – multiple times – for it to happen.”

Using five key metrics to compare the current economic situation to that which proceeded the last true housing crash in Ontario (1989-1995), Kyprianou says today’s consumers can remain confident that home values will largely maintain their strength, even as COVID-19 continues to cast its shadow over the Canadian economy.

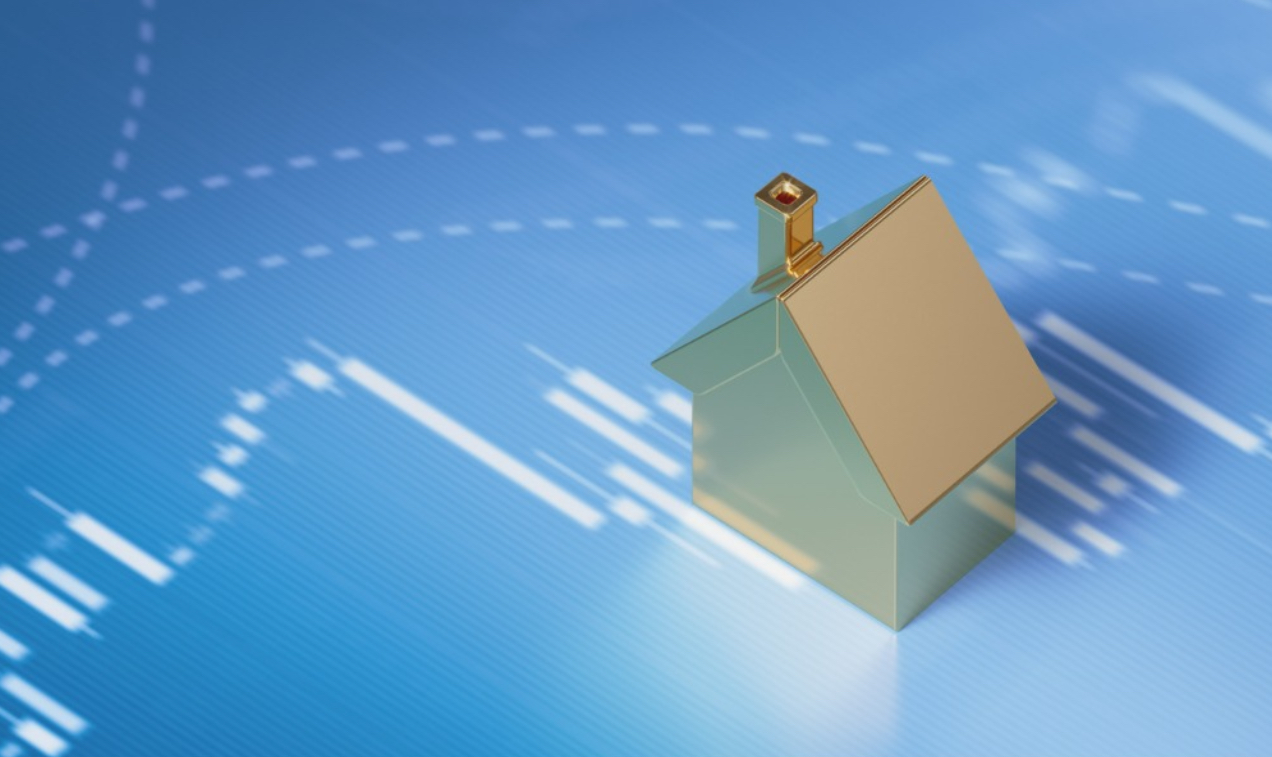

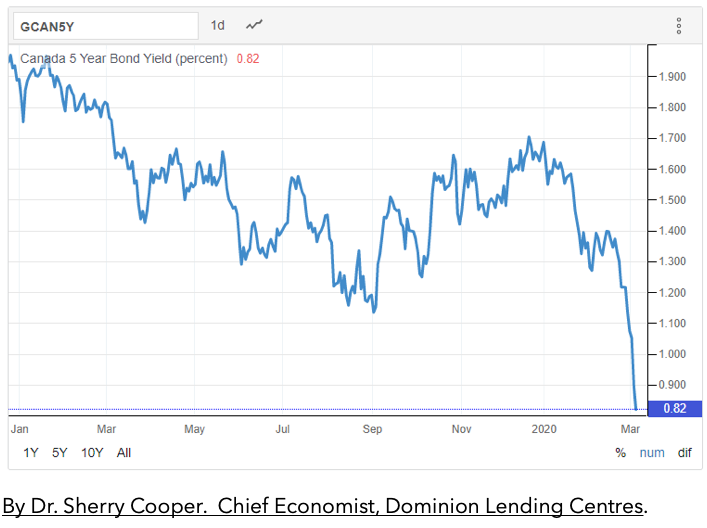

1. Interest rates

“Interest rates are your biggest factor,” Kyprianou says “If interest rates keep going up, that’s the biggest burden on housing because your dollar just doesn’t go as far.”

Interest rates almost doubled during Ontario’s last crash, rising from from eight to fifteen percent, putting pressure not only on buyers but the province’s builders as well. That is simply not going to happen this time around. The Bank of Canada estimated that it may not raise its key interest rate target before 2022.

2. Unemployment

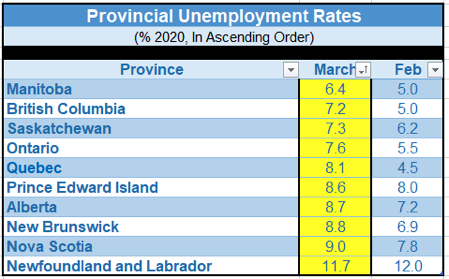

There is no question that Canada’s employment situation is a worry. Unemployment was 10.2 percent in August 2020, almost double the rate seen in August 2019. But Kyprianou says there’s more to the story than just the headline.

In the early 1990s, when unemployment was hovering around 11 percent, most of the jobs being lost belonged to high earners – middle management, skilled tradespeople, factory workers – who saw their employers close up shop and move their operations to countries like Mexico during the first rocky years of the North American Free Trade Agreement.

“When these jobs are evaporating and the bulk of the unemployed are the higher income earners, that is going to have an effect on housing,” Kyprianou says, adding that most of the labour disruption caused by COVID-19 has been proven to involve low-wage earners who are predominantly renters, not prospective home buyers.

“That’s a big dynamic change,” he says. “You just can’t look at what the unemployment number is. You have to drill down through it and look at who is unemployed.”

3. Equity

Much of the concern expressed by CMHC’s Siddall over Canadian debt levels and high-ratio mortgages is the risk of borrowers being dragged underwater if falling home prices leave them in a negative equity position. Fair enough. But Kyprianou, quoting statistics provided by Canadian Mortgage Professionals, says the vast majority of Canadians have far more than five percent equity in their homes.

In its most recent Annual State of the Residential Mortgage Market in Canada report, CMP found that 88 percent of Canadian homeowners have equity ratios of 25 percent or higher. Among the 6 million homeowners with mortgages, 81 percent have equity ratios of 25 percent or more.

Kyprianou says there is also the concept of emotional equity to consider. Defaulting on a mortgage is seen as an embarrassing failure most homeowners will do all they can to avoid. He saw many of them get resourceful during the last recession – taking on boarders, getting a second job, asking their families for assistance – as a means of making their monthly mortgage payments. He expects the same level of effort from today’s borrowers.

“You gotta make it work,” he says.

4. Taxes

In the early 90s, sky-high personal and corporate tax rates were deemed responsible for driving companies and individual professionals into the waiting arms of the United States. The resulting brain drain eventually led to lower tax rates in Canada, but the damage was done.

With unemployment high and business confidence muted, it is highly unlikely that taxes will see any kind of significant spike over the near-term. Canadians are likely to be up in arms when their CERB payments are taken into account come tax time next year, and the billions in government aid used to prop up the economy for six months will eventually need to be recouped, but it’s safe to say the feds won’t threaten the nation’s economic recovery – or their polling numbers – by implementing any significant new taxes.

5. Immigration

In the 1989-1995 downturn, the problem wasn’t a lack of new Canadians, it was an inability to keep them. The brain drain days are over, but by limiting international immigration, COVID-19 has thrown a wrench into the works. With just over 100,000 permanent residents being welcomed into the country in the first six-months of 2020, Canada has little chance of hitting its immigration target of 341,000 for the year.

Immigration has been a significant driver of all things good in Canada over the past several years – population growth, innovation, economic expansion, home sales – but Kyprianou doesn’t see a fall in immigration numbers having too negative an impact on home prices, largely because immigrants don’t tend to buy properties for the first two years after arriving in Canada.

“If the pandemic affects immigration for three years, it’s not going to be a problem,” he says. “If it’s just a year, year-and-a-half, it’s not going to be a problem.”

Canada’s reputation for being a stable presence in a chaotic world has also been strengthened by the country’s handling of the pandemic (and the humiliating failure of our neighbours to the south to do the same). Once recovered from COVID-19, the country should still offer the same opportunity for new arrivals to find not only a safe environment to raise their families, but high-paying jobs in growing industries like tech and financial services.

The only sub-market where Kyprianou sees prices softening is high-rise condos. But with so many investors having purchased rapidly appreciating pre-construction properties over the past five years, even those who may be forced to sell, like unlucky Airbnb operators, are unlikely to face a loss. If the average price per square foot in Toronto, for example, falls from its current level of approximately $1,100 to $900, anyone who purchased at $500 per square foot in 2015 will still be making a hefty profit.

“It’s not like there’s going to be a bloodbath,” Kyprianou says. “They just don’t make as much money if they have to sell.” By Clayton Jarvis.

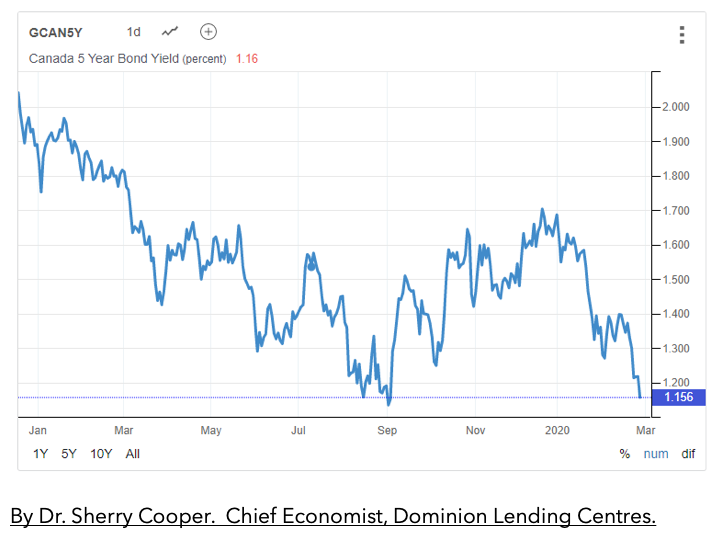

Mortgage costs stay low, central bank keeps interest rate at rock-bottom level

The Bank of Canada announced today that it would be keeping its mortgage-market influencing policy rate at the record low 0.25 percent level with no sign that it would increase any time soon.

The policy rate, which has a major effect on how mortgage lenders set their rates, has been steady at 0.25 percent since March, when the central bank sprung into action with a dramatic series of rate cuts meant to support the economy during the early days of the pandemic.

A lot has happened since then, to say the least. The central bank, now led by recently appointed Governor Tiff Macklem, has repeatedly stated that its policy rate will remain ultra-low to continue supporting the country’s economic recovery. But the summer brought with it some significant signs that a healthy bounce back is underway, led by the country’s housing market.

This did not appear to faze the bank, according to Capital Economics’ Stephen Brown, who noted that the robust housing recovery only received a brief mention in today’s announcement.

“While home sales were admittedly still lower on a year-to-date basis in July than they were in 2019, the timelier local real estate board data for Toronto and Vancouver showed even further strong rises in sales in August,” wrote Brown.

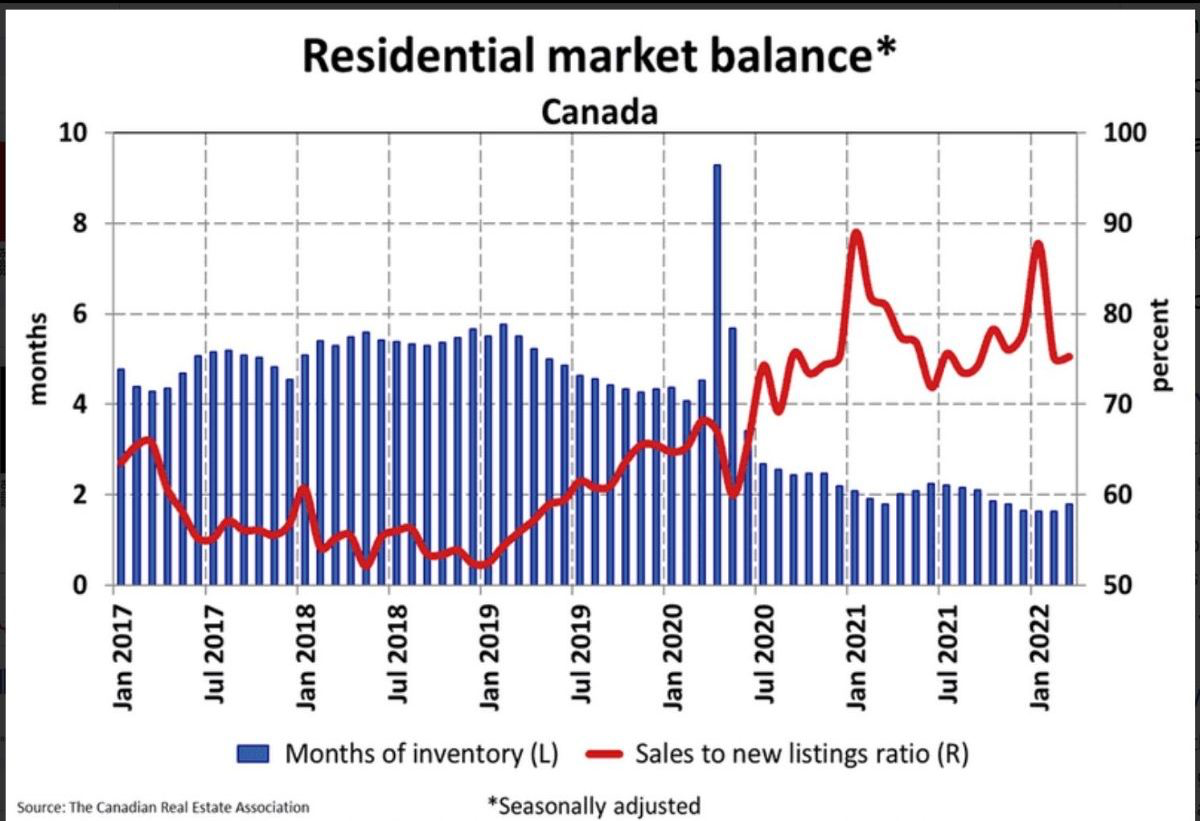

“Moreover, as sales have surged by more than new listings, the nationwide sales-to-new listing ratio now points to very strong house price inflation, which is surely making at least some members of the [Bank of Canada’s] Governing Council nervous,” he continued.

Brown is alluding to the fact that the central bank wants to avoid a situation in which a sustained low interest rate environment causes home prices to skyrocket due to high demand driven by rock bottom borrowing costs.

Lenders have already been competing for mortgage market share by cutting fixed and variable rates that have now reached historic lows.

A renewed flurry of mortgage borrowing could exacerbate an already worrying pre-pandemic trend that saw Canadian household debt reach and remain at one of the highest levels recorded in developed countries. An event that triggers rates to rise rapidly or incomes to fall quickly — like a wind down of pandemic-related government support — could prove to be disastrous for many indebted households.

But despite these concerns it appears the Bank of Canada’s policy rate, and by extension, mortgage rates will remain low for a long time to come. As Capital Economics’ Brown wrote, the bank has essentially reiterated in today’s announcement that “interest rate rises are years away.” By Sean McKay.

What if we shut down again? Are you ready?

With such a hot market over these past few months, instead of sitting back and relaxing throughout the summer, most people have been really busy. That’s a good thing for sure.

As we start the fall market though, there is a lot of uncertainty ahead. Have you planned for the “what if”? What if schools shut down again, what if the market slows down again, what if they run out of toilet paper again (lol)?

Seriously though, are you ready? Watch to see what I think you should focus on right now to ensure you’re ahead of this thing in case we go back into lockdown. By David Greenspan.

Bank of Canada drives another nail in the coffin for savers

Growing your retirement nest-egg safely became even more elusive this week after the Bank of Canada reiterated its pledge to keep its trend-setting interest rate near zero for years to come.

For borrowers it’s a reprieve, but for savers looking for a safe haven in fixed income it’s the continuation of more than a decade of paltry yields.

Bank of Canada Governor Tiff Macklem held Canada’s benchmark rate at 0.25 per cent until the country’s COVID-battered economy can sustain an annual growth rate of two per cent. In the meantime, safe fixed income investments such as guaranteed investment certificates (GICs) will trickle out annual returns of about one per cent.

It presents a real dilemma for Canadians saving for retirement through registered retirement savings plans (RRSPs), tax-free savings accounts (TFSAs), and workplace defined-contribution (DC) pension plans. A typical retirement plan calls for portfolio growth of between five per cent and eight per cent. Much of the heavy lifting is done through equity investments linked to the stock market, and that risk is offset by a significant portion of fixed income.

Lower fixed income yields will continue to force investors to generate income by putting a greater proportion of their retirement savings into riskier equity investments such as stocks that pay dividends. Unlike fixed income, dividends are paid at the discretion of the company and the underlying stock is subject to price changes at the discretion of the market. With the threat of a second wave of COVID-19 and a turbulent U.S. presidential election campaign, equity markets could be in for a wild ride.

That could cause even more grief for older investors in, or nearing, retirement who need to draw on a reliable source of cash for day-to-day living expenses. If cash and fixed income reserves dry up, they could be forced to sell equities in a down market, leaving less money invested to grow over time and see them through retirement.

Longer term government and corporate bonds can pay out a bit more but many bond experts say the extra yield is not worth the added risk of default, and having your money exposed to the market for long periods of time.

One questionable fixed income option is bond funds. Many investment advisors substitute them for the fixed income portion of a portfolio but returns are not consistent. That’s because holdings are often traded before maturity, and the funds themselves are subject price changes. In other words: income is not fixed. In many cases, advisors only have access to mutual funds, which pay them a commission.

Good advisors say fixed income should always have a place in a diversified portfolio regardless of yield. Even at zero, fixed income could be your best performing asset class if equity markets are down. The portion of a portfolio that should be dedicated to fixed income depends on the comfort level of the individual investor but should increase as they get older and closer to the time when they want to withdraw funds.

They say the best way to squeeze out the highest yields over the long term is to ladder maturities over different time intervals. The goal is to have fixed income maturities come often so there are more opportunities to get the best yields.

Deciding to sacrifice returns for security is a gut-wrenching reality in today’s economy. You might not reach your return goals, but at least you can rest easy knowing that something will be there.

Payback Time is a weekly column by personal finance columnist Dale Jackson about how to prepare your finances for retirement. Have a question you want answered? Email dalejackson.paybacktime@gmail.com. By Dale Jackson. BNN Bloomberg.

Builders record busiest month for home construction in 13 years

Canadian housing starts, led by a blazing construction pace in Ontario, accelerated to the highest level seen in 13 years in August.

On a national level, starts reached 262,400 annualized units in August, up seven percent from July’s reading for the fastest pace of home building seen since 2007.

Housing starts measure how many homes began construction during a given period and are viewed as a key factor in determining market health.

The housing starts data, released earlier this week by the Canada Mortgage and Housing Corporation (CMHC), was hailed as another sign the housing market is in the midst of a robust recovery.

“Add this report to the list of very strong Canadian housing data that we’ve seen since the worst of the pandemic in April, as the sector continues to outperform other parts of the economy,” wrote TD Economist Rishi Sondhi.

“The robust pace of homebuilding is being driven by past sales gains, with low interest rates also providing support. These factors should keep homebuilding elevated through next year as well,” he continued.

Condo developers in Ontario were responsible for a substantial amount of the home construction strength seen on the national level, with starts in the province jumping by 30,700 units in August to 114,800 annualized units. Sondhi said it marked the strongest pace of home building in the province since 1990.

Looking ahead, market experts believe the blazing pace of home construction will likely run into the realities of the ongoing pandemic, with population growth temporarily slowing and government income support programs winding down, resulting in dampened demand for housing.

Sondhi noted that building permits, a reliable indicator of where home construction is heading, eased up in July, pointing to a come down from the dizzying pace seen in August. By Sean MacKay.

Stress test must be revised to reflect market realities – economist

Improved purchasing power will stem from the mortgage stress test being updated to reflect the sub-2% rates currently available in the market, according to economist Will Dunning.

The disparity is particularly jarring when one considers that new borrowers are tested against an interest rate of 4.79%, Dunning said in an interview with the Georgia Straight.

“This is an impediment to many Canadians achieving their reasonable home-buying goals and is also an impediment to the broader economic recovery,” Dunning said.

Moreover, the stress test does not take into account rising incomes, which Dunning said has been a decades-long trend.

“It is omitting one of the most important factors that will affect people’s ability to make their future payment, and so that’s a major flaw in the testing system that exists today,” Dunning said.

The economist added that while it’s “very good policy” to put borrowers through these assessments to ensure that they can actually pay their loans, some adjustments might be appropriate at this point.

“It’s time to recalibrate that policy to say, you know, what is a reasonable expectation about the conditions that will exist in five years and will affect people’s ability to make their payments,” Dunning said. “If you think interest rates might rise by two points over the next five years, and you also have an expectation that incomes will continue to rise the way they have in the past, then the way to simulate that combination is to say that the test should be the contracted interest rate plus three-quarters of a point.” By Ephraim Vecina.

Second homes and the principal residence tax exemption

From what I have read, the demand for cottage properties has soared during COVID-19. City folk are eager to get out of the city for a change of scenery, especially since many people are still working from home. So the idea of having your laptop set up on the dock of your second home is definitely appealing. And if you are on the selling side, you likely have benefitted from the high demand for properties.

A question I get from both purchasers and sellers is whether the principal residence exemption can be used to shelter the capital gain on a cottage property. The short answer is yes, it’s possible.

In order to take advantage of the principal residence exemption (PRE), certain requirements must be met:

- You, your spouse or former spouse or a child must ordinarily occupy the house for some time during the year. Ordinarily occupy can also include a vacation home that is used by you and your family.

- To claim the PRE on a large lot (over half a hectare – about 1 1/2 acres), you must be in a position to establish that the land over half a hectare is necessary for the “use and enjoyment” of your home. This may be quite relevant if your cottage or second home is located on a large piece of land or island.

- Restrictions will also apply if part, or your entire home, is rented out or is not used by a family member, or if you have not been resident in Canada throughout the period of ownership (other than in the year of purchase).

- As a general rule, a family can claim the PRE on only one home at a time. So the second home is more of a problem: to stop you from trying to claim a separate exemption for another home by putting it in the name of a child, children are restricted from claiming the exemption unless they have reached age 18 in the year or are married.

- Where specific conditions are met, non-Canadian properties may also qualify for the PRE.

- Subject to new rules that were introduced in 2016, it may be possible for certain trusts to claim the PRE provided that a corporation is not a beneficiary, and the trust designates a beneficiary (or their spouse, common-law partner or child) of the trust who ordinarily inhabits the property (referred to as a “specified beneficiary”). See further discussion below regarding trusts.

How it works

Most people think of the PRE as a black-and-white matter – either you qualify to sell tax-free or you don’t. Actually, this is not the case. When you sell your home, you must calculate the gain on your residence just like any other capital gain. Then PRE itself reduces your gain.

Moreover, eligibility for the exemption is on a year-by-year basis, which might come as a surprise to you. The more years you qualify relative to your total period of ownership, the more your gain gets reduced. The basic formula that normally applies:

1 + number of years after 1971 the house was used and designated as a principal residence (and you were a resident of Canada), divided by the number of years of ownership calculated after 1971, times the capital gain otherwise calculated.

Despite only allowing one property to be claimed, the rules allow you to have two residences in the same year: that is, where one residence is sold and another is purchased in the same year. That is why the above formula adds “1” to the number of years the property was a principal residence (the “plus one rule”). Note: As a result of certain changes to the rules that were announced in 2016 the “plus one rule” will not apply where an individual is not resident in Canada during that year. Prior to the change in rules, you could benefit from the PRE for the year that you purchased a residence in Canada, even though you were not a Canadian resident in the year of acquisition.

As you can see from the formula, to get the tax reduction you must designate the home as principal residence on a year-by-year basis.

Ownership by a trust:

Starting as of 2017, additional requirements will be applicable where a trust owns a principal residence (for the years that begin after 2016). Essentially, only the following types of trusts are able to designate a principal residence (where the trust has Canadian-resident beneficiaries and a “specified beneficiary”):

- An alter ego trust, a spousal or common-law partner trust, a joint spousal or common-law partner trust (or a similar trust for the exclusive benefit of the settlor of the trust during his/her lifetime).

- A testamentary trust created under a will that is a qualifying disability trust; or

- A trust for the benefit of a minor child of deceased parents.

If you have a trust that owns a principal residence and don’t meet the above conditions, you can take advantage of transitional rules that will allow the trust to crystallize the PRE in respect of any accrued capital gain relating to the property up to Dec. 31, 2016. Essentially, the trust will be deemed to have disposed of the property on Dec. 31, 2016 (and the trust can shelter the gain under the PRE up until that date) and to have reacquired the property at a cost equal to the fair market value on Jan. 1, 2017.

However, it would appear that as long as the trust distributes the property to a specified beneficiary prior to an eventual sale, and the specified beneficiary in turn sells the property, the PRE would be available for those years after 2017 as well. That is because the trust would not be claiming the PRE; rather, the specified beneficiary does. So if you have purchased a cottage, and you happen to have children that are over the age of 18 (who don’t own their own home), it is still possible to make use of a discretionary trust to hold the cottage property for some time (with your adult children as beneficiaries) and then eventually distribute the property to your children. When the children eventually sell, they may choose to designate the cottage property as their principal residence for those years that they did not own another home. This results in tax savings, since if you held the cottage personally, you would have to pay capital gains tax on either the cottage or your home.

If your entire gain is covered by the PRE, you are now required to report the sale of your principal residence and make the designation (this was not the case prior to 2016). If you fail to do so, the CRA will accept a late principal residence exception in certain circumstances, but you could be subject to a penalty of up to $8,000.

Moreover, the CRA has the ability to reassess you beyond the normal reassessment period (three years from the date of the notice of assessment) if you do not report the disposition of your principal residence.

So whether you are preparing to find your perfect second home, or have just sold one, consider whether you and your family members might be able to take advantage of the PRE rules. By Samantha Prasad.

Economic Highlights

Assessing the economy six months into the pandemic

While lockdowns have been eased, the outlook remains uncertain

In this month’s letter, we examine the impact of the pandemic on the Canadian economy as the magnitude of the initial shock is now measurable.

We also share our expectations for the next six months. The economy still faces multiple challenges and a vaccine for the coronavirus will be necessary, but not sufficient, for a full recovery.

The economic impact—six months after the great lockdown

In the face of the unknown, the early months of the pandemic were marked by sweeping restrictions aimed at limiting the spread of the virus.

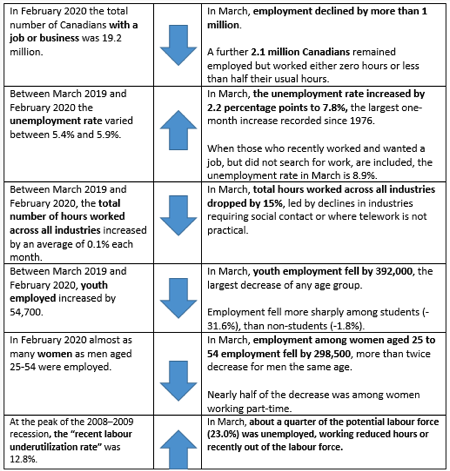

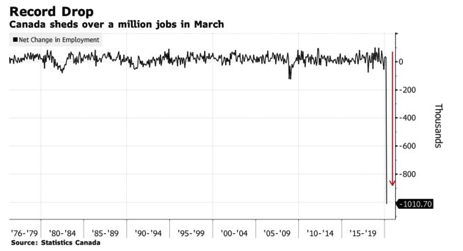

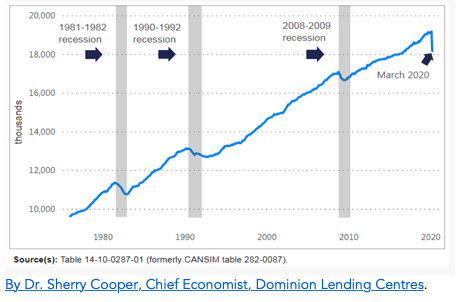

The economic impact of these measures was immediate. One in six Canadians lost their jobs between February and April (three million jobs lost). City centres around the world were emptied, industrial production slowed sharply and retail sales fell to an unprecedented low.

The most recent data from Statistics Canada shows the magnitude of the economic shock. In the first half of the year, the economy contracted by 13.4% compared to the fourth quarter of 2019.

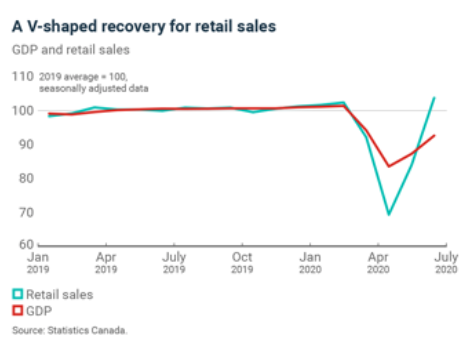

However, since May, activity has picked up again and points to a rebound in GDP that would bring economic activity in September back to about 95% of its pre-crisis level. (See the Canada section.)

By August, 63% of the jobs lost during the lockdowns had been recovered. But not surprisingly, the most affected sectors remained accommodation and food services (21% fewer jobs) and information, culture and recreation (13%). These two industries depend on proximity to customers and an influx of tourists, who have been largely absent in 2020.

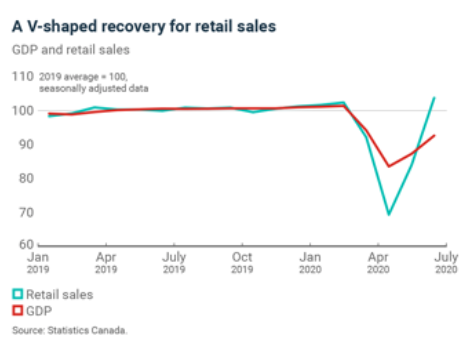

While the economy has performed mostly as expected, there have been some surprises. A V-shaped recovery—a rapid return to pre-crisis GDP—remains out of the question for the Canadian economy as a whole, but retail sales have exceeded expectations and even set a record in June.

These results are mainly attributable to the significant income support measures put in place by various levels of government, and consumers catching up on purchases that could not be made during the lockdowns.

Nevertheless, the economy remains in a severe recession with permanent job losses. Although it’s operating at close to 95% of its capacity, compared to 82% in April, the coming period is likely to be more difficult.

The expected scorecard for Year 1 of the COVID-19 era

In the absence of a second wave, the economy will continue to grow over the next six months, but at a much slower pace.

Despite increased confidence since the easing of the distancing measures, business investment intentions remain weak. According to our internal surveys, many entrepreneurs are focused on shoring up their finances as they emerge from the crisis. Investments will be delayed even longer in the hard-hit oil-producing provinces. (See oil section.)

Meanwhile, exports were down 8% in July compared to the pace observed in 2019. Several factors will continue to impact Canadian exporters, including low oil prices, uncertainty caused by tensions between the U.S. and China, and more generally, increased protectionism by several trading partners.

Finally, the gradual withdrawal of government support programs will have an impact on household disposable income, which has so far remained buoyant during the crisis.

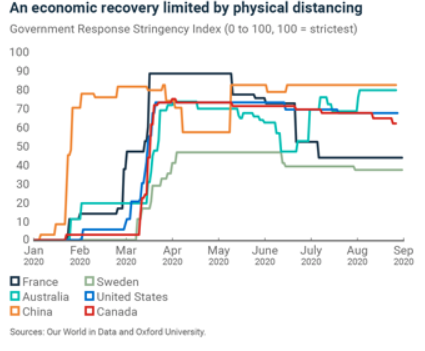

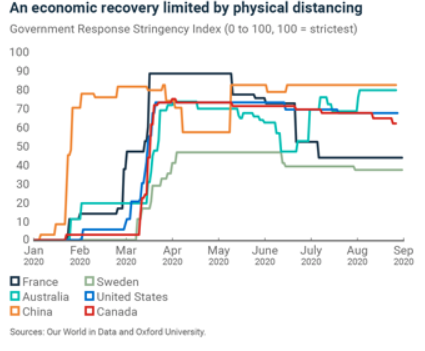

Caution by consumers that’s reflected in a higher savings rate could lead to a slowdown in retail sales. In addition, physical distancing measures will limit the recovery potential of several sectors. It is unlikely that these measures will be further relaxed until a vaccine is developed and distributed. In the graph, the closer to 100, the more stringent are distancing measures. It shows that Canada’s current standing compares to the United States and is stricter than much of Europe.

Currently, we are forecasting a contraction of the Canadian economy of about 7% in 2020. This implies that the momentum observed over the summer will fade this fall.

Underlying risks remain significant

The strength of the recovery will depend on how two key risks play out.

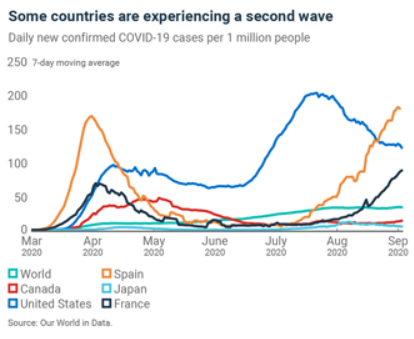

- In the short term, will a second wave of infections occur?

- In the medium term, will a vaccine be deployed and how effective will it be?

In the short term

Our baseline scenario assumes Canada will escape a second wave of infections. However, a severe second wave would lead to a W-shaped recovery, where the economy would contract again in a few months’ time.

The reintroduction of lockdowns as stringent as the ones in effect last spring remains unlikely. However, a tightening of physical distancing measures would lead to further setbacks in several sectors, as demonstrated by the situation in some U.S. states.

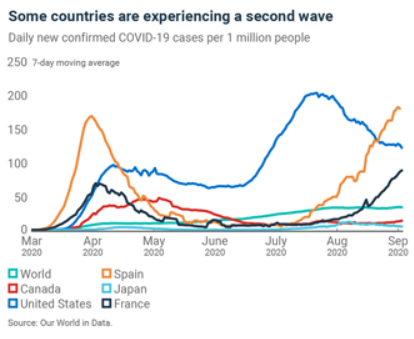

A mushrooming number of cases is currently being reported in several European countries, including France and Spain. Thus, a partial lockdown remains a definite downside risk for Canadian entrepreneurs.

In the medium term

The full recovery of the global economy will require the development of a vaccine against COVID-19 that would likely be available in 2021. Several potential vaccines are currently in late-stage development.

However, there will still be many challenges to returning to a full-employment economy like the one we had before the pandemic began.

A vaccine is never 100% effective and the longevity of the immunity period would remain uncertain. Additionally, the production and distribution of a vaccine will be an unprecedented operation, suggesting it may run up against numerous bottlenecks.

Thus, a vaccine is necessary but not sufficient for an economic recovery. It is therefore likely the economic impact of COVID-19 will persist for some time to come. As things stand, outbreaks of infection could be part of our reality until 2022.

What does it mean for entrepreneurs?

1. The recovery is progressing well and the number of cases of infection remains stable for the moment.

2. However, the increase in infections in Europe shows the fragility of the situation. Canada could experience a second wave in the coming months.

3. Lockdowns as stringent as those in the spring are unlikely. However, business owners operating in service sectors with close physical proximity (e.g. accommodation and food services) should have a contingency plan to deal with the possibility of a tightening of measures to counter the spread of the virus.

4. The development of a vaccine will not be enough to erase the economic damage done by COVID-19. Entrepreneurs need to keep an eye on their cash flow.

5. According to our surveys, many companies have bet on a strategy of minimizing costs and increasing efficiency. With the economy still nearly two years away from full recovery, it may be useful to follow their lead by reviewing your business processes to remain competitive.

Bank of Canada’s willingness to speak up will offend some, but it’s time to open policy debates

Tiff Macklem has been Bank of Canada governor for only four months, but he must be feeling comfortable, because he is making a habit of entering dangerous territory.

Macklem’s latest speech was about income inequality, a societal problem that economic orthodoxy suggests should be off limits for a central banker since there’s little that monetary policy can do to correct it. Mark Carney, a previous Bank of Canada governor, once offended some for expressing sympathy for the Occupy movement, which made a cause of trying to claw back the outsized wealth of the one per cent.

But economic orthodoxy was cracked by the Great Recession, and is now being shattered by the coronavirus pandemic.

Macklem started his professional career at the Bank of Canada in the 1980s, fought the 2008-09 financial crisis as a senior official at the Finance Department, and then had a chance to reflect on all that he had observed when he became dean of the University of Toronto’s Rotman School of Management. No governor has been more prepared for extraordinary events, and Macklem appears set to lead the central bank in a new direction.

Last month, Macklem signalled an end to the Bank’s tradition of aloofness, using a virtual appearance at the annual Jackson Hole central banking conference to argue that central banks had made a mistake by relying on traders, economists and journalists to interpret monetary policy for the masses. “The best way to get our messages to the public is to deliver them ourselves,” he said on Aug. 27.

Macklem on Sept. 10 backed that up in remarks given at a virtual event hosted by the Canadian Chamber of Commerce, yet clearly directed to a far broader audience than the business community. He used the bulk of his speech to share an analysis of how the COVID-19 recession has taken a disproportionate toll on women and younger workers, pledging to take that into account when assessing the state of the economy.

“Our mandate is to maximize the economic well-being of Canadians,” Macklem said. “Very uneven recessions tend to be longer and have a larger impact on the labour market. So, uneven outcomes for some can lead to poorer outcomes for all.”

Most people will find those comments reassuring, others will simply see them as a statement of the obvious. But some will deem them controversial, since certain political parties have made a virtue of closing the income gap, and convention suggests the central bank governor should speak only about arcana such as the output gap and the neutral rate of interest.

Those people will be doubly displeased by Macklem’s assertion during the question-and-answer period that “we are going to need to accelerate our efforts” on dealing with climate change, a fact-based statement that nonetheless will be construed by some as political.

However, it’s 2020 and central bankers are learning how to live with the fame that was thrust upon them during the financial crisis, when they arrested the Great Recession with relatively little help from elected officials.

There have been missteps, to be sure. Carney, who also served as head of the Bank of England, and Raghuram Rajan, the former Reserve Bank of India governor, often strayed too far from monetary policy in their public remarks, making themselves partisan targets. Rajan, while celebrated in the Indian press, was effectively run out of his home country by the ruling political party. Carney allowed himself to become a lightning rod in the Brexit debate.

Yet central bankers would be doing the public a disservice if they retreated entirely, because voters would lose access to an important perspective. Macklem appears willing to speak frankly on important economic issues, while steering clear of offering prescriptive advice on what legislators should do about them. “Striving for equality of opportunity is simply the right thing to do,” he said in his speech to the Chamber of Commerce.

Such an approach will invite slings and arrows.

You could argue that it’s a bit rich for a central bank to express concern about economic disparity, since monetary policy over the past decade probably made things worse. The most obvious beneficiaries of quantitative easing (QE), the policy of creating billions of dollars to buy bonds, have been equity investors, an already wealthy minority. Macklem acknowledged that possibility in his speech, while pointing out there is also research that suggests the opposite.

“Lower borrowing costs stimulate economic activity, which in turn boosts jobs and incomes, particularly for people with lower incomes,” he said. “Research on this topic is ongoing both internationally and here in Canada. We will continue to study and monitor all the effects of QE.”

Macklem was also fuzzy on how the Bank of Canada’s observations about the unbalanced nature of the COVID-19 recession would factor in policy going forward.

Before the pandemic, Jerome Powell, chair of the U.S. Federal Reserve, often boasted that the Fed’s decision to let the U.S. economy run past conventional limits associated with full employment resulted in more jobs for underprivileged groups without creating inflation. It seems likely the Bank of Canada will attempt to do the same, although Macklem declined to commit to that explicitly.

“It’s very important that we understand the dynamics of this recession,” he said on a conference call with reporters. “The unevenness affects the durability of the recovery and while we can’t target specific sectors or workers, the amount of stimulus we put in place will be calibrated to support the recovery, to support the durability of the recovery. That is how you get inflation back to target and keep it there.”

There will be chatter that Macklem’s Bank of Canada is letting itself get distracted by the latest fad in economics. So be it. At least the debate will be had out in the open. By Carmichael Kevin.

Mortgage Update – Mortgage Broker London

Mortgage Interest Rates

Both Fixed and Variable mortgage rates have decreased slightly and are at historically low levels. View rates Here – and be sure to contact us for a quote to help you find the lowest rate for your specific needs and product requirements.

The Bank of Canada’s kept it’s overnight rate is 0.25%. Prime lending rate remains at 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is 4.94%.

The Bank of Canada’s target overnight rate is 0.25%. Prime lending rate is 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is 4.79%. Read the Government of Canada Department of Finance summary on Benchmark Rate for Insured Mortgages statement here.

Mortgage Update – Mortgage Broker London

Your Mortgage

To ensure you obtain the best deals and lowest rates for your mortgage in a rapidly changing market, please contact us to discuss your needs, review your options and secure the lowest rates to protect your best interest.

At iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options with the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

We encourage you to follow guidelines from our public health authorities:

Middlesex Health Unit

https://www.healthunit.com/novel-coronavirus

Southwestern Public Health

https://www.swpublichealth.ca/content/community-update-novel-coronavirus-covid-19

Ontario Ministry of Health

https://www.ontario.ca/page/2019-novel-coronavirus

Public Health Canada

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Factual Statistics Coronavirus COVID-19 Globally:

https://www.worldometers.info/coronavirus/

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6