Housing markets across Canada slowed significantly in 2018 as a result of higher interest rates coupled with mortgage stress tests and other policy changes that have constrained homebuying.

Mortgage Professionals Canada’s latest consumer research report, Annual State of the Residential Mortgage Market in Canada, examines the negative impacts of federal policies on housing markets across the country.

Report author and Mortgage Professionals Canada Chief Economist, Will Dunning, shares how policy changes are disqualifying potential first-time homebuyers and creating considerable pressure on the rental market, which is in turn driving rental prices higher. The reduction of activity in the housing market and extremely low rental vacancy rates have had significant consequences on homebuyers and renters, as well as employment and the overall economy.

The report illustrates that, as President and CEO Paul Taylor has discussed with policymakers, a more reasonable stress test level and lending restriction reforms are now needed to strike a better balance for borrowers and policymakers, improving housing affordability and Canada’s economy. Read the FULL REPORT HERE.

2018 Q4 Data Now Available

Mortgage Professionals Canada and its Chief Economist Will Dunning produce monthly Housing Market Digests to provide a snapshot and trend analysis of the Canadian – and respective regional – housing markets, content that includes information around housing starts, the resale market, employment trends, interest rates, and more.

Get fourth quarter housing market information for Canada and each province including resale market data, housing stats, employment trends and interests rates from the latest Housing Market Digests here.

As goes housing, so goes the economy

The pundits have been saying for quite some time that the slowdown in Canada’s housing market is going to have a negative effect on the country’s Gross Domestic Product. That prediction appears to have come true.

For the past several years housing has been one of the few things that has helped keep the economy afloat. But it is now clear that rising interest rates and restrictive government policies are supressing the housing market. The Bank of Canada estimates the slowdown in residential housing investment will represent a -0.1% hit to the overall economy.

It is not a big blow, but it crosses the line into negative territory. Previous projections had residential housing investment continuing to make a positive contribution of +0.1%.

Many market insiders see this as proof that the federal B-20 guidelines are too heavy-handed and are having an unnecessarily harsh effect on home ownership. They believe the market decline will take an even bigger bite out of GDP and that there is the real threat of a recession.

Now that it has been about 18 months since the BoC started raising its key interest rate, the effects of the increases are being felt in the greater economy. Some forecasters predict other sectors are going to experience significant slowdowns as debt-laden consumers adjust to the higher cost of paying back their loans.

Housing: An early election issue

Housing appears to be taking root as a key issue in upcoming federal election.

We got a preview of that when NDP leader Jagmeet Singh hinted at what an NDP government would do as he launched his campaign in a British Columbia by-election.

Singh was light on details but said his Party’s program would get 500,000 affordable housing units built over a 10 year period. He also called for the elimination of the GST on the construction of affordable housing, and a doubling of the first-time buyer’s tax credit to $1,500.

In the 2015 election the current Liberal government came to power, in part, on a pledge to revamp Canada’s National Housing Strategy and entrench the “right to housing”. It also promised to help the middle class and those working to join it. Presumably that included making sure housing would remain affordable for those buyers.

Steps taken by the Liberals since then have fallen short according to critics and the political opposition. More than a year ago the Liberals unveiled their $40 billion, 10-year strategy for housing and launched ongoing consultations. But advocates say the government has gone quiet on the issue of the right to housing. Many feel it is now too late to get legislation passed before Parliament rises in June, ahead of the October election. The Liberals says they have spent nearly $6 billion building and repairing affordable housing, so far.

Overall housing affordability for the middle class also remains an unresolved concern. Rising interest rates, taxes, fees and financial stress tests are seen by many as undue impediments to middle class home ownership.

A recent poll by Abacus Data suggests the price of housing is a top issue for millennials, who will outnumber baby boomers when Canadians vote in the fall.

Mortgage Professionals Canada is renewing its call for action to help millennials and other first-time buyers. The association estimates government stress tests will have affected 200,000 families by the time the October election is held; having either reduced or completely eliminated their home purchasing power.

MPC has put forward a proposal that would make the current B-20 rules less onerous by reducing the stress test interest premium to just 0.75%, from the current 2.0%.

B-20 Guidelines for Private Mortgages

A number of media outlets picked up a story published by Reuters that opened with:

“Canada is considering subjecting private lenders to the same mortgage stress test rules faced by banks to prevent housing markets from being destabilized by the lenders’ rapid growth, three sources with direct knowledge of the matter said.”

We contacted the Ministry of Finance directly for comment and were advised by a senior ministry official that these reports are unsubstantiated. The Ministry official confirmed that they are not currently considering any regulation of private lending. We were told to advise our membership that this article should not be interpreted as the ministry “sending a signal”.

The Ministry continues to monitor the mortgage marketplace, but at this time, any suggestion of the extension of B-20 Guidelines or equivalent to private lending is unsubstantiated.

Mortgage Professionals Canada continues to be in regular contact with the Ministry and government agencies and we will keep you informed should there be any change in this matter.

Weekly Bottom Line

Summary of recent economic events and what to expect in the weeks ahead.

U.S. Highlights

•Financial markets extended their gains this week. The re-opening of the U.S. government, the dovish FOMC statement, progress in the U.S.-China trade talks and a strong January payroll report all helped to boost sentiment.

•Global growth concerns persisted this week, but the U.S. economy continued to move along nicely. The labor market added 304k new jobs in January, and the ISM manufacturing index improved after a sharp decline in December.

•Even as domestic economic performance remains solid, global growth slowdown did not go unnoticed by the FOMC. The Committee left the fed funds rate unchanged, and went to great lengths to emphasize patience.

Canadian Highlights

•Canada’s economy contracted 0.1% in November as the energy sector weighed on growth. Real GDP is tracking a modest 1% (annualized) for the fourth quarter as a whole.

•A “patient” Federal Reserve will mean an even more patient Bank of Canada. Canada’s outlook is even cloudier than that stateside, providing numerous reasons for caution from the central bank.

•In a speech this week, Deputy Governor Wilkins noted that the oil shock is coming through not only on the unemployment rate but also the pace of wage growth. Until there is some clarity on the path of global growth, expect the Bank of Canada to remain on the sidelines.

Inflation: Just a blip on the radar

Inflation has popped back onto the market watcher radar, but it does not appear to be much of a threat.

Statistic Canada’s headline number for December came in at 2%. That increase was actually held in check by lower prices at the pumps. With gasoline taken out, headline inflation jumped to 2.5%, year-over-year. That seems like a significant increase given that November inflation clocked-in at 1.7% and the expectation for December was for the same, 1.7%.

The two big drivers of inflation were a nearly 30% increase in airfares and a 15% jump in the price of fruits and vegetables. Both of these can be explained as seasonal variations, with the December spike in holiday travel and the usual wintertime reliance on imported produce.

The Bank of Canada is unlikely to be moved to make any interest rate adjustments though. The average of its three measures of core inflation – which factor out volatile items like food and fuel – put the December rate at 1.9%. That remains right in the middle of the Bank’s target range and is in line with its projections for 2019.

Of note to mortgage brokers, StatsCan also singled-out a 7.5% increase in mortgage interest rates as a factor in the jump in inflation. However, that is proving to be something of a moot point as Canada’s big banks appear to be starting a round of cuts to their 5-year fixed rates.

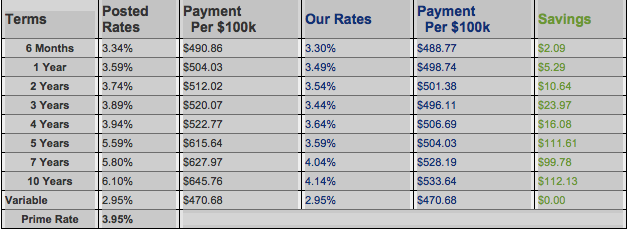

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are on hold. Some lenders are offering special promotional rates to try and take more market share. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive.

- Toronto Real Estate Board urges OSFI to ‘revisit’ stress tests (BNN Bloomberg)

- Days On Market: Here’s How Long It Will Take You To Sell A House In 63 Canadian Markets (Huffington Post)

- Vancouver says empty home tax cut number of homes sitting vacant by 15% (BNN Bloomberg)

- City of Vancouver says number of vacant homes down (Vancouver Sun)

- After a tough 2018, Toronto’s housing market is ‘soggy’ but stabilizing (Livabl)

- Councillor wants local approach to mortgage rules over national ‘stress test’ (Calgary Herald)

- Canadian banks on notice with mortgage growth at 17-year low (BNN Bloomberg)

- Biggest Vancouver home price fall since 2013 is tip of iceberg (BNN Bloomberg)

- OSFI, Canada’s Financial Regulator, Under Pressure From Banks, Lobbyists Over Mortgage Stress Test (Huffington Post)

- How unaffordable housing is hurting Canada’s job market (Livabl)

- The staggering price gap between new GTA condos and low-rise homes is starting to close (Livabl)

- New home sales in GTA sank to lowest level since 2000, reports find (CBC)

- Inside Canada’s changing online listing landscape in 2019 (Livabl)

- Why homebuyer assistance programs can make purchasers miss the “big picture” (Livabl)

- Toronto new home sales plunge as buyers balk at spiraling prices (BNN Bloomberg)

- Ontario may allow disclosure of prices in real estate bidding wars (BNN Bloomberg)

- How a year of rate hikes impacted Canadians’ mortgage payments in 2018 (Livabl)

- Jason Kenney promises to fight Ottawa’s ‘unfair’ mortgage stress test rules (CBC)

- Why this big bank economist is questioning Canadian policymakers on mortgage stress testing (Livabl)

- Debt is keeping one in five Canadians from buying a home (Livabl)

- 5 Predictions For Toronto’s Housing Market In 2019 (Huffington Post)

- Are many Canadian households really on the brink of going bust? (Livabl)

- Mortgage industry calls for more lenient stress tests for first-time buyers (BNN Bloomberg)

- Why the government should rethink the mortgage stress test (Ottawa Citizen)

- Federal Housing Policies Drive Higher Prices: Mortgage Professionals Canada (Building.ca)

- A first-time homebuyer’s guide to Canadian government programs and incentives (Livabl)