WEEKLY RESIDENTIAL MARKET UPDATE

Industry & Market Highlights

The Activist Budget—There Is No Problem This Government Cannot Fix

Patting himself on the back, the Finance Minister opened his speech by reminding us that “a little over two years ago…Canadians had the opportunity to stay the course. They could stick with a Government that favoured cuts and a set of failed policies that produced stubborn unemployment and the worst decade of economic growth since the depths of the Great Depression.” This, of course, was Stephen Harper’s Conservative Government. Never mind that the global financial crisis caused the recession, not the “failed policies” of the previous government. Throughout the budget documents, the message is that austerity was “needless” or “excessive.” Instead, Canadians chose, “a more confident and more ambitious approach…that gave Canadians the tools they needed to succeed. Starting with raising taxes on the wealthiest, so we could lower them for the middle class.”

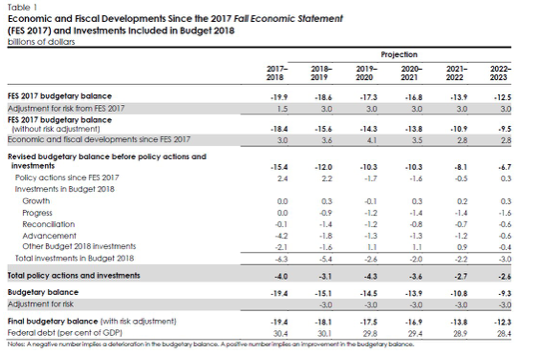

The Liberals have forgotten their promise to run deficits no larger than $10 billion and to balance the budget by 2019. Instead, they now see sound fiscal management as a declining debt-to-GDP ratio—never mind that double-digit deficits remain as far as the eye can see—to a stunning $12.3 billion deficit at the end of the forecast horizon in fiscal year (FY) 2022-23.

The deficit figures have indeed improved—down more than $2.0 billion in FYs 2017 and 2018–thanks to the stronger-than-expected economy and rapidly reduced unemployment last year. But, initiatives in today’s federal budget add $6.3 billion to the current year’s (ending March 31, 2018) budget deficit, $5.4 billion to next year’s federal red ink and an additional $2.0-to-$3.0 billion annually over the forecast horizon ending in FY 2022-23 (see Table below).

Fortunately, Canada has by far the lowest debt-to-GDP ratios in the G7, reflective of the austerity programs of the past, beginning in the mid-1990s and continuing until the financial crisis in 2008-09 when counter-cyclical global fiscal policy was essential to assure financial stability and rebounding economic activity by late-2009. While the U.S. and much of the rest of the developed world suffered the longest and deepest recession since the Great Depression, Canada’s was the shortest and mildest recession in the postwar period—contrary to the impression left by the Finance Minister in his opening remarks.

Thanks to this backdrop, the debt-to-GDP ratio in Canada will continue to decline despite continued fiscal stimulus. The ratio is forecast to gradually edge downward from 30.4% this year to 28.4% in 2022-23, assuming the economy continues to grow. Clearly, all bets are off if we hit a pothole, such as the end of NAFTA or a recurrence of plunging oil prices.

Budget 2018 proposes to:

• Put more money in the pockets of those who need it the most, by improving access to the Canada Child Benefit and introducing the Canada Workers Benefit, a stronger and more accessible benefit that will replace the Working Income Tax Benefit.

• Make significant progress towards equality of opportunity, by taking leadership to address the gender wage gap, supporting equal parenting, tackling gender-based violence and sexual harassment, and introducing a new entrepreneurship strategy for women.

• Support the next generation of researchers, by providing historic funding to increase opportunities for young researchers and provide them the equipment they need, while strengthening support for entrepreneurs to innovate, scale up and reach global markets.

• Advance reconciliation with Indigenous Peoples, by helping to close the gap between the quality of life of Indigenous and non-Indigenous people, providing greater support to keep First Nations children safe and supported within their communities, accelerating progress on clean drinking water, housing, and employment, and supporting recognition of rights and self determination.

• Protect the environment for future generations, by making historic investments to preserve our natural heritage, ensuring a price is put on carbon pollution across Canada, and extending support for clean energy projects.

• Uphold Canada’s shared values and support the health and wellness of Canadians, by partnering with provinces and territories to address the opioid crisis, taking action to advance national pharmacare, and bolstering support for Canada’s official languages.

This list summarizes 367 pages of more than 100 relatively small government initiatives impacting everything from Workers Benefits payments to low-income families, improving access to the Canada Child Benefit to supporting opportunities for women, pay equity for federal workers, strengthening trade, improving worker skills, and cracking down on tax evasion—all of this among the roughly 25 government actions described in Chapter 1 under the heading of Growth. The details of changes in the rules regarding the holding of passive investments inside private corporations as well as closing tax loopholes fall under this Growth rubric.

Chapter 2, called Progress, includes more than 35 initiatives under the headings of Investing in Canadian scientists and researchers, Stronger and more collaborative Federal science, and Innovation and Skills Plan—a more client-focussed Federal partner for business.

Chapter 3, Reconciliation, largely deals with Indigenous Peoples, including roughly 20 actions.

And finally, Chapter 4, called Advancement, covers the environment under Canada’s Natural Legacy, Canada and the World, Upholding Shared Values, and Security and Access to Justice. I lost count here at over 40 initiatives.

And, that’s not all! A bonus section called Equality, goes into detail regarding Canada’s commitment to gender budgeting, which includes $6.7 million over five years for “Statistics Canada to create a new Centre for Gender, Diversity and Inclusion Statistics, a Centre that will act as a Gender Budget Accounting data hub to support future, evidenced-based policy development and decision-making”.

I kid you not. At my rough count, I have been to 34 budget lock-ups, but I can’t remember ever seeing anything like this for sheer magnitude of the number of relatively tiny initiatives, nor can I ever remember leaving a lock-up with such a screaming headache.

Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

Federal Budget Housing Market Overview

Mortgage Professionals Canada was invited by the Minister of Finance’s office to the attend today’s budget lock-up in Ottawa. As a result of our advocacy efforts, we are pleased that the government has not introduced any new changes to mortgage rules.

However, we are disappointed that the government has not committed to increasing the supply of new homes in Toronto and Vancouver and remain concerned about the economic impact the existing changes are having on the marketplace.

The government did announce support to build more rental units and clarified the rules around taxation for passive investments. More information on the specifics of those measures are outlined below.

Support for Rental Units

The government proposes to increase the amount of loans provided by the Rental Construction Financing Initiative from $2.5 billion to $3.75 billion over the next three years. In total, this measure alone is expected to spur the construction of more than 14,000 new rental units across Canada.

Passive Investments in a Corporation

The government proposes two new measures to passive investment savings in a corporation, which replace the previous announcement made in the summer.

First, Budget 2018 proposes to introduce an additional eligibility mechanism for the small business tax deduction, based on a corporation’s passive investment income.

Under the proposal, if a corporation and its associated corporations earn more than $50,000 of passive investment income in a given year, the amount of income eligible for the small business tax rate would be gradually reduced.

The small business deduction limit would be reduced by $5 for every $1 of investment income above the $50,000 threshold (equivalent to $1 million in passive investment assets at a 5-per-cent return), such that the business limit would be reduced to zero at $150,000 of investment income (equivalent to $3 million in passive investment assets at a 5-per-cent return).

Existing savings will not be subject to any additional tax upon withdrawal and capital gains, realized from the sale of active investments or investment income incidental to the business, will not be considered passive investments under this proposal.

Second, Budget 2018 proposes that corporations no longer be eligible to obtain refunds of taxes paid on investment income while distributing dividends from income taxed at the general corporate rate. Refunds will continue to be available when investment income is paid out.

The two measures will apply to taxation years after 2018.

We will continue to advocate for common-sense changes to the existing mortgage rules to improve choice and competition for Canadian consumers. By Mortgage Professionals Canada.

New CMHC study sheds light on rising house prices

In June 2016, CMHC launched a study to better understand the causes of rapidly rising home prices in major metropolitan centers across Canada. The report represents one of the most thorough examinations of house price patterns ever completed in Canada and is the result of advanced, data-driven analyses and engagement with stakeholders and government partners.

Why undertake this kind of study in the first place?

Housing affordability challenges exist in many centres throughout Canada. Rapidly rising house prices in high priced markets have benefited existing homeowners, but have also created challenges for first-time buyers. However, this is not just an issue for first-time homebuyers. Rapidly rising house prices also tend to drive rents higher and increase the cost of rental assistance and non-market housing solutions.

What were the study’s findings?

In conducting this study, it was important to look at both supply and demand. Very briefly, we found that:

•Strong economic and population growth, together with low mortgage rates, have been important drivers of house price growth in Canada

•The increase in average house prices in Vancouver and Toronto is also attributable to rising income inequality in these centres — price increases have tended to be greater for more expensive single-detached housing, rather than for condominium apartments

•Supply response to rising house prices has been weaker in Toronto and Vancouver, than in other Canadian metropolitan areas

What are the next steps?

The report represents an important step towards stimulating discussion across all levels of government, housing advocates, industry, academia, and the general public — with the full recognition that this is the beginning of a process of improving the functioning of Canadian housing market.

Read the full report by CMHC Here.

Canadians Have $230 Billion In Home Equity Loans – Raising Red Flags In Ottawa

Canadians are borrowing money against their homes in record amounts – a situation that is raising red flags among politicians and policy setters in Ottawa.

Balances on Home Equity Lines of Credit (HELOCs) rose 7.2% in December 2017 from a year earlier, the fastest annual growth rate since 2012, and hitting a record amount of $230 billion, according to data released by the Office of the Superintendent of Financial Institutions (OSFI).

All other types of consumer debt such as personal loans, credit cards, car loans and overdraft limits climbed just 3.2% over the same period, less than half the pace of HELOC growth, the same data showed.

Canadians can tap HELOCs for up to 65% of the value of their homes, and the funds are most commonly used for renovations, investing and consolidating other forms of debt, according to a June 2017 report by the Financial Consumer Agency of Canada.

“Houses are becoming piggy banks,” said Paul Gulberg, a Bloomberg Intelligence analyst following the release of the data from OSFI. “It’s either greed based or need based,” he added.

The growth in the use of HELOCs raises red flags for policy makers in Ottawa. It’s a type of borrowing that may contribute to increased household vulnerabilities because it typically doesn’t require the principal to be repaid on a fixed schedule, the Bank of Canada said in its most recent financial system review. About 40% of HELOC borrowers don’t regularly pay down the principal on the debt. Of total loans secured to individuals for non-business purposes, those secured by residential property represent about 46%, the OSFI data shows.

Compared to other loan types, such as car loans and credit cards, rates on HELOCs are typically cheaper, making them more attractive to consumers. They also tend to be more sensitive to fluctuations in borrowing costs, because they’re usually tied to prime interest rates.

“It’s a rising risk factor because it’s something that re-prices more rapidly than a typical mortgage pool,” said Mr. Gulberg, adding the risk is rising “in conjunction with the fact that it’s fuelling overall consumer credit, which is considered to be an issue.”

Canadians have about three million HELOC accounts and the average outstanding balance on them is $70,000, which makes borrowers vulnerable to rising interest rates and a housing market correction.

By Joel Baglole.

Economic Highlights

U.S. Highlights

A holiday-shortened trading week light in economic data left markets to focus on communications from the Federal Reserve.

U.S. existing home sales slumped in January, beleaguered by low inventories and deteriorating affordability.

The FOMC minutes revealed a Fed busy revising up economic projections, suggesting that further gradual policy firming is warranted.

Canadian Highlights

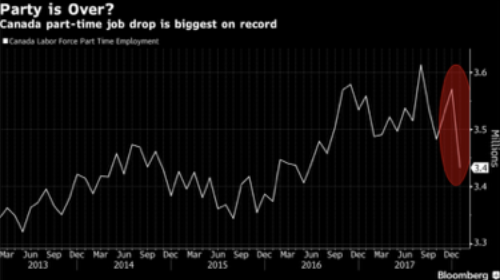

The December 2017 data continued to disappoint, with declines in retail and wholesale trade joining earlier softness in trade and manufacturing.

Real GDP in 2017 as a whole likely saw a robust 2.9% expansion, with a respectable 2.0% pace of growth expected for Q4. The December softness and weaker housing market activity in January suggest a further deceleration is likely, leaving 2018 to start-off on a softer note.

Noise can mask the trend, which can hardly be defined by a few months’ data. Prudence in the face of domestic and external risks suggests that the Bank of Canada is likely to stand pat until mid-year, when it is better able to assess the underlying Canadian growth trend.

By TD Economics. Read the full report Here.

Mortgage Interest Rates

No change to Prime lending rate currently at 3.45%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.14%. Slight increase in fixed rates. Deeper discounts are becoming available for variable rates making adjustable variable rate mortgages more attractive again.

Mortgage Update – Mortgage Broker London

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

Open Access

•Tighter tax rules for small businesses and passive income in Liberal budget (BNN)

•Federal budget’s simpler plan to tax passive income likely to calm small business outcry (National Post)

•National Bank first-quarter profit rises 11%, beating estimates (BNN)

•How is the Fair Housing Plan affecting the Ontario housing market in 2018? Experts weigh in (BuzzBuzzNews)

•These BC real estate boards think new property taxes will have little impact on housing markets (BuzzBuzzNews)

•More evidence of fraud in Canadian mortgages, warns ratings agency S&P (CBC)

•Scotiabank Looks Abroad for Earnings as Profit Beats Estimates (Bloomberg)

•How much is a lack of supply driving up GTA home prices? More than you think, according to this expert (BuzzBuzzNews)

•Toronto new-home sales down 48% from January 2017 (Toronto Star)

•Royal Bank’s Mortgage Juggernaut Shows Little Sign of Slowing (Bloomberg)

•Expansion of foreign buyers tax to Okanagan, Vancouver Island questioned (Vancouver Sun)

•B.C. housing taxes could put recent buyers underwater on mortgages (Vancouver Sun)

•The Canadian housing market hasn’t been this affordable in 3 years (BuzzBuzzNews)

•RBC tops first-quarter profit expectations, raises dividend (BNN)

•Small businesses with large passive investment income to be taxed more (Globe and Mail)

•Laurentian Bank continues to review problem mortgages (Globe and Mail)

•Ontario regulator probes cryptocurrency use in real estate (Globe and Mail)

•Evidence of mortgage fraud in Canada raises red flag at credit rating giant (Financial Post)

•RBC boosts dividend as earnings beat market expectations (Globe and Mail)

Now’s the perfect time of year for a free mortgage check-up. With spring on its way and interest rates on the rise, it makes sense for us to revisit your mortgage and ensure it still meets your needs. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or you simply want to take a vacation. Whatever your needs, we can evaluate your situation and help you determine what’s right for you.