Industry & Market Highlights

CMHC

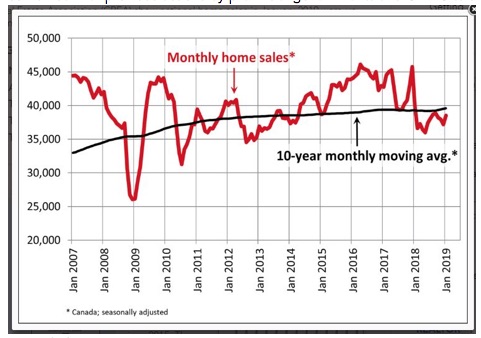

Statistics released by the Canadian Real Estate Association (CREA) show that national home sales increased in April with most markets recording increases in both transactions and prices.

The number of homes sold rose 3.6% compared with March, on a seasonally adjusted basis. The rebound in sales over the past two months still leaves activity slightly below readings posted over most of the second half of 2018, having dropped in February of this year to its lowest level since 2012.

April sales were up in about 60% of all local markets, with the Greater Toronto Area (GTA) accounting for over half of the national gain.

Actual (not seasonally adjusted) sales activity was up 4.2% year-over-year (y-o-y) in April (albeit from a seven-year low for the month in 2018), the first y-o-y gain since December 2017 and the largest in more than two years. The increase reflects improvements in the GTA and Montreal that outweighed declines in the B.C. Lower Mainland.

“Sales activity is stabilizing among Canada’s five most active urban housing markets,” said Gregory Klump, CREA’s Chief Economist. “That list no longer includes Greater Vancouver, which fell out of the top-five list for the first time since the recession and is well into buyers’ market territory. Sales there are still trending lower as buyers adjust to a cocktail of housing affordability challenges, reduced access to financing due to the mortgage stress-test and housing policy changes implemented by British Columbia’s provincial government,” said Klump.

New Listings

The number of newly listed homes rose 2.7% in April, adding to the 3.4% increase in March. New supply rose in about 60% of all local markets, led by the GTA and Ottawa.

With sales up by more than new listings in April, the national sales-to-new listings ratio tightened marginally to 54.8% from 54.3% in March. This measure of market balance has remained close to its long-term average of 53.5% since early 2018.

Based on a comparison of the sales-to-new listings ratio with the long-term average, about three-quarters of all local markets were in balanced market territory in April 2019.

There were 5.3 months of inventory on a national basis at the end of April 2019, down from 5.6 and 5.5 months in February and March respectively and in line with the long-term average for this measure.

Housing market balance varies significantly by region. The number of months of inventory has swollen far beyond long-term averages in Prairie provinces and Newfoundland & Labrador, giving homebuyers their ample choice. By contrast, the measure remains well below long-term averages in Ontario and Maritime provinces, resulting in increased competition among buyers for listings and fertile ground for price gains.

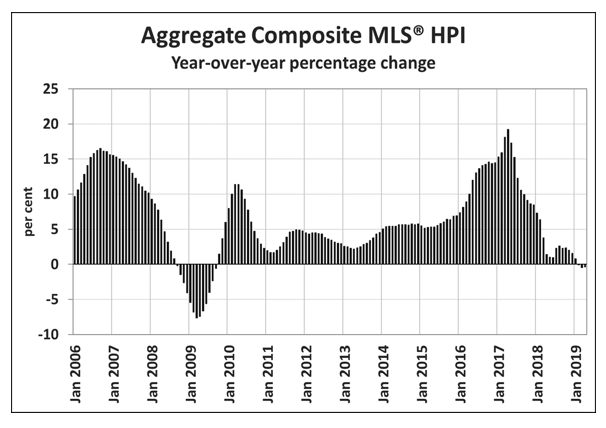

Home Prices

The Aggregate Composite MLS® Home Price Index (MLS® HPI) appears to be stabilizing, having edged lower by 0.3% y-o-y in April 2019. Among benchmark property categories tracked by the index, apartment units were again the only one to post a y-o-y price gain in April 2019 (0.5%), while two-storey there was little change in single-family home and townhouse/row unit prices from April 2018 (-0.3% and -0.2%, respectively). By comparison, one-storey single-family home prices were down by -1.4% y-o-y.

Trends continue to vary widely among the 18 housing markets tracked by the MLS® HPI. Results remain mixed in British Columbia, with prices down on a y-o-y basis in Greater Vancouver (GVA; -8.5%) and the Fraser Valley (-4.6%), up slightly in the Okanagan Valley (1%) and Victoria (0.7%), while climbing 6.2% elsewhere on Vancouver Island.

Among Greater Golden Horseshoe housing markets tracked by the index, MLS® HPI benchmark home prices were up from year-ago levels in the Niagara Region (6.2%), Guelph (5.1%), Hamilton-Burlington (4.6%) the GTA (3.2%) and Oakville-Milton (2.5%). By contrast, home prices in Barrie and District held below year-ago levels (-5.3%).

Across the Prairies, supply remains historically elevated relative to sales and home prices remain below year-ago levels. Benchmark prices were down by 4.6% in Calgary, 4% in Edmonton, 4.3% in Regina and 1.7% in Saskatoon. The home pricing environment will likely remain weak in these cities until demand and supply return to better balance.

Home prices rose 7.8% y-o-y in Ottawa (led by an 11% increase in townhouse/row unit prices), 6.3% in Greater Montreal (driven by a 7.8% increase in apartment unit prices), and 1.8% in Greater Moncton (led by an 11.5% increase in apartment unit prices).

Bottom Line:

The spring rebound in home sales is most evident in Toronto, where transactions climbed 11%, and prices rose 1.3%. Of 19 major markets tracked by the Ottawa-based real estate association, 16 recorded price gains last month.

One huge exception is Vancouver, which continues to soften. Benchmark home prices in that city were down 0.3% in April and have fallen 8.5% over the past 12 months. Even with the widespread rebound, national home sales are still below historical averages.

Economic fundamentals — from substantial employment gains to a sharp increase in immigration — remain supportive. Governor Poloz said earlier this week that he expects the housing markets to return to a more normal pace in the second half of this year. Benjamin Tal, the deputy chief economist at CIBC, reported yesterday that housing demand is stronger than suggested by official figures. Tal said incorrectly counting the number of students who live outside of their parents’ home for the majority of the year is problematic because it doesn’t provide a real sense of supply and demand in the country’s housing market.

Also supportive for housing is the dovish tilt globally from central banks that have helped bring down borrowing costs in recent months. Rates to renew a five-year mortgage aren’t much higher than they were when the mortgages were taken out, according to National Bank research. That means “no payment shock” for the 17.4% of mortgages renewing in 2019. By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

Dirty money in the real estate market

Some startling numbers released last week show how deeply Vancouver real estate is influenced by money laundering.

A report prepared for the British Columbia government says about $7.4 billion was laundered through the province in 2018. More than two-thirds of that money, about $5 billion, was used to buy real estate.

It is estimated that money laundering activity raised the benchmark price of a home in B.C. by an average of 5%. Popular and high-priced markets like Victoria and Greater Vancouver likely felt even bigger impacts, but separate numbers were not provided.

The report by Maureen Maloney, a law professor who chairs B.C.’s expert panel on money laundering in real estate, says the problem is even worse in Alberta, Ontario and the Prairies. It is estimated that more than $40 billion was laundered through Canada last year.

The B.C. government is taking aim at money laundering in real estate with the Land Owner Transparency Act. The legislation would create a public real estate registry that would clearly show who owns what. One estimate, from 2016, put one-third of the most expensive properties in the Vancouver region under the ownership of opaque entities such as numbered companies.

The Maloney report goes a step further though, recommending the province implement “unexplained wealth orders”. These would force people to prove they made purchases with legitimate money or have their property seized. The orders would not require criminal charges or even any evidence of criminal activity. They have been roundly condemned by civil rights organizations. By First National Financial.

BoC: Financial system is stable

The Bank of Canada is maintaining its optimistic outlook for the country’s economy – but…

The central bank’s latest Financial System Review says two persistent problems remain and two others are on the rise.

High household debt and imbalances in the housing market continue to represent the greatest threats to the financial system, while the increasing chance of a recession and riskier corporate borrowing are adding to concerns.

The household debt-to-income level in Canada closed-out 2018 at nearly 180%. That is $1.80 owing for every dollar of disposable income. Canada’s corporate debt-to-income level now stands at 315%. A growing amount of that borrowing is being done through the U.S. bond market and being paid in U.S. dollars. Smaller firms and those with lower credit ratings are turning to the syndicated loan market, which could subject them to the changing whims of investors.

Bank of Canada governor Stephen Poloz is more confident about what is happening in housing.

“New measures have curbed borrowing, reduced speculative behaviour in housing markets and made the financial system more resilient,” he said in the report.

“While the fundamentals in the housing sector remain solid overall, and the sector should return to growth later this year, we continue to monitor these vulnerabilities closely.” By First National Financial.

Creeping rate cut speculation

In the run up to this week’s rate setting by the Bank of Canada, talk of a coming rate cut is creeping into the forecast.

A recent Reuters poll of 40 economists put the chances of a cut, within the next 12 months, at 40%. However, the same poll but the chances of a cut, within this year, at about 20%.

Many of the economists cite global trade uncertainties – which are stalling economic growth in Canada and other countries – as the key trigger for a possible 25 basis-point reduction. Most of the concern centres on the current China – U.S. tensions and the potential for a recession in the States rather than domestic, Canadian, factors.

Realistically, it is unlikely there will be any interest rate movement – down or up – in Canada before 2020. The BoC is calling for moderate GDP growth through the second half of this year. As well, the politics surrounding the October federal election will keep the bank on the sidelines.

In a separate Reuters poll, property market gurus predict home prices will remain in the doldrums for the rest of 2019. They are forecasting a little breeze next year that will push prices up by about 1.7%, which will barely meet the rate of inflation. The Canadian Real Estate Association is forecasting a 1.6% decline in sales for this year, with a 2.0% increase in 2020.

The market-watchers polled by Reuters point to debt-burdened consumers as the key reason for the slowdown. By First National Financial.

Toronto is steadily becoming a sellers’ market – TREB analysis

Toronto is in a gradual trajectory towards being a sellers’ market, with home sales last month shooting up and supply remaining virtually static.

According to latest figures from the Toronto Real Estate Board, the city saw 9,989 home sales through the Board’s MLS System in May. This represented an 18.9% increase from the 15-year low for the month, which was seen last year.

TREB president Garry Bhaura emphasized, however, that last month’s numbers are still markedly below the long-term May average of 10,300, despite the tangible improvements from the glacial pace at the beginning of 2019.

“Sales activity continues to be below the longer-term norm, as potential home buyers come to terms with the OSFI mortgage stress test and the fact that listings continue to be constrained relative to sales,” Bhaura explained.

On the whole, the market is still seeing a positive trend, the Board head assured.

“After a sluggish start to 2019, the second quarter appears to be reflecting a positive shift in consumer sentiment toward ownership housing. Households continue to see ownership housing in the GTA as a quality long-term investment as population growth from immigration remains strong and the regional economy continues to create jobs across diversity of sectors.”

In comparison, listings ticked up by a mere 0.8%, ending up at 19,386 properties for sale. Intensified market competition pushed sales prices up by 3.6% annually, up to an average of $838,540. Said increases in value considerably outpaced the year-over-year gains seen in April (1.9%) and March (0.5%).

TREB warned that while the market can absorb single-digit annual price increases, continued scarcity in housing supply could aggravate price growth to unsustainable levels.

“This potential outcome underpins calls from TREB and other housing industry stakeholders to address roadblocks preventing a more sustainable and diverse supply of housing reaching the market,” the Board’s chief market analyst Jason Mercer stated.

“Many households are not comfortable listing their homes for sale because they feel that there are no housing options available to better meet their needs.” By Ephraim Vecina.

Economic Highlights

Another Strong Employment Report Signals Rebound In Canadian Economy

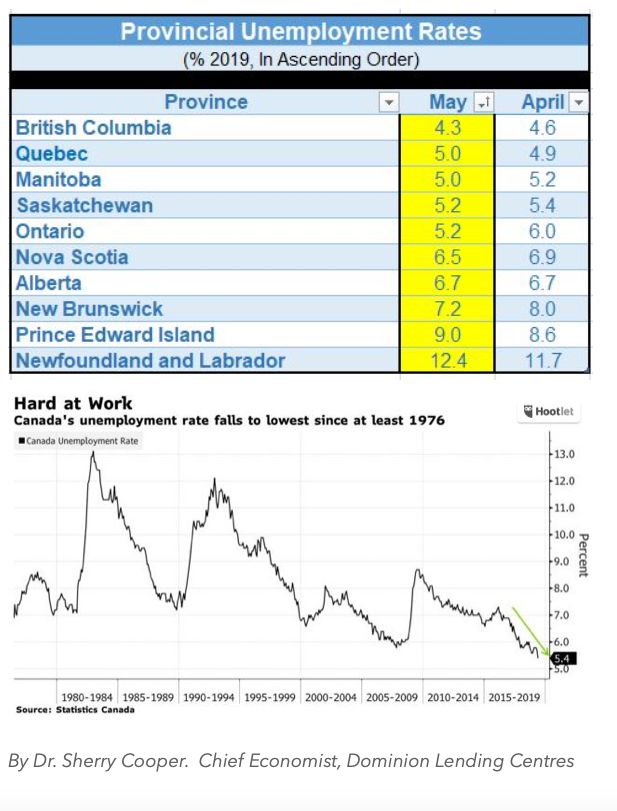

It appears that the Bank of Canada’s optimism that the Canadian economy’s growth will pick up in the third and fourth quarters of this year is well founded. Not only was the employment report very robust for two consecutive months, but the jobless rate has fallen to its lowest level since at least 1976.

Also, Canada’s trade deficit, reported today, hit a six-month low in April, as exports continue to rebound from a recent slump. Consumer spending and business investment are also making a big comeback. Household spending has accelerated, despite concerns over bloated debt loads, assisted by easing rates on loans, substantial jobs gains, stabilizing housing markets and improving financial markets.

The Bank of Canada forecasts that growth will accelerate to an annualized 1.3% in the second quarter–following the meagre 0.4% expansion in Q1–and pick up further in the second half of this year, before accelerating back to above 2% growth by 2020. This comeback begs the question–why were markets expecting a rate cut by the bank in December? That expectation may well change after this morning’s Statistics Canada releases. Of course, one caveat remains, which is the uncertainty surrounding a trade war with China and Mexico. If the trade situation were to worsen, Canada’s economy would undoubtedly be sideswiped.

Canadian employment rose by 27,700 in May, bring the number of jobs created over the past year to a whopping 453,100. The jobless rate plunged to 5.4%, from 5.7% in April, the lowest in data going back to 1976. Economists had been forecasting employment to rise by only 5,000 last month after Canada recorded a record gain of 106,500 in April. The loonie jumped on the news.

The composition of the job gain was particularly heartening, as the rise was all in full-time employment. On the other hand, jobs by those who are self-employed increased by 61,500–the gig economy is alive and well.

The most substantial job gains were in Ontario and BC.

Wage growth continued to be strong in May as pay gains for permanent workers sere steady at 2.6%.

In direct contrast, the US jobs report, also released today, was weaker than expected. US payrolls and wage gains cooled as Trump’s trade war weighed on the economy. US employers added the fewest workers in three months, and wage gains eased, suggesting broader economic weakness and boosting expectations for a Federal Reserve interest-rate cut as President Donald Trump’s trade policies weigh on growth.

![]()

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates have dropped between 10-15 basis points in the last two weeks. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- Toronto home sales jump 18.9% as spring selling season heats up (BNN Bloomberg)

- Vancouver home sales rise 44.2% in May, but market still sluggish (BNN Bloomberg)

- BC residents think the government’s affordable housing initiatives aren’t helping (Livabl)

- Canadian Reverse Mortgage Debt Makes Largest Jump Since October (Better Dwelling)

- Consumers risk predatory lending in current environment (Canadian Real Estate Wealth)

- Toronto Is The Fastest-Growing City In U.S. And Canada, And That’s Not Good (Huffington Post)

- Construction costs keep rising in Canada, and it’s hitting homebuyers in the wallet (Livabl)

- Regional condo sales trends continue to diverge (Canadian Real Estate Wealth)

- Canadian Housing Is The Least Affordable In The World… For Local Incomes (Better Dwelling)

- Homebuyers escaping high housing costs by relocating to secondary cities (BNN Bloomberg)

- Canadian housing affordability just saw its biggest improvement in 5 years (Livabl)

- Mortgage Professionals Canada appears before FINA to testify on Bill C-97

- New mortgage loans slowed in Canada but overall value is still rising, says CMHC (CBC)

- Data Reveals Decrease in Non-Resident Home Purchases in GTA (Point2Homes)

- Canada’s big-city housing markets are all at different stages of the cycle, April figures show (Vancouver Sun)

- Wood frame buildings could help alleviate ‘missing middle’ shortage (Canadian Real Estate Wealth)

- Once a contender for Canada’s hottest market, Hamilton housing is weak this spring (Livabl)

- IMF urges Canada not to change policy despite calls to ease mortgage stress test (CBC)

- Canadian House Price Forecast: What The Next 5 Years Will Look Like In 33 Cities (Huffington Post)

- Only 3 Canadian Real Estate Markets Are Still Printing Peak Prices (Better Dwelling)

- Housing Market Vulnerabilities Diminish in Canada (Point2Homes)

- High household debt, possible housing market shocks are main risks to the economy: Bank of Canada (CBC)

- When it comes to money laundering in real estate, there are more unknowns than knowns (Vancouver Sun)

- ‘I would frown upon it’: Poloz on calls to loosen mortgage rules (BNN Bloomberg)

- Toronto 2-bedroom rents are still hovering near $3,000 in May (Livabl)

- Ultra high net worth buyers are pushing Toronto luxury home prices even higher (Livabl)

- Vancouver Detached Real Estate Sales Drop To 20 Year Low, Prices Roll Back 3 Years (Better Dwelling)

- Toronto Detached Real Estate Sales Rise, But Still Second Weakest April In 10 Years (Better Dwelling)

- National Home Sales Rebound in April: CREA (Canadian Mortgage Trends)

- Vancouver’s Dirty Money Figures: The Smoking Gun That Wasn’t (Bloomberg)

- B.C. to hold public inquiry into money laundering (BNN Bloomberg)

- The Bank of Canada is underestimating the housing slump, Capital Economics warns (Vancouver Sun)

- Why criminals look to Canada to launder their money through real estate (BNN Bloomberg)

- Time to ditch the homeownership dream? The debate rages on (BNN Bloomberg)

- Interest-Only Mortgages Have Come To Canada, But Do We Really Need This ‘Innovation’? (Huffington Post)

- Where are Canadian interest rates heading in 2019? It depends on who you ask (Livabl)

- What $2-million will buy in five Canadian real estate markets (Maclean’s)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.