Liberal Government Woes & Housing

After two years of continuous rule changes reducing home owners purchasing power, creating a massive affordability gap, and stealing the future wealth from first time homeowners now unable to purchase their first home – the new Federal budget includes first-time buyer incentives.

It’s hard not to see this as a public opinion political stunt on the eve of a federal election this fall. Real Estate and Mortgage Industry professional associations have been telling the liberal government for the past two years they have made a wrong move. To top it off, The Justice Committee met behind closed doors to decide whether Canadians could hear the whole story on the SNC-Lavalin scandal. Unsurprisingly, the Liberals used their majority to cover it up. And now, Justin Trudeau plans to use his pre-election, big deficit budget to get his corruption scandal out of the newspaper headlines. Don’t you just love honestpoliticians… Oh Canada! See more HERE.

Mortgage Professionals Canada Federal Budget 2019 Housing Market Overview

Mortgage Professionals Canada welcomes aspects of the housing affordability component of today’s Federal Budget.

The announcement of a new CMHC First-Time Home Buyers Incentive Plan represents a shared equity mortgage program that would give eligible first-time homebuyers the ability to lower their borrowing costs by sharing the cost of buying a home with CMHC.

The incentive would provide funding (equity sharing) of up to five percent of the purchase price of an existing home, or 10 percent of a newly constructed home. No ongoing monthly payments are required. The buyer would repay the incentive, for example at resale. The government has budgeted up to $1.25 billion over the next three years to support this program.

For example, if a borrower purchases a $400,000 home with five per cent down and a five per cent CMHC shared equity mortgage ($20,000), the size of the borrower’s insured mortgage would be reduced from $380,000 to $360,000, helping to lower the borrower’s monthly mortgage bill. This would make it easier for Canadians to buy homes they can afford.

The program limits eligibility to households earning a maximum of $120,000 annually, and lets them borrow no more than four times their annual household income. This limits a home purchase to roughly $505,000. This Incentive Plan will be discussed more fully in the coming days, but it is not expected to begin until fall, 2019. In principle, the increased equity share eligibility for newly constructed homes will help incent new construction and supply across Canada.

Further analysis is needed, however, some aspiring homebuyers, especially at the lower end of the economic ladder, will have greater opportunities to purchase a home with the assistance of this new program.

Also of note is an increase in the eligible RRSP withdrawal amount through the Home Buyers’ Plan (HBP). Previously $25,000, this has been increased to a maximum to $35,000.

The budget included a lengthy defense of the current stress tests but does suggest that adjustments may be made in future. We will continue to discuss this issue with policymakers.

While we did not see immediate movement on the stress tests, and the new Home Buyers Incentive Plan can be seen as an alternate and more targeted response than an insurable 30 year amortization, we are encouraged by the announcements made today.

The forthcoming federal election will provide opportunities to continue the conversations with policymakers and candidates in the coming months. We will continue our ongoing market analysis and maintain our support for a stable housing market for our members and their customers.

Residential Market Commentary – Less Wealth as Debt to Income Grows again

Canadian households are a little poorer and a little deeper in debt. The latest numbers from Statistics Canada show the country’s national wealth diminished and the infamous debt-to-income ratio increased in the fourth quarter of 2018.

The net worth of the household sector dipped 2.8% in the final three months of last year, to $10.74 billion. The slowing housing market was a factor but the main cause was a drop in the value of “financial assets”, led by a 7.5% decrease in the price of stocks and other investment fund shares.

The fourth quarter of 2018 was the worst quarter for real estate since Q4-2008. A 1.4% decline in the value of residential real estate is pegged with leading an overall drop of 1.0% in the value of “non-financial” assets. In general real estate is the biggest non-financial asset for any household.

Canada’s worrisome household debt-to-disposable-income ratio edged up again at the end of 2018. It is now 178.5%, or $1.79 in debt for every $1.00 that is left after all of the other bills are paid. Most of that increase was triggered by mortgage borrowing. Demand for mortgage loans was up, while other consumer credit borrowing declined. The Bank of Canada calls the high debt-to-income ratio the biggest domestic threat to the country’s economy.

StatsCan is offering some reassurance. It points out that the first two months of this year have shown signs of a rebound. Employment numbers for both January and February were far above expectations. February also showed an uptick in wage growth the exceeded forecasts. By First National Financial.

Canadian Economy Hits a Major Pothole in Q4

Stats Canada released disappointing figures showing that the economy barely grew in the final quarter of last year. Weakness in the oil sector was expected, but the downturn went well beyond the energy sector and bodes ill for a return to healthy growth this year.

The country’s economy grew by just 0.1% in the fourth quarter, for an annualized growth rate of 0.4%–the weakest performance since the second quarter of 2016, down from an annualized 2% pace in the third quarter and well below economist’s expectation of a 1% annualized gain.

For the year as a whole, real gross domestic product (GDP) grew at a 1.8% pace in 2018, down substantially from the 3% growth recorded in 2017. In comparison, the U.S. economy grew 2.9% last year with Q4 growth at 2.6%.

Canada’s economy was battered by lower export prices for crude oil and crude bitumen walloping Alberta. Housing activity in the province slowed from already weak levels as unsold inventories rose and prices edged downward. As well, business investment dropped sharply in the final three months of the year, and household spending slowed for the second consecutive quarter.

Consumer spending on durable goods, especially motor vehicles, hit the skids as overall household outlays for products and services weakened. Consumption spending grew at the slowest pace in almost four years.

Housing fell by the most in a decade, business investment dropped sharply for a second straight quarter, and domestic demand posted its most significant decline since 2015. Housing investment plummeted, falling at a 3.9% quarterly rate as the housing market continued to soften, with the most substantial decrease in new construction (-5.5% quarterly), followed by renovations (-2.7%) and ownership transfer costs (-2.6%). (*see note below)

Business investment in plant and equipment fell 2.9%, the sharpest drop since the fourth quarter of 2016.

The only thing that kept the nation’s economy from contracting was a build-up in inventories as companies stockpiled goods. Without a doubt, much of the inventory accumulation was unintended, as the slowdown in demand caught businesses by surprise.

Implications for the Bank of Canada

Canada’s economy has been plagued by trade uncertainties, reduced oil demand by the U.S., rising interest rates, and tighter mortgage credit conditions. Consumer and business confidence has declined, and inflation remains muted. Despite a relatively robust labour market, wage growth has slowed. The Bank of Canada is widely expected to stay on the sidelines next week when the Governing Council meets once again on Wednesday. The central bank’s latest forecast, from January, was for annualized growth of 1.3% in the fourth quarter, more than three times stronger than today’s reported pace of 0.4%. The Bank expects growth to decelerate further to 0.8% in the current quarter, before rebounding back to above 2% growth by next year.

The latest data puts the economy’s ability to rebound to more normal levels in question. Monthly data released today show the economy ended the year contracting, with December gross domestic product down 0.1%. Most economists now expect the Bank of Canada will refrain from raising interest rates for the remainder of this year.

*Note:

*Housing investment in the GDP accounts is technically called “Gross fixed capital formation in residential structures”. It includes three major elements:

- new residential construction;

- renovations; and

- ownership transfer costs.

New residential construction is the most significant component. Renovations to existing residential structures are the second largest element of housing investment. Ownership transfer costs include all costs associated with the transfer of a residential asset from one owner to another. These costs are as follows:

- real estate commissions;

- land transfer taxes;

- legal costs (fees paid to notaries, surveyors, experts, etc.); and

- file review costs (inspection and surveying).

Royal Bank Cautions Against Budget Measures to Increase Millennial Homeownership Demand

A new report hit my inbox yesterday written by Robert Hogue, a senior economist at the Royal Bank urging the federal government to withhold the expected support for millennial home purchases in the March 19th budget. Mr. Hogue writes that “Federal Finance Minister Bill Morneau is reportedly poised to unveil new budget measures to help more Canadian millennials become homeowners. While that generation does face housing-related challenges, especially in some larger and more expensive Canadian cities, we urge him to tread carefully. On the surface, ideas like relaxing the mortgage stress test, extending the maximum amortization period for insured mortgages, or increasing the amount of RRSP take-out for a first home down payment might bring short-term relief to buyers. But they do nothing to address what we believe is the root of Canada’s housing woes: gaps in the mix of housing options in some of Canada’s larger markets. Meanwhile, the measures won’t address the issue of high household debt, and may actually inflate home prices.”

The bank economist takes “issue with the notion that Canada has a home ownership problem in the first place. On average, more than 40% of Canadian households under 35 years of age own their own homes. And the proportion of all Canadian households who own a home is one of the highest among advanced economies. Even Toronto and Vancouver—the least affordable markets in the country—rank near the top of global cities on home ownership and have home ownership rates that are about double cities like Paris and Berlin. And despite a notable decline in the past decade, the ownership rate among younger households (Canada’s millennials) remains not only high historically in Canada but also compared to other countries, including the U.S.”

I urge you to read the report. The data provided in the charts are compelling. The real problem is the dearth of supply of “starter” homes in Canada’s most expensive cities. The measures likely to be introduced in the budget will not address the housing supply gaps and could well further inflate prices. “What millennials in Vancouver and Toronto really need is more inventory of homes they can afford, and a better mix of housing options—be it to own or rent…. At the very least, the collective goal should be to remove barriers (regulatory, administrative or otherwise) inhibiting home developers and builders to respond quickly to the demand for new housing—especially when that demand is rising rapidly.” By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

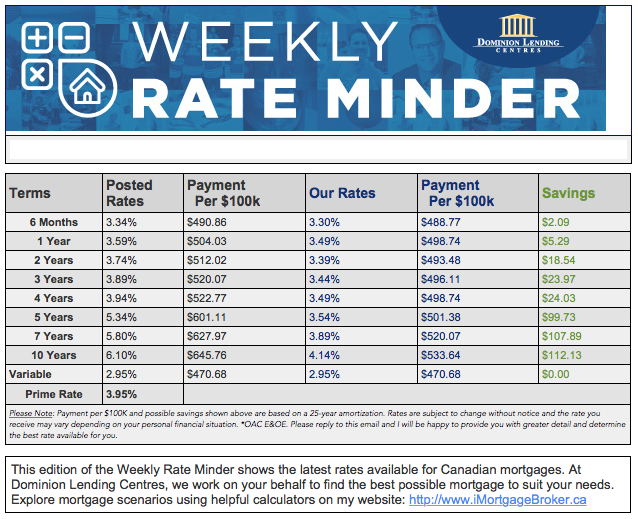

Mortgage Interest Rates

Prime lending rate is at 3.95%. The Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are slowly moving down again. Some lenders are offering special promotional rates to try and take more market share. Variable rate discounts are offered by some lenders making adjustable variable rate mortgages somewhat attractive.

- Trudeau Targets Home-Buying Millennials With Equity Plan (Bloomberg)

- Federal budget includes new loans to help first-time homebuyers (The Star)

- New home construction to decline for next two years, says report (CBC)

- As budget looms, most Canadians say policy alone won’t help housing issues: Poll (BNN Bloomberg)

- Housing affordability is getting worse even though prices are falling. How is that possible? (Vancouver Sun)

- Lagging Canadian new condo construction could be ready for a comeback. Here’s why. (Livabl)

- Canadian Real Estate Developer Debt Hits An All-Time High (Better Dwelling)

- A first-time homebuyer’s guide to avoiding the house poor trap (Livabl)

- 4 problems with Canada’s mortgage stress tests that are hurting homebuyers and the economy (Livabl) featuring MPC Chief Economist Will Dunning

- Fewer new homes are being built in Canada now, and mortgage rules and affordability are to blame (Livabl)

- Canada’s Housing Market Is Breaking Some Alarming Records Right Now (Huffington Post)

- CMHC reports annual pace of housing starts slowed in February (CBC)

- The Federal Government’s Attack on Home Ownership (Rebuttal by MPC Chief Economist Will Dunning to CMHC CEO Evan Siddall’s Op-Ed opinion in Toronto Star this week)

- 3 key predictions for Canada’s spring 2019 housing market (Livabl)

- Are current mortgage rules too strict? No. (The Star) By CMHC President Evan Siddall

- Bank of Canada Waters Down Rate Conviction Amid Growth Slowdown (Bloomberg)

- A first-time homebuyer’s guide to purchasing home insurance