Industry & Market Highlights

Bank of Canada key interest rate announcement

The Bank of Canada left its key interest rate unchanged, as expected, at 1.75 per cent.

This announcement came in the wake of a move by the Alberta government to curtail oil production in the province after Jan. 1 to try to clear a crude storage glut that has driven western Canadian oil prices to multi-year lows.

Meanwhile, the recently announced plan to close the General Motors of Canada car plant in Oshawa similarly offers a downside risk to future growth.

Bank economists say an unexpected dip in monthly gross domestic product figures in September and lower-than-expected oil prices so far in the fourth quarter have dampened growth expectations and placed in doubt forecasts for a January bank rate increase.

Lower growth prospects are expected to reinforce Bank of Canada Governor Stephen Poloz’s strategy of moving very gradually on increases to its overnight rate.

Economists say they will be closely watching Poloz’s speech on Thursday for signs of how events are affecting his view of the path forward. By The Canadian Press.

LSTAR’s News Release for November 2018 – Strong Home Sales Continue in November

London and St. Thomas Association of REALTORS® (LSTAR) announced 746 homes* were sold in November, up 6.7% over November 2017. The number of home resales was the second highest total ever for November since LSTAR began tracking data in 1978. November 2016 holds the record with 749 home resales, only three more than November 2018.

“In November, we saw more positive signs with new listings in the marketplace, which contributed to the robust sales activity,” said Jeff Nethercott, 2018 LSTAR President. “November had 898 new listings, an increase of 17.5% over the same month last year. The area of London East continues to be making healthy gains in both new listings and average sales price. It had 192 new listings, up 24.7 % from November 2017, where the average sales price was $302,737, up 18.7% from 2017 and up 58.9% compared to five years ago. Going back further, that’s up 75.0% compared to 10 years ago.”

Average sales price also made steady gains in the major geographic areas in London. In London North, the average sales price was $482,202, up 24.4% from last November and up 62.4% compared to the same month five years ago. It’s an increase of 98.7% compared to the average sales price in 2008.

“Similar to October, we saw inventory (what is called active listings) making slight gains, despite the overall record low inventory that dominated our marketplace this year,” Nethercott said. “Last month, LSTAR’s jurisdiction had 1,391 active listings, up 7.6% from November 2017. The sales-to-new listings ratio was 83.1%, which the Canadian Real Estate Association (CREA) says represents conditions in the marketplace that favour sellers (a ratio between 40% and 60% is generally consistent with a balanced market). Looking at the major centres, St. Thomas had the highest sales-to-new listings ratio at 97.0%.”

A total of 65 homes were sold in November, up 10.2% from November 2017. The average home sales price in St. Thomas was $304,618 up 13.1% from a year ago and up 43.5% compared to five years ago. It’s also up 78.6% from 10 years ago.

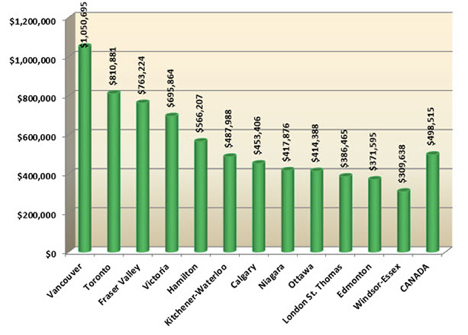

The following chart is based on data taken from the CREA National MLS® Report for October 2018 (the latest CREA statistics available). It provides a snapshot of how average home prices in London and St. Thomas compare to other major Ontario and Canadian centres.

According to a research report1, one job is created for every three real estate transactions and approximately $53,000 in ancillary spending is generated each time a home changes hands in Ontario. “It’s turning out to be another exceptional year for real estate across London and St. Thomas,” Nethercott said. “The business of real estate touches every layer of our regional economy, with November resale activity generating potentially more than $39 million and helping create approximately 248 jobs. The impact to economic growth is priceless.”

The London and St. Thomas Association of REALTORS® (LSTAR) exists to provide its REALTOR® Members with the support and tools they need to succeed in their profession. LSTAR is one of Canada’s 15 largest real estate associations, representing over 1,700 REALTORS® working in Middlesex and Elgin Counties, a trading area of 500,000 residents. LSTAR adheres to a Quality of Life philosophy, supporting growth that fosters economic vitality, provides housing opportunities, respects the environment and builds good communities and safe neighbourhoods and is a proud participant in the REALTORS Care Foundation’s Every REALTOR™ Campaign.

*These statistics are prepared for LSTAR by the Canadian Real Estate Association (CREA) and represent a data snapshot taken on December 1, 2018, based on processed home sales activity between November 1 and 30, 2018.

Predictions on a Cooling Down of the Real Estate Market

For the first time since 2007 we are seeing an inverted Bond Yield Curve, and indicator that a potential bear market is ahead for stock markets and a cooling of other related markets. Join Mike Maloney as he reveals an important factor of the partial Yield Curve inversion that is being ignored by mainstream news and media. Then stick around to the end of the video to see yet another indicator that is suggesting a huge change in markets could be upon us. You can watch a full presentation by Mike Maloney HERE.

CMHC Announced that the cooling down of the Real Estate Market is finally here and predict that we will see house prices and mortgage rates moderate throughout 2019 into 2020. Many economists have been claiming the prime rate increases (currently at 3.95%) are only cooling down the remainder of an extremely hot real estate housing market. Hopefully in London the pressure of having multiple offers are soon behind us. Read more on CMHC Announcement HERE.

CIBC economist Benjamin Tal explains we are nearing comparable times to what the markets were like from 2007 to 2008 with the inverted bond. What does inverted bonds mean? This is where the 10 year fixed is almost side by side to the 5 year fixed. For example, today a 5 year conventional fixed rate is close to 3.94% and some banks have a 10 year special at 4.19% much like the fixed rates in 2007 where the 5 year was 5.65% and the 10 year fixed 5.75%. If you recall, in 2008 we saw the lower term products, 3-5 year fixed, quickly decrease.

In summary, CMHC and the economists say that everything is stabilizing and much like the past, we could even see some decreases on low term rates and also decreases to the prime rate and variable rate/Line of credit products.

Read Benjamin Tal’s market forecast HERE.

Economic Highlights

Canada’s Employment Numbers

Canada’s November employment numbers were stunning. Economists had projected about 10,000 new jobs. The economy created an amazing 94,000 jobs for the month, most of them full time. The unemployment rate dropped to 5.6%, down 2 basis points from October and down 3 bps from a year ago.

Numbers like that usually set the stage for a lot of speculation about more interest rate hikes by the Bank of Canada, but not this time.

Two key details suggest the economy is not as robust as the headline employment number might suggest.

1Youth participation in the work force is down

2Wage growth continues to slow

For October and November the number of young people, aged 15 to 24, who wanted to work and who were employed sat at 62.5%. That is the lowest level since 1998. It is an indication that employers are not having any trouble finding the older, experienced help they want, suggesting there is still slack in the economy and labour pool.

Hourly wage growth, which is a key driver of inflation – which is, in turn, a key trigger for interest rate increases – came in at just 1.7% in November, compared to a year ago; the 6th straight monthly decline for wage growth. It indicates the labour market is weaker than it appears and employers are not being compelled to raise wages to attract workers.

Then there is what the Bank of Canada, itself, is saying. While the language used by central bankers can be downright cryptic, once you decipher what is in the economic statement that came with the latest interest rate decision it sounds a lot like “we’re just going to keep an eye on this for the time being.” By First National Financial.

Bank of Canada’s Dovish Tone

As was universally expected, the Bank of Canada’s Governing Council held overnight interest rates steady at 1-3/4% as it heralded a weaker outlook for the Canadian economy. The dovish tone in today’s Bank of Canada statement is in direct contrast to its attitude when it last met on October 24. Since that time, the global economy has moderated, and oil prices have fallen sharply. Troubling prospects for Alberta’s energy sector have weighed on the economy as the U.S. has expanded shale oil production. Benchmark prices for “western Canadian oil–both heavy and, more recently, light–have been pulled down even further by transportation constraints and a buildup of inventories”. The Notley government in Alberta ordered production cuts this week leading the Bank to conclude that Canada’s energy sector will be “materially weaker” than expected.

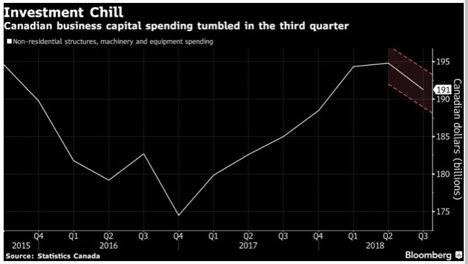

The Canadian economy grew at a 2% annual rate in the third quarter, mainly in line with the Bank’s expectation, however, September data suggest significantly less momentum going into Q4. The biggest disappointment was the plunge in business investment, which likely reflected trade uncertainty (see chart below). Business investment outside of the oil sector is likely to improve with the signing of the new trade agreement USMCA, the new federal tax measures to improve capital depreciation write-offs, and ongoing capacity constraints.

Household credit appears to be stabilizing following a significant slowdown in recent months. However, the rise in interest rates this year has had a more substantial impact on credit-sensitive spending than many had expected. For example, plunging car sales add to evidence that higher borrowing costs are dampening economic activity possibly to a more significant extent than the central bank expected. Light vehicle sales dropped 9.4% in November, the most since 2009. As well, Bank of Canada data show growth in residential mortgages decelerated to 1.4% in September on an annualized three-month basis, the weakest pace since 1982.

The Bank has raised borrowing costs five times since July 2017. New home building declined for the third consecutive quarter, down an annualized 5.9% in Q3. Moreover, according to the Toronto Real Estate Board (TREB), Toronto’s housing market posted its biggest monthly sales decline since March while prices remained little changed. Sales in Canada’s largest city fell 3.4% in November from the previous month TREB reported today (see chart below).

The housing market in the Toronto region has been stabilizing after a slowdown in sales and prices earlier this year amid more stringent mortgage-lending rules. The market picked up its pace through the summer, though sales have declined for the third month in a row.

The drop in sales could in part be attributed to a decline in new listings, which fell 26% year-over-year. “New listings were actually down more than sales on a year-over-year basis in November,” Garry Bhaura, the president of the board, said in a statement. “This suggests that, in many neighbourhoods, competition between buyers may have increased. Relatively tight market conditions over the past few months have provided the foundation for renewed price growth.”

Here is a sampling of other factors that highlight some of the headwinds confronting the Canadian economy:

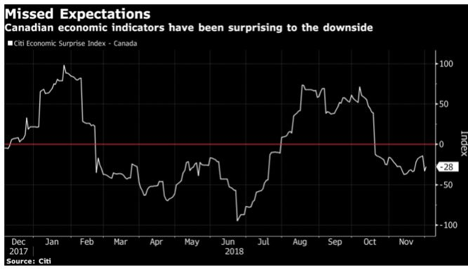

Economic data have been coming in below expectations according to Citibank’s Surprise Index, which tracks the difference between market expectations for economic indicators and their actual values. This index has trended downward since last summer and has been below zero since mid-October–around the time of the Bank of Canada’s last Monetary Policy Report (MPR) and the most recent rate hike.

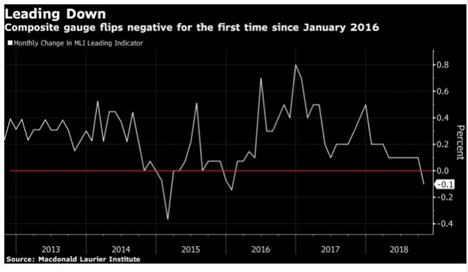

The Macdonald Laurier Institute’s Leading Indicator fell 0.1% in October. The composite gauge’s first decline since January 2016 was primarily driven by a pullback in S&P/TSX Composite Index, which fell 6.5% on the month, as well as marked decreases in commodity prices.

As well, inflation pressures have diminished. For example, gasoline prices have tumbled by about 25 Canadian cents back toward a dollar a litre since October. The latest policy statement says, “CPI inflation, at 2.4% in October, is just above target but is expected to ease in coming months by more than the Bank had previously forecast, due to lower gasoline prices. Downward historical revisions by Statistics Canada to GDP, together with recent macroeconomic developments, indicate there may be additional room for non-inflationary growth. The Bank will reassess all of these factors in its new projection for the January MPR.”

Bottom Line: “Governing Council continues to judge that the policy interest rate will need to rise into a neutral range to achieve the inflation target,” the bank said in the statement, adding the appropriate pace of increases will depend on the “effect of higher interest rates on consumption and housing, and global trade policy developments.”

“The persistence of the oil price shock, the evolution of business investment, and the Bank’s assessment of the economy’s capacity will also factor importantly into our decisions about the future stance of monetary policy,” the bank said.

As recently as October, investors were expecting at least three more rate hikes in 2019. Currently, those expectations have lessened to no more than two. The Bank had previously estimated the “neutral” range for overnight rates at between 2.5% and 3.5%. Today’s more dovish statement might well indicate that rate hikes over the next year will be to levels well below this neutral range. By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres.

![]()

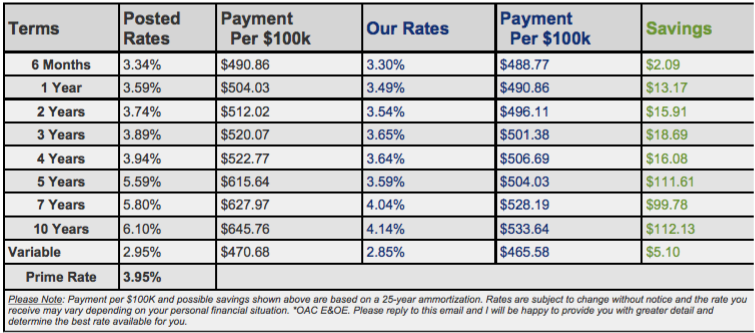

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are on hold. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive.

This edition of the Weekly Rate Minder shows the latest rates available for Canadian mortgages. At Dominion Lending Centres, we work on your behalf to find the best possible mortgage to suit your needs.

Explore mortgage scenarios using helpful calculators on my website: http://www.iMortgageBroker.ca

![]()

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

•Canada’s new construction housing market could be hit a wall, thanks to higher interest rates: TD (Livabl)

•Consumer Insolvency Filings Spike In Canada, And It’s Likely Just The Beginning (Huffington Post)

•Here’s how the final quarter of 2018 is shaping up for the Canadian housing market (Livabl)

•Will changes to rent control mean more Toronto rental buildings? This expert says probably not (Livabl)

•Not too hot, not too cold: Vancouver’s new home market to remain stable in 2019 (Livabl)

•A ‘grey tsunami’ and the precariousness of aging for Vancouver renters (Vancouver Sun)

•These Canadian Housing Markets Took A Beating In 2018. What Does 2019 Have In Store? (Huffington Post)

•Once on top, the Canadian housing market has fallen to the bottom of this global price ranking (Livabl)

•New data shows how active foreign-homebuyers are in Metro Vancouver after big policy changes (Livabl)

•How migration impacts Vancouver’s housing prices (Vancouver Sun)

•The next Canadian interest rate hike may have just been pushed back all the way to next spring (Livabl)

•Bank of Canada holds key interest rate steady at 1.75% (CBC)

•Investors have little to fear of a housing meltdown (Canadian Real Estate Wealth)

•Here’s how Canadian household debt levels could affect the housing market in 2019 (Livabl)

•Vancouver real estate: sales and prices down to more ‘historical’ levels, says board (Vancouver Sun)

•Toronto home prices stable in November amid sharp drop in listings (BNN Bloomberg)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.

Adriaan Driessen

Mortgage Broker

Dominion Lending Forest City Funding 10671

Cell: 519.777.9374

Fax: 519.518.1081

riebro@me.com

www.iMortgageBroker.ca

415 Wharncliffe Road South

London, ON, N6J 2M3

Lori Richards Kovac

Mortgage Agent & Administrator

Dominion Lending Forest City Funding 10671

Cell: 519.852.7116

Fax: 519.518.1081

loriakovac@icloud.com

415 Wharncliffe Road South

London, ON, N6J 2M3

Adriaan Driessen

Sales Representative & Senior Partner

PC275 Realty Brokerage

Cell: 519.777.9374

Fax: 519.518.1081

adriaan@pc275.com

www.PC275.com

415 Wharncliffe Road South

London, ON, N6J 2M3