Industry & Market Highlights

Canadians are smarter that that

The liberal government has been very disruptive to the real estate and mortgage industry, and has severely negatively affected the economic prosperity of most Canadians. First the Liberal Government created lending rules that were not in the best interest of Canadians, and now in the months leading up to a new elections they bring about a “pseudo benefit” for first time buyers. As if that is not blatant enough now this…: “If you don’t vote for us, there’s nothing to help you.’’

‘It is not free money’: Canada’s new homebuyers’ incentive program is not for everybody

Here’s a look through the fine print of the program, along with some tips for Canadians looking to purchase their first house. Nicole Wells, RBC’s vice-president of Home Equity Financing, goes through the fine print of the new homebuyers’ incentive program with the Financial Post’s Larysa Harapyn and offers tips for Canadians looking to buy their first home. By Vanouver Sun. View the Video Here.

Pressure mounts on federal parties to amend B-20 ahead of election

With the October 21 federal election around the corner, real estate boards across Canada are calling on all federal parties to significantly alter B-20.

“In its current form, the stress test in the GTA adds about $700 a month to the average mortgage, which is a good chunk that could be used for daycare or a car payment, and to add that burden on a family when they’re trying to buy a house is too much,” Toronto Real Estate Board President Michael Collins told MortgageBrokerNews.ca. “We think there is some benefit to the stress test, but we’d like to see it reduced so that it’s more prudent.”

In addition to TREB, boards from Calgary, Vancouver and Quebec, representing some 90,000 realtors, are calling for 30-year amortizations, replacing the $750 First-Time Home Buyers Tax Credit with a $2,500 non-refundable tax credit for Canadians buying their first homes, and adjust the stress test according to economic headwinds and interest rate environments.

Collins added that the boards would like to B-20 implemented regionally rather nationally.

“Again, we’re not totally against the stress test, but the one-size-fits-all approach—essentially what’s good for one market must be good for others—needs to be revised,” he said. “A 30-year amortization for properties would create better environments for Canadians trying to buy houses.”

Montreal might have Canada’s hottest real estate market, but, using 2016 Census data, the provincial homeownership rate (61%) is below the national average (70%), according to a statement from the Quebec Professional Association of Real Estate Brokers.

“We believe there needs to be better support offered to buyers of residential properties, particularly first-time buyers,” QPAREB’s President and CEO Julie Saucier said in the statement. “We also support the implementation and maintenance of home renovation tax credit programs to encourage the purchase of properties requiring upgrades, a refund of transfer duties for first-time buyers, and the introduction of mortgage rules that are adapted to regional and provincial differences.”

The real issue, says Collins, is adequate housing supply has been obstructed, notably by red tape, but he’s encouraged by the Ontario and Toronto municipal governments’ acknowledgement of the problem.

“At the centre of the problem it was a supply issue and people were looking to buy homes without there being enough product out there,” he said. “And [B-20] was brought in to offset that, but that shouldn’t have been the focus.” By Neil Sharma

Liberals’ proposed foreigner-targeted tax will not cool down markets

The Liberals’ campaign promise of a new tax on foreign home buyers may not be enough to moderate a national housing market on the resurgence, observers say.

Last week, the party pledged that if re-elected, it will “address the impact of foreign speculation, which drives up housing costs.” This will be in the form of a 1% speculation and vacancy tax on residential properties with “non-resident, non-Canadian” owners.

Said levy will be on top of already existing measures targeting foreigners in multiple markets, particularly in Vancouver and Toronto. Indeed, the Liberals said that their anti-speculation measure will emulate that of British Columbia, which is currently set at 2% for foreign owners.

In an interview with the Financial Post, Barclays Capital analyst John Aiken argued that the proposal is shaping up to be another “incremental factor” that will reduce demand only minimally.

“Realistically, the inelasticity in demand that these type of buyers have, I’m not sure if this is going to have an overly material impact on pricing or the housing market,” Aiken said.

Bank of Montreal chief economist Doug Porter mirrored these thoughts, noting that the tax will likely not prevent the national housing market’s return to its previous red-hot state.

“I don’t rule out that it could have an impact on cities other than Vancouver and Toronto, but I think they’re much less influenced by non-resident purchases,” Porter explained. “And what’s driven the housing market has largely been healthy job gains, strong population growth and, yes, a pullback in long-term mortgage rates this year.”

However, any such measure will be valuable in sending the message that Canada will not tolerate wealthy foreigners pushing other hopeful home buyers out of the market, Porter added.

“In a world where, especially in the big cities, housing affordability is such an issue, I don’t really think we can afford to allow any forms of speculation, especially from outside of the country, to be influencing the market.” By Ephraim Vecina.

What is a Central Bank?

As we head into the federal election we’ll be hearing a lot about the economy, interest rates and housing. In this country, one of the key players in all of those things is the Bank of Canada, commonly referred to as “the central bank”.

Since the financial collapse a decade ago central banks and the people who run them have become fixtures in the news. There is hardly a day that goes by that the Bank of Canada, the U.S. Federal Reserve, the European Central Bank, or some other is not cited in media coverage.

Generally, knowledge about central banks is limited to interest rate announcements, so here is a deeper look at what they do.

A central bank is an independent, national body that:

- conducts monetary policy

- guides the economy by managing inflation and currency valuation

- helps regulate banks

- provides research and advice to governments

Most central banks are governed by boards. The highest ranking member of the board – the Chair or the Governor – is often named by the head of the government. They can also be named by a selection committee. In either case the national legislative body (congress or parliament, or a committee of legislative members) approves the choice. This keeps the central bank aligned with the country’s long-term policy goals while keeping it at arm’s length from political interference in its day-to-day operations.

The key responsibility of a central bank is to promote a stable and secure economy and financial system. The banks have a few tools they use to do this including:

- regulating the lending and reserve requirements of private banks

- controlling the amount of currency that is in circulation

- setting interest rates

Regulating banks and other financial institutions allows central banks to control risks to the financial system caused by over lending or improperly secured loans.

Controlling the amount of currency in circulation allows central banks to manage the value of the currency relative to other national currencies. This can be a useful tool for managing inflation.

Setting interest rates is the main tool central banks use to manage inflation.

In our next article we will take a closer look at the specifics of how the Bank of Canada operates, and how it affects you. By First National Financial.

Treading water in a rising tide

In the rising tide of interest-rate-cut expectations, the Bank of Canada is treading water. The central bank did meet expectations by holding its policy rate at 1.75% for a seventh consecutive setting.

The reasons are fairly apparent: inflation is on target, GDP growth is good (Q2 was far better than expected even if it was based on some one-off stats), job growth is steady and unemployment is at a generational low of 5.7%.

It seems pretty clear that the BoC really does not want to trim its trend setting rate. The economic numbers do not warrant it and we are in a federal election cycle. The Bank has a long history of stepping to the sidelines during elections in an effort to preserve its reputation for political neutrality.

But the BoC is under a lot of external pressure to cut its rate. Canada is one of just a handful of developed economies with a policy rate above zero. Of course, the United States is one of the others and it is already making cuts.

The U.S. Fed says it is trying to ensure the economy does not stall in the months ahead. Being as the U.S. is the biggest economy in the world, others – including Canada – will likely have to take out some insurance of their own.

The next BoC setting is October 30th. That is close to, but after, the October 21st election so it is politically doable. The next opportunity is December 4th, just in time for Christmas. By First National Financial.

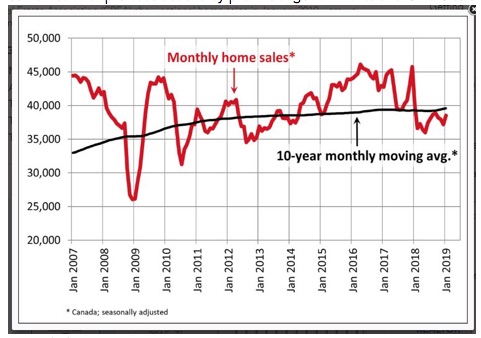

August Data Confirm That Housing Has Turned the Corner

Statistics released today by the Canadian Real Estate Association (CREA) show that national home sales rose for the sixth consecutive month. Transactions are now running almost 17% above the six-year low reached in February 2019, but remain about 10% below highs reached in 2016 and 2017. Toronto, Montreal and Vancouver all saw sales and prices rise. CREA updated its 2019 sales forecast, now predicting a 5% gain this year. Gains were led by a record-setting August in Winnipeg and a further improvement in the Fraser Valley. These confirm signs that the country’s housing market is returning to health.

Actual (not seasonally adjusted) sales activity was up 5% from where it stood in August 2018. The number of homes that traded hands was up from year-ago levels in most of Canada’s largest urban markets, including the Lower Mainland of British Columbia, Calgary, Winnipeg, the Greater Toronto (GTA), Ottawa and Montreal.

New Listings

The number of newly listed homes rose 1.1% in August. With sales and new supply up by similar magnitudes, the national sales-to-new listings ratio was 60.1%—little changed from July’s reading of 60.0%. The measure has risen above its long-term average (of 53.6%) in recent months, which indicates a tighter balance between supply and demand and a growing potential for price gains.

Based on a comparison of the sales-to-new listings ratio with the long-term average, about three-quarters of all local markets were in balanced market territory in August 2019. Of the remainder, the ratio was above the long-term average in all markets save for some in the Prairie region.

There were 4.6 months of inventory on a national basis at the end of August 2019 – the lowest level since December 2017. This measure of market balance has been increasingly retreating below its long-term average (of 5.3 months).

There is considerable regional variation in the tightness of housing markets. The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers an ample choice in these regions. By contrast, the measure is running well below long-term averages in Ontario, Quebec and Maritime provinces, resulting in increased competition among buyers for listings and fertile ground for price gains. Meanwhile, the measure is well centred in balanced-market territory in the Lower Mainland of British Columbia, making it likely that prices there will stabilize.

Home Prices

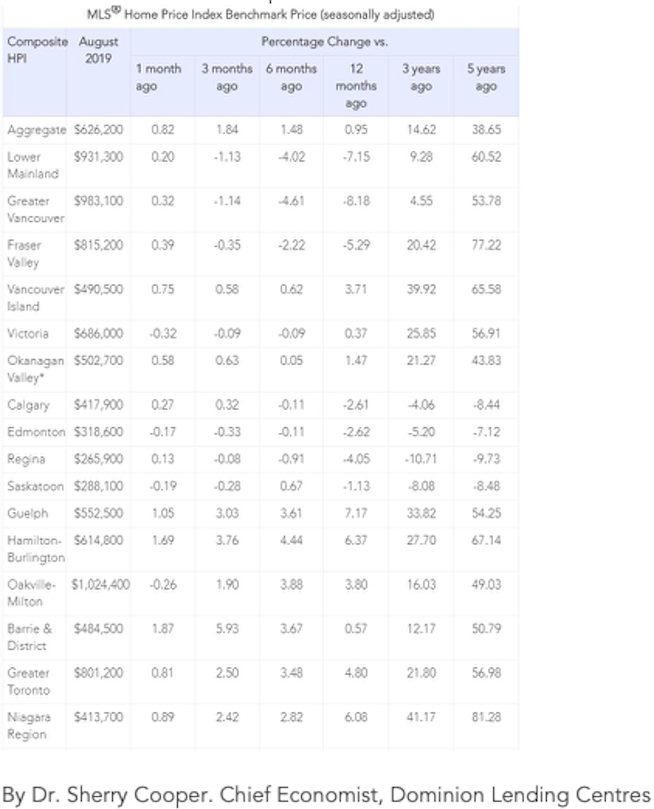

Canadian home prices saw its biggest one-month gain in two years. The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8% m-o-m in August 2019.

Seasonally adjusted MLS® HPI readings in August were up from the previous month in 14 of the 18 markets tracked by the index, marking the biggest dispersion of monthly price gains since last March.

In recent months, home prices have generally been stabilizing in British Columbia and the Prairies, a measure which had been falling until recently. Meanwhile, price growth has begun to rebound among markets in the Greater Golden Horseshoe (GGH) region amid ongoing price gains in housing markets east of it.

A comparison of home prices to year-ago levels yields considerable variations across the country, with declines in western Canada and price gains in eastern Canada.

The actual (not seasonally adjusted) Aggregate Composite MLS® (HPI) was up 0.9% year-over-year (y/y) in August 2019. This marks the second consecutive month in which prices climbed above year-ago levels and the most substantial y/y increase since the end of last year.

Home prices in Greater Vancouver (GVA) and the Fraser Valley remain furthest below year-ago levels, (-8.3% and -5.5%, respectively). Vancouver Island and the Okanagan Valley logged y/y increases of 3.7% and 1.5% respectively.

Prairie markets posted modest price declines, while y-o-y price growth has re-accelerated ahead of overall consumer price inflation across most of the GGH. Meanwhile, price growth has continued uninterrupted for the last few years in Ottawa, Montreal and Moncton.

All benchmark home categories tracked by the index returned to positive y/y territory in August. Two-storey single-family home prices were up most, rising 1.2% y/y. This category of homes had .been hardest hit during the slump. One-storey single-family home prices rose 0.7% y/y, while townhouse/row and condo apartment units edged up 0.3% and 0.5%, respectively.

Stress Test

Canada’s introduction of stricter mortgage-lending rules last year inhibited some potential home buyers. Until recently, declining interest rates and lower home prices may have allowed some of those buyers to return to the market, according to the CREA report.

“The recent marginal decline in the benchmark five-year interest rate used to assess homebuyers’ mortgage eligibility–from 5.34% to 5.19%–together with lower home prices in some markets, means that some previously sidelined homebuyers have returned,” said Gregory Klump, CREA’s chief economist. “Even so, the mortgage stress-test will continue to limit homebuyers’ access to mortgage financing, with the degree to which it further weighs on home sales activity continuing to vary by region.”

CREA also updated its forecasts. National home sales are now projected to recover to 482,000 units in 2019, representing a 5% increase from the five-year low recorded in 2018. The upward revision of 19,000 transactions brings the overall level back to the 10-year average, but remains well below the annual record set in 2016, when almost 540,000 homes traded hands, CREA said.

Bottom Line: This report is in line with other recent indicators that suggest housing has recovered from a slump earlier, helped by falling mortgage rates. The run of robust housing data gives the Bank of Canada another reason — along with robust job gains, higher wage rates and stronger than expected output growth in Q2 — to hold interest rates steady, even as more than 30 central banks around the world have cut interest rates further.

The Federal Open Market Committee meets again on Wednesday, and it is widely expected that they will cut rates by 25 basis points as the White House is calling for “emergency easing moves.” The Trump administration has just in the past few days succumbed to political pressure to reduce trade tensions. Trade uncertainty is the only thing right now that would derail the Canadian recovery.

As a result of this recent easing in trade tensions and last week’s cut in overnight rates further into negative territory by the European Central Bank, the flight to US Treasury bond safety diminished, raising the US and Canadian government bond yields by roughly 25 basis points from extremely low levels. Canadian 5-year bond yields at 1.48% are at their highest level in two months. In consequence, the spread between the best 5-year fixed mortgage rates and 5-year government bonds is at a very tight 77 basis points, which is likely not sustainable. A more normal spread between the two is 120-ish (or more) for the best rates and 150-plus-ish (for regular rates). Some lenders are already hiking mortgage rates.

The situation has been compounded with even more considerable uncertainty with the weekend bombing of the Saudi Aramco oil fields, taking an estimated half of all Saudi oil out of production. Stay tuned.

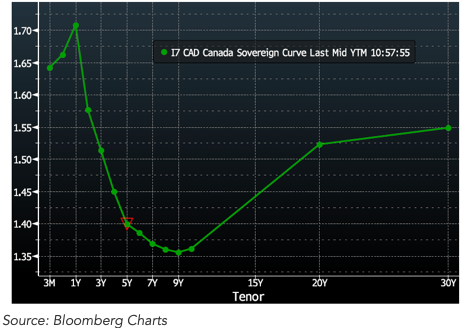

What happened with rates, yield curves and new issues this week?

Canadian bond yields whipsawed throughout the week on the back of nothing substantive economic news wise. The current 5 year GOC is yielding 1.40% and the current 10 year is yielding 1.36%. Since the last commentary on September 13th, 5 year Government of Canada yields are actually lower by 10 bps. That’s still 25bps higher than a month ago. Suffice to say, it’s been an active month in determining market level mortgage rates.

On the credit curve, CMB’s have reacted similarly with the 5 year CMB yielding 1.70% and the 10-year yielding 1.78%. The 5-10 spread has widened out from about a month ago when it was only 5bps. There is still a metric-ton of demand for 10 year product. Luckily for you, the borrower, First National has you covered for even 10, 15 or 20 year commercial mortgages! Talk to your favourite sales gal or guy today.

So how’s the yield curve look these days? Well, if you remember there was a lot of talk back when the yield curve inverted. If you also read the leading paragraph you probably noticed that the 5 year is yielding less than the 10 year. That’s inversion in my book. No news yet on signs of a recession either. However, what they don’t teach you in ECON 101 is that yield curves can sometimes be not only inverted, but can also look like they are modelled after Canada Wonderland’s ” Behemoth”. Don’t believe me? See Canada’s current yield curve below:

It looks like a fun ride, but it’s unbeknownst to me where it takes our economy next.

Finally, the low rate environment and decent risk appetite made new issuances flush the last couple weeks. Equitable Bank came to market with $200 Million in deposit notes maturing September 26, 2022. The deal priced at a spread of +145 bps over the GOC curve and was well subscribed with over 30 buyers. It’s always good to see fellow lenders issuing debt to get a sense of borrowing costs.

Merrill Lynch Canada or the soon to be called ‘Bank of America Securities’ issued a Jumbo NHA MBS deal this Tuesday. Merrill sold $750 Million of the $1.5 Billion pool at a spread of +47 bps over the GOC curve. The deal priced well with over 23 buyers, 15%-20% fills and the books were 2x covered. This is coming on the back of Home Trust’s market-leading RMBS deal, so it’s great for both borrowers (you) and lenders (us), that investor appetite is “50% off coupon at Mandarin Buffet” level for Mortgage-Backed securities.

Economic and Other News

We missed covering CPI on the 18th, but overall it didn’t shake any markets. The CPI or inflation metric for August came in at -0.1% vs the -0.2% as expected. That keeps the YoY CPI number at a solid 1.9%. Not much there for the Bank of Canada. On the 20th, we had retail sales for July which came in lower than expected. The month-over-month number for July came in at 0.4% vs the expected 0.6%. The market shrugged off the outcome overall and all eyes are on GDP which comes out next Tuesday. The Bank of Canada is currently priced at around 19% for a cut before the end of 2019.

South of the border, the Fed did what was expected of them and cut their fed funds rate by 25bps. More interesting than that is what’s happening in the US repo markets. Repo markets, which are the basis of all short term funding for financial institutions, saw large spikes in funding costs the last couple weeks. Reaching a level of 10% for overnight funding at some points, the repo market south of the border has seen a major squeeze for a variety of reasons including: corporate tax day, smaller bank balance sheets and large Treasury bill settlements. Why am I talking about this? It’s a niche but important market and the backbone of the financial system, so it’s worth reading into if you’re interested.

Finally, in other niche news you probably didn’t know, a German court recently ruled that being hungover is an illness. The ruling came after a food product marketed as a “hangover cure” lost in court. In Germany, information about food products cannot ascribe properties preventing, healing or treating illnesses. Unfortunately, when I tried using my new found illness to skip work this morning, the Treasury Guy had me writing this instead. ByAndrew Masliwec, Analyst, Capital Markets, First National Financial.

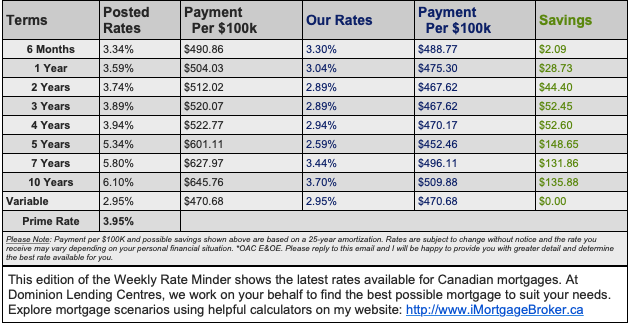

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is set at 5.19%. Bond market are placing upward pressure on Fixed rates and lender haves started raising fixed rates. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- Soaring rents and house prices in Canadian cities make housing a key election issue (CBC)

- Rising home prices encourage consumers to borrow and spend, giving economy a boost (CBC)

- HELOCs, refinancing helped fuel spending, Bank of Canada researchers say (BNN Bloomberg)

- These are Canada’s most in-demand housing markets right now (Livabl)

- Canadian Home Sales Edge Higher In August (Building.ca)

- Customer-driven Demand Shapes Real Estate in Canada (CISION)

- For Seniors, Reverse Mortgages Help With High Rental Costs (Toronto Storeys)

- Growing debts, shrinking pensions: Study finds average Canadian’s net worth dropped in 2018 (CityNews Vancouver)

- Ottawa Leads Canadian Cities in Rising Home Prices: CREA (Canadian Mortgage Trends)

- Amanda Lang: Reverse mortgages not as safe as they may seem (BNN Bloomberg)

- Residents in some parts of the GTA spend more than half their income on rent (CTV News)

- What Is Driving Toronto Real Estate Prices? (REMAX)

- Canadians scared off by stress test are starting to buy homes again (Livabl)

- This major forecast for the Canadian housing market just got a lot better (Livabl)

- Canadian home prices see biggest one-month gain in two years (BNN Bloomberg)

- CREA Updates Resale Housing Market Forecast (CISION)

- Rising Toronto home prices, sales lift national real estate forecast (The Star)

- 2019 home sales outlook improves, after 5% rise in August (CBC News)

- CREA raises home sales forecast as mortgage rates fall (Advisor)

- Reaction to First-Time Home Buyer Incentive Tweaks (Canadian Mortgage Trends)

- Trudeau promises new speculation tax on foreign buyers if re-elected (BNN Bloomberg)

- The boom continues for one of Canada’s hottest housing markets (Livabl)

- These are the most expensive areas for homebuying in Canada (Livabl)

- Toronto housing starts level among Canada’s strongest last month (Canadian Real Estate Wealth)

- CMHC reports annual pace of housing starts climbed 1.9% in August (CBC)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.