WEEKLY RESIDENTIAL MARKET UPDATE

Industry & Market Highlights

Housing Affordability Increase First Time in 2 Years

There was an improvement in Canada’s housing affordability measure at the end of 2017.

It was the first time in two years that RBC Economics Research’s Housing Trends and Affordability Report has shown a decrease in its aggregate measure, albeit just 0.2 percentage points nationally to 48.3%.

As the measure is shown as the share of household income that would be required to carry the costs of owning a home at market price, a decrease indicates improving affordability.

Toronto saw a larger decrease in the measure, down 2.3 percentage points to 75.1%, but it is unlikely to have a meaningful effect.

“We expect the relief to Toronto ownership costs that ensued from the introduction of Ontario’s Fair Housing Plan to be short-lived,” said Craig Wright, Senior Vice-President and Chief Economist at RBC. “Our view is that Toronto prices will bottom out sometime this spring. Then we expect further interest rate hikes through the remainder of this year, which has the potential to stress housing affordability markedly in Canada.”

The report shows that affordability worsened in BC with Vancouver and Victoria both seeing higher prices in the last quarter of 2017, with the aggregate affordability measure rising 1.8 and 0.5 percentage points respectively.

“Unfortunately, Vancouver homebuyers are being challenged by the worst affordability levels ever recorded in Canada,” said Wright. “The costs of owning a home at today’s prices would have represented an astounding 85.2% of a typical household’s income in the fourth quarter. In this context, it wasn’t a surprise to see the BC government announced further housing policy initiatives to cool the market in its 2018 budget.”

Affordability also weakened in Montreal for the ninth time in the past ten quarters, denting its reputation as an affordable market.

The picture has changed little for housing markets in the Prairies and Atlantic Canada. Home ownership costs have remained largely stable though, a small increase in mortgage rates contributed to a slight deterioration in affordability within these regions in the fourth quarter. By by Steve Randall.

What is Influencing Interest Rates

April is Mathematics and Statistics awareness month. Here’s a statistic. The probability of Treasury Guy getting beat up by the commercial underwriters went up by 67% after mentioning Math and Statistics awareness month.

Raw Interest Rate Data

2yr GoC Yield: 1.82% (6 month high of 1.88%; 6 month low of 1.40%)

5yr GoC Yield: 2.03% (6 month high of 2.16%; 6 month low of 1.60%)

10yr GoC Yield: 2.18% (6 month high of 2.38%; 6 month low of 1.84%)

Stuff influencing Interest Rates

Last week, PM Justin Trudeau suggested that NAFTA talks have picked up momentum. “We are having a very productive moment” he said. Optimism that a NAFTA deal is within reach hasn’t filtered into expectations for a Bank of Canada interest rate hike yet. Markets are currently placing only a 20%-25% chance of a hike at the central bank policy meeting on April 18th. That’s down from as high as 55-60% six weeks ago. Today’s net change in employment data came in a little stronger than expected at +32,300 vs. +20.000 Not enough to materially move rates or change BoC rate hike expectations though. Hourly earnings ticked up 3.1% year over year and the jobless rate remained at 5.8%, which is a 40+ year low.

Down south, the change in non-farm payrolls came in on the softer side of expectations at +103,000 vs. +185,000. Hourly earnings increased at 2.7% from a year earlier, matching projection, and the jobless rate remained unchanged at 4.1%.

New Issues and Credit Spreads

Ontario and Quebec both came to the market this week with 10yr bonds and Ontario was taught a tough lesson. Quebec priced its issue 8bps tighter. Ontario issued at GoC +73.5 bps and Quebec issued at GoC +65.5. Vive le Quebec moins cher! The provinces are rated the same but investors have traditionally demanded a little extra when lending to Quebec due to its higher debt load relative to the size of its economy. Investors have also cited an intense dislike for the Montreal Canadiens. Of course, Ontario’s planned budget deficits for the next six years may be a contributing factor too. In either case, those spreads are about 15 bps wider than either province could issue at back in January.

Canada Mortgage Bond spreads have also been drifting wider since January. CMB’s have gone from +26 to +32 but have outperformed 5 year senior deposit notes which have gone from +65 to +80 over the same time.

Closing thoughts

This ‘national walk to work day’ nonsense has me thinking. I might try out this new fad called jogging this weekend. I believe it’s jogging…or yogging; it might be a soft ‘j’. I’m not sure but apparently you just run for an extended period of time. It’s supposed to be wild.

Whatever you’re doing, remember, when it comes to the weekend, the question isn’t “what are you going to do,” the question is “what aren’t you going to do?” By Jason Ellis, Senior Vice President and Managing Director, Capital Markets, First National Financial.

LSTAR Market Statistics

The London and St Thomas Association of REALTORS® (LSTAR) announced 769 homes* were sold in March, down 37.9% over March 2017, which set a record for best March results since LSTAR began tracking sales data in 1978.

“The marketplace is still being challenged with low levels of housing inventory, which continues to impact sales across the region,” said Jeff Nethercott, 2018 LSTAR President. “Looking at inventory, there were 1,192 Active Listings, down 20.4% from this time last year and down 55.3% from March 2016. Similar to February, the March inventory is the lowest level for the month in the last 10 years.”

Average home sales price across London and St. Thomas continues to rise, despite the low inventory. The average March sales price in the region was $364,112 up 8.6% over March 2017. By geographic area, London South was $360,587 up 3.1% from last March. In London North, average home sales price was $438,827 up 7.1% compared to the previous year, while in London East, it was $291,161 an increase of 8.4% from March 2017. In St. Thomas, it was $295,980 up 18.5% over last March.

“Another interesting statistic that paints a picture of the marketplace is the sales-to-new listings ratio,” Nethercott said. “According to the Canadian Real Estate Association (CREA), a ratio between 40% and 60% is generally consistent with a balanced housing market. In March, London and St. Thomas had a sales-to-new listings ratio of 75.1%, which CREA says represents conditions in the marketplace that favour sellers. It reinforces the trends LSTAR Members have been experiencing, with low supply and high demand, and also managing multiple offer situations and out-of-town interest in our region.”

St. Thomas saw a total of 73 homes sold in March, down 29.1% from the same period last year. When looking at inventory, there were 42 active listings, down 51.2% from last March.

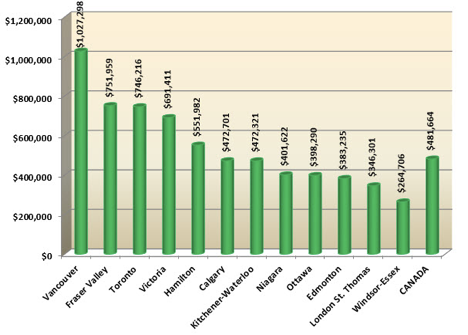

The following chart is based on data taken from the CREA National MLS® Report for February 2018 (the latest CREA statistics available). It provides a snapshot of how average home prices in London and St. Thomas compare to other major Ontario and Canadian centres.

According to a research report1, one job is created for every three real estate transactions and approximately $53,000 in ancillary spending is generated every time a home changes hands in Ontario. “Real estate makes a tremendous contribution to growing the regional economy and beyond, generating potentially more than $40 million right here in London and St. Thomas,” Nethercott said. “This broad impact also helped create approximately 256 jobs in March, further boosting the robust economic engine of southwestern Ontario.” By London & St. Thomas Association of Realtors. Click here to see the original News Release.

Economic Highlights

Market Commentary – Replace “If” with “When”

As we begin the second quarter of 2018 there can be no doubt left, we are in a rising interest rate environment. Despite caution on the part of the Bank of Canada the improving economy in the United States and a more hawkish tone from the U.S. Federal Reserve have changed the discussion from “if rates rise”, to “when will rates rise and by how much”.

Interest rate increases in the U.S. have been pushing up the yields on government bonds there and in Canada, leading to hikes in fixed-rate mortgage costs. The U.S. influence takes some pressure off the Bank of Canada to raise its policy rate. It is worth noting that rising interest rates are not being handed to savers to the same extent that they are being passed on to borrowers.

A key factor in this will be inflation. Both the American and Canadian economies are running near capacity and employment is strong; the two main drivers of inflation. Canada just posted an annual inflation rate of 2.2%, topping the central bank’s 2% target, while U.S. inflation is running at 2.8%, also above target.

With the latest round of interest rate announcements behind us (the Fed bumped up a quarter point and the BoC was unchanged) analysts expect two, or maybe three more increases in the U.S. and two, or perhaps even just one, in Canada. By First National Financial.

United States

· Trade developments captured headlines this week. The U.S. disclosure of detailed plans regarding the tariffs on $50bn worth of Chinese imports led Beijing to retaliate with planned tariffs on $50bn of U.S. exports. The hardened Chinese stance led President Trump to threaten additional tariffs on $100bn worth of Chinese goods.

· While the announced tariffs are likely to merely shave off about 0.2pp from annualized GDP growth in the U.S. over the next two years, the potential for the conflict to escalate to a full-scale trade war is much more concerning.

· Economic data came in healthy with the ISMs holding near recent highs while auto sales came in slightly better than expected in March. Payrolls disappointed despite a healthy ADP print, but wage growth accelerated on the month.

Canada

· It was a good week for the Canadian dollar despite the pullback in oil prices. The loonie was lifted by improved prospects of a North American trade deal, with a preliminary agreement on NAFTA 2.0 potentially as early as next weekend, when leaders gather for the Summit of the Americas in Peru.

· Economic data was mixed. The trade deficit widened, with the weakness in net exports a drag on Q1 growth.

· On the other hand, the Canadian economy added an impressive 32.3 thousand jobs. The jobless rate held steady at 5.8%, with wage growth accelerating to 3.3% y/y. Wages were up a solid 3.1% y/y for permanent employees.

By TD Economics. Read the full report Here.

Mortgage Interest Rates

No change to Prime lending rate currently at 3.45%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.14%. No change in fixed rates. Deeper discounts are becoming available for variable rates making adjustable variable rate mortgages more attractive again.

Other Industry News & Insights

Consumer Psychology Shift

The chief executive of Royal Bank says the housing market slowdown is a welcome shift in consumer psychology toward more caution.

David McKay told shareholders at the company’s annual meeting Friday that the bank is seeing a more balanced pricing trend after tighter conditions last year.

The Vancouver and Toronto region real estate boards, representing the country’s hottest markets, reported double-digit annual sales declines in March earlier this week.

B.C. and Ontario have introduced a series of measures to cool the housing market, including taxes on non-residents.

Further cooling pressure came from the federal level, including a financial stress test for buyers implemented Jan. 1 for federally-regulated lenders.

Both variable and fixed-rate mortgage rates have also risen as a result of moves by the Bank of Canada and fluctuations in the bond markets. By The Canadian Press, MortgageBrokerNews.ca

Social Media Impacts on Consumers

Banks are at risk of being pushed to the sidelines in the age of social media and big data, Royal Bank of Canada’s chief executive David McKay said Friday.

Customers are increasingly leaving a digital trail of their financial plans on social media or search histories, such as buying a house, allowing technology giants to not only capitalize on that information, but potentially get into banking themselves, McKay said.

“As these technology players realize their digital dividend there is a risk that our visibility with clients will diminish in the networked economies _ or ecosystems _ of the future,” he told shareholders at RBC’s annual meeting on Friday.

Technology continues to reshape the financial services landscape as more consumers do their banking online or via smartphone rather than in physical branches. McKay said Friday that mobile is now RBC’s number one digital channel, with 3.4 million active users, up 19 per cent over the last year.

In turn, Canada’s biggest banks have been investing heavily in technological innovation to stay ahead of the curve. During the last fiscal year, RBC spent more than $3-billion on technology, including on digital initiatives, cybersecurity and artificial intelligence.

And while smaller financial technology companies are both partnering with and competing with traditional banks, larger tech companies and their deep pockets present a more formidable threat.

Last month, for example, it emerged that Amazon was in talks with two large U.S. banks to start offering a chequing-like product to the e-commerce titan’s customers, according to the Wall Street Journal.

McKay said there is a risk that these companies in search, e-commerce or social may be the first to deduce what customers’ needs are and direct them to financial institutions willing to pay for that information, but also get into banking themselves.

“We think about somebody getting between you and your customer with that information, and start influencing the customer to choose other providers.”

He added that RBC, Canada’s largest bank, has identified a number of digital “ecosystems” where its clients live and work within which the bank believes it can play an “integral role in the future.”

McKay pointed to RBC’s recently released Drive app, which allows users to store car-related information, track trips and book service appointments.

“We’re preparing ourselves for a world where others can see what you are trying to do before we see it,” he told reporters. “So we have a number of strategies to make sure that we stay connected to our customers. So we understand what’s going on and we can be relevant.”

RBC is also investing heavily in artificial intelligence, and now has more than 200 data scientists working across the bank.

While data allows RBC and other companies to develop more relevant products and refine its approach to customers, it is important to balance this with transparency, McKay said.

The recent revelations that the Facebook data of millions of users was improperly shared with political consultancy Cambridge Analytica, among other things, has prompted a “healthy dialogue” about how personal information should be handled.

He said regulations may be needed to set the boundaries, but hoped that would not be necessary.

“We’re poised for a societal discussion on how we’re going to use personal information… The way I think that we have acted in the past, globally, as government, industries, whatever it happens to be, may not be sufficient to meet societal norms going forward.’’ by Armina Ligaya. Canadian Press.

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

Open Access

- Housing affordability rising, but Toronto prices near bottom: RBC (BNN)

- Houses became more affordable for 1st time in over 2 years, says RBC, but there’s a catch (CBC)

- Oakville homebuyers purchased at their own risk, housing minister says (Toronto Star)

- Haider-Moranis Bulletin: Canada needs more up-to-date data on mortgage fraud (Vancouver Sun)

- Rising rates and mortgage rules weighed on Vancouver’s housing market last quarter. Here are 11 facts to prove it (BuzzBuzzNews)

- Here’s what the Liberal’s proposed Toronto-Waterloo high-speed rail system would mean for the Waterloo housing market (BuzzBuzzNews)

- Canada’s mortgage market might be a cesspool, the federal government just warned (Maclean’s)

- Vancouver home sales continue to drop but the new mortgage rules aren’t the main cause (BuzzBuzzNews)

- Customer says BMO ignored her plea to cap limit on joint line of credit with ex: debt more than doubles (CBC)

Subscription May Be Required

- That sound you hear this week will be the thud of Canadian home sales (Globe and Mail)

- ‘Getting close to the bottom’: Housing affordability relief likely to be short-lived, says RBC (Financial Post)

- Investors in new Toronto condos face growing risk that rent won’t cover expenses (Globe and Mail)

- Toronto real estate market may be poised for a spring rebound (Globe and Mail)

- Condo owners make big gains, but nearly half in negative cash flow: report (Financial Post)

Now’s the perfect time of year for a free mortgage check-up. With spring on its way and interest rates on the rise, it makes sense for us to revisit your mortgage and ensure it still meets your needs. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or you simply want to take a vacation. Whatever your needs, we can evaluate your situation and help you determine what’s right for you.

Adriaan Driessen

Mortgage Broker

Dominion Lending Forest City Funding 10671

Cell: 519.777.9374

Fax: 519.518.1081

415 Wharncliffe Road South

London, ON, N6J 2M3

Adriaan Driessen

Sales Representative & Partner

PC275 Realty Brokerage

Cell: 519.777.9374

Fax: 519.518.1081

415 Wharncliffe Road South

London, ON, N6J 2M3