Industry & Market Highlights

Mortgage business on the move

In an effort to fill in some of the gaps in the country’s housing market data Canada Mortgage and Housing Corporation has launched a new Residential Mortgage Industry report. The agency says the report is designed to support “evidence-based policy and informed decision making within the housing finance sector.”

Not surprisingly the report confirms that Canada’s big banks have the vast majority of the country’s residential mortgage business with a 75% share. The average mortgage is a little less than $221,000 and their delinquency rate is just 0.24%.

Credit Unions hold 14% of the market, with an average mortgage value of $151,000 and a delinquency rate of 0.17%. Mortgage finance companies have 6% of the market, an average mortgage of $258,000 and a delinquency rate of 0.25%.

So called “alternative lenders” – mortgage investment companies (MIC) and private lenders – have a market share of just 1.0%, an average mortgage of $195,000 and a delinquency rate of 1.93%.

While the alternative lenders have the smallest slice of the pie many market watchers are concerned that their share is growing while overall mortgage origination have declined.

In 2018 the growth of mortgage originations hit its lowest level in 25 years. At the same time mortgage investment companies (MICs) increased their share of originations, more than doubling their share of the mortgage stock.

Overall, 200 to 300 active MICs and private lenders held an estimated $13 billion to $14 billion of mortgages outstanding, up from $12 billion estimated for 2017 and $10 billion in 2016.

Tougher mortgage stress testing is seen as a key reason home buyers are moving to alternative lenders where the terms are easier, but more expensive. CMHC says a culture shift from owning to renting helps explain the drop in mortgage originations. Of course, that shift is likely a response to the tougher mortgage qualifying rules as well.

By First National Financial.

Bank of Canada Holds Policy Rate Steady Amid Global Uncertainty

It is rare for the Bank of Canada and the US Federal Reserve to announce rate decisions on the same day, but today’s announcements highlight the stark differences in policy in the two countries. The Bank this morning announced they would maintain their target for the overnight rate at 1.75% for the eighth straight meeting. The Fed is widely expected to cut its target for the fed funds rate by another 25 basis points, taking it below the key rate in Canada for the first time since 2016. More than 30 central banks have cut interest rates in the past year and the Bank of Canada in today’s Policy Statement highlighted the weakening in the global economic outlook since the release of its July Monetary Policy Report (MPR).

In today’s MPR, the Bank revised down its forecast for global economic growth this year to below 3.0%, reflecting a downward revision in growth in the United States to 2.3% (from 2.5%), the Euro area (to 1.1% from 1.2%), oil-importing emerging market economies and the rest of the world. China’s growth pace remains at a 30-year low of 6.1%.

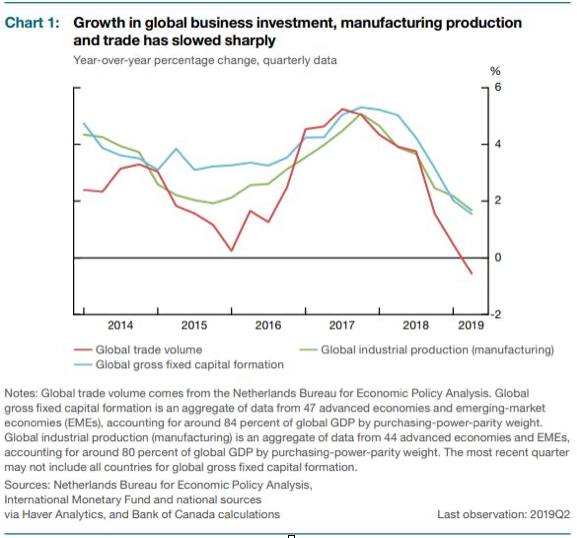

Trade conflicts and uncertainty are weakening the world economy to its slowest pace since the 2007-09 economic and financial crisis. The slowdown has been most pronounced in business investment and the manufacturing sector and has coincided with a contraction in global trade (Chart 1). Despite the manufacturing slowdown, unemployment rates continue to be near historic lows in many advanced economies, as growth in employment in service sectors has remained resilient.

Growth is projected to strengthen modestly to around 3.25% by 2021, with a pickup in some emerging-market economies (EMEs) more than offsetting slower growth in the United States and China.

Canada has not been immune to these developments. Commodity prices have fallen amid concerns about global demand. Despite this, the Canada-US exchange rate is still near its July level, and the Canadian dollar has strengthened against other currencies.

Growth in Canada is expected to slow in the second half of this year to a rate below its potential. This reflects the uncertainty associated with trade conflicts, the continuing adjustment in the energy sector, and the unwinding of temporary factors that boosted growth in the second quarter. Business investment and exports are likely to contract before expanding again in 2020 and 2021. At the same time, government spending and lower borrowing rates are supporting domestic demand, and activity in the services sector remains robust. Employment is showing continuing strength and wage growth is picking up, although with some variation among regions. Consumer spending has been choppy but will be supported by solid income growth. Meanwhile, housing activity is picking up in most markets. The Bank continues to monitor the evolution of financial vulnerabilities in light of lower mortgage rates and past changes to housing market policies.

Canadian Economy Boosted By Housing

The Canadian economy grew at a moderate pace over the past year, supported by a healthy labour market and the recent turnaround in housing. However, global trade conflicts and related uncertainty dampened business investment and export activities, and investment in the energy sector continued to decline. The impact on growth of both global headwinds and energy transportation constraints is expected to diminish, and the pace of economic expansion should gradually pick up in 2020 and 2021.

In 2020 and 2021, Canada’s economy is anticipated to grow near potential. Consumer spending is projected to increase at a steady pace, and housing activity to continue its ongoing recovery. Overall, investment and exports are anticipated to grow moderately. In the energy sector, investment is forecast to stabilize, and oil exports should improve as pipeline and rail capacity gradually expands.

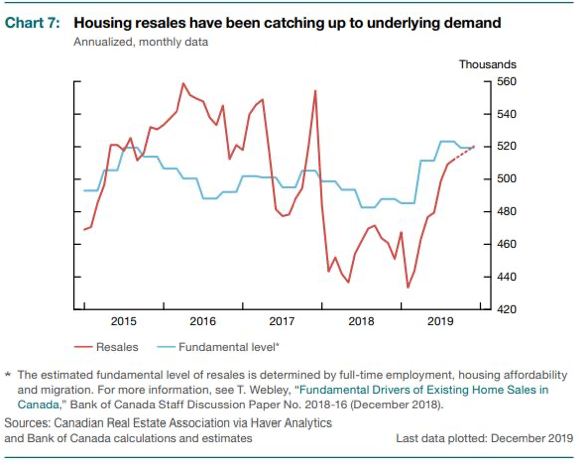

In today’s MPR, the Bank states that housing resales have been catching up to underlying demand (see chart 7 from the MPR). Housing markets generally reflect regional economic conditions. Housing starts and resales have been particularly robust in Quebec and Ontario, where labour markets have been strong. These provinces will likely continue to be the main drivers of the growth in residential investment. In Alberta, where the oil industry is expected to stabilize, modest improvements in housing are expected. In British Columbia, residential investment has recovered in recent months and

should remain near current levels, reflecting the creation of new households.

Bottom Line

The dovish tone of today’s policy statement suggests that the Bank of Canada has become more cautious in its holding pattern amid a weakening global economy. The central bank “is mindful that the resilience of Canada’s economy will be increasingly tested as trade conflicts and uncertainty persist,” policymakers led by Governor Stephen Poloz said in the statement. “In considering the appropriate path for monetary policy, the Bank will be monitoring the extent to which the global slowdown spreads beyond manufacturing and investment.”

The statement and the fresh batch of more pessimistic growth forecasts will raise questions about the central bank’s commitment to a neutral stance on rates, particularly in the face of global easing in many other countries that has made the Bank of Canada an outlier. If the Federal Reserve lowers its interest rates later today, as expected, the Bank of Canada would have the highest policy rate in the industrialized world.

It may well be that the Bank of Canada cuts rates early next year. Mitigating this prospect is that the Bank was more bullish on consumption and housing–fueled by the robust labour market. Another source of future growth is additional fiscal stimulus from Prime Minister Justin Trudeau’s newly elected Liberal government, which has promised to implement new spending and tax cuts next year. For now, the Bank is maintaining a neutral stance.

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

Canadian Real Estate Reality Check

From a housing perspective, it was an interesting and enlightening 40 days leading up to Canada’s 2019 federal election. Justin Trudeau’s new mandate was far from a landslide win, resulting in a Liberal minority government at the helm. This means Liberals will need the support of the other parties to pass legislation. Could this prospect of collaboration be a saving grace for Canada’s housing?

One thing Canadians have agreed on is that housing affordability and the cost of living are a top priority. The question about which party would effectively address those concerns was largely up in the air, and it still is.

The new minority government could be just what Canada needs to pull it out of this housing quagmire, which only seems to have gotten muddier since the Liberals took power in 2015. The last four years have seen skyrocketing housing prices and rents rising in lockstep, while housing supply dwindles.

This story of unsustainable growth in parts of Ontario is offset by the turmoil in Western Canada, with Liberal policies taking the brunt of the blame for what’s happening in British Columbia, Alberta and Saskatchewan. Generally speaking, the Liberals haven’t had positive impacts on real estate – yet.

The solution to Canada’s housing woes, at least for the next four-year term (barring any political shake-ups, which could cut that short) might be found through collaboration.

The Conservatives and New Democrats laid out some seemingly solid plans to address the housing crisis in their 40-day campaign period, tabling changes to the mortgage stress test, a return of 30-year amortizations for first-time homebuyers (even though it’s likely that both of these policies would have only pushed prices up in the long run) and addressing housing supply. Meanwhile, the Liberals are largely planning to stay the course, much to the chagrin of many Canadians who have been hoping, if not praying, for real estate relief.

With that being said, Team Trudeau has made some moves on the housing front over the last four years.

The National Housing Strategy is one of the wins, established in 2017 to help reduce homelessness and increase the availability and quality of affordable housing, at a cost of $50 billion over 10 years. Trudeau also increased the amount first-time homebuyers can withdraw from their registered retirement savings plan, from $25,000 to $35,000. And let’s not forget about the First-Time Home Buyer Incentive, an interest-free government loan covering up to 10 per cent of a home’s price, to lower the mortgage payments.

On the questionable side of the Liberals’ 2019 campaign was their promise to boost the First-Time Home Buyer Incentive amount in Toronto and Vancouver, to offset the sky-high prices in these markets. But when the average home hovers around $800,000 and $1 million respectively, the First-Time Home Buyer Incentive isn’t much of an incentive. The Liberals have also tabled a one-per-cent speculation tax on vacant homes owned by foreigners, which could limit price growth. But in reality, this policy won’t have much impact on the average Canadian.

What the Liberals have failed to address entirely is the prohibitive mortgage stress test, which was implemented to put the brakes on Canada’s runaway housing markets. While it did help rein in unprecedented price growth in Toronto and Vancouver, the policy has come under scrutiny for being outdated and ultimately, a barrier to home ownership. I am 100 per cent supportive of responsible debt levels and policies to ensure that goal, but even with the recent modifications, the mortgage stress test is more hindrance than help.

Another gap in the Liberals’ platform is the issue of housing supply, which is at the crux of our affordability crisis. Between the lack of rental housing and supply of affordable housing and less incentive for developers to build new communities, Canada is experiencing a serious housing shortage. This is particularly true in Vancouver and Toronto, where the average cost of living continues to tick upward, and residents are left scrambling for affordable alternatives.

It seems to me that Trudeau needs a reality check, which may come from the Conservatives, NDP and Bloc Québécois. By taking the best proposals put forth by each party, perhaps a patchwork solution will be found. But the collaboration can’t stop at the federal level. Trudeau must work closely with provincial and municipal governments, as well as the private sector, to create more housing supply.

Many Canadians, especially millennials, new immigrants and those employed in the so-called “gig economy” feel home ownership is becoming less tangible by the day. While politicians of all stripes acknowledge the mounting urgency of affordable housing, few are offering any timely or compelling solutions.

Real estate is still one of the safest and most reliable financial investments for Canadians. As real estate professionals, it’s our duty to help prospective homebuyers navigate this tricky landscape. Outside of creating more supply and affordable housing, I urge governments to refrain from meddling with the private real estate market. History shows that whenever they do, the effects are mostly detrimental.

I urge Canada’s new government to work together to develop a national housing strategy that addresses all issues relating to affordability. The health of Canada’s housing is at stake. By Christopher Alexander

Mortgage-free or diversity?

Canadians put a high priority on paying off their mortgage debt – sometimes maybe a little too high.

Paying off debt is always a good move. Wanting to be mortgage free is a laudable goal. Making it your only goal may not be as sound.

Traditionally paying off your mortgage as quickly as possible has been seen as one of the best routes to financial success. Interest rates used to be higher. Some will remember that nasty period in the ‘80s and ‘90s when they were in double digits. Even the 5% and 6% rates in place just before the Great Recession make today’s rates seem cheap. So it can make more sense to take your focus off of your home and mortgage and view them as part of a more diversified investment strategy.

Over the past 10 years stock markets have tended to deliver rates of return that are markedly higher than mortgage interest rates. By diverting some money away from your mortgage you could invest through RSPs or TFSAs. It has been shown that people who start investing when they are young end up wealthier later in life.

Of course markets do fluctuate and some people prefer the stability of the “guaranteed return” that comes with paying down a mortgage. It is a form of enforced saving. There is also a sense of security that comes with mortgage free home ownership in the case of job loss or a sudden drop in income.

There is also protection in diversification. Because you have expenses that go beyond your mortgage, having a collection of smaller assets can be useful. If money gets tight you could sell a lesser investment in order to pay other bills.

While it is never a bad plan to pay down your mortgage faster, it is always a good plan to diversify and spread around your assets and your risks. As the old expression says, “Don’t put all your eggs in one basket.” By First National Financial.

Toronto real estate ranked second-highest bubble risk in the world

The real estate bubble risk in Toronto is the second-highest in the world, according to data from the UBS Global Real Estate Bubble Index 2019. Canada’s largest city has a risk of 1.86, which is second only to Munich, which has a risk of 2.01. Amsterdam and Hong Kong tie for third place with a risk of 1.84.

Vancouver still poses a threat with a risk of 1.61, although that is a modest drop from its assessment of 1.92 in 2018. Toronto also experienced a slight drop from its 2018 risk of 1.95, and even more from its 2017 bubble risk of 2.12.

The UBS Global Real Estate Bubble Index gauges the risk of a property bubble—defined here as the substantial and sustained mispricing of an asset—on the basis of patterns of property market excesses. Signs typically include a “decoupling” of prices from local incomes and rents and imbalances in the real economy, such as excessive lending and construction activity.

“Low affordability already poses one of the biggest risks to property values in urban centers. If employees cannot afford an apartment with reasonable access to the local job market, the attractiveness and growth prospects of the city in question drop,” write Head of Swiss & Global Real Estate Claudio Saputelli and Head of Swiss Real Estate Investments Matthias Holzhey in the report.

These drops are often followed by attempts to curb price appreciation through regulatory measures, what have served to correct the market in the most overheated cities in recent years. In fact, real prices in the top four ranking cities in the 2016 UBS Global Real Estate Bubble Risk Index have fallen on average by 10%.

Between 2000 and 2018 real home prices in the Canadian cities in the UBS Index (Vancouver and Toronto) rose consistently by more than 5% each year. But, the report reads, over the last four quarters, price growth has stalled.

“The introduction of taxes on foreign buyers, vacancy fees and stricter rent controls seem to have taken effect. While the average price level in Toronto has remained broadly unchanged from last year, prices in Vancouver are down by 7%,” the report reads. “Lower mortgage rates are supportive, but cannot outweigh lower economic growth.”

In other words, while homes are still overvalued, the housing frenzy seems to have come to a halt—for now.

In Toronto, home prices almost tripled between 2000 and 2017, and although measures have been put in place to address affordability, a major price correction seems unlikely in the near future due to factors such as a weakening Canadian dollar and low housing supply. In Vancouver, the growth rates have reversed from higher than 10% to -7% in just two quarters, and the market remains vulnerable to the slightest shift in demand. Regional housing supply in Vancouver is increasing, although prices are 75% higher than they were 10 years ago.

In both cities, the report states that favourable financing conditions are keeping home prices high, although affordability remains a key risk.

There are, however, several differences between today’s bubbles and those that destroyed the American housing market more than a decade ago, dragging parts of the world down with it. Currently, lending growth is on par with GDP growth, which is in contrast to the run-up to the Great Financial Crisis, when outstanding mortgage volumes increased up to 2.5% faster than GDP, according to the UBS report.

Toronto and Vancouver are the only cities in North America that have a high risk of having real estate bubbles; with the exception of Hong Kong, all other high-risk cities are in the Eurozone. By by Kimberly Greene.

Ownership registry to help stamp out money laundering in housing

The creation of a beneficial ownership registry is one of the most effective ways to fight money laundering in Canadian real estate, according to Ontario Real Estate Association CEO Tim Hudak.

In a recent contribution to the Toronto Sun, Hudak noted that such a public database would make it easier to determine a property’s ownership, thus ensuring much improved transparency and accountability.

“It would allow law enforcement, tax authorities, media and everyday citizens to search for properties of corrupt officials, their families or people they may know who are involved in money-laundering crimes, and better connect money from criminal acts overseas to property purchased in Canada,” Hudak wrote.

Said system would compel companies, trusts, and partnerships to disclose beneficial owners, most particularly controlling shareholders and partners.

Fortunately, the infrastructure to readily implement such a registry is already in place, the OREA chief assured.

“Teranet, the exclusive provider of Ontario’s online property search and registration, already operates one of the most advanced, secure and sophisticated land registration systems in the world. To add the Beneficial Ownership Registry to its current platform would be a smart move to further increase transparency in housing transactions.”

Hudak cited research by Transparency International Canada, which found that since 2008, more than $28.4 billion worth of homes in the GTA alone were bought by shell companies.

“The problem is we don’t know how much of this money comes from legitimate businesses and how much are anonymous front companies hiding laundered money,” he stressed. “What we do know is the dirty money coming into our housing market is competing against hard-working young families trying to buy homes — and that has to stop.”

Hudak’s comments mirrored those of former RCMP top investigator Henry Tso. Earlier this year, Tso warned that Canada’s justice system currently has significant loopholes – most notably, toothless prosecution, feeble sentencing, and insufficient resources for law enforcement – that promote the growth of fraud as a business.

“Currently, weak corporate transparency rules in Canada allow criminals to hide behind anonymous shell companies and wash large amounts of money through housing. That’s because shell companies are permitted to buy homes without disclosing the names of the beneficial owners — those who enjoy the benefits of ownership even though the title of the property is in someone else’s name,” Hudak stated. By Ephraim Vecina

Economic Highlights

Canadian economy now feeling the heat of global pressures

Latest Statistics Canada economic data indicated that Canada is not as impervious to global turmoil as initially thought.

“It also reinforces the Bank of Canada’s decision on Wednesday to keep rates unchanged for the eighth consecutive meeting, though policy makers signaled they are leaving the door open for a rate cut in December,” BNN Bloomberg reported.

In the wake of a flat GDP reading in July, the national economy’s 0.1% August growth was slower than expert predictions of 0.2%, “reinforcing the view the nation’s economy is showing signs of decelerating into the second half of the year,” the report added.

Despite the languid pace, fully 14 of 20 sectors grew during the month. Manufacturing accounted for the bulk of the August expansion, going up by 0.5%.

However, the 3.7% annual growth observed during the second quarter might deteriorate during Q3, StatsCan warned.

Fortunately, Canada can still expect greater consumer purchasing power in the near future, with the addition of almost 54,000 jobs in September. This far outstripped earlier expert predictions of just 7,500 new jobs, and accompanied a decline of the national unemployment rate to a near-record low of 5.5%.

CIBC World Markets Inc. chief economist Avery Shenfeld argued that on the whole, the Canadian economy can maintain its robustness against fluctuations in global trade currents through its healthy workforce growth.

“Canada’s labour market seems to have been vaccinated against the global economic flu going around,” Shenfeld wrote in a mid-October investor note, as quoted by Bloomberg. By Ephraim Vecina.

BoC has clearer path to a rate cut

The Bank of Canada has remained – somewhat defiantly – on the sidelines yet again, but it is feeling the pressure to get back into the game and one obstacle has now been removed.

The bank held its benchmark rate at 1.75% for an eighth straight setting. At the same time it has clearly signalled it may not be able to hold that line much longer. In its quarterly Monetary Policy Report (MPR) the bank pointed directly at trade conflicts (such as the U.S. – China tariff war) as the key cause of a global economic slowdown. Growth has fallen to its lowest level since the financial collapse in 2007. Around the world more than 35 other central banks have already cut rates in an effort to keep growth from stopping altogether.

The U.S. Federal Reserve has made three cuts in the past several months. That has boosted the strength of the Canadian dollar which makes the country’s exports more expensive on the world market. Given that the central bank has been counting on more business investment and spending to pick up the economic slack as debt-burdened consumers switch from spending to saving and repaying their loans, headwinds for exports and business are unwelcome.

The BoC, however, is not concerned that a drop in interest rates will trigger a renewed frenzy of debt-funded consumer spending. It is satisfied that the biggest component of household debt – mortgages – have been stabilized by the B-20 regulations. And another big obstruction has been removed. The federal election is over so the bank can operate without risking the appearance of political favouritism. By First National Financial.

The Bank of Canada: What it is, what it does

In an earlier commentary we took a look at what central banks are and what they do. In this piece we focus on the Bank of Canada.

Like other central banks around the world the Bank of Canada has the broad responsibility for managing the economic and financial welfare of the country.

The Bank of Canada was founded in 1934 and it is relatively young by central bank standards. In 1938 it became a Crown Corporation, which means it is owned by the federal government. The bank is governed by legislation in the Bank of Canada Act which says the bank exists “to regulate credit and currency in the best interests of the economic life of the nation.”

There are three main ways the Bank of Canada shows up in our daily lives.

Monetary Policy is designed to preserve the value of money. This is the part of the bank’s job that most people know about, because it gets the most coverage in the media. The factor in monetary policy is managing inflation to keep it low, stable and predictable.

The bank’s main tool for managing inflation is interest rates. The bank sets its Policy Rate eight times a year. It is the rate large financial institutions are charged when they borrow money from the Bank of Canada, or each other, to settle their daily accounts. The Policy Rate is also known as the “overnight” rate.

Financial institutions base their interest rates on the Policy Rate. As it goes up or down so do the rates for business and consumer borrowing such as variable rate mortgages, lines of credit and car loans. Raising interest rates makes borrowing and spending more expensive which slows down economic activity and inflation. Lowering rates does the opposite.

The Policy Rate can also influence the value of our dollar which affects the cost of Canadian goods and services on world markets. Higher interest rates tend to increase the value of the Canadian dollar, making Canadian goods more expensive which, again, slows economic activity and inflation.

So, you can see the bank is performing an economic balancing act.

The Bank of Canada is known as “the banker’s bank” and it helps manage and regulate the country’s Financial System. The bank facilitates borrowing and investing for Canada’s large financial institutions and it regulates those institutions. The bank controls how much they can lend out by setting standards for how the loans are secured and imposing cash reserve requirements.

The most obvious way the Bank of Canada enters our lives is through our Currency. The bank is responsible for designing, issuing and delivering bank notes (coins are the responsibility of the Royal Canadian Mint). By First National Financial.

![]()

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.19%. Fixed rates moved up slightly. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

![]()

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.