WEEKLY RESIDENTIAL MARKET UPDATE

Industry & Market Highlights

CMHC forecasts higher rates, slower housing

The conditions are right for further interest rate increases and that will blunt home sales and slow price acceleration.

The Canada Mortgage and Housing Corporation predicts the economy will continue to grow at a moderate pace well into next year. The housing agency expects that will keep pressure on the Bank of Canada to raise rates which will, in turn, increase the debt service costs for mortgages and other borrowing.

CMHC says households will likely be forced to put a larger portion of their income into debt service payments. The agency expects wage gains – which have not been keeping pace with economic growth – will also not keep pace with increasing debt costs and consumer spending will contract.

Combined with tougher borrowing rules, tighter money for consumers will be reflected in a drop in demand for housing, with a consequent softening of real estate prices.

The CMHC report covers the period from July through September of this year. It predates the signing of the new NAFTA deal, the collapse of Canadian oil prices and the announcement that General Motors is closing its largest Canadian manufacturing operation.

The Bank of Canada is not expected to raise its benchmark interest rate at its setting later this week. By First National Financial.

Mortgage Professionals Canada – Housing Market Digest – Rental Market in Canada – Fall 2018

Published annually, CMHC provides a comprehensive review of rental markets across Canada, through their Rental Market Report. Over the past year, a number of factors have caused demand for rental housing to rise and outpace supply.

Mortgage Professionals Canada Chief Economist, Will Dunning has summarized the data in a special Housing Market Digest which provides a condensed, yet detailed overview. Read the Report Here.

BoC takes a holiday from rate increases

The Bank of Canada gets one more chance to raise interest rates before the end of the year but market watchers are betting against a Christmas increase.

The October inflation numbers, which came in above expectations, would normally be seen as green light for the Bank to go ahead with another quarter-point increase. Headline inflation for October came in at 2.4%, with analysts having called for a flat reading of 2.2%.

However, core inflation – which is what the central bank really cares about – came in pretty much on target, at 2%, across all three of the measurements used by the Bank. The core inflation calculations strip out volatile items like food and fuel to give a truer picture of the underlying economy.

In an example of how interrelated the components of our economy are, market watchers – and the BoC – are also keeping a very close eye of the price of oil. Canada’s benchmark crude price has been taking a serious hit lately, selling at less than US$20 a barrel (U.S. benchmark crude is selling for more than US$40 a barrel.)

The plunge in oil prices is expected to take a significant bite out of November’s inflation numbers and the Bank of Canada is expected to wait for better stability in the market before imposing any more rate increases.

Look to January for the next move. By First National Financial.

Lower prices, fewer sales, more building

Canada’s housing market seemed to be heading in two different directions at once in October. While prices and sales declined, starts increased.

The latest numbers from the Canadian Real Estate Association show a 3.7% drop in sales compared to a year ago, with a 1.6% decline from September to October. The association says the Greater Vancouver Area and Fraser Valley led the slide which offset sales increases in the Greater Toronto Area and Montreal.

CREA also reports a 1.1% drop in the number of new listings between September and October. The sales-to-new-listings ratio sits at 54.2% for October which is in line with the long term average and is deemed to be in “balanced” territory. At the same time there has been an unexpected surge in the number of housing starts.

The October report from Canada Mortgage and Housing Corporation shows a seasonally adjusted annual increase of 8.5% over September, topping analysts’ estimates. The increase was led by urban starts in multi-unit construction. Single-detached urban starts fell nearly 11%.

CREA’s MLS Home Price Index shows a 2.3% increase from a year ago while the national average price of a home in Canada actually fell 1.5% over the same period to just under $497,000. That number is heavily skewed by pricing in Vancouver and Toronto. With those markets taken out of the calculation the price comes in at just under $383,000 – up from about $335,000 in September.

The Teranet Home Price Index shows an October decline of 0.4% compared to September. It is the first index decline in eight months, and just the fourth time in 20-years there has been a drop in October. Year-over-year the index rose 2.8%. That number is more pronounced than usual because of an abrupt drop in the index a year ago. By First National Financial.

Mortgage Update – Mortgage Broker London

Economic Highlights

Q3 Canadian GDP Growth Slowed On The Back of Weak Housing and Business Investment

Stats Canada released the third quarter GDP figures indicating an expected slowdown to 2.0% growth (all figures quoted in annual rates), compared to a 2.9% pace in Q2. Over the first three quarters of this year, quarterly growth has averaged 2.2% which is down from the 3.0% annual growth recorded in 2017. The Canadian economy is at or near full capacity, so slower growth is not a bad thing.

However, while the headline growth of 2.0% was on trend, the details of the report are troubling. The bulk of the growth last quarter came from a contraction in imports–hardly a sign of a robust economy–leaving final domestic demand–which excludes trade–negative for the first time since early 2016. The softness in imports reflected a contraction in refined energy products as well as aircraft and other transportation equipment.

The NAFTA trade battle over the summer took its toll on the economy as households and businesses sharply curtailed their spending. Consumer spending grew at its slowest pace in more than two years, while businesses posted an unexpected drop in investment and trimmed inventories. Consumer spending moderated, as overall household consumption rose just 1.2%, held back by durable goods spending (-2.7%) as Canadians bought fewer vehicles for a third straight quarter.

The biggest surprise in the report was the sharp decline in non-residential business investment (-7.1%). Spending on non-residential structures fell 5.2%, while machinery and equipment spending, which includes computer software and hardware, plunged at a 9.8% annual rate. Business spending was weighed down by softer oil and gas investment.

Though residential investment was expected to decline, the reported 5.9% drop in Q3 was more significant than expected. Despite an uptick in home sales activity, residential investment weakened as both new construction of housing and renovation activity pulled back (see Note below). Investment in new residential construction posted its largest decline since the second quarter of 2009 when the financial crisis was hammering the global economy. The uptick in home sales was reflected in a sharp uptick in ownership transfer costs, which includes real estate commissions, land transfer taxes, legal fees and file review costs (inspection and surveying).

On the income side, compensation of employees rose 2.7% (4.0% on a year-on-year basis), leaving overall wage gains over the quarter at a modest 2.2% year-on-year. The household savings rate rose to 4.0% from an upwardly revised 3.4% in Q1.

Looking at the monthly data for September, there was not much momentum going into the final quarter of this year. Monthly GDP in September declined -0.1% as just half of major industries expanded. It was mainly down in goods production (-0.7%) as oil and gas extraction pulled back, hit in part by maintenance work. Substantial gains in services (+0.2%) were not enough to keep the headline in positive territory.

The projected further weakening in Q4 will be abetted by the transitory downward impact from the recent postal strike. The risks are on the downside for the Bank of Canada’s forecast of 2.3% growth in the final quarter of this year. Currently, it appears that growth in Q4 will be closer to 1% than 2%.

Implications for the Bank of Canada

The headline 2% growth rate was spot on the Bank of Canada’s expectation, but certainly, the Bank will note the weakness in the underlying data. Potentially more important is the deep reduction in the price of oil for Canadian producers already struggling with transportation bottlenecks that have been pummelling the energy sector and depressing growth in Alberta. Cuts in oil production are likely to hit economic activity in the current quarter, with a full recovery not expected until at least mid-2019.

As well, the GM shutdown in Oshawa, Ontario raises concerns about the viability of the Canadian auto industry and adds to the weakness in the economic outlook. The two largest export sectors in Canada are energy and autos, so weakness in these sectors will keep the Bank of Canada on the sidelines in December, notably as consumers may well be tapped out. Markets had been expecting a rate hike in January, but the latest data suggest that the prospects of such a move have dropped significantly.

Notes:

*Housing investment in the GDP accounts is technically called “Gross fixed capital formation in residential structures”. It includes three major elements:

- new residential construction;

- renovations; and

- ownership transfer costs.

New residential construction is the most significant component. Renovations to existing residential structures are the second largest element of housing investment. Ownership transfer costs include all costs associated with the transfer of a residential asset from one owner to another. These costs are as follows:

- real estate commissions;

- land transfer taxes;

- legal costs (fees paid to notaries, surveyors, experts, etc.); and

- file review costs (inspection and surveying).

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

![]()

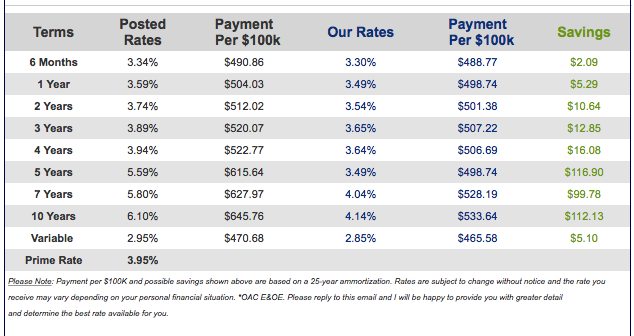

Mortgage Interest Rates

Prime lending rate increased to 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are slowly increasing. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive.

Other Industry News & Insights

$1 billion money laundered by crime networks in BC real estate?

Criminal networks could have used British Columbia’s real estate market for more than $1 billion of money laundering.

A secret police report, obtained by Global News, reveals that crime networks are linked to 10% of the 1,200 luxury real estate purchases in the Lower Mainland included in a police study in 2016.

These include a $17 million Shaughnessy mansion owned by a suspected importer of the potent drug Fentanyl.

Of around 120 properties linked to crime, 95% are believed to have Chinese crime network origins.

Global News own analysis says that the crime networks may have laundered more than $5 billion in Vancouver-area homes since 2012.

The extent of the money laundering issue and the findings of the police study are discussed on the Simi Sara Show from 980 CKNW. By Steve Randall.

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- How to know which Toronto neighbourhoods will see home price declines, according to one expert (Livabl)

- Time to relax mortgage regulations, Canada home builders urge (BNN Bloomberg)

- The Good News About Canada’s Suddenly Shrinking Economy (Huffington Post)

- 5 charts that explain why condos reign supreme in the GTA (Livabl)

- 3 hurdles the GTA housing market will have to overcome in 2019, according to experts (Livabl)

- Canada Has Achieved a Housing Soft Landing, Biggest Builder Says (Bloomberg)

- Rental vacancy rate dips to 2.4% across Canada, CMHC says (CBC)

- Metro Vancouver tenants paying more for rent while homebuyers see prices drop (Livabl)

- No relief in sight as Toronto’s rental vacancy rates remain historically low and rents climb (Livabl)

- Canada’s housing market may be unaffordable, but it’s stable (for now) (Livabl)

- Why this economist says Vancouver’s housing recovery will probably be rougher than Toronto’s (Livabl)

- A “flat performance” from the Canadian housing market isn’t doing GDP growth any favours (Livabl)

- Housing watchdog at risk as Liberals worry about too much bureaucracy (CTV)

- Rental lottery with 50:1 odds reveals dark side of Toronto’s housing boom (BNN Bloomberg)

- 3 hurdles the Ontario housing market will have to contend with in 2019 (Livabl)

- The formerly hot Hamilton housing market will see sales drop nearly 16% in 2018 (Livabl)

- Affordable housing goals hang in delicate balance, Bank of Canada deputy says (Hamilton Spectator)

- Bank of Canada: housing market vulnerabilities are still high (Reuters Canada)

- Canada’s financial watchdog to review banks’ complaints-handling processes (CTV News)

- Canadian banks look to in-house hackers to improve cybersecurity (BNN Bloomberg)

- 7 charts that explain the Canadian housing market’s autumn sales dip (Livabl)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.