Industry & Market Highlights

The short break in interest rate increases may be over

Over the past few months rates have held steady and gave home owners a reprieve in the increasing mortgage interest rate market. After the official announcement of a trilateral trade agreement with Canada, the U.S. and Mexico, and the US Federal Reserve Bank raising interest Rates – most Economists agree that the Bank of Canada is next to make a rate announcement, and we may start to see some slow, but steady interest rate increases again. Of course no one can say for sure, but the signs seem to point in that direction. If you’re feeling nervous about rates increasing contact your broker to review your options to look out for your best interest.

If you are currently in a variable rate mortgage with a lower risk tolerance, this may be the time to consider locking in. If you have a high risk tolerance and are used to the ebb and flow of markets, it’s business as usual.

Increases in the U.S. and the potential ripple effect

Market watchers who are forecasting another Bank of Canada rate increase next month have been handed more backing for their prediction.

Last week the U.S. Federal Reserve pushed up its policy rate for the eighth time since December of 2015. The Fed increased its benchmark rate by 25 basis points (a quarter of a percent) to a range of 2% to 2.25%, the same level it was at in April 2008, before the height of the global financial crisis. The U.S. central bank also made it clear it intends to continue along that path.

The Fed says it expects one more increase this year and is projecting at least three hikes in 2019. It has also changed some of the language in the accompanying statement, eliminating the phrase “the stance of monetary policy remains accommodative.”

The effects of U.S. rate increases routinely ripple across the border influencing bond rates and the value of the Canadian dollar. A declining loonie could trigger further inflation, as the cost of imported goods increase.

The Bank of Canada is already facing an inflation rate that is running on the high side of its 1% to 3% target range. Unemployment is at generationally low levels in Canada, and working people exercising their spending power can also fuel inflation.

Given these pressures and the BoC’s stated desire to normalize interest rates another quarter-point increase seems very likely on October 24th. By First National Financial.

SOLD Date Coming to Realtor.ca

CREA’s Board of Directors has voted to add sold and historical data to the property listings on Realtor.ca without the need for a login.

In a message to real estate boards across the country, CREA says the move comes “in order to meet consumer demand and at the request of Realtors and boards.”

It says, “In addition to responding to requests from members, this will ensure we continue to offer leading edge services on the best real estate website in Canada.”

A Competition Tribunal decision in July 2016 found that by not including sold and other data in its VOW feed to members, TREB had engaged in anti-competitive acts. An appeal court upheld the decision and on Aug. 23 of this year, the Supreme Court of Canada announced that it would not hear TREB’s appeal. CREA supported TREB at the tribunal and had intervenor status in the proceedings.

TREB is now supplying the disputed data to its member VOWs.

CREA media relations officer Pierre Leduc says that before the sold data can be displayed on Realtor.ca, each real estate board must request that the information be added. CREA will then work with the boards, the provincial associations and the regulators to ensure that it complies with all laws and regulations.

“We’ll have to check with the boards to see what historic sold data they have access to, and how far back that data will go,” says Leduc.

Only historic sold prices will be posted and not pending solds, he says. Pending solds were part of the Competition Tribunal order for VOWs, but consumers and Realtors are concerned about privacy issues on deals that have yet to close.

Leduc says CREA hopes to have the sold data rolled out on Realtor.ca as soon as possible. By REMonline.com

CREA: National home sales post modest sales gain

Growth in Canada’s housing market in August was modest as the effects of the mortgage stress test continues, although is beginning to fade.

The latest sales data and forecast from the Canadian Real Estate Association released Monday shows a small rise for sales in August, a 0.9% increase month-over-month.

Actual (not seasonally-adjusted) activity was down 3.8% year-over-year while prices nationally increased 1% from a year earlier. Sales activity is weaker than most months over the last 4 years.

“The new stress-test on mortgage applicants implemented earlier this year continues to weigh on national home sales,” said CREA President Barb Sukkau. “The degree to which the stress-test continues to sideline home buyers varies depending on location, housing type and price range.”

There were 5.2 months of inventory on a national basis at the end of August 2018, right in line with the long-term average for the measure.

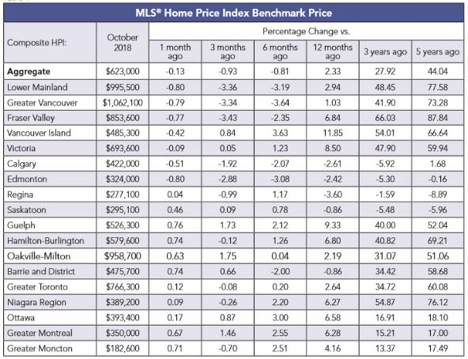

The Aggregate Composite MLS® Home Price Index (MLS® HPI) was up 2.5% y-o-y in August 2018.

The largest y-o-y price gains in August were for apartments (+9.5%), followed by townhouse/row units (+4.3%). But prices for one-storey and two-storey single family homes were little changed on a y-o-y basis in August (+0.4% and -0.4% respectively).

Where the gains were

Around half of all local markets recorded an increase in sales from July to August, led again by the GTA.

TD Economics’ analysis of the data shows the largest gains were in Toronto (+2.2%), Montreal (+2.8%) and Edmonton (+5.4%) while sales were lower in Halifax (-8.2%), London (-1.2%) and Winnipeg (-1.0%).

Activity picked up in several markets in B.C. including 2.9% in Vancouver – the first gain this year – along with the Fraser Valley (+0.6%), Okanagan-Mainline (+1.7%), and Victoria (+2.7%).

“Our view is that sales and prices will continue to grow, but that rising borrowing costs will restrain the pace of expansion. This is particularly true for more expensive markets in Ontario and B.C. where affordability pressures are acute,” TD economist Rishi Sondhi says.

Activity had fallen too far

In his assessment of the CREA data, RBC Economics’ senior economist Robert Hogue says that the figures show that the recent drop in activity was part of the market finding its normal level following B-20.

“The fact that home resales snapped back by 8.1% in the four months since reaching a seven-year low in April tells us that activity had fallen too far. This is typical following a major policy change that pulled some activity forward,” he said.

He added that the latest figures reflect a new, slower phase of recovery. By Steve Randall.

Decreasing certainty for an increase in rates

Market watchers have now fixed their gaze on October 24th as the most likely date for the next rate move by the Bank of Canada. As of the setting last week, that saw no change, the betting was about 75% in favour of a hike in October, but that certainty seems to be slipping.

The latest employment numbers from Statistics Canada will likely have the Bank carefully considering any move toward an increase. The August unemployment rate popped-up 0.2 of a percentage point to 6.0%, on a net loss of 51,600 jobs in August.

The August jobs report is sending mixed messages though. Most of the losses came in part-time positions, which fell by 92,000. Full-time jobs actually increased by 40,400. Year-over-year employment in Canada is up 0.9%. While 155,000 part-time positions have disappeared, there has been a gain of 326,000 full-time jobs for a net gain of 171,000 positions.

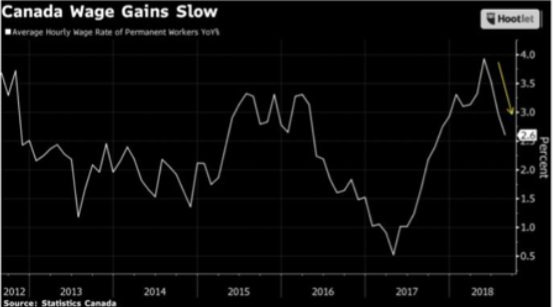

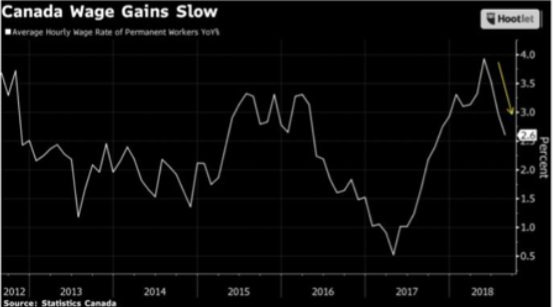

Another factor that could hold back an October rate increase is a softening of wage growth. The rate of increase in hourly pay slowed to 2.9% in August, down from 3.2% – year-over-year – in July and a 3.6% in June.

The bigger issue, though, remains the NAFTA re-negotiations. Uncertainty about the outcome of the talks is a drag on the Canadian economy. It is hampering the Bank of Canada’s efforts to move economic growth away from debt-fueled consumer spending to business investment and export growth.

The Bank continues to use words like cautious and gradual to describe its approach and with inflation remaining well inside the Bank’s target range there is no urgency for a rate increase. By First National Financial.

Canadian Mortgage Credit Growth Grinds To A Halt, Worst Growth In 18 Years

The Canadian real estate market is slowing down, and it’s hitting mortgages. Bank of Canada (BoC) numbers show mortgage credit grinded to a halt in July. The annual rate of mortgage growth fell to the lowest level in nearly 18 years, and is set up to go lower.

Canadians Owe Over $1.52 Trillion In Mortgage Debt

Canadians set a new dollar record for outstanding mortgage credit at institutional lenders. The outstanding balance stood at $1.52 trillion in July, up $4.95 billion from the month before. Households sent the total $54.22 billion higher than the same time last year. On the upside, lenders are primed to receive a whole lot of interest payments. On the other hand, if we look closely – we see the rate of growth is actually shrinking very quickly.

Outstanding Mortgage Credit

The outstanding balance of Canadian mortgage credit.

Mortgage Debt (in millions)

Source: Bank of Canada, Better Dwelling.

Canadian Mortgage Credit Falls To Lowest Growth Since July 2001

The growth of mortgage credit fell to its lowest levels in almost two decades. The $54.22 billion increase from last year comes in at just 3.7% growth. That still sounds pretty decent, until you realize it’s only 0.68% in real terms. The annual pace of growth is now the lowest it’s been since July 2001. For historical context, a then new artist named Shaggy topped the charts with It Wasn’t Me when mortgage growth was last this low. Of course most of you have no idea who he is, so ask your mom for the best explanation. Then tell her mortgage levels fell to Shaggy-era levels of growth, and email us her take.

Canadian Outstanding Mortgage Credit Change

The 12 month percent change, and 3 month annualized change, of outstanding mortgage credit.

Source: Bank of Canada, Better Dwelling.

Mortgage Growth Likely To Head Lower

Looking at the short-term trend, these numbers will likely come in lower for at least a few more months. Annualizing growth over the past 3 months, we get just 1.7% – lower than inflation. This means if the annual growth rate came in at the same pace as the past 3 months, the rate would fall to 1.7%. Until this number rises above the annual pace for a while, expect the rate to continue to fall.

Canada is coming off of record sales years, and interest rates are quickly climbing. That’s dropping demand for new loans, and tightening credit requirements. It shouldn’t be a huge surprise that mortgage growth is on the decline, and likely to slide further. By betterdwelling.com

Reviewing the Stress Test and B-20 Lending rules hindering the Canadian Housing Market

Back in 2013, the B-20 rules as underwriting guidelines for residential mortgages came into effect. The rules were put in place as a direct response to the financial issues in the United States caused by “poor mortgage lending practices” (mortgagebrokernews.ca).

Now, 5 years after these rules have come into effect, Canada’s housing market is said to be facing affordability issues. It is widely believed that it is become increasingly more difficult for first time home buyers to purchase a property. To deal with the affordability issues and the stress test, some young people are borrowing from parents to help with a down payment.

Recently, it has been reported that there is a decrease in mortgage originations from the Millennial and Generation Z cohort and a rise amongst the Pre-War Generation (those between the ages of 73-93). Findings have shown an increase of mortgage originations of 63% in the last quarter from the Pre-War Generation (theglobeandmail.com).

This begs the questions: are those who are trying to get into the housing market seeking help from their grandparents and asking them to take out mortgages for their grandchildren? Is the current generation asking and receiving help from their aging grandparents? If so, what else are they willing to do to achieve their goal of home ownership?

The Conservative party as made a motion to the House of Commons to institute a subcommittee to review the stress test and B-20 rules to determine if it is helping or hindering the Canadian housing market. By CMBA, Canadian Mortgage Brokers Association.

Economic Highlights

Canadian Jobs Plunge in August As Unemployment Rises

In a real shocker, Statistics Canada announced this morning that employment dropped by 51,600, retracing most of the 54,100 gain in July. Economists had been expecting a much stronger number, but the Labour Force Survey is notoriously volatile, and job gains continue to average 14,000 per month over the past year. Full-time employment growth has run at about twice the pace at an average monthly increase of 27,000. Labour markets remain very tight across the country.

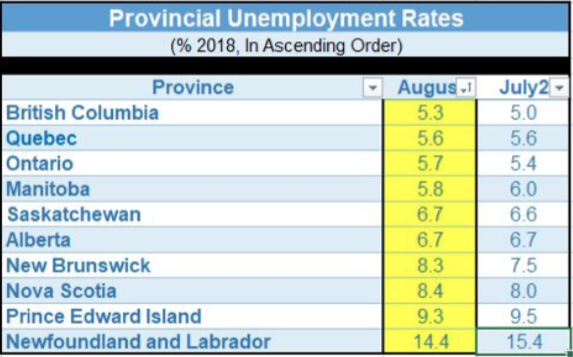

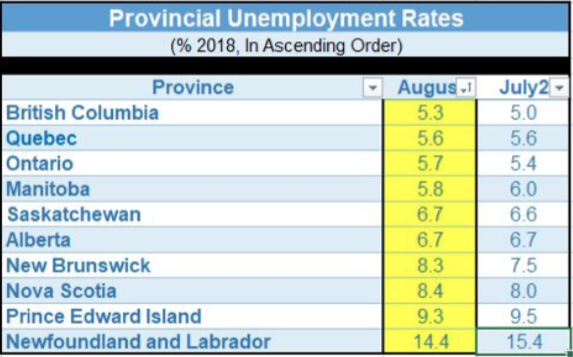

The unemployment rate returned to its June level of 6.0%, ticking up from 5.8% in July. July’s jobless figure matched a more than four-decade klow. At 6.0%, the unemployment rate is 0.2 percentage points below the level one year ago.

All of the job loss last month was in part-time work, down 92,000, while full-time employment rose by 40,400. The strength in full-time jobs is a sign that the labour market is stronger than the headline numbers for August suggest.

On a year-over-year basis, employment grew by 172,000 or 0.9%. Full-time employment increased (+326,000 or +2.2%), while the number of people working part-time declined (-154,000 or -4.3%). Over the same period, total hours worked were up 1.6%.

Statistics Canada commented that monthly shifts in part-time employment could result from movements between part-time and full-time work, the flux of younger and older workers in and out of the labour force, changes in employment in industries where part-time work is relatively common, or deviations from typical seasonal patterns.

By industry, the decline was broadly based and included a loss of 16,400 jobs in construction and 22,100 in the professional services sector. The number of people working in wholesale and retail trade declined by 20,000, driven by Quebec and Ontario.

Job losses were huge in Ontario as employment increased in Alberta and Manitoba. Employment was little changed in the other provinces.

After two consecutive monthly increases, employment in Ontario fell by 80,000 in August, which was the province’s most significant job loss since 2009. All of the decline was in part-time work. On a year-over-year basis, Ontario employment increased by 79,000 (+1.1%). The Ontario unemployment rate rose 0.3 percentage points in August, to 5.7% (see table below).

In Ontario, full-time employment held steady compared with the previous month, with year-over-year gains totalling 172,000 (+3.0%). Part-time jobs fell by 80,000 in August, following a roughly equivalent rise in July. In the 12 months to August, part-time work decreased by 93,000 (-6.7%).

Employment in Alberta rose by 16,000, and the unemployment rate remained at 6.7% as more people participated in the labour market. Compared with August 2017, employment grew by 53,000 (+2.3%), mostly in full-time work.

In Manitoba, employment rose by 2,600, driven by gains in part-time work, and the unemployment rate was 5.8%. On a year-over-year basis, employment in the province was unchanged, while the unemployment rate increased 0.8 percentage points as more people looked for work.

In British Columbia, employment edged up and the unemployment rate increased 0.3 percentage points to 5.3% as more people searched for work. Compared with a year earlier, employment was virtually unchanged.

Wage gains decelerated to their lowest level this year as average hourly earnings were up 2.9% y/y, the slowest pace since December.

There is no real urgency for the Bank of Canada to hike interest rates as the economy shows little risk of overheating. So far in 2018, the economy has shed 14,600 jobs, but the number masks a 97,300 gain in full-time work. Part-time employment is down by 111,900 this year.

The economy is running at or near full-employment as job vacancies continue to mount. If a NAFTA agreement comes to fruition, it is still likely the Bank of Canada will raise interest rates once again at the policy meeting in October. The Bank of Canada guided in that direction yesterday when Senior Deputy Governor Carolyn Wilkins said the central bank’s top officials debated this week whether to accelerate the pace of potential interest rate hikes, before finally choosing to stick to their current “gradual” path.

By Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres.

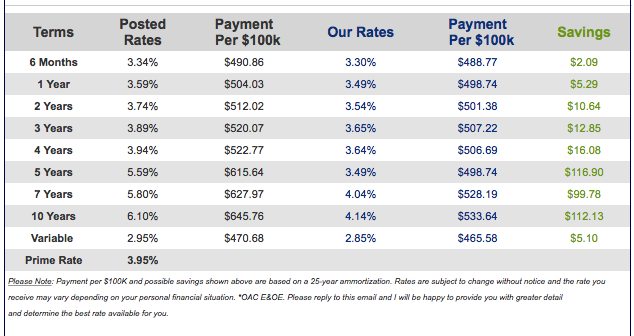

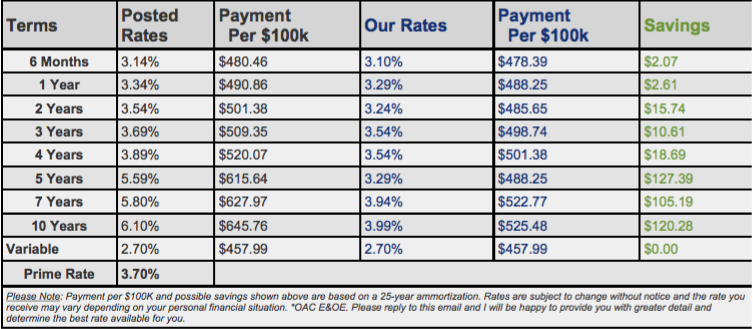

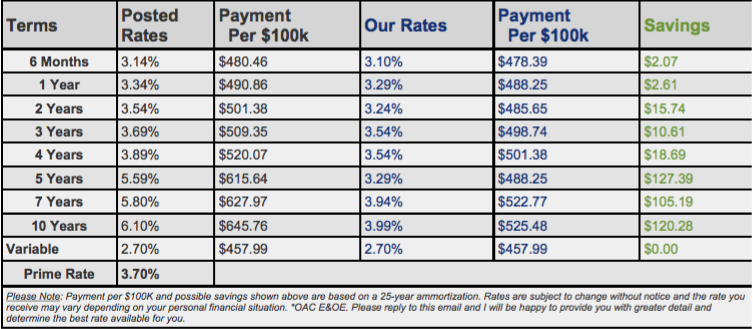

Mortgage Interest Rates

Prime lending rate is 3.7%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.34%. Fixed rates are starting to creep up again. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive.

This edition of the Weekly Rate Minder shows the latest rates available for Canadian mortgages. At Dominion Lending Centres, we work on your behalf to find the best possible mortgage to suit your needs.

Explore mortgage scenarios using helpful calculators on my website: http://www.iMortgageBroker.ca

Mortgage Update – Mortgage Broker London

Other Industry News & Insights

The benefits of flexibility – Interest Only Mortgage

Merix financial recently launched a brand-new product, the Interest-Only Flex Mortgage, geared toward homeowners and investors looking to purchase or refinance up to 80% of the value of the home and take advantage of lower monthly payments during the term. The product offers clients an interest-only payment or a combination of an interest-only payment and an amortizing (principal and interest) payment with either fixed and ARM rates, giving clients choice and flexibility with their finances.

Boris Bozic, founder and CEO of MERIX Financial, sat down with CMP to share more about this significant opportunity for brokers and homeowners.

CMP: Why did MERIX Financial develop this product?

Boris Bozic: We felt there was a need for it. Affordability of homes is an issue, and cash flow is increasingly important. With the increased cost of carrying homes and interest rates on the rise, there was an opportunity to innovate and offer something new to the industry.

CMP: How do you see this meeting the needs of mortgage brokers and their clients?

BB: Brokers will have choice – or, at the very least, have more choice. It’s no longer required of them to just support one of the Big Five, and they can offer solutions where they may not have been able to previously.

For borrowers, it’s primarily about providing additional cash flow for those with other liabilities – for example, student loans. The monthly mortgage payments are comparatively lower than they would typically pay; therefore, they can dedicate those excess funds to other outstanding debts. It also speaks to borrowers whose circumstances may change over the next few years – for example, for maternity/paternity leaves, etc.

CMP: What other types of clients would this mortgage be suitable for?

BB: Well, in my estimation, it’s suitable to all borrowers. However, it could be for clients with seasonal work who would like to pay down their mortgage using the 20% repayment feature on a schedule that fits their irregular cash flow; clients who are living in markets with high real estate prices who want to purchase a home in their desired neighbourhood with manageable monthly payments; investors looking to improve wealth over the long-term, who can put that extra cash to better use through investment opportunities, rather than repaying the principal on a mortgage; clients looking for lower monthly payments to save for home renovations to improve property value; and property investors who own multiple rentals and want to keep mortgage expenses low.

I don’t want to pigeonhole this product – the possibilities really are endless. Adaptations are being provided by our customers, too; they are utilizing this product in ways and in scenarios that we didn’t even contemplate.

CMP: What are the main advantages of the Interest-Only Flex?

BB: The biggest one, of course, would be the monthly payments. That’s why someone would want this over a traditional mortgage – the cash flow. It’s extremely customizable and flexible to be exactly what you need in your financial situation.

Other advantages would be things like LTV up to 80% – maximum 65% in interest-only, and the remaining 15% can be in an amortizing loan. It also applies to all mortgages: purchases, refinances, switches and rentals.

CMP: How do you position this mortgage’s higher interest rate to brokers and borrowers?

BB: That is a challenge. Both brokers and borrowers are hardwired to look at interest rate only. This is not an interest rate mortgage. This is a cash flow mortgage. Therefore, sometime is required to educate the broker base as well as the borrower – but numbers speak for themselves, and the math should guide brokers and borrowers alike.

One of the education tools we’ve created is an Interest-Only Flex calculator that will demonstrate to your client which product mix will provide the best cash flow option for their specific situation.

CMP: Does it meet B-20 requirements?

BB: Absolutely. Obviously great effort was made to ensure that the mortgage features were B-20 compliant.

Also, the product speaks to the concerns that regulators and government officials had that a large portion of borrowers’ disposable income went towards mortgage payments. Because Canadians are predisposed to ensuring that their mortgage payments are up to date, the greater economy doesn’t benefit – those are the government’s words, not ours. Therefore, we created a product that allows Canadian borrowers to still provide shelter for their families, but with lower payments so that the excess funds can be applied to other market sectors.

CMP: Will this product be launched in Quebec in the future?

BB: Not for the foreseeable future, but we plan on other innovative products and launches solely for the Quebec marketplace.

CMP: How does the compensation on this mortgage work?

BB: It’s identical to our existing commission structure, whether it be trailer fees through MERIX or upfront compensation with our Lendwise model. Nothing changes.

CMP: What has the initial reaction to Interest-Only Flex been like?

BB: Extremely positive. We’ve received significant kudos for launching something new and being innovative. The response in larger urban centres – i.e. GTA and GVA – has been very positive, given that our loan limits can now be up to $2 million on an uninsured basis.

CMP: Are there any future innovations in the pipeline from MERIX Financial? What’s next?

BB: There’s always something that’s next. It’s what we do. A lot of our focus and attention is geared towards the digital experience for the broker and the borrower. Stay tuned. By CMP.

Some Ontario Realtors may need to become licensed travel agents

Real estate brokerages in Ontario that work with consumers to arrange short-term accommodations are being told they must become licensed as travel agents.

The Travel Industry Council of Ontario (TICO) has begun a campaign targeting real estate brokerages with threats of legal action because they work with consumers arranging short-term accommodations, says the Ontario Real Estate Association (OREA). TICO is sending “compliance letters” to Realtors demanding that they become registered as travel agents.

In a letter to Jim Wilson, Ontario’s Minister of Economic Development, OREA CEO Tim Hudak says, “As you know, Realtors are registered under the Real Estate & Business Brokers Act, 2002 (REBBA). This double registration requirement is a needless piece of red tape that costs real estate small businesses thousands of dollars, considerable time and much aggravation with no discernable benefit to consumers.”

To register under TIA, a real estate brokerage must take a nine-module TICO administered course and exam. In addition, brokerages are required to pay a $3,000 registration fee, a

$10,000 security deposit and maintain at least $5,000 of working capital, says OREA.

The brokerages being targeted are operating in Georgian Bay, Prince Edward County, Muskoka and Haliburton, where recreational properties are in high demand, it says.

“According to TICO, real estate professionals are not permitted to transact short term rental properties because these properties do not fall under the Residential Tenancies Act, 2006 (RSA). TICO defines short-term rental properties as accommodations offered to ‘travelers’ for 30 days or less. The term ‘travelers’ is not defined under the Travel Industry Act, 2002. TICO maintains that a real estate registrant is only permitted to transact residential leases covered by the RSA,” says the OREA letter.

“OREA opposes TICO’s arbitrary double registration requirement. Our position is based on the following:

“Real estate registrants in Ontario are licensed to trade in all types of real estate with very limited exceptions.

“Based on our preliminary analysis, there is no basis for TICO’s ruling that real estate registrants can only transact RSA defined rental leases.

“Real estate registrants are subject to strong ethical requirements under REBBA, making the registration requirement redundant from a consumer protection point of view; and,

“Real estate registrants are required to carry robust errors and omissions insurance that is designed to protect consumers.”

Hudak’s letter continues: “This piece of red tape is a money grab, which is costing real estate brokerages thousands of dollars. These funds should be repaid to our member real estate brokerages.”

The association is asking that TICO put its compliance campaign on hold until all parties can meet to try and work out a solution that “protects consumers and minimizes unnecessary overlap and duplication.” By REMonline.com

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

•Toronto home prices steady as short supply offsets mortgage woes (BNN Bloomberg)

•Vancouver home sales sink in September as listings hit multi-year highs (BNN Bloomberg)

•Here’s how mid-density housing could become a reality for GTA cities (Livabl)

•Despite affordability concerns, Millennials are surprisingly optimistic about the GTA housing market (Livabl)

•Vancouver Housing Demand Drops Like A Rock, And Prices Are Now Falling (Huffington Post)

•Here’s one way the new USMCA deal will affect the Canadian housing market (Livabl)

•Starting today, self-employed Canadians have a better shot of qualifying for a mortgage (Livabl)

•Housing affordability is more important to BC Millennials than fighting climate change, childcare: poll (Livabl)

•A jump in sales marks the start of the GTA fall housing market, according to experts (Livabl)

•Housing Affordability In Canada At Worst Levels In Almost 30 Years: RBC Economics (Huffington Post)

•Toronto, Vancouver Have World’s 3rd And 4th Largest Housing Bubbles: UBS (Huffington Post)

•According to this expert, there’s going to be a surge of GTA new home sales this fall (Livabl)

•This website reveals what your neighbours paid for their Vancouver homes — whether real estate boards like it or not (Livabl)

•Priced out of Toronto? Here are Ontario’s most affordable housing markets (Livabl)

•GTA luxury real estate rebounds heading into the fall: Sotheby’s (Livabl)

•Toronto Isn’t Ontario’s Least Affordable Housing Market: Zoocasa Report (Huffington Post)

•Benefits of Homeownership Reaffirmed in New Study (Canadian Mortgage Trends)

•Home sales increase for 4th straight month, but prices still flat nationally (CBC)

•Canadian Home Sales Rise for a Fourth Straight Month (Bloomberg)

•The Canadian housing market will be kept “in check” for the rest of the year: CREA (Livabl)

There is never a better time than now for a free mortgage check-up. It makes sense for us to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal. Whatever your needs, we can evaluate your situation and help you determine what’s right for you.

Adriaan Driessen

Mortgage Broker

Dominion Lending Forest City Funding 10671

Cell: 519.777.9374

Fax: 519.518.1081

riebro@me.com

www.iMortgageBroker.ca

415 Wharncliffe Road South

London, ON, N6J 2M3

Lori Richards Kovac

Mortgage Agent & Administrator

Dominion Lending Forest City Funding 10671

Cell: 519.852.7116

Fax: 519.518.1081

loriakovac@icloud.com

415 Wharncliffe Road South

London, ON, N6J 2M3

Adriaan Driessen

Sales Representative & Senior Partner

PC275 Realty Brokerage

Cell: 519.777.9374

Fax: 519.518.1081

adriaan@pc275.com

www.PC275.com

415 Wharncliffe Road South

London, ON, N6J 2M3

![]()