Industry & Market Highlights

Coronavirus COVID-19: Helping our Clients

As this COVID-19 pandemic continues to evolve, we want you to know that we will be doing everything we can to support our customers and clients through this difficult time, both with their financial needs and also their safety and well-being.

iMortgageBroker is setup to service our clients all over Ontario, whether you prefer in person, or remotely: virtually or over the phone. As long as you have access to a phone and also internet, or scan email, or fax, or courier services, or can drop documentation at our office – we have you covered.

We are actively monitoring the Coronavirus (COVID-19) situation and are taking precautionary measures to help keep our communities safe. We are implementing best practices to prevent the spread of the virus so that we can be there to help when you need us.

To help with prevention for in person meetings we are taking these added precautions to keep our clients and agents safe:

Staff will be wearing face masks for in person face-to-face consultations and meetings, and will be avoiding direct contact.

We follow the local Municipal Health Unit directions for prevention of spreading germs with frequent disinfection of used surfaces and washing of hands. See the details here.

We ask our customers who are concerned about their health, or who are concerned that you may have contracted the virus to allow us to serve you remotely. PLEASE follow the Government Canada Public Health Agency directions on how to protect yourself and others. See the details here.

Thank you for doing your part to help keep our communities safe, and for supporting one another as we navigate through this difficult time together.

The Public Health Agency of Canada recommends that we all take the following everyday precautionary measures to help prevent the spread of germs and viruses:

- Wash your hands thoroughly and often with soap and water for at least 20 seconds. If soap and water are not available, use an alcohol-based hand sanitizer

- Avoid touching your face, eyes, nose and mouth

- Avoid close contact with people who are sick

- Stay home when you are sick

- Clean and disinfect frequently touched objects and surfaces

- Cover your mouth and nose with your arm when coughing and sneezing

- Avoid all non-essential travel

One last thought: It is okay to say “Hi” to new faces and old friends during a health pandemic and show you care without physical touch. A sincere smile, kinds words and caring for others goes a long way!

Extraordinary Coordinated Policy Actions To Ease the Economic Impact of Pandemic In Canada

Prime Minister Justin Trudeau said Canada would introduce a “significant” fiscal stimulus package, as part of a coordinated effort with other Group of Seven countries to counter the virus-driven global economic slowdown and calm markets. In an exceptional press conference held at 2 pm today, Finance Minister Morneau sat at the side of the Governor of the Bank of Canada, and the head of the Office of the Superintendent of Financial Institutions (OSFI) to announce measures to soothe financial markets, boost confidence and support the Canadian economy.

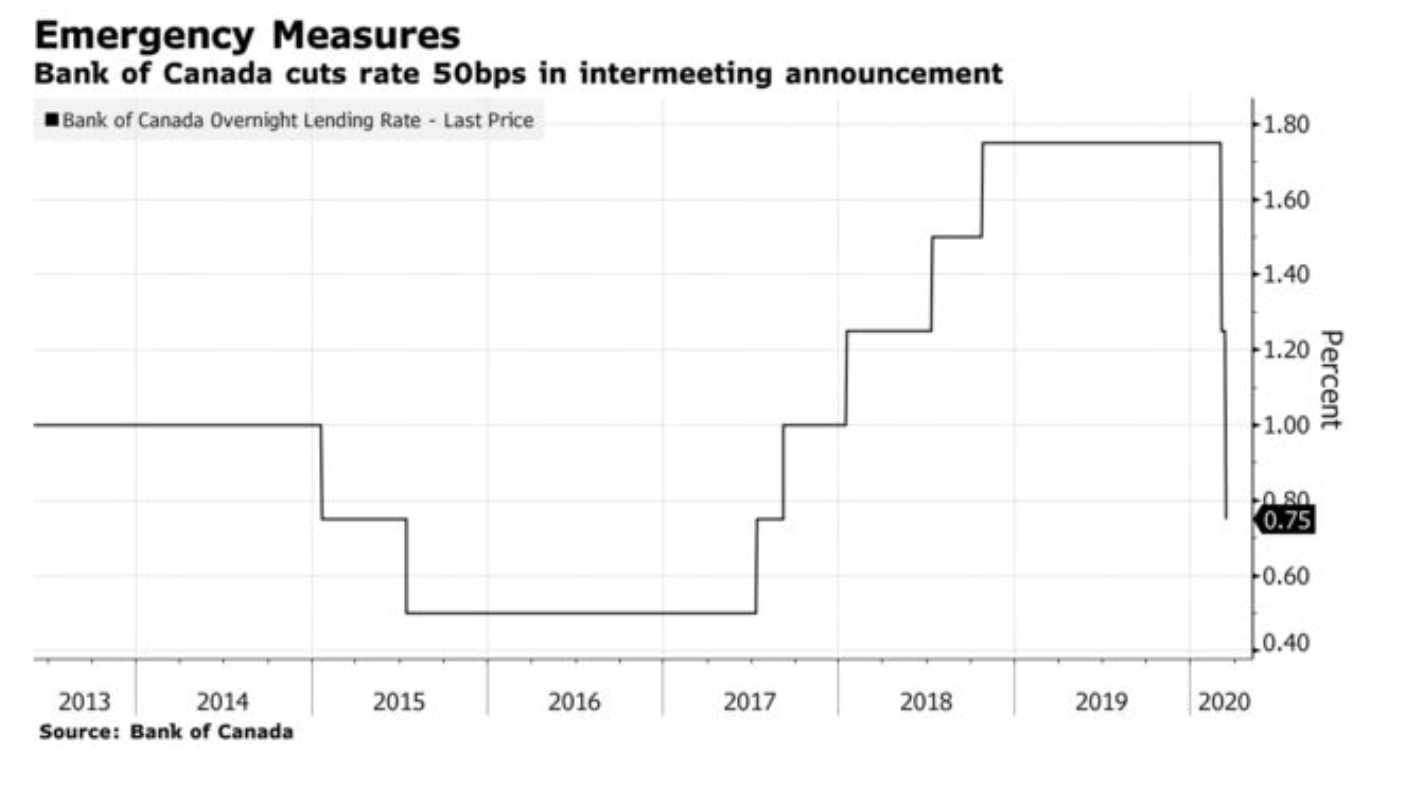

Only nine days after the Bank of Canada cut the overnight policy rate by 50 basis points to 1.25%, Governor Poloz announced another 50 bps reduction in the policy rate to a level of 0.75%. Here is the Bank of Canada’s official statement:

- “The Bank of Canada today lowered its target for the overnight rate by 50 basis points to ¾%. The Bank Rate is correspondingly 1%, and the deposit rate is ½ percent. This unscheduled rate decision is a proactive measure taken in light of the negative shocks to Canada’s economy arising from the COVID-19 pandemic and the recent sharp drop in oil prices.

- It is clear that the spread of the Coronavirus is having serious consequences for Canadian families, and for Canada’s economy. In addition, lower prices for oil, even since our last scheduled rate decision on March 4, will weigh heavily on the economy, particularly in energy-intensive regions.

- The Bank will provide a full update of its outlook for the Canadian and global economies on April 15. As the situation evolves, Governing Council stands ready to adjust monetary policy further if required to support economic growth and keep inflation on target.”

- The Bank has also taken steps to ensure that the Canadian financial system has sufficient liquidity. These additional measures were announced in separate notices on the Bank’s website. The Bank is closely monitoring economic and financial conditions, in coordination with other G7 central banks and fiscal authorities.”

At the press conference, a reporter asked Poloz whether he would take the policy rate down to negative levels. He responded that he “does not like negative interest rates” and that “there is sufficient fiscal firepower in Canada” so that, hopefully, “negative interest rates are not likely to be needed.”

He also commented: “Combined with the other measures announced today, lower interest rates will help to support confidence in businesses and households. For example, borrowing costs will be lowered both for new purchases of homes and through variable-rate mortgages and mortgage renewals.”

Today, the Bank also announced a new Bankers’ Acceptance Purchase Facility. This facility will support a key funding market for small- and medium-sized businesses at a time when they may have increased funding needs, and credit conditions are tightening. The facility will buy 1-month BAs starting the week of March 23. More details are forthcoming. This comes in addition to introducing a 6-month and 12-month bi-weekly repo operation yesterday.

Finance Minister Morneau announced he would deliver a fiscal stimulus package next week that will include an additional $10 billion in new funding to the country’s two business financing agencies — the Business Development Bank of Canada and Export Development Canada. This announcement follows $1 billion of funding for the country’s public health response outlined earlier this week, which came with some modest measures to support disrupted workers.

So significant fiscal stimulus measures are coming next week. There were no details on the size of these measures, but something on the order of 1% of GDP seems like a reasonable estimate. Mr. Morneau also noted that the government is looking at providing direct aid to individuals and families. The floodgates are about to be flung open.

The final bit of stimulus came from OSFI’s lowering capital requirements for the Big Six Canadian banks. Jeremy Rudin, head of Canada’s banking regulator, announced he would reduce the nation’s “domestic stability buffer” by 1.25 percentage points of risk-weighted assets, effective immediately. The buffer will drop to 1%, from its prior level of 2.25%. He said that the government is looking at providing direct aid to individuals and families. This action will free up about $300 bln in funds for the big banks to lend. It will also offer some solace to the stock market, where bank stock prices have plunged in the past two weeks. Concern about the Canadian banks’ balance sheets is always rife when markets are stressed.

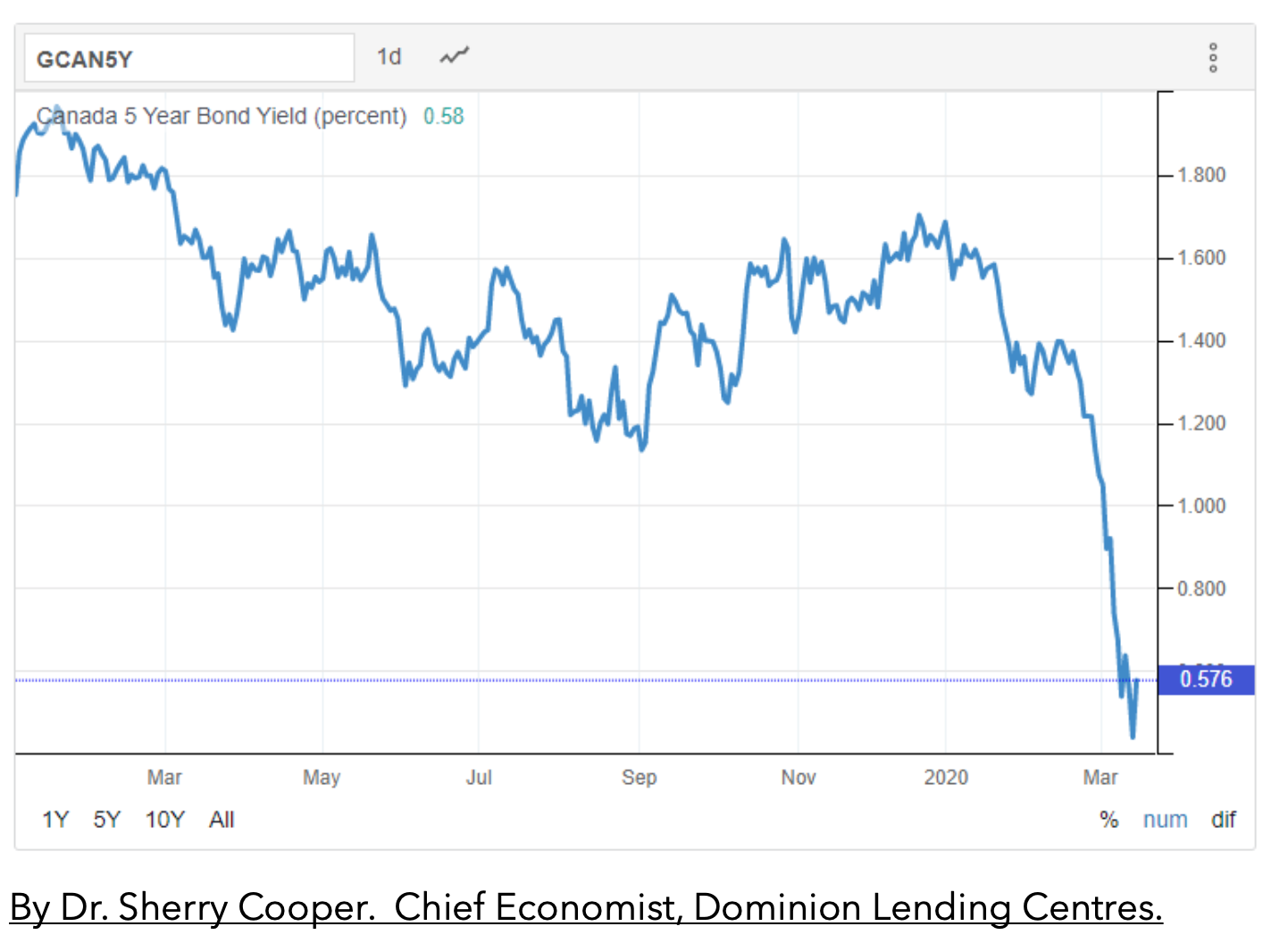

In another move, the government announced that it is suspending consultation on the proposed change to the uninsured mortgage stress test. The insured stress test revision will start on April 6 as planned. OSFI wants to wait until markets return to more normal activity before making a final decision on the insured qualifying rate. Hopefully, banks will cut their posted mortgage rates in response to the combined 100 bp decline in the overnight rate and the plunge in 5-year bond government yields (see chart below). As of yesterday, March 12, the BoC Daily Digest held the conventional mortgage rate (5-year, aka the posted rate) steady at 5.19%.

We will now watch what the Canadian banks do in response to these actions. Will they cut their prime rates another full 50 basis points? And will they pass that on to borrowers of variable-rate mortgage money? Monday will be an interesting day.

Bottom Line: This is an excellent start to getting ahead of what will likely be a very challenging period for the Canadian economy. However, we need to see more of the details. Look for additional fiscal stimulus to be announced in the coming days and weeks (from the federal government as well as the provinces), and expect the Bank of Canada to ease policy rates another 50 bps to a level of 0.25% for the overnight benchmark rate by April. And, if conditions deteriorate more than anticipated, there’s room for the BoC, government and OSFI to do more.

This is in direct contrast to the inept and disjointed policy response south of the border. Hopefully, the financial markets will take note that Canada is far better equipped both financially as well as from a public health perspective than our recent stock market performance has suggested.

Residential Market Commentary – Buying season off to a brisk start

The annual spring home buying season seems to have jumped the gun and is already out of the blocks. Canada’s biggest and busiest markets are reporting significant sales and price increases based on activity recorded even before the announced easing of the B-20 stress test and the, coronavirus inspired, drop in the Bank of Canada rate.

February figures from Greater Vancouver show a 45% sales increase over a year earlier. Toronto is reporting a 46% jump. Calgary, which has been struggling because of the depressed energy sector, saw a 23% increase. Montreal continues to boom with a record setting 5,334 sales in February – a 23% increase over a year ago.

Of course, last February’s numbers were extraordinarily low, which takes some of the shock value out of the increases. However, prices are seeing renewed acceleration.

Vancouver’s MLS composite benchmark price stands at $1.02 million. That is just 0.3% higher than a year ago, but it is a 2.7% increase over the past six months. In Toronto the composite benchmark price increased by 10.2%. The average sale price for all types of housing rose to $910,000. (The average price for a detached home has, once again, topped $1 million.) Montreal’s median price is up about 12%. Calgary remains, essentially, flat.

Markets across the country are tightening as sales outpace new listings, signalling the strong probability of even greater price acceleration.

Given the recent actions of the BoC, the announced intentions of the federal government, and the slumping bond market it seems unlikely there will be any move to step on the brakes. By First National Financial.

Ontario’s Property Assessment System, Re-assessment of all properties in Ontario in 2020

The Municipal Property Assessment Corporation (MPAC) is an independent, not-for-profit corporation funded by all Ontario municipalities. Our role is to accurately assess and classify all properties in Ontario. We do this in compliance with the Assessment Act and regulations set by the Government of Ontario.

We are the largest assessment jurisdiction in North America, assessing and classifying more than 5.3 million properties with an estimated total value of $2.78 trillion in 2018.

We are accountable to the Province, municipalities and property taxpayers of Ontario through a 13-member Board of Directors. The Board of Directors is comprised of provincial, municipal and taxpayer representatives appointed by the Minister of Finance.

MPAC completes a province-wide Assessment Update every four years based on a legislated valuation date. The valuation date, established by the Ontario government, is a fixed day on which all properties are valued.

The last province-wide Assessment Update took place in 2016, based on a January 1, 2016 valuation date. In 2020, MPAC will update the assessments of all properties in Ontario to reflect a new legislated valuation date of January 1, 2019. These assessments will be in effect for the 2021-2024 property tax years.

To provide an additional level of property tax stability and predictability, market increases in assessed value between Assessment Updates are phased in gradually over four years. A decrease in assessed value is introduced immediately.

Annual property assessment increases are revenue neutral, which means they have no impact on the total property tax amount that a municipality might raise. Rather, these changes provide for a redistribution of property taxes within a municipality, based on the value of the property owned. Learn more in this video: https://www.youtube.com/watch?v=xgGbLotF_QQ.

Visit the MPAC Fact Sheet for more information here.

![]()

Mortgage Interest Rates

Prime lending has lowered an additional 50 bps is 2.95%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is still at 5.19% but changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

Fixed rates are moving down further with lower bond yields. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive again.

View rates Here – and be sure to contact us for a quote as rates are moving faster than can be updated.

![]()

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalized your decision when you are certain you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients needs to ensure your best interest is protected. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!