WEEKLY RESIDENTIAL MARKET UPDATE

Industry & Market Highlights

First Monthly Canadian Home Sales Gain This Year In June

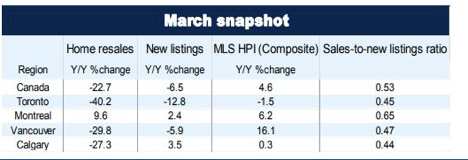

National home sales rose by 4.1% in June compared to May, the first such rise this year. Even so, June’s sales activity remains well below the monthly pace of the past five years (see chart). The sales gains were led by the Greater Toronto Area (GTA) as 60% of all local housing markets reported increased existing home sales.

According to the Toronto Real Estate Board, sales were up 17.6% in the GTA on a seasonally adjusted basis between May and June.

In contrast, sales in British Columbia continued to moderate. The Real Estate Board of Greater Vancouver reported a 14.4% decline in home sales last month compared to the month before. June’s sales for the GVA were 28.7% below the 10-year June sales average. On a year-over-year (y/y) basis, sales declined a whopping 37.7%.

National home sales activity declined almost 11% y/y. Annual sales hit a five-year low and stood nearly 7% below the 10-year average for June. Activity came in below year-ago levels in about two-thirds of all local markets, led overwhelmingly by those in the Lower Mainland of British Columbia.

“This year’s new stress-test on mortgage applicants has been weighing on homes sales activity; however, the increase in June suggests its impact may be starting to lift,” said CREA President Barb Sukkau. “The extent to which the stress-test continues to sideline home buyers varies by housing market and price range.”

B.C. was hit with a double whammy as the province raised the foreign purchase tax as well. Also, mortgage rates have risen increasing the burden of the new stress tests.

Looking ahead, home sales and price gains will likely be dampened by higher interest rates as the Bank of Canada just hiked the benchmark rate once more last week. The prime rate rose from 3.45% to 3.70% in the wake of the rate hike, while the posted 5-year fixed mortgage rate–the critical stress-test yield–remained steady at 5.34%. Nevertheless, more upward pressure on mortgage rates is likely over the next couple of years as economic activity bumps up against capacity limits and inflation edges upward. The Bank made it very clear that further interest rate hikes are on the way but reiterated that it will be taking a gradual approach to future increases, guided by incoming economic data and a recognition that the economy is more sensitive to interest rate movements now than it was in the past.

New Listings

The number of newly listed homes fell in June by 1.8% and also remained below levels for the month in recent years. New listings declined in a number of large urban markets including those in B.C.’s Lower Mainland, Calgary Edmonton, Ottawa and Montreal.

With new listings up and sales virtually unchanged, the national sales-to-new listings ratio eased to 50.6% in May compared to 53.2% in April and stayed within short reach of the long-term average of 53.4%. Based on a comparison of the sales-to-new listings ratio with its long-term average, about two-thirds of all local markets were in balanced market territory in May 2018.

There were 5.7 months of inventory on a national basis at the end of May 2018. While this marks a three-year high for the measure, it remains near the long-term average of 5.2 months.

Home Prices

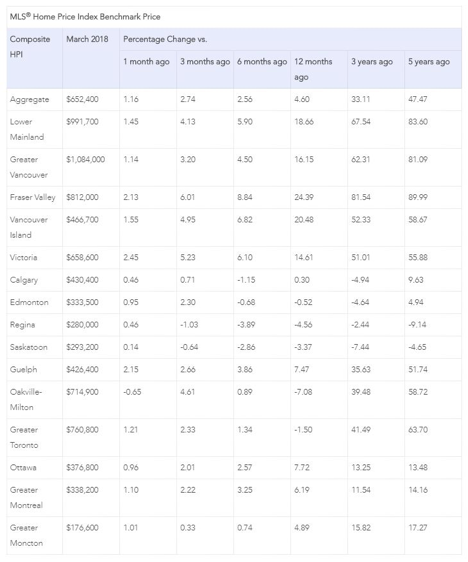

On a national basis, the Aggregate Composite MLS Home Price Index (HPI) rose only 0.9% y/y in June 2018, marking the 14th consecutive month of decelerating y/y gains. It was also the smallest annual increase since September 2009.

Decelerating y/y home price gains have reflected mainly trends at play in Greater Golden Horseshoe (GGH) housing markets tracked by the index. Home prices in the region have begun to stabilize and trend higher on a month-over-month basis in recent months.

Condo apartment units again posted the most substantial y/y price gains in June (+11.3%), followed by townhouse/row units (+4.9%); However, price gains for these homes have decelerated this year. By contrast, one-storey and two-storey single-family home prices were again down in June (-1.8% and -4.1% y/y respectively).

Benchmark home prices in June were up from year-ago levels in 8 of the 15 markets tracked by the index (see Table below).

Home price growth is moderating in the Lower Mainland of British Columbia (Greater Vancouver Area: +9.5% y/y; Fraser Valley: (+18.4%), Victoria (+10.6%) and elsewhere on Vancouver Island (+16.5%).

Within the GGH region, price gains have slowed considerably on a y/y basis but remain above year-ago levels in Guelph (+3.5%). By contrast, home prices in the GTA, Oakville-Milton and Barrie were down from where they stood one year earlier (GTA: -4.8%; Oakville-Milton: -2.9%; Barrie and District: -6.5%). The declines reflect rapid price growth recorded one year ago and masks recent month-over-month price gains in these markets.

Calgary and Edmonton benchmark home prices were down slightly on a y/y basis (Calgary: -1.0%; Edmonton: -1.5%), while prices declines in Regina and Saskatoon were comparatively more substantial (-6.1% and -2.9%, respectively).

Benchmark home prices rose by 7.9% y/y in Ottawa (led by a 9.1% increase in two-storey single-family home prices), by 6.4% in Greater Montreal (driven by a 7.4% increase in townhouse/row unit prices) and by 6% in Greater Moncton (led by a 6.5% increase in one-storey single-family home prices).

The actual (not seasonally adjusted) national average price for homes sold in June 2018 was just under $496,000, down 1.3% from one year earlier. While this marked the fifth month in a row in which the national average price was down on a y/y basis, it was the smallest decline among them.

The national average price is heavily skewed by sales in the Greater Vancouver and GTA, two of Canada’s most active and expensive markets. Excluding these two markets from calculations cuts almost $107,000 from the national average price, trimming it to just over $389,000.

Bottom Line

Housing markets continue to adjust to regulatory and government tightening as well as to higher mortgage rates. The speculative frenzy has cooled, and multiple bidding situations are no longer commonplace in Toronto and surrounding areas. The housing markets in the GGH appear to have bottomed, and supply constraints may well stem the decline in home prices in coming months. The slowdown in housing markets in the Lower Mainland of B.C. accelerated last month as the sector continues to reverberate from provincial actions to dampen activity, as well as the broader regulatory changes and higher interest rates.

Five-year fixed mortgage rates have already risen roughly 110 basis points, while rates for new variable mortgages rose by close to 40 basis points. Since the implementation of new mortgage standards, nonprice lending conditions for mortgages and home equity lines of credit have also tightened. Additional rate hikes by the Bank of Canada are coming, although the Bank will remain cautious particularly in light of continued trade tensions with the United States.

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

CREA releases June sales figures

The Canadian Real Estate Association says the number of homes sold in June was down 10.7 per cent from a year ago.

The result was a five-year low for the month of June.

However, sales volume was up 4.1 per cent when compared with May.

The association says it was the first substantive month-over-month increase this year.

The national average price for a home sold in June was just under $496,000, down 1.3 per cent from a year ago.

Excluding the Greater Vancouver and Greater Toronto markets, the average price was just over $389,000. By The Canadian Press.

Ontario markets outside Toronto see accelerated home price growth

While the Toronto residential market has seen the median cost of its housing shrink in Q2 2018, price growth accelerated in other major Ontario locales such as Kitchener, Waterloo, Cambridge, according to the latest Royal LePage House Price Survey and Market Survey Forecast.

The average price of a standard 2-storey home increased by 8.9% annually across the region (up to $515,733) in the second quarter of the year. Meanwhile, the median price of a bungalow grew by 6.2% year-over-year (up to $443,572), and the average price of a condominium rose by 5.1% in the same time frame (up to $287,080).

However, Royal LePage Grand Valley Realty broker and owner Keith Church stressed that “while prices are up across all housing categories year-over-year, the rate of appreciation has slowed compared to last quarter’s double-digit year-over-year gains. We are beginning to see a shift towards a balanced market where sales and prices are more stable.”

Church added that the region’s economic growth is pulling buyers from the Greater Toronto Area. Royal LePage is also predicting a healthy influx of first-time buyers and retirees looking to downsize into new condominiums.

The aggregate price of a home in the Kitchener/Waterloo/Cambridge area increased by 8.2% year-over-year in Q2 2018 (up to $485,946). Housing costs in the region are expected to continue increasing at a steady rate in the next quarter, the report noted.

On the national level, price appreciation slowed to a relative crawl in Q2 2018, a development influenced mainly by what was characterized as “softness” in the GTA, where many markets have suffered year-over-year declines in home prices. By Ephraim Vecina.

CMHC’s new rules

Canada Mortgage and Housing Corporation is making a couple moves that will send ripples through the mortgage market. One could give lenders access to more confidential financial information about borrowers. The other could ease frustrations for a group of borrowers that has consistently had problems securing loans.

According to documents obtained by Reuters, through a freedom of information request, the federal housing agency wants the Canada Revenue Agency to take a “more direct and formal role” in verifying income statements made on mortgage applications. Right now the CRA does not verify income claims for lenders, even with the permission of the borrower/taxpayer.

A two-year plan drafted by CMHC shows the agency is concerned about a systemic risk posed by mortgage fraud. The agency has said there is no evidence of widespread fraud in Canada, but it also says its information is limited.

The CMHC plan says paperless transactions, pressures to close deals quickly, rising prices and new regulations can “create strong incentives for individuals or mortgage professionals to engage in … fraud.” A spokesperson also says CMHC is developing data-driven systems to screen for commission fraud, where a lender or a broker may have encouraged a borrower to exaggerate income claims. The documents reveal the agency intends to start publishing statistics on mortgage fraud.

At the same time CMHC says it wants to make it easier for the self-employed to qualify for a mortgage. The agency says it is giving lenders more guidance and flexibility to help self-employed borrowers. The effort focuses on those who have been running their business – or have been in the same line of work – for less than 24 months. The new policy is set to take effect October 1st. By First National Financial

CMHC makes announcement regarding self-employed borrowers

Canada Mortgage and Housing Corp. is making changes intended to make it easier for the self-employed to qualify for a mortgage.

The national housing agency says it’s giving lenders more guidance and flexibility to help self-employed borrowers.

Self-employed Canadians may have a harder time qualifying for a mortgage as their incomes may vary or be less predictable.

CMHC is providing examples of factors that can be used to support the lender’s decision to lend to borrowers who have been operating their business for less than 24 months, or in the same line of work for less than 24 months.

It is also providing a broader range of documentation options to increase flexibility for satisfying income and employment requirements.

The changes, which apply to both transactional and portfolio insurance, will take effect Oct. 1.

CMHC chief commercial officer Romy Bowers said self-employed Canadians represent a significant part of the workforce.

“These policy changes respond to that reality by making it easier for self-employed borrowers to obtain CMHC mortgage loan insurance and benefit from competitive interest rates,” Bowers said in as statement. By Canadian Press.

Economic Highlights

Jasson Ellis looks at the latest in government bond yields

Greetings mortgage market participants,

Forgive me gentle readers. It’s been a month since my last post and it feels like at least twice that long.

In my defense, I’ve been occupied by some ‘deep thoughts’ that have kept me distracted. For instance, I’ve been thinking that maybe to understand mankind we have to look at the word itself: “Mankind”. Basically, it’s made up of two separate words, mank and ind. What do these words mean? It’s a mystery, and that’s why mankind is too.

I’ve also been thinking that if dogs ever take over the world, and they choose a king, I hope they don’t just go by size, because I bet there are Chihuahuas out there with some good ideas.

Economic Data

Today’s data featured two top tier Canadian reports, Retail Sales and Consumer Price Index (“CPI”).

Month over month retail sales in May came in at +2.0% and +1.4% ex-autos, exceeding expectations of +1.0% and +0.5% respectively. Headline CPI for June came in a little hot at 2.5% year over year vs. 2.3% expected and 2.2% last month ‘Core’ CPI came in as expected a 1.9%, right around the BoC 2.0% target.

Rates

Rates have jumped about 4 basis points higher on today’s data but Government bond yields in Canada continue to be relatively range bound. 5 year GoC’s are around 2.06% and have traded between 2.00% and 2.10% the last five weeks. 10 year GoC’s are around 2.15% and have traded between 2.10% and 2.20% over the same horizon. Yes…you read that right. There are less than 10 basis points between the 5 and 10 year benchmarks. In fact, there are only 20 basis points between the 2 year (1.95%) and the 30 year (2.15%) bond. It’s a flat curve all right. Flattest it’s been in a decade. I don’t want to alarm you, but your first year Economics text book will tell you that a flat yield curve is an indication that investors and traders are worried about the macro-economic outlook. A less pessimistic argument is that it’s only natural when a central bank is raising short-term interest rates. Whatever the reason, if you’re getting a “glass half empty” feeling, just add vodka and stir.

Speaking of central banks, following the July 11th rate hike, the next BoC meeting is September 5th. The implied probability of another then hike is a modest 10%. No doubt lingering uncertainty with respect to NAFTA, auto tariffs and broader trade drama are creating headwinds. Despite the small pop in rates this morning, the market won’t lean too heavily on the modestly stronger than expected retail sales and CPI data today.

Securitization news

On Wednesday, RBC priced a new offering of CMBS in the form Real Estate Asset Liquidity Trust, better known as REAL-T. It’s the second Canadian CMBS transaction of 2018 and the sixth issuance of REAL-T since its post liquidity crisis return to the market in 2014.

The simple senior/subordinate sequential pass through structure featured a 3.5 year A-1 note and a 7.5 year A-2 note. Both rated ‘AAA’ by DBRS and Fitch with 13.25% credit support from subordinate notes. The A-1 priced at GoC +105 and the longer A-2 priced at GoC+155. An attractive spread for a ‘AAA’ note considering the current delinquency rate on all outstanding Canadian CMBS issuance since 1998 is a microscopic 0.08%. For context, the last REAL-T deal was issued in October 2017 and the A-1/A-2 notes were priced at +125/+175 or 20bps wider than this week’s deal.

The roughly $350 million pool was made up of 70 loans across 140 properties with loan to value < 60% and a weighted average remaining term of 6.67 years.

No new ‘syndicated’ NHA MBS deals to mention but the indicative spread for a new 5 year single family residential pool is around +48, virtually unchanged since January. That’s impressive considering Bank Deposit notes have widened since January from about +65 to +90. The outperformance by MBS can be partially explained by reduced issuance compared to last year and the special utility of MBS for Federally Regulated Financial Institutions (“FRFIs”) as Tier 1 High Quality Liquid Assets (“HQLA”).

Finally, CMHC’s call for allocation requests came out yesterday for next month’s 10 year CMB issue. It will be the first opening (of three) for the new December 2028 maturity date. Yes…it’s 124 months for the price of 120! Send in your deals!

Heading into the weekend

Take it easy this weekend and remember, it’s always a good idea to carry two sacks of something when you walk around. That way, if anybody asks “Hey, can you give me a hand?”, you can say, “Sorry, got these sacks”.

Sometimes I wish I were a nicer person…but then I laugh and continue my day. By Jason Ellis, Senior Vice President and Managing Director, Capital Markets.

United States

· Economic data was a mixed bag this week: retail sales were a bright spot, but housing starts unexpectedly plunged in June.

· Trade developments continued to make headlines, with Donald Trump announcing he was prepared to extend duties on $500bn of imports from China – roughly the value of all China’s imports into the U.S.

· In his testimony to Congress, Fed Chair Powell offered an upbeat view of the U.S. economy, and noted that the risks posed by trade protectionism would not push them off course on further rate hikes.

Canada

· It was a good week for Canadian data releases, with positive surprises in retail, manufacturing, and housing, affirming last week’s upbeat tone set by the Bank of Canada.

· Existing home sales were particularly positive, and, taken together with last week’s housing starts, support the view that the housing market is gradually stabilizing following the implementation of B-20 guidelines.

· The U.S. announced that it will probe tariffs on uranium imports, increasing already-heightened global trade uncertainty risks. By TD Economics. Read the full report Here.

Mortgage Interest Rates

No change to Prime lending rate currently at 3.7%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.34%. Fixed rates are holding steady, no change in fixed rates. Deep discounts are are available for variable rates making adjustable variable rate mortgages very attractive for the right borrowers.

| Terms | Posted

Rates |

Payment

Per $100k |

Our Rates | Payment

Per $100k |

Savings |

| 6 Months | 3.14% | $480.46 | 3.10% | $478.39 | $2.07 |

| 1 Year | 3.04% | $475.30 | 2.99% | $472.73 | $2.57 |

| 2 Years | 3.44% | $496.11 | 3.24% | $485.65 | $10.46 |

| 3 Years | 3.59% | $504.03 | 3.39% | $493.48 | $10.55 |

| 4 Years | 3.89% | $520.07 | 3.54% | $501.38 | $18.69 |

| 5 Years | 5.59% | $615.64 | 3.29% | $488.25 | $127.39 |

| 7 Years | 5.80% | $627.97 | 3.94% | $522.77 | $105.19 |

| 10 Years | 6.10% | $645.76 | 3.99% | $525.48 | $120.28 |

| Variable | 2.70% | $457.99 | 2.66% | $455.97 | $2.01 |

| Prime Rate | 3.70% | ||||

| Please Note: Payment per $100K and possible savings shown above are based on a 25-year ammortization. Rates are subject to change without notice and the rate you receive may vary depending on your personal financial situation. *OAC E&OE. Please reply to this email and I will be happy to provide you with greater detail and determine the best rate available for you. | |||||

| This edition of the Weekly Rate Minder shows the latest rates available for Canadian mortgages. At Dominion Lending Centres, we work on your behalf to find the best possible mortgage to suit your needs.

Explore mortgage scenarios using helpful calculators on my website: http://www.iMortgageBroker.ca |

|

Other Industry News & Insights

How Do Interest Rates Affect the Stock Market?

The investment community and the financial media tend to obsess over interest rates—the cost someone pays for the use of someone else’s money— and with good reason. When the Federal Open Market Committee (FOMC) sets the target for the federal funds rate at which banks borrow from and lend to each other, it has a ripple effect across the entire U.S. economy, not to mention the U.S. stock market. And, while it usually takes at least 12 months for any increase or decrease in interest rates to be felt in a widespread economic way, the market’s response to a change (or news of a potential change) is often more immediate.

Understanding the relationship between interest rates and the stock markets can help investors understand how changes might affect their investments and how to make better financial decisions.

The Interest Rate That Impacts Stocks

The interest rate that moves markets is the federal funds rate. Also known as the overnight rate, this is the rate depository institutions are charged for borrowing money from Federal Reserve banks.

The federal funds rate is used by the Federal Reserve (the Fed) to attempt to control inflation. Basically, by increasing the federal funds rate, the Fed attempts to shrink the supply of money available for purchasing or doing things, by making money more expensive to obtain. Conversely, when it decreases the federal funds rate, the Fed is increasing the money supply and, by making it cheaper to borrow, encouraging spending. Other countries’ central banks do the same thing for the same reason.

Why is this number, what one bank pays another, so significant? Because the prime interest rate—the interest rate commercial banks charge their most credit-worthy customers—is largely based on the federal funds rate. It also forms the basis for mortgage loan rates, credit card annual percentage rates (APRs) and a host of other consumer and business loan rates.

What Happens When Interest Rates Rise?

When the Fed increases the federal funds rate, it does not directly affect the stock market itself. The only truly direct effect is it becomes more expensive for banks to borrow money from the Fed. But, as noted above, increases in the federal funds rate have a ripple effect.

Because it costs them more to borrow money, financial institutions often increase the rates they charge their customers to borrow money. Individuals are affected through increases to credit card and mortgage interest rates, especially if these loans carry a variable interest rate. This has the effect of decreasing the amount of money consumers can spend. After all, people still have to pay the bills, and when those bills become more expensive, households are left with less disposable income. This means people will spend less discretionary money, which will affect businesses’ revenues and profits.

But businesses are affected in a more direct way as well because they also borrow money from banks to run and expand their operations. When the banks make borrowing more expensive, companies might not borrow as much and will pay higher rates of interest on their loans. Less business spending can slow the growth of a company; it might curtail expansion plans or new ventures, or even induce cutbacks. There might be a decrease in earnings as well, which, for a public company, usually means the stock price takes a hit.

Interest Rates and the Stock Market

So now we see how those ripples can rock the stock market. If a company is seen as cutting back on its growth or is less profitable—either through higher debt expenses or less revenue—the estimated amount of future cash flows will drop. All else being equal, this will lower the price of the company’s stock. (For related reading, see: Taking Stock of Discounted Cash Flow.)

If enough companies experience declines in their stock prices, the whole market, or the key indexes (e.g., Dow Jones Industrial Average, S&P 500) many people equate with the market, will go down. With a lowered expectation in the growth and future cash flows of the company, investors will not get as much growth from stock price appreciation, making stock ownership less desirable. Furthermore, investing in equities can be viewed as too risky compared to other investments.

However, some sectors do benefit from interest rate hikes. One sector that tends to benefit most is the financial industry. Banks, brokerages, mortgage companies and insurance companies’ earnings often increase as interest rates move higher, because they can charge more for lending.

Interest Rates and the Bond Market

Interest rates also affect bond prices and the return on CDs, T-bonds and T-bills. There is an inverse relationship between bond prices and interest rates, meaning as interest rates rise, bond prices fall, and vice versa. The longer the maturity of the bond, the more it will fluctuate in relation to interest rates. (For related reading, see: How Bond Market Pricing Works.)

When the Fed raises the federal funds rate, newly offered government securities, such Treasury bills and bonds, are often viewed as the safest investments and will usually experience a corresponding increase in interest rates. In other words, the “risk-free” rate of return goes up, making these investments more desirable. As the risk-free rate goes up, the total return required for investing in stocks also increases. Therefore, if the required risk premium decreases while the potential return remains the same or dips lower, investors might feel stocks have become too risky and will put their money elsewhere.

One way governments and businesses raise money is through the sale of bonds. As interest rates move up, the cost of borrowing becomes more expensive. This means demand for lower-yield bonds will drop, causing their price to drop. As interest rates fall, it becomes easier to borrow money, causing many companies to issue new bonds to finance new ventures. This will cause the demand for higher-yielding bonds to increase, forcing bond prices higher. Issuers of callable bonds may choose to refinance by calling their existing bonds so they can lock in a lower interest rate.

For income-oriented investors, reducing the federal funds rate means a decreased opportunity to make money from interest. Newly issued treasuries and annuities won’t pay as much. A decrease in interest rates will prompt investors to move money from the bond market to the equity market, which then starts to rise with the influx of new capital.

What Happens When Interest Rates Fall?

When the economy is slowing, the Federal Reserve cuts the federal funds rate to stimulate financial activity. A decrease in interest rates by the Fed has the opposite effect of a rate hike. Investors and economists alike view lower interest rates as catalysts for growth—a benefit to personal and corporate borrowing, which in turn leads to greater profits and a robust economy. Consumers will spend more, with the lower interest rates making them feel they can finally afford to buy that new house or send the kids to a private school. Businesses will enjoy the ability to finance operations, acquisitions and expansions at a cheaper rate, thereby increasing their future earnings potential, which, in turn, leads to higher stock prices.

Particular winners of lower federal funds rates are dividend-paying sectors such as utilities and real estate investment trusts (REITs). Additionally, large companies with stable cash flows and strong balance sheets benefit from cheaper debt financing.

Impact of Interest Rates on Stocks

Nothing has to actually happen to consumers or companies for the stock market to react to interest-rate changes. Rising or falling interest rates also affect investors’ psychology, and the markets are nothing if not psychological. When the Fed announces a hike, both businesses and consumers will cut back on spending, which will cause earnings to fall and stock prices to drop, everyone thinks, and the market tumbles in anticipation. On the other hand, when the Fed announces a cut, the assumption is consumers and businesses will increase spending and investment, causing stock prices to rise.

However, if expectations differ significantly from the Fed’s actions, these generalized, conventional reactions may not apply. For example, let’s say the word on the street is the Fed is going to cut interest rates by 50 basis points at its next meeting, but the Fed announces a drop of only 25 basis points. The news may actually cause stocks to decline because assumptions of a 50-basis-points cut had already been priced into the market. (For related reading, see: 8 Pshychological Traps Investors Should Avoid.)

The business cycle, and where the economy is in it, can also affect the market’s reaction. At the onset of a weakening economy, the modest boost provided by lower rates is not enough to offset the loss of economic activity, and stocks continue to decline. Conversely, towards the end of a boom cycle, when the Fed is moving in to raise rates—a nod to improved corporate profits—certain sectors often continue to do well, such as technology stocks, growth stocks and entertainment/recreational company stocks.

The Bottom Line

Although the relationship between interest rates and the stock market is fairly indirect, the two tend to move in opposite directions: as a general rule of thumb, when the Fed cuts interest rates, it causes the stock market to go up; when the Fed raises interest rates, it causes the stock market as a whole to go down. But there is no guarantee how the market will react to any given interest rate change the Fed chooses to make. By Mary Hall.

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

|

Now’s the perfect time of year for a free mortgage check-up. With spring on its way and interest rates on the rise, it makes sense for us to revisit your mortgage and ensure it still meets your needs. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or you simply want to take a vacation. Whatever your needs, we can evaluate your situation and help you determine what’s right for you.

Adriaan Driessen

Mortgage Broker

Dominion Lending Forest City Funding 10671

Cell: 519.777.9374

Fax: 519.518.1081

415 Wharncliffe Road South

London, ON, N6J 2M3

Lori Richards Kovac

Mortgage Agent & Administrator

Dominion Lending Forest City Funding 10671

Cell: 519.852.7116

Fax: 519.518.1081

415 Wharncliffe Road South

London, ON, N6J 2M3

Adriaan Driessen

Sales Representative & Senior Partner

PC275 Realty Brokerage

Cell: 519.777.9374

Fax: 519.518.1081

415 Wharncliffe Road South

London, ON, N6J 2M3