Industry & Market Highlights

The Bank of Canada 5-year Benchmark Qualifying Rate reduced to 4.79%

Effective Monday August the 17th, The Bank of Canada Benchmark qualifying rate was reducing from 2.94% to 2.79%. The impact of the lower qualifying rate on borrower’s purchasing power is small – e.g for an average single family home costing $485,000 in London requiring an income of $97,500 to qualify, the income now required will be around $96,000.

Or using the same income of $97,500 you qualify for about $5,000 more in purchase price.

Residential Market Commentary – Feds seem split on mortgage policy

Buyers, brokers and lenders can be forgiven if they see the federal government’s attitude toward mortgages heading in two different directions at once. The federal housing agency is calling for one thing while the Bank of Canada appears to be clearing the way for the opposite.

Earlier this month the CEO of Canada Mortgage and Housing Corporation, Evan Siddall, sent a letter to banks, mortgage lenders and private mortgage insurers calling on them to tighten their requirements for borrowers. He asked lenders to stop offering higher-risk mortgages to over-leveraged first-time buyers in the name of Canada’s future economic health and for the sake of CMHC itself.

“We are approaching a level of minimum market share that we require to be able to protect the mortgage market in times of crisis,” Siddall wrote, adding that CMHC requires the support of lenders to prevent “further erosion of our market presence.”

While CMHC is calling for stricter standards the Bank of Canada has just relaxed its mortgage stress test requirements for the third time since the pandemic started. The qualifying rate has been dropped by 15 basis points to 4.79%. That is about $7,500.00 more purchasing power for a well-qualified, high-ratio borrower. It is probably not enough to clear the barriers to entry, but it would certainly help with closing costs. By First National Financial.

Canada’s housing market seeing V-shaped recovery: TD

July saw the Canadian housing market break sales records as transactions across the country rose over 30 percent compared to the previous year.

The 62,355 sales total recorded in July was the highest for any single month in the Canadian Real Estate Association’s (CREA) records, which go back over 40 years.

Many individual large markets across the country saw sales jumps in the 40 percent to 50 percent range, while on a national level, sales rose 26 percent compared to June figures.

In a note titled “Record highs during a pandemic? Must be Canadian housing,” TD Senior Economist Brian DePratto called the sales increase seen in July “astonishing.”

As other sectors of the economy continue to struggle with the immense challenges brought on by the COVID-19 pandemic, it appears that, at least for now, the Canadian housing market has scored the elusive “V-shaped” recovery so many industries had hoped for.

“It looks like we got at least one “V” recovery after all,” wrote DePratto.

“In just three short months, Canadian resale activity and average prices have not just popped back to above pre-pandemic levels, but to new record highs. With many markets extremely tight and the pandemic making a mockery of typical sales patterns, August is already shaping up to be another hot month.”

DePratto noted that sales climbed so high in July that there was no chance for listings to keep up. This sent the widely monitored national sales-to-new listings ratio — a key indicator of market balance — surging into seller’s market territory while the average national sale price rose 14.3 percent year-over-year.

Anticipating that many would be left wondering about this historic performance during a time of high unemployment and economic uncertainty, DePratto offered a number of explanations for the surprisingly strong July activity levels.

Pent-up demand from the spring market and the fact that lower wage earners were more affected by job losses were among the economist’s top reasons for the market’s strength. DePratto also pointed to home sellers returning quickly to the market to at least partially satisfy demand from buyers who were able to take advantage of ultra-low interest rates brought on by the pandemic.

Looking ahead, DePratto said it will be important to monitor the resiliency of home prices as economic support programs that were introduced in the pandemic’s earlier days change or wind down. By Sean MacKay.

CRA shuts down online services after cyberattacks expose thousands of accounts

The Canada Revenue Agency has temporarily disabled its online services following news of two separate cyberattacks that compromised thousands of its accounts.

In a statement Sunday, the CRA confirmed that online services were being disabled as an “additional precaution,” on top of the links between its My Account and My Service Canada also being shut down temporarily. The CRA has not provided a timeline for when the online services would be restored.

In two separate incidents, about 5,500 CRA accounts were impacted as of Aug. 14. Hackers were then able to access some users’ My Account, My Business Account and Represent a Client of certain individuals functions on the CRA website. By David Lao.

OREA: Canada cannot tax its way to housing affordability

Governments imposing more taxes to improve housing affordability is a wrong-headed strategy at best, according to Tim Hudak, the chief executive of the Ontario Real Estate Association (OREA).

Although the Canada Mortgage and Housing Corporation (CMHC) recently said that claims that it is researching a home equity tax are spurious, the rumours have pointed to an undesirable undercurrent in the federal government’s approach to the affordability problem, Hudak wrote in a recent contribution to the Toronto Star.

“Where there’s smoke, there’s fire,” Hudak said. “A home equity tax would be unfair and hurtful to Canadians during the best of times, but at this very moment – during a global pandemic – it is reckless. Across the country, people have lost their jobs or a significant portion of their income and are struggling to make ends meet. For them, their home equity could be a lifeline during these uncertain times and beyond.”

“While the CMHC backpedalled from a home equity tax after the media uproar, they were clear that their goal is to level the playing field between homeowners and renters by making home ownership less attractive.”

Hudak cited a recent OREA poll finding that around 63% of Ontarians are opposed to a new capital gains tax on sales of primary residences. More than 72% of the province’s homeowners are also averse to new CMHC taxes.

“This is hardly a surprise,” Hudak said. “Homes are taxed enough as it is. Hardworking Canadians already pay taxes on their income.”

Ultimately, the most effective solutions would stem from policies addressing the supply and consumer sides, Hudak said.

“Lowering the tax and red-tape burden on homes – especially for first-time home buyers – would be a helpful step toward affordable home ownership,” Hudak said. “Creating more affordable options and greater choice in the marketplace should be a focus of all governments. Increasing housing supply and accelerating the approvals process would make a big difference.” By Ephraim Vecina.

“Supercharged” housing market could last through September: RBC

Ask anyone who’s been paying close attention to the Canadian housing market throughout the pandemic and you’ll hear that homebuyers are making up for lost time and then some this summer.

Toronto shattered home sales records in July while Vancouver saw sales spike 22 percent compared to the same time last year. Calgary posted a solid 12 percent year-over-year sales increase and Montreal buyers went on a shopping spree that may result in the city’s best-ever month for home sales.

The consensus expectation from the pandemic’s spring peak was that some pent-up demand would lift most markets out of the trough and set them on a path to recovery. Instead, across the country, we’ve seen major markets take off like rocket ships.

The questions being asked now are: How long will this epic run last? What will happen as we approach the final quarter of 2020?

In a note last week, RBC Senior Economist Robert Hogue said that sellers have clearly joined buyers in pushing their planned springtime activities to the summer. Despite this alignment, there remained a mismatch between supply and demand, with sales outpacing listings and prices rising as a result.

Looking ahead to the remaining summer and early fall months, Hogue wrote that the pent-up demand carried over from the spring that “supercharged” markets in July hasn’t been fully exhausted yet.

“We expect the market’s vigour to continue in August and perhaps September. We believe there’s still some pent-up demand left to satisfy,” he said.

“The plunge in activity at the seasonal high point (spring) potentially delayed as many as 70,000 transactions that would have otherwise occurred across Canada during this period,” Hogue added.

But taking a long view, the economist believes that pent-up demand can only sustain the housing market for so long before other pandemic-influenced factors begin to weigh activity down again.

“We expect the phasing out of CERB and other financial support programs, high unemployment and lower in-migration to cool housing demand later this year,” Hogue wrote. By Sean MacKay.

Pandemic Triggers Red-Hot Summer Housing Market.

We will get the full story on July housing in Canada when the Canadian Real Estate Association releases its July data in the next few days, but local real estate boards have reported a robust July market. Even in Calgary, year-over-year sales have jumped by double digits. Sales in Montreal were up more than 45% y-o-y, while Ottawa and the GTA were also very strong. Out west, Vancouver and other hot spots in BC saw the results of pent up activity, from both homebuyers and sellers, that had been accumulating over the past year.

Remember, had it not been for the pandemic, a record spring sales season was in the cards. The lockdown postponed that strength, with sales jumping sharply in May, June and July. Supply continues to remain limited relative to demand, and the Bank of Canada is looking towards housing as a leading sector in the recovery.

Record-low interest rates have boosted affordability everywhere. The Bank of Canada has made it clear that interest rates will remain low for an extended period. Mortgage rates have fallen, as have interest rates on home equity lines of credit. Even five of the Big Six banks have cut their advertised 5-year fixed mortgage rates (posted rates) by about 15 basis points to 4.79%.

These rates have been very sticky on the downside, as banks are reluctant to cut posted rates, which are is used to calculate the penalty for breaking a mortgage. Indeed, the gap between the posted rate and the 5-year government of Canada bond yield is historically wide. So is the gap between posted rates and actual contract mortgage rates at the very same banks.

The Bank of Canada posted rate is the qualifying rate for the mortgage stress test for insured and uninsured mortgages at the federally-regulated lenders–the so-called B-20 rule. That qualifying rate is set to fall from its current level of 4.94% to 4.79% later today when the central bank is due to update its figure.

Last February, following months of pressure from the real estate industry, the Department of Finance and the federal banking regulator announced they would rejig the “floor” of stress tests that borrowers must pass to qualify for insured and uninsured home loans. Then came COVID-19, and a sweeping government rescue that included regulatory relief for lenders. As part of the response, the change to the stress test, which was planned for April, was suspended indefinitely.

Last month, the Office of the Superintendent of Financial Institutions announced it would “gradually restart” policy work in the fall. Still, it made no mention of resuming consultations on the change to its stress test for uninsured mortgages, a vital component of the regulator’s B-20 guideline. If the new rules had been implemented, it is estimated that the qualifying rate floor would be roughly 4.09% rather than the new rate of 4.79%.

Several factors, in addition to low interest rates, have contributed to the housing market surge. Having spent so many months working from home, many people are looking for more space. With a significant number of businesses announcing that telecommuting will be the new normal, at least most of the time, buyers are moving to more remote suburban locations where their dollars buy more space. This has been reflected in the slowdown in the condo market. This is not just a Canadian phenomenon but is evident in the US and parts of Europe as well.

Despite the surprising strength in homebuying during COVID, CMHC continues to blast warnings.

CMHC Wants To Expose The “Dark Economic Underbelly”

Yesterday, Evan Siddall, the CEO at the Canada Mortgage and Housing Corp, published an August 10 letter to the financial industry imploring lenders to “reconsider” offering mortgages to highly leveraged households, saying excessive borrowing will worsen the pain of the coming economic adjustment. Evan Siddall said the Crown corporation had lost market share due to restrictions it imposed on high-risk borrowers earlier this summer. Private mortgage insurers have picked up that business, weakening CMHC’s position and threatening the agency’s ability to protect the mortgage market in the event of a crisis, he said.

CMHC continues to project that house prices will fall later this year, and next, “once government income supports unwind, bankruptcies increase and unemployment starts to bite.” A highlighted sentence in the letter says, “We don’t think our national mortgage insurance regime should be used to help people buy homes with negative equity. But by offering 95 percent loan-to-value mortgages subject to a 4 percent capitalized insurance fee in the midst of an economic calamity, that’s what insurance providers are doing.” Siddall, who steps down from his position at the end of the year, goes on to say that we risk exposing too many people to foreclosure.

CMHC announced in June it would narrow eligibility criteria to require higher credit scores and lower debt burdens to qualify for a mortgage. The move, which took effect on July 1, was intended to protect new home buyers from falling prices and reduce taxpayer risk to any market correction.

We have sustained a reduction in our market share to promote a more competitive marketplace for your benefit,” Siddall said in the letter. “However, we are approaching a level of minimum market share that we require to be able to protect the mortgage market in times of crisis. We require your support to prevent further erosion of our market presence.”

CMHC’s private-sector competitors, Genworth MI Canada Inc. and Canada Guaranty Mortgage Insurance Co., opted not to follow along with the rule changes and have increased their market share, as a result, said Siddall.

Siddall concluded with two requests for lenders: “We would hope you would reconsider highly leveraged household lending. Please put our country’s long-term outlook ahead of short-term profitability. Second, please don’t aggravate the impact by undermining CMHC’s market presence unnecessarily.”

CMHC’s ability to respond effectively in a crisis will be weakened if its market share deteriorates significantly further, he said. “If you want us in wartime, please support us in peacetime.”

By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres.

First-time home buyers priced out of London’s hot real estate market.

The average price of a home in London has climbed nearly 20 per cent since this time last year, meaning first time buyers are being priced out of the market, according to a local real estate agent.

The London and St. Thomas Association of Realtors (LSTAR) said in the month of July the average price of a home — including single detached homes and high-rise condos — was up 19.6 per cent to $484,884.

Because many homes are getting multiple offers and are selling for more than the asking price, Rafi Habibzadeh, a real estate agent with NuVista Realty in London, said it’s “very hard” for first time home buyers to get into the market.

“I’ve had clients put offers on four or five properties, because there is only so much that they’re qualified for in terms of the mortgage,” he said.

“We actually had one last week, this was a $2.1 million house, and that one went multiple offers and we ended up selling it above asking.”

This is happening, said Habibzadeh, because pandemic restrictions are relaxing.

“A lot of people have been waiting since the pandemic started, they were waiting at the sidelines to see where things were going … more people [now] have confidence in the market.”

Selling a home during the pandemic

There were 856 homes sold in London in July, and 1,275 homes sold across LSTAR’s jurisdiction, according to the association. Most homes exchanged hands in London’s south end, where there were 336 homes sold and where there was the biggest price gain compared to July, 2019.

The average price of a home in south London, which includes data from the western part of the city, was $449,448 in the month of July. The average price of a home in east London was $380,365. In the north end, the average sale price was $562,529.

Homes are staying on the market, according to the Canadian Real Estate Association, for an average of 10 days.

Habibzadeh said he was surprised when on Sunday, during his first open house since the pandemic shut down, 12 groups of people showed up for a tour.

“It was between two and four o’clock and I expected maybe a couple groups, two, three, four or five groups, to come in,” he said. “I had people waiting outside in a line to get in the house.”

Habibzadeh said he had four people inside the house at a time, and they followed masking and physical distancing rules.

He also said there are no signs of relief for first-time home buyers trying to break into the market — unless a second wave of COVID-19 slows things down. By CBC News.

Insurers: Mortgage deferral extensions not on the table

Mortgage insurers are not signalling enthusiasm towards the extension of six-month payment deferrals, according to an analysis by The Financial Post.

The socio-economic disruption brought about by the COVID-19 pandemic brought deferrals to the fore as a vital support system for Canadian households that suddenly found their purchasing power severely restricted.

Data from the Canadian Bankers Association indicated that deferrals since March represented approximately 16% of bank-based mortgages, amounting to more than 760,000 borrowers.

However, Genworth Canada said that it forecasted a “vast majority” of six-month deferrals shifting to regular payment schedules very soon – with a significant caveat.

The private-sector residential mortgage insurer “expects that a subset of insured mortgages with payment deferrals will likely end up in default after the deferral period ends,” Genworth said. “As a result, the company and its lenders have plans in place to increase loss mitigation activities to address the increase in reported delinquencies that is expected starting in the fourth quarter of this year.”

Canada Mortgage and Housing Corporation recently said that an extension was not on the table.

“In developing the COVID-19 Default Management Playbook, the insurers did not feel that further extensions were a viable option on a global basis,” CMHC said. “If the borrower cannot be helped with the existing (default management) tools (stable source of some revenue), then there are few options as there are no government programs currently available.” By Ephraim Vecina.

Economic Highlights

Record Setting Canadian Housing Market in July.

Today’s release of July housing data by the Canadian Real Estate Association (CREA) showed a blockbuster July with both sales and new listings hitting their highest levels in 40 years of data. This continues the rebound in housing that began three months ago.

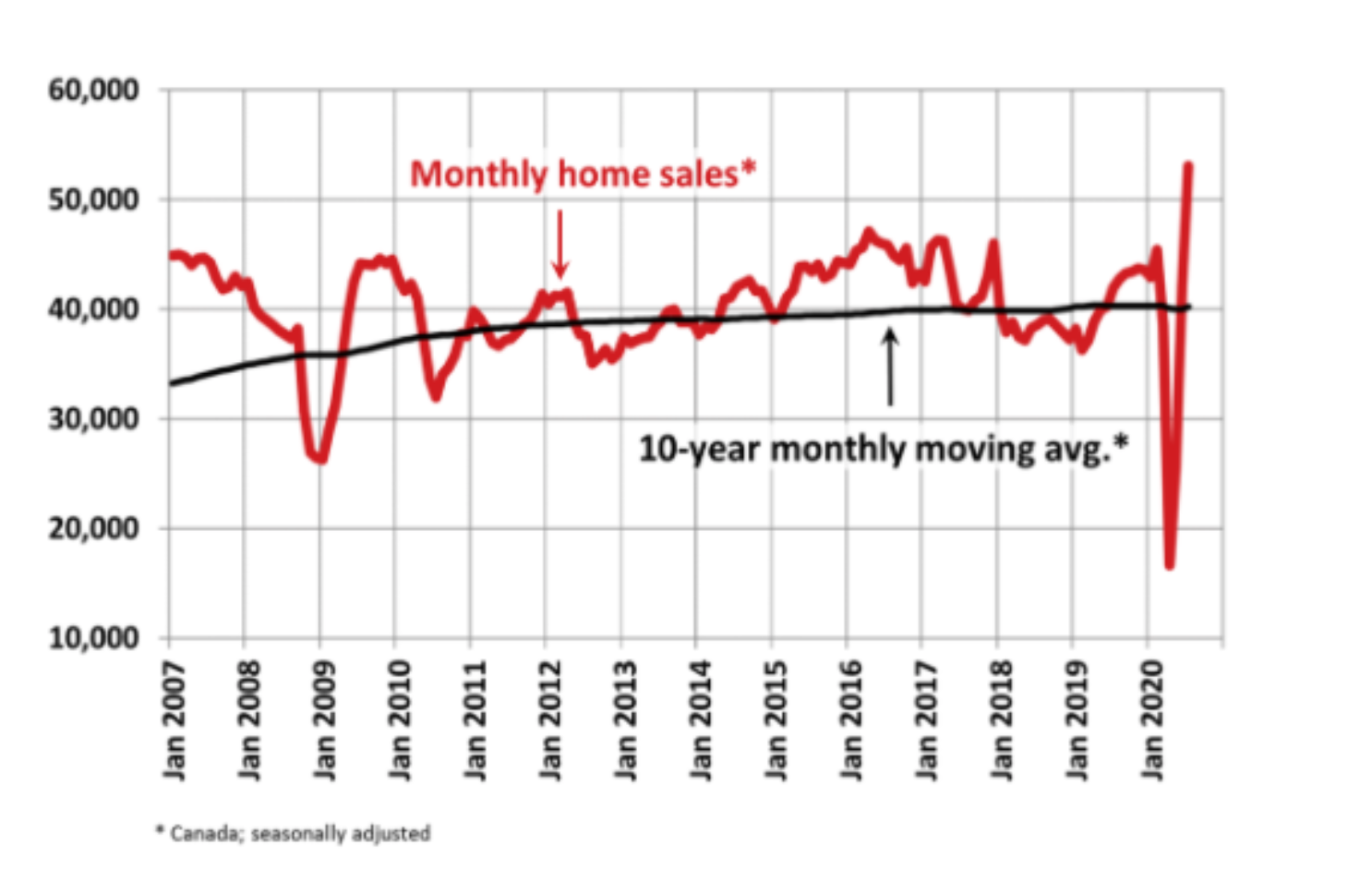

National home sales rose 26% month-over-month (m-o-m) in July, which translates to a 30.5% gain from a year ago (see chart below). July’s sales activity was the strongest for any month in history. According to Shaun Cathcart, CREA’s Senior Economist, “A big part of what we’re seeing right now is the snapback in activity that would have otherwise happened earlier this year. Recall that before the lockdowns, we were heading into the tightest spring market in almost 20 years. Things may have gone quiet for a few months, but ultimately the market we’re seeing right now is mostly the same one we were heading into back in March. That said, there are some new factors at play as well. There are listings that will come to the market because of COVID-19, but many properties are also not being listed right now due to the virus, as evidenced by inventories that are currently at a 16-year low. Some purchases will no doubt be delayed, but the new-found importance of home, lack of a daily commute for many, a desire for more outdoor and personal space, room for a home office, etc. will certainly also spur activity that otherwise would not have happened in a non-COVID-19 world.”

For the third month in a row, transactions were up on a month-over-month basis across the country. Among Canada’s largest markets, sales rose by 49.5% in the Greater Toronto Area (GTA), 43.9% in Greater Vancouver, 39.1% in Montreal, 36.6% in the Fraser Valley, 31.8% in Hamilton-Burlington, 28.7% in Ottawa, 16.9% in London and St. Thomas, 15.7% in Calgary, 12.1% in Winnipeg, 9.7% in Edmonton and 5.4% in Quebec City.

New Listings

The number of newly listed homes climbed by another 7.6% in July compared to June, to a level of 71,879–the highest level for any July in history. New supply was only up in about 60% of local markets, as the rebound in supply appears to be tapering off in many parts of the country. The national increase in July was dominated by gains in the GTA. More supply is expected to come on the market in future months, particularly once a vaccine is widely available.

With the ongoing rebound in sales activity now far outpacing the recovery in new supply, the national sales-to-new listings ratio tightened to 73.9% in July compared to 63.1% posted in June. It was one of the highest levels on record for this measure, behind just a few months back in late 2001 and early 2002.

Based on a comparison of sales-to-new listings ratios with long-term averages, only about a third of all local markets were in balanced market territory, measured as being within one standard deviation of their long-term average, in July 2020. The other two-thirds of markets were all above long-term norms, in many cases well above.

The number of months of inventory is another important measure of the balance between sales and the supply of listings. It represents how long it would take to liquidate current inventories at the current rate of sales activity.

Housing markets are very tight, especially in Ontario, as demand has far outpaced supply. There were just 2.8 months of inventory on a national basis at the end of July 2020 – the lowest reading on record for this measure. At the local market level, a number of Ontario markets shifted from months of inventory to weeks of inventory in July.

Home Prices

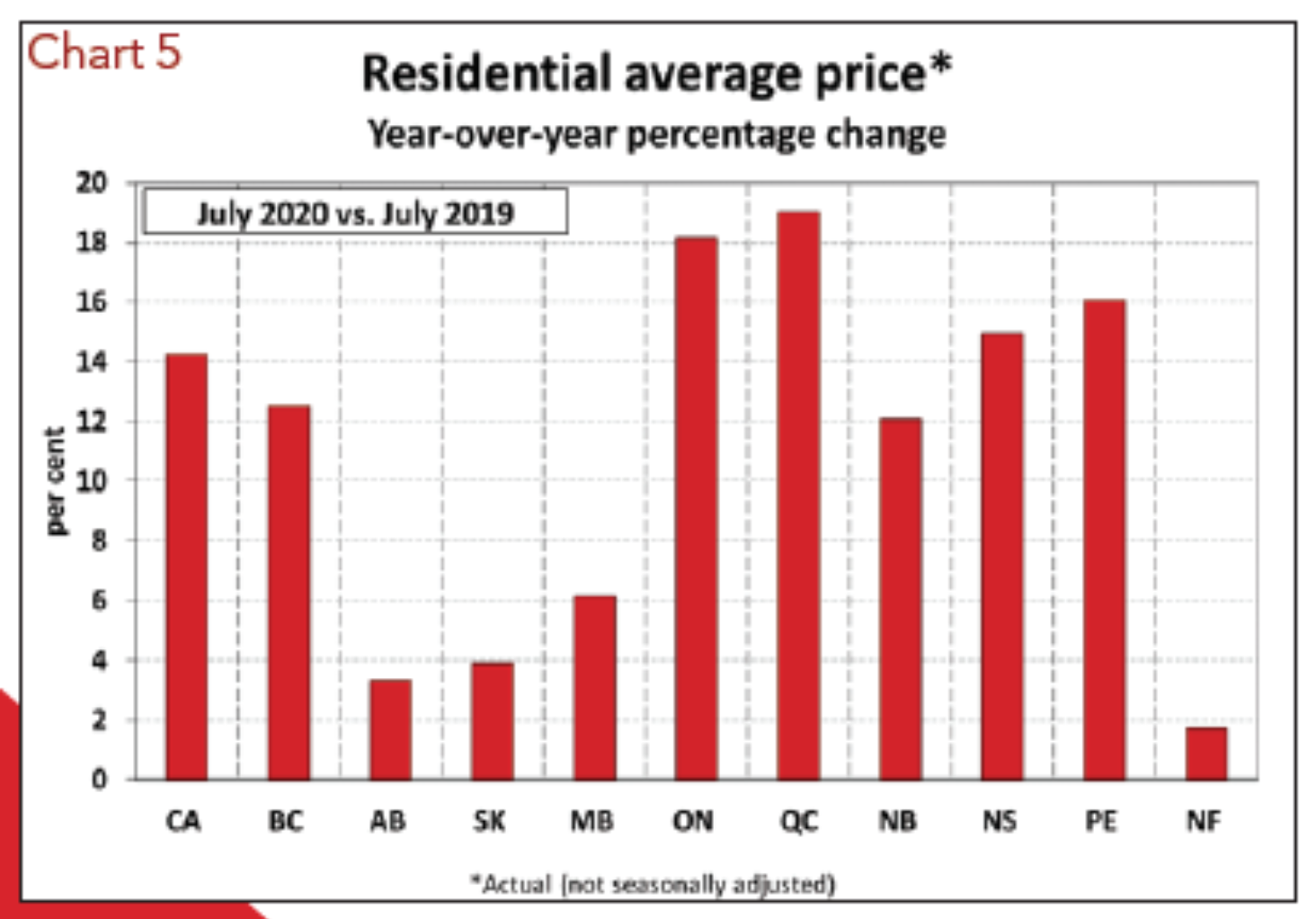

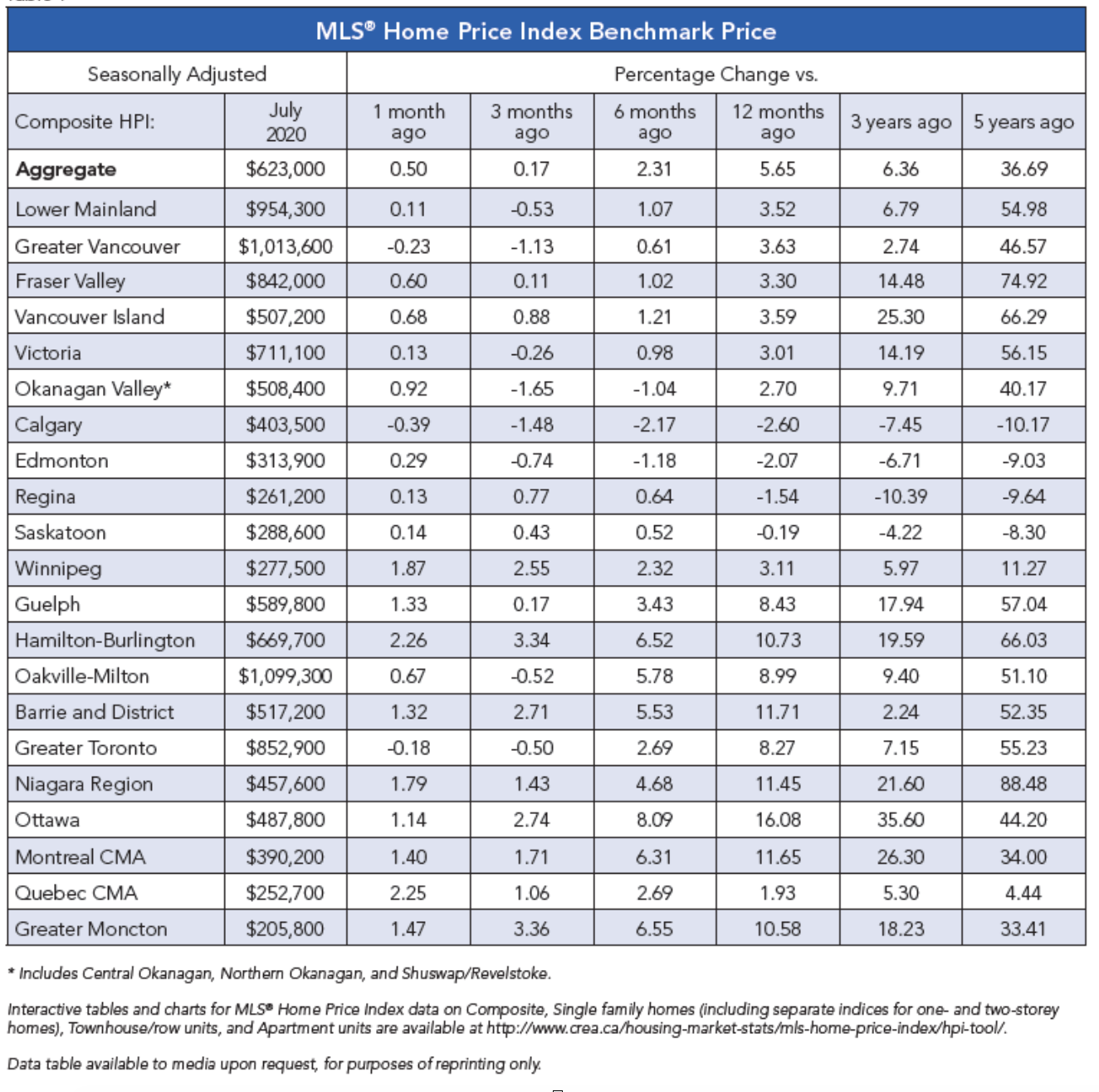

The Aggregate Composite MLS® Home Price Index (MLS® HPI) jumped by 2.3% m-o-m in July 2020 – the second largest increase on record (after March 2017) going back 15 years. (see Table below). Of the 20 markets currently tracked by the index, they all posted m-o-m increases in July.

The biggest m-o-m gains, in the range of 3%, were recorded in the GTA outside of the city of Toronto, Guelph, Ottawa and Montreal; although, generally speaking, most markets east of Saskatchewan are seeing prices accelerate in line with strong sales numbers. Price gains were more modestly positive in B.C. and Alberta.

The non-seasonally adjusted Aggregate Composite MLS® HPI was up 7.4% on a y-o-y basis in July the biggest gain since late 2017.

The MLS® HPI provides the best way to gauge price trends because averages are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average price for homes sold in July 2020 was a record $571,500, up 14.3% from the same month last year.

The national average price is heavily influenced by sales in the Greater Vancouver and the GTA, two of Canada’s most active and expensive housing markets. Excluding these two markets from calculations cuts around $117,000 from the national average price. The extent to which sales continue to fluctuate in these two markets relative to others could have further compositional effects on the national average price, both up and down.

Bottom Line

CMHC has recently forecast that national average sales prices will fall 9%-to-18% in 2020 and not return to yearend-2019 levels until as late as 2022. I continue to believe that this forecast is overly pessimistic. Here we are in the second half of 2020, and the national average sales price has risen 14.3% year-over-year.

The good news is that the housing market is contributing to the recovery in economic activity. While the course of the virus is uncertain, Canada’s government has handled the COVID-19 situation very well from both a public health and a fiscal and monetary perspective. The future course of the economy here will depend on the virus. While no one knows what that will be, suffice it to say that Canada’s economy is en route to a full recovery, but it may well be a long and bumpy one. By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

Mortgage Update – Mortgage Broker London

Mortgage Interest Rates

Fixed mortgage rates have dropped to historically low levels. Variable rates discounts deepened only slightly and are showing a small spread compared to fixed rates making variable rate less attractive. View rates Here – and be sure to contact us for a quote to help you find the lowest rate for your specific needs and product requirements.

The Bank of Canada’s kept it’s overnight rate is 0.25%. Prime lending rate remains at 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is 4.94%.

![]()

Your Mortgage

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options and the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

COVID-19 Pandemic Public health links:

Middlesex Health Unit

https://www.healthunit.com/novel-coronavirus

Southwestern Public Health

https://www.swpublichealth.ca/content/community-update-novel-coronavirus-covid-19

Ontario Ministry of Health

https://www.ontario.ca/page/2019-novel-coronavirus

Public Health Canada

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Factual Statistics Coronavirus COVID-19 Globally:

https://www.worldometers.info/coronavirus/

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6