Industry & Market Highlights

COVID-19 Ontario Announces Regional Approach Reopening Into Stage 2

Ontario will be taking a regional approach to move into Stage 2. As directed by the province, each region will be permitted to enter Stage 2 when safe to do so as public health criteria outlined in the framework are met.

Regions are based on public health unit boundaries.

Residential Market Commentary – CMHC takes a bite out of purchasing power

While forecasting a collapse in house prices of as much as 19% over the next 12 months, Canada Mortgage and Housing Corporation is tightening the rules for its mortgage insurance.

As of July 1st, applicants will need a bigger credit score, a smaller debt load and more, real money up front. It could be seen as an effort to squelch any growth in demand triggered by improved affordability.

CMHC is upping its credit score to 680 from 600. In an effort to reduce the practice of borrowing money for a down payment the agency will no longer treat unsecured personal loans and unsecured lines of credit as equity for insurance purposes. The maximum gross debt servicing ratio (GDS) is being trimmed to 35%, down from 39%. The maximum total debt service ratio (TDS) falls to 42% from as high as 44%.

The reduction in debt servicing levels is seen as having the biggest impact on home buyers. By some calculations a household with an income of $100,000 and a 10% down payment could lose as much as 12% of their purchasing power.

The head of CMHC, Evan Siddall, has made no secret of his concerns about “excessive [housing] demand and unsustainable house price growth.”

“COVID-19 has exposed long-standing vulnerabilities in our financial markets, and we must act now to protect the economic futures of Canadians,” Siddall said in a press release.

“These actions will protect home buyers, reduce government and taxpayer risk and support the stability of housing markets,” he said.

Many market watchers are calling the moves excessive and say CMHC’s forecasts are unduly pessimistic. They worry the new rules will batter the confidence of buyers and sellers, bruise market psychology and hurt the near-term housing outlook.

CMHC did decide to leave the minimum down payment size at 5%, which should keep the pool of potential buyers at about the same level. By First National Financial.

Business As Usual with Genworth Financial & Canada Guarantee

Both Genworth Financial & Canada Guaranty has released statements that they will not be changing any of their underwriting guidelines after CMHC tightened its lending rules for high ratio insured mortgages. What this means to home buyers is that the recent change with CMHC will not impact their borrowing capacity and ability to qualify for a high ratio insured mortgage in Canada.

Genworth MI Canada Inc. Confirms That It Does Not Plan To Change It’s Underwriting Policy

Genworth MI Canada Inc. (the “Company”) (TSX: MIC) confirms that it has no plans to change its underwriting policy related to debt service ratio limits, minimum credit score and down payment requirements. One of the Company’s competitors announced changes to their internal underwriting guidelines with respect to the aforementioned underwriting criteria on June 4, 2020.

“Genworth Canada believes that its risk management framework, its dynamic underwriting policies and processes and its ongoing monitoring of conditions and market developments allow it to prudently adjudicate and manage its mortgage insurance exposure, including its exposure to this segment of borrowers with lower credit scores or higher debt service ratios,” said Stuart Levings, President and CEO. By Genworth Financial.

Canada Guaranty Underwriting Policy Clarification

Canada Guaranty confirms that no changes to underwriting policy are contemplated as a result of recent industry announcements.

Canada Guaranty utilizes a dynamic underwriting process where our underwriting policies are consistently updated to reflect evolving economic environments and emerging mortgage default patterns. This philosophy has resulted in the lowest loss ratio in the industry. Recent insurer announcements relating to down payment and minimum credit score represent a very small component of Canada Guaranty’s business, and we will continue to be prudent in these areas. Given implementation of the qualifying stress test and historic default patterns, Canada Guaranty does not anticipate borrower debt service ratios at time of origination to be a significant predictor of mortgage defaults. By Mary Putnam, Canada Guaranty.

Canada’s housing agency criticized for alarming home price forecast

Last week, the head of Canada’s housing agency made a startling prediction that home prices could fall up to 18 percent in the next year as a result of the economic devastation caused by the COVID-19 pandemic.

Canada Mortgage and Housing Corporation (CMHC) President Evan Siddall’s comments during testimony before the House of Commons Finance Committee were widely reported by media across the country (including this publication).

The media frenzy inspired by the comments was not surprising due to both the source of the warning and the scale of the decline Siddall warned of — even his low-end prediction was a nine percent price dip.

The CMHC is Canada’s public mortgage insurer and responsible for hundreds of billions of dollars in assets. So when the president of Canada’s largest Crown corporation makes a dire prediction like this one, it gets picked up, not just nationally, but beyond the country’s borders as well.

An article published this week by Australian business daily The Australian Financial Review, carried the headline ‘Canadian housing market to crater amid pandemic’ and cited only the CMHC’s recent commentary on the pandemic’s housing market impact.

But since Siddall’s House of Commons testimony was reported, several prominent industry voices have criticized the claim, zeroing in on the potential worst-case scenario 18 percent price drop figure.

Brokerage RE/MAX Canada was quick to jump on the claim with a blog post titled ‘No Nosedive Ahead for Canadian Real Estate Prices.’ In it, the brokerage cited economists from several large Canadian banks who believe the market is at risk of a milder 5 to 10 percent decline as things currently stand.

“RE/MAX brokers in some of the biggest Canadian real estate markets say a dramatic price drop is unlikely under current conditions, barring any major unforeseen circumstances — and as we’ve all come to learn recently, anything is possible,” the brokerage said in the blog post.

“But assuming current market conditions remain stable, the current inventory of homes for sale continues to fall short of demand — even amidst this pandemic, social distancing measures and the economic fallout,” the blog post continued.

Stephen Brown, an economist at Capital Economics, cautioned that the CMHC forecasts are “not as alarming as they first seem” but the “very public warning” from the Crown corporation could become self-fulfilling. He went on to note that his firm’s forecast pegs the pandemic-induced fall in Canadian home prices at 5 percent.

Further, he explained that the CMHC is looking at declines to average selling prices, while Capital Economics makes forecasts based on the Teranet-National Bank Home Price Index. The difference is that predictions based on selling price look simply at the average sale price for all homes sold during a particular period, while the Home Price Index-based forecast looks at the price change for any given home over time.

“This is an important distinction, because changes in average selling prices and changes in like-for-like house prices can be very different in downturns,” Brown wrote.

“As we have already seen in the home sales data for April, during market downturns the proportion of higher-value homes that are sold often falls significantly. That in turn pulls down the average selling price,” he added.

In its blog post, RE/MAX Canada highlighted the regional diversity in how markets will experience the pandemic fallout and subsequent recovery. The brokerage said a five percent price correction is possible in Vancouver while prices appear to be stable so far in Toronto. Alberta’s major markets are expected to be hit hardest as they grapple with an oil price shock significantly impacting employment. By Sean MacKay.

Mortgage rates will stay historically low until economy nears recovery

The Bank of Canada this week announced it’s maintaining its mortgage-market influencing key interest rate at 0.25 percent, a rock bottom level unseen since the peak of the 2008-2009 Global Financial Crisis.

The key interest rate acts as a guide for lending rates offered by all of Canada’s financial institutions. Changes to the rate are announced by the Bank of Canada at eight scheduled times each year.

With the key interest rate sitting so low, and being expected to remain there for some time as the pandemic’s economic impacts continue to be strongly felt, mortgage market experts are projecting that these favourable rates offered to Canadian homebuyers will persist for the foreseeable future.

“The Bank is committed to maintaining the key rate at its current level until the economy has recovered,” wrote Ratehub.ca in an email to subscribers on Wednesday.

“The historic low mortgage rates currently in the market should therefore continue until the economy approaches its pre-pandemic level. This means that anyone with a variable rate can expect prime to remain unchanged. Fixed rates will stay near historic lows,” the email continued.

In early May, BMO economist Robert Kavcic wrote that he didn’t anticipate the Bank of Canada to increase its key interest rate until 2022 at the earliest, though this doesn’t mean mortgage rates will stay exactly as low as they are now.

That said, rates were already considered low through 2019, and Kavcic noted that in May, they were about 50 points lower than last year’s average levels as a result of cuts that followed the pandemic outbreak. When rates do begin climbing back up, it will likely be at a very gradual pace.

This week’s rate announcement was also noteworthy for its relatively optimistic tone, as the Bank of Canada stated that the country’s economy “appears to have avoided the most severe scenario” that had been envisioned in its April report. With a harrowing second quarter nearly behind us, the Bank noted that economic growth is expected to resume in the third quarter, though there is still significant uncertainty around the path of Canada’s recovery. By Sean MacKay.

Bank of Canada Takes A More Positive Tone

On the heels of a devastating decline in the Canadian economy, the Bank of Canada suggested today that the worst of the pandemic’s negative impact on the global economy is behind us, conceding, however, that uncertainty remains high. The Bank today maintained its target overnight rate at 0.25%. No additional rate cut was expected as the Bank has described the 0.25% level as the effective lower bound of the policy rate. Governor Poloz has all but ruled out negative interest rates unless the economy deteriorates dramatically further.

Today’s Governing Council meeting is Stephen Poloz’s swan song, as the new Governor, Tiff Macklem, takes the helm today. Macklem took part as an observer in the Governing Council’s deliberations and endorsed today’s rate decision and measures announced in the press release, thereby assuring continuity in monetary policy.

The Bank has taken very aggressive action to support liquidity and the full functioning of financial markets by buying short- and long-term securities. The central bank’s balance sheet holdings of securities have grown to about 20% of Canada’s GDP, up from 5% pre-crisis. That’s still well below the levels seen at the US Federal Reserve, the Bank of Japan, and the European Central Bank, which have conducted these quantitative easing operations since the financial crisis more than a decade ago. However, the Bank of Canada’s securities purchases have been extraordinary in relation to the size of our economy.

“Decisive and targeted fiscal actions, combined with lower interest rates, are buffering the impact of the shutdown on disposable income and helping to lay the foundation for economic recovery.” According to the central bank, the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report (MPR).

The level of real GDP in Q1 was 2.1% below the level in the fourth quarter of 2019. The Bank of Canada is now predicting that real GDP in Q2 will likely post a further decline of 10%-to-20%, as continued shutdowns and sharply lower investment in the energy sector take an additional toll on output. That suggests a peak-to-trough decline of 12% to 22%, instead of the 15% to 30% scenario the central bank had previously been estimating. “The Canadian economy appears to have avoided the most severe scenario,” the Bank of Canada said.

Bottom Line: While the degree of uncertainty remains high, there is evidence that the worst of the economic downturn is behind us. Preliminary data for May suggests that home sales picked up on a month-over-month basis in May in the GTA and GVA, although home sales continued to be down significantly from levels one year ago.

Some people are concerned that the extraordinary stimulus in monetary and fiscal measures in recent months might, in time, be inflationary. Governor Poloz has made it clear that the dire results of the economic shutdown would have been highly deflationary had these actions not been taken. Deflation, coupled with high debt levels, would have triggered a depression. Economic models are ill-equipped to deal with the fallout of the pandemic. Policymakers need to be nimble in responding, and when the economy has recovered sufficiently, they will begin the unwinding of all of this stimulus, which will require an equally deft response on both the fiscal and monetary side. By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres.

May Sees An Uptick in Sales, Listings and Prices

The London and St. Thomas Association of REALTORS® announced that 668 homes exchanged hands last month in its jurisdiction, down 41.6% from May 2019 and 26.3% less than in May 2010. The number of LSTAR’s listings was 973 in May, which represents a 42.3% decrease from a year ago and 41.5% from ten years ago.

“Even though the total number of residential transactions remained well below the 10-year average, in May, we saw notable month-over-month increases: 42.4% in home sales and 31.8% in listings, which we find very encouraging,” said Blair Campbell, 2020 LSTAR President. “In addition, when looking at the year-over-year percentage changes, one can notice that the decrease in home sales is directly proportional to the one in listings, which means that the ratio between supply and demand is almost unchanged,” he added.

“Despite the new social distancing rules, the open house prohibition and the lay-offs caused by COVID-19, the local real estate market succeeded in staying in Sellers’ territory, which speaks to the strength of its fundamentals,” Campbell emphasized.

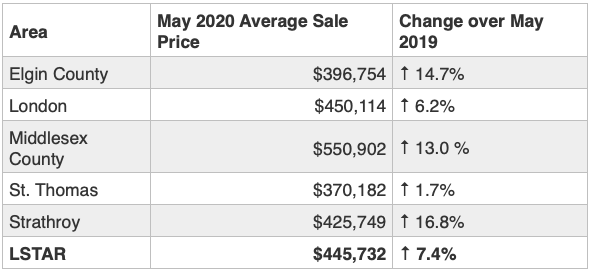

The overall average home price saw an increase of 7.4% over a year ago, rising to $445,732 in May. This average sales price includes all housing types – from single detached homes to high-rise apartment condominiums. All the five major areas of LSTAR’s region witnessed increases in their average home sales price. The following table illustrates last month’s average home prices by area and how they compare to the values recorded at the end of May 2019.

“Looking at London’s three main geographic areas, London South saw the highest number of home sales last month, while London East saw the biggest price gain compared to May 2019,” Campbell said.

The average home price in London East was $365,261, up 8.4% from the same time last year, while in London North increased 7.7% over the same period to $531,626. In London South, which also includes data from the west of the City, the average home price was $462,334, up 6.5% over May 2019. St. Thomas saw an average price of $370,182, an increase of 1.7% from last May.

According to a report by the Canadian Real Estate Association, last month, in London, the median number of days that a home was on the market was 14 – up from 9 days in May 2019. As compared to a year ago, in Elgin County, the median number of days spent by a home on the market was 17 – down from 26; in Middlesex County it was 22 – up from 17; in Strathroy was 19, up from 14; and in St. Thomas it was 12 days – exactly the same as in May 2019.

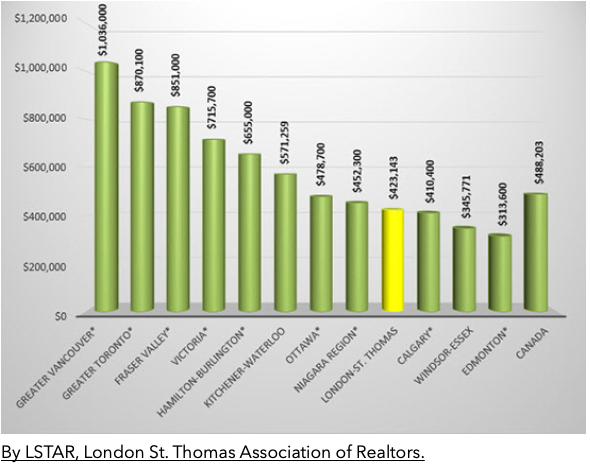

The following chart is based on data taken from the CREA National Price Map for April 2020 (the latest CREA statistics available). It provides a snapshot of how home prices in London and St. Thomas compare to some other major Ontario and Canadian centres.

Economic Highlights

Good News in May Job Report, Employment Rebounds 10.6%

The doomsayers have been proven wrong by this employment report and by the high-frequency data that have been pointing to the start of a rebound in Canada’s economic activity. We have been signalling green shoots in the economy for several weeks, and while these are early days, those green shoots are surely growing. We are optimistic but mindful that just under 5 million Canadians remain without work or with substantially reduced hours.

Job Market Has Improved From Mid-April to Mid-May

Canada’s Labour Force Survey (LFS) results for May, released this morning by StatsCanada, reflect jobs market conditions as of the week of May 10 to May 16. By then, some provinces had begun to gradually ease the pandemic lockdown that has thrown our economy into recession. Already, as of mid-May, the jobs market had shown a marked improvement, and no doubt, it has subsequently continued to revive.

From February to April, 5.5 million Canadian workers were affected by the pandemic shutdown. This included a drop in employment of 3.0 million and a COVID-related rise in absences from work of 2.5 million. Economists were expecting another 500,000 job losses last month. They were wrong.

In May, employment rose by 289,600 (1.8%), while the number of people who worked less than half their usual hours dropped by 292,00 (-8.6%). Combined, these changes represented a recovery of 10.6% of the pandemic-related employment losses and absences recorded in the previous two months. Three-quarters of the employment gains from April to May were in full-time work. The growth was across most industries and provinces, though largely driven by higher employment in Quebec, the province hardest hit by the pandemic.

Compared to February–prior to the lockdown–however, full-time employment was down 11.1% in May, while part-time work was down 27.6%.

Unemployment Rate Rises As More Canadians Look For Work

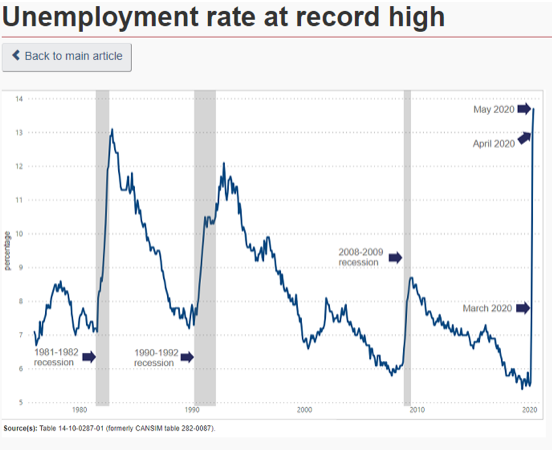

Even though we posted employment gains from mid-April to mid-May, the jobless rate rose to 13.7%–up from 13.0%–as easing restrictions caused more discouraged workers to actively look for employment (see chart below). The 13.7% figure is the highest jobless rate recorded since comparable data became available in 1976. In February, prior to the economic shutdown, the unemployment rate was a mere 5.6%. It shot up to 7.8% in March and to 13% in April.

Unlike previous economic downturns. the bulk of the job losses were felt first in the services sector. The pandemic impact subsequently spread to the goods-producing and construction industries in April. Last month, employment rebounded more sharply in the goods-producing sector ( +5.0% or 165,000) than in services (+1.0% or 125,000). The construction industry enjoyed the largest gains in hours worked from April to May with 19.0% growth.

Quebec Accounts For Nearly 80% Of Overall Employment Gains in May

The Quebec provincial government eased restrictions on business activity before the jobs report reference week of May 10 to May 16, notably in construction from mid-April, and in retail trade and manufacturing outside Montréal from May 4. The proportion of workers labourers from a location other than home increased from 60% in April to 65% in May.

The largest employment increases in Quebec were in construction (+58,000), manufacturing (+56,000) and wholesale and retail trade (+54,000), three industries with a relatively high proportion of jobs that are difficult to do from home.

Employment increased by 97,000 (+5.3%) within the Montréal census metropolitan area.

Employment Declines Continued in Ontario But At A Slower Pace

Ontario was the only province where employment continued to fall in May. This is consistent with the fact that most restrictions on economic activity remained in place in Ontario during the week of May 10 to May 16.

While employment declined in Ontario in May (-65,000), it did so at a much slower pace than in March (-403,000) and April (-689,000). All of the employment decline in the province in May was in the services-producing sector (-80,000). At the same time, employment rose by 15,000 in the goods-producing sector, driven by manufacturing (+14,000).

The proportion of employed people in Ontario who worked less than half their usual hours dropped from 22.1% in April to 21.2% in May.

In Ontario, 55% of workers worked from a location other than home in May, the lowest proportion of all provinces and little changed from April.

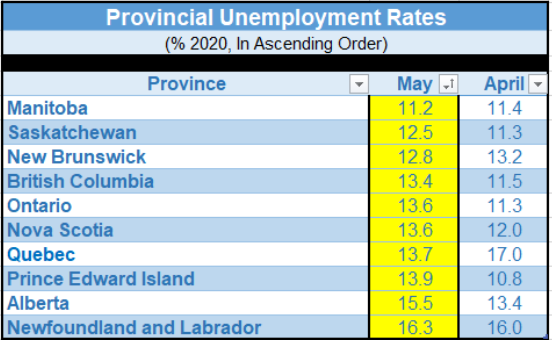

As most restrictions on economic activity remained in place in Ontario, the number of people who were not in the labour force but wanted to work and did not look for a job was little changed. The unemployment rate continued its upward trend, rising from 11.3% in April to 13.6% in May (see the table below).

Employment Picture Mixed In Western Provinces

Employment in British Columbia increased by 43,000 in May and the unemployment rate rose 1.9 percentage points to 13.4%, as more people looked for work. Almost all of the employment increase in the province was in the services-producing sector (+41,000), led by accommodation and food services (+12,000), educational services (+12,000), and wholesale and retail trade (+12,000).

British Columbia announced a first phase of reopening on May 6, with a plan to lift restrictions on non-essential medical services and parts of the retail trade industry starting May 19, after the reference week.

The number of employed people in Alberta grew by 28,000 in May, following a cumulative decline of 361,000 from February to April. The employment increase in the province was entirely driven by the services-producing sector (+33,000). The unemployment rate increased by 2.1 percentage points to 15.5%.

Alberta allowed some businesses such as restaurants and non-essential shops to start operating from May 14.

In Manitoba, employment increased by 13,000 in May. At the same time, the proportion of employed Manitobans who worked less than half their usual hours fell by 1.7 percentage points to 12.9%. In May, most of the employment increase in Manitoba was in the services-producing sector (+12,000), the majority of which was in wholesale and retail trade (+7,000).

On May 4, Manitoba allowed a number of services businesses to resume their activities, with limited occupancy and physical distancing requirements.

There was little change in overall employment in Saskatchewan. Increases in wholesale and retail trade, manufacturing and accommodation and food services were offset by declines in many sectors, led by information, culture and recreation as well as in construction.

Employment increases in all Atlantic provinces

With the exception of Nova Scotia, provincial governments in the Atlantic provinces started to ease restrictions in early May, with New Brunswick reopening most of its economy from May 8. The number of employed people increased in New Brunswick (+17,000), Newfoundland and Labrador (+10,000), Nova Scotia (+8,600) and Prince Edward Island (+2,600).

Green Shoots

There is increasing evidence that the economy has bottomed and is gradually improving. Business shutdowns are easing, and while it will be some time before we see a complete reopening, early signs of improvement are evident.

A Bloomberg News poll taken at the end of May found that 30% of respondents who had lost their job or seen hours decline because of the coronavirus pandemic said they were re-employed or working more. The survey, conducted by Nanos Research, is consistent with other high-frequency data from Indeed Canada and Google that suggest stabilization in labour conditions and economic activity over the past few weeks.

The rebound story is also reinforced by Canadians’ movement patterns. Mobility data from Apple and Google smartphones during the latter half of May suggest more people present in retail stores and parks — coinciding with re-openings across Canada. While transit usage remains down, driving and walking have picked up, a positive sign for commerce.

In addition, the Office of the Superintendent of Bankruptcy Canada reported that the total number of insolvencies (bankruptcies and proposals) decreased by 38.7% in April compared to the previous month. Bankruptcies decreased by 41.5% and proposals decreased by 37.2%. The total number of insolvencies in April 2020 was 43.5% lower than the total number of insolvencies in April 2019. Consumer insolvencies decreased by 43.1%, while business insolvencies decreased by 54.8%.

On another positive note, commodity prices have rebounded. Most notably for Canada, oil prices have risen sharply–great news for Alberta and Saskatchewan. As well, the Canadian stock market has rebounded significantly and the Canadian dollar is up. The Bank of Canada noted this week that the worst of the pandemic decline is behind us.

The Royal Bank economists survey of consumer spending in May shows continued recovery as discretionary spending is returning.

- “As Canadian provinces take steps to reopen their economies, consumers have begun spending more on the discretionary items they shunned during the early phase of the pandemic.

- Entertainment and art spending has benefited most from easing restrictions.

- Spending on dining out continues to recover from lows, as restaurants adapt to take-out and other delivery models.

- Formerly slow spending at merchants selling apparel, gifts & jewelry picked up steam in early May; Canadians spent more at clothing stores in particular.

- Spending at merchants selling household goods remains strong, reflecting spending at DIY construction stores, and on appliances and furniture.

- Canadians began to drive more through early May, and card spending on auto expenses continued to pick up.

- In mid-May, spending at entertainment and art merchants was down 37% from a year earlier, compared with a 58% drop in late April.

- Golfers dusted off their putters as golf courses opened up around the country. Those who prefer playing inside continued to spend on online and console gaming.”

Concerning the housing market, before the pandemic, we were going into the spring season with the prospect of record sales activity in much of the country. Aside from oil country–Alberta and Saskatchewan–all indications were for a red-hot housing market. So the underlying fundamentals for housing remain positive as the economy recovers. How long that will take depends on the course of the virus and whether we see a second wave in the fall.

Real estate boards report a pick-up in home sales in May in the GTA and GVA.

Interest rates have plummeted. Thanks to the 150 basis point decline in the prime rate, variable rate mortgage rates have fallen for the first time since late 2018. Once the Bank of Canada was able to establish enough liquidity in financial markets, even fixed-rate mortgage rates have fallen.

The posted mortgage rate finally fell to 4.94% last week, but it remains well above contract rates; but with any luck at all, this qualifying rate for mortgage stress tests will ease in coming months and the regulators will change the qualifying rate to a contract rate plus 200 basis points, as planned to happen in April before the pandemic hit.

The Bank of Canada will remain extremely accommodating. In my view, interest rates will not rise until 2022.

One piece of bad news for housing was yesterday’s CMHC announcement of a tightening in mortgage qualification rules for mortgage borrowers with less than a 20% down payment. As I wrote yesterday, I believe this action flies in the face of measures taken by the Bank of Canada, OSFI, and the Department of Finance to cushion the blow of the pandemic and prevent unnecessary insolvencies. CMHC’s tightening measures reduce housing affordability, especially for first-time home buyers, by more than 10% and are totally unwarranted from a prudential perspective. For more on that, see yesterday’s report. As well, Bloomberg News also suggested the same in their article, Canadian Housing Agency Draws Fire For Tightening Mortgage Rules. By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres.

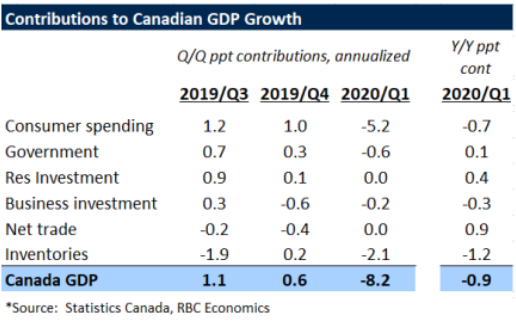

Near-Record Decline in Q1 GDP Better Than Flash Estimate

The hand-wringing about the Q1 GDP data released today misses the point that the data were actually better than expected. The Canadian economy declined at an 8.2% annualized rate in the first quarter, less harsh than the earlier estimate by StatsCan of -10%. Of course, every sector of the economy was hit by the enforced shutdown, but not by nearly as much as most economists anticipated. For the month of March, the decline was 7.2%, less dire than the -9% earlier estimate.

In light of the current unprecedented national and global economic environment, StatsCan is providing leading indicators of economic activity. Their preliminary flash estimate for April is an 11% decline in real GDP. This estimate will be revised as more info becomes available, but the March and April decreases are likely to be the largest consecutive monthly declines on record.

The Economy Has Bottomed

It looks increasingly likely that we are already past the bottom of the latest economic downturn, with GDP potentially getting back on a positive growth trajectory as early as May.

That won’t be enough to prevent a historically large drop in Q2 output– likely multiples of the decline in Q1–but it would leave the data tracking along the more “optimistic” end of the -15% to -30% growth range estimated by the Bank of Canada in their last Monetary Policy Report. Government support programs for those losing work have been unprecedented–household disposable income actually edged up slightly in Q1 despite the large drop in overall economic activity, boosted by government transfers. With the decline in spending in March and April and the rise in disposable income, the savings rate is soaring. All of us are saving money by doing our own cooking and cleaning. We aren’t travelling and shopping is certainly limited, not to mention the savings on gasoline, entertainment, hairstyling and gym memberships. Hopefully, this could provide a cushion to support spending and the economy will turn sharply higher in Q3.

Still, the three million jobs lost over March and April will not be recouped quickly. The lockdown is easing only gradually, and any activities requiring large gatherings–think tourism, conferences, concerts, movies and sports–will remain closed until there is a vaccine or effective treatment. We expect things will begin to get better from this point, but still look for the unemployment rate to remain elevated at 8.5% in Q4 of this year. It is currently 13%.

The Housing Outlook

Much has been made of the recent CMHC Housing Market Outlook report released this week. The gloomy outlook of up to an 18% drop in home prices, a delayed recovery not until 2022, and a 20% arrears rate garnered headlines. First-time homebuyers were warned that housing was no longer a good investment, at least not over a three-year horizon. But the CMHC’s own data shows that home prices have risen an average of 5% annually over the past twenty-five years. And though no one’s retirement nest egg should consist solely of their residential real estate, a home is one of the few investments that you can actually use. People buy homes for many reasons well beyond wealth accumulation. The pride of ownership and lifestyle choice dominates the decision to buy for many.

Also this week, the Governor of the Bank of Canada suggested that the doomsters were overly pessimistic and asserted his view that the economy would recover from its medically induced coma much faster than the pessimists were suggesting. Clearly, none of us have a crystal ball, nor have we ever before experienced a pandemic recession. While we rise from the abyss, the pain may well be far from over. People are still losing jobs and many businesses continue to sink. Any recovery is dependent on whether the virus cases keep slowing and whether there is a second wave of infections.

But oil prices have risen sharply, a major boon for Alberta and some high-frequency data have improved. The stock market is well off its lows, interest rates have fallen sharply and the qualifying rate for mortgage stress tests has fallen to 4.94%. Actual mortgage rates are near record lows and are likely to remain low for the foreseeable future.

In time, immigration to Canada will restart, and foreign students will return. New businesses are blossoming even now and many sectors will continue to advance. To name a few, we are seeing burgeoning growth in telemedicine, artificial intelligence, big data analysis, cloud services, cybersecurity, 5G, home entertainment, virtual everything, home fitness, DYI renovations, indeed, DIY anything. By Dr. Sherry Cooper Chief Economist, Dominion Lending Centres.

![]()

Mortgage Interest Rates

Fixed mortgage rates appears to have bottomed out with rates right back at historically low levels. Variable rates discounts deepened in the last week to become more competitive and appealing compared to fixed rates. View rates Here – and be sure to contact us for a quote to help you find the lowest rate for your specific needs and product requirements.

The Bank of Canada’s kept it’s overnight rate is 0.25%. Prime lending rate remains at 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is 4.94%.

Mortgage Update – Mortgage Broker London

Your Mortgage

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options and the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

We encourage you to follow guidelines from our public health authorities:

Middlesex Health Unit

https://www.healthunit.com/novel-coronavirus

Southwestern Public Health

https://www.swpublichealth.ca/content/community-update-novel-coronavirus-covid-19

Ontario Ministry of Health

https://www.ontario.ca/page/2019-novel-coronavirus

Public Health Canada

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Factual Statistics Coronavirus COVID-19 Globally:

https://www.worldometers.info/coronavirus/

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6