Industry & Market Highlights

Residential Market Commentary – What we know, What we can hope for

We have been receiving a lot of unsettling economic data lately.

Coming out of February, unemployment stood at 5.6% and nearly 250,000 jobs had been created in the previous 12 months. By the end of March, nearly a million jobs had disappeared. The Conference Board of Canada projects that could climb to 2.8 million by the end of April. The best guess right now is that unemployment stands at about 20%.

Nationally, March housing starts dropped 7.3% compared to February. The value of building permits – a forward looking indicator – crashed in March, dropping 23%.

As distressing as the numbers are, the real anxiety remains the unknown. But, many of the country’s best-known economists are putting on brave faces. They point to the temporary nature of the job losses. StatsCan reports most workers expect to be back on the job in about six months, once the coronavirus pandemic is deemed to be under control. We have also come to know that month-to-month job numbers can be volatile and need to be watched over time to establish trends.

The decline in housing starts can, at least in part, be attributed to bans on new construction. A number of jurisdictions are restricting builders to the completion of existing projects, only. And the drop in building permits is uneven across the country. B.C. is down nearly 27%, Ontario is down 50.5%, while Alberta increased nearly 12% and Halifax jumped 153%. By First National Financial.

Housing Market Another Victim of the Virus

Data released this morning from the Canadian Real Estate Association (CREA) showed national home sales fell 14.3% on a month-over-month (m-o-m) basis in March, the first national indication of the early impact of social isolation. The economic disruption and massive layoffs caused both buyers and sellers to increasingly retreat to the sidelines over the second half of the month.

Transactions were down on a m-o-m basis in the vast majority of local markets last month. Among Canada’s largest markets, sales declined in the Greater Toronto Area (GTA) (-20.8%), Montreal (-13.3%), Greater Vancouver (-2.9%), the Fraser Valley (-13.6%), Calgary (-26.3%), Edmonton (-13.2%), Winnipeg (-7.3%), Hamilton-Burlington (-24.9%) and Ottawa (-7.9%).

Actual (not seasonally adjusted) sales activity was still running 7.8% above a quiet March in 2019, although that was a considerable slowdown compared to the y-o-y gain of close to 30% recorded in February.

“March 2020 will be remembered around the planet for a long time. Canadian home sales and listings were increasing heading into what was expected to be a busy spring for Canadian REALTORS®,” said Jason Stephen, president of CREA. “After Friday the 13th, everything went sideways. REALTORS® are complying with government directives and advice, all the while adopting virtual technologies allowing them to continue showing properties to clients already in the market, and completing all necessary documents.”

“Numbers for March 2020 are a reflection of two very different realities, with most of the stronger sales and price growth recorded during the pre-COVID-19 reality which we are no longer in,” said Shaun Cathcart, CREA’s Senior Economist. “The numbers that matter most for understanding what follows are those from mid-March on, and things didn’t really start to ratchet down until week four. Preliminary data from the first week of April suggest both sales and new listings were only about half of what would be normal for that time of year.”

New Listings

The number of newly listed homes declined by 12.5% in March compared to the prior month. As with sales, the declines were recorded across the country.

With sales and new listings each falling by similar magnitudes in March, the national sales-to-new listings ratio edged back to 64% compared to 65.4% in February. While this is down slightly, the bigger picture is that this measure of market balance was remarkably little changed considering the extent to which current economic and social conditions are impacting both buyers and sellers.

Based on a comparison of the sales-to-new listings ratio with the long-term average, two-thirds of all local markets were in balanced market territory in March 2020. Virtually all of the remainder continued to favour sellers.

There were 4.3 months of inventory on a national basis at the end of March 2020. While this is up from the almost 15-year low of 3.8 months recorded in February, it remains almost a full month below the long-term average of 5.2 months. With the overall number of listings on the market continuing to fall in March, the m-o-m decline in the months of inventory measure was entirely the result of the outsized drop in sales activity.

The number of months of inventory is well above long-term averages in the Prairie provinces and Newfoundland & Labrador. By contrast, the measure is running well below long-term averages in Ontario, Quebec and the Maritime provinces. The measure remains in balanced territory in British Columbia.

Home Prices

With measures of market balance at this point, little changed from recent history, and most of the impact on sales and listings from the COVID-19 situation only showing up towards the end of March, the impact on housing prices will likely take a little longer to become apparent. Price measures for March 2020 were strongly influenced by very tight markets and a very strong start to the spring market in many parts of Canada before physical distancing measures were implemented.

The Aggregate Composite MLS® Home Price Index (MLS® HPI) rose 0.8% in March 2020 compared to February, marking its 10th consecutive monthly gain.

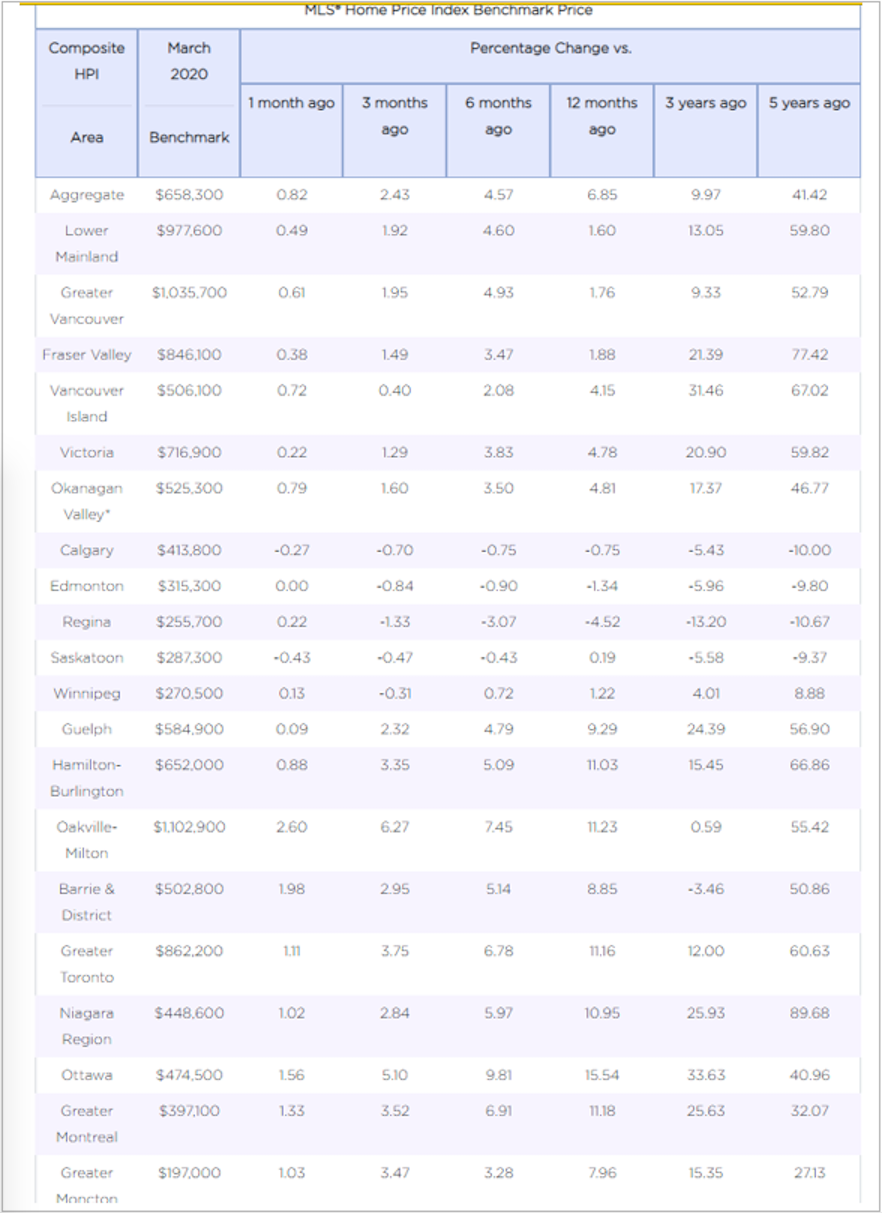

The MLS® HPI was up in March 2020 compared to the previous month in 16 of the 19 markets tracked by the index. (See the Table below)

Looking at the major Prairie markets, home price trends have ticked downwards in Calgary and Edmonton to start 2020 but have generally been stable since the beginning of last year. Prices in Saskatoon have also been stable over the last year, while those in Regina have continued to trend lower. Prices in Winnipeg have been on a slow upward trend since the beginning of 2019.

Meanwhile, the recovery in home prices has been in full swing throughout British Columbia and in Ontario’s Greater Golden Horseshoe (GGH) region. Further east, price growth in Ottawa, Montreal and Moncton continues as it has for some time now, with Ottawa and Montreal prices accelerating to start 2020.

Bottom Line: Clearly this is only the beginning, but the plunge in sales and new listings in the second half of March is indicative of the stall out in housing market activity likely until social distancing is removed and people feel safe enough to resume normal activities. No doubt, at that point, there will be buying opportunities, but right now, housing is just another contributor to the collapse in the economy. By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres.

Canadian home sales saw 14% drop in March

Home buying activity in major markets across Canada dropped steeply in the second half of March, leading to what amounted to a 14 percent decline in sales compared to February’s total.

While the strength of the first half of the month and the relative weakness of March 2019 ultimately led to a year-over-year national sales gain of 7.8 percent, the impact of the COVID-19 pandemic on Canada’s housing market is clear in the data published today by the Canadian Real Estate Association (CREA).

“March 2020 will be remembered around the planet for a long time. Canadian home sales and listings were increasing heading into what was expected to be a busy spring for Canadian REALTORS®. After Friday the 13th, everything went sideways,” said CREA President Jason Stephen in a media release accompanying the data.

The pandemic’s impact on housing activity is especially evident when comparing the relatively modest year-over-year sales gain seen in March to the near 30 percent increase recorded in February.

Although CREA published Canadian home sales data for the full month as is standard practice, the association’s Senior Economist Shaun Cathcart said the early March numbers reflect a “pre-COVID-19 reality which we are no longer in.”

“The numbers that matter most for understanding what follows are those from mid-March on, and things didn’t really start to ratchet down until week four,” Cathcart said. “Preliminary data from the first week of April suggest both sales and new listings were only about half of what would be normal for that time of year.”

As sales fell in March, CREA observed new listings declining by “similar magnitudes.” New listings dropped by 12.5 percent last month when compared to February data.

The CREA team believes that the full impact of the COVID-19 crisis on the Canadian housing market will become apparent in the months to come. While there is scant data to draw from on just how deeply affected Canadian housing will be, many industry leaders have come forward to voice confidence in the market’s ability to remain relatively stable through this challenging period.

“The impact of COVID-19 on the Canadian economy has been swift and violent, with layoffs driving high levels of unemployment across the country,” said Royal LePage CEO Phil Soper.

“While it is sad that these people skewed strongly to young and to part-time workers, for the housing industry, the impact of these presumably temporary job losses will be limited as these groups are much less likely to buy and sell real estate,” he continued.

Soper noted that evidence from past housing downturns leads him to believe that Canadian home prices will not be significantly impacted in 2020.

“Home price declines occur when the market experiences sustained low sales volume while inventory builds. Currently, the inventory of homes for sale in this country is very low, matching low sales volumes as people respect government mandates to stay at home,” he said. By Sean MacKay.

Real Estate Not Business As Usual

The Ontario Government extended emergency orders for the province until April 23, 2020. The list of essential businesses still includes real estate agent services, which the Government has grouped under Financial Services. Please note the Government has prohibited open house events, stipulating “Every person who is responsible for a business that provides real estate agent services shall ensure that the business does not host, provide or support any open house events.”

Not Business As Usual

The Real Estate Council of Ontario RECO) has emphasized, “Real estate brokerages, brokers and salespeople must cease hosting and attending open houses. In addition, RECO strongly recommends that brokers and salespeople follow the direction of health officials by limiting showings to situations where they are absolutely necessary.”

RECO has also said, “Everyone, including registrants, must take this crisis seriously for their own health and that of the general public. The Real Estate and Business Brokers Act, 2002 and the Code of Ethics include provisions that require registrants to practice with integrity, to promote the best interests of their clients and to act honourably and professionally. We take these matters very seriously. Registrants who demonstrate a blatant disregard for the protection of the public, by ignoring the direction of health officials during their trading activities, will face serious sanctions, including possible disciplinary prosecution by RECO.”

Check out more from RECO on some questions and guidelines. By London St. Thomas Association of Realtors LSTAR 2020 President Blair Campbell.

What Landlords Need To Know

Despite federal and provincial government supports, a prolonged COVID-19 crisis and the resultant loss of jobs and income will make it difficult for some tenants to pay their rent.

As a landlord, it is important to know what type of supports you have in order to continue making mortgage payments and paying the bills. Both tenants and landlords alike need a more comprehensive solution through this crisis with the shared understanding that all Ontarians need a secure place to call home.

What are my responsibilities as a landlord?

Landlords should maintain an open line of communication with their tenants to ensure that both parties are aware of each others’ expectations during this time. Landlords should ensure that they comply with occupancy limits, increase sanitation of their properties and are able to comply with social distancing measures by providing video tours of properties.

As many have fallen on hard financial times due to COVID-19, it should be noted that the Ontario government has ordered a stop to all evictions during the State of Emergency.

Buying or selling a tenanted property?

If a client has an urgent need to buy or sell a home during the COVID-19 crisis, REALTORS® have the modern tools and knowledge at their disposal to do virtual showings.

REALTORS® should work with landlords and tenants to ensure that the health and well-being of Ontario’s home buyers, sellers and families remains a focus. REALTORS® and landlords are encouraged to use modern technology that facilitates remote interactions, such as virtual tours, video conferencing and digital signing.

Do tenants need to pay rent?

Tenants need to continue paying rent during the COVID-19 pandemic. If your tenants’ financial situation has been affected by the coronavirus, landlords should work with their tenants to come to an agreement surrounding rent payments, reductions and deferrals.

What financial relief is available for landlords?

Mortgage Deferral

Canada’s big six banks are offering deferred mortgage payments for up to six months on a case-by-case basis. Landlords may be eligible for mortgage deferrals on their non-principal residence, including a rental property. For more information, please see our detailed guide for homeowners and reach out to your financial advisor.

Tax Extensions

The Canada Revenue Agency (CRA) has extended the deadline for filing income tax returns to June 1, 2020, and the deadline for payment of income tax to September 1, 2020.

Temporary Wage Subsidy for Employers

A Temporary Wage Subsidy is available for eligible employers, like landlords, that will allow for a reduction in the amount of payroll deductions require to be remitted to the CRA. Employers must see a 15 percent decline in revenue for March compared to January and February of 2020 to apply for the subsidy. Employers can apply through the CRA’s My Business Account portal.

Read an open letter to Minister Steve Clark from OREA CEO Tim Hudak about supporting rental-housing providers during the COVID-19 Crisis. By OREA.

Economic Highlights

Bank of Canada holds the line on its benchmark rate

This morning, the Bank of Canada left its target overnight benchmark rate unchanged at ¼ percent, which the Bank has framed as its effective “lower bound.”

This decision was expected after the BoC lowered its target for the overnight rate 150 basis points since the beginning of March.

Comparing the Bank’s two most recent statements (today and March 27, 2020), we find several notable new comments on the economy and financial markets:

- While the outlook is “too uncertain” to provide a complete forecast, analysis of alternative scenarios suggests the level of real economic activity was down 1-3 percent in the first quarter of 2020 and will be 15-30 percent lower in the second quarter than in Q4 2019.

- CPI inflation is expected to be close to 0 percent in the second quarter of 2020 “primarily due to the transitory effects of lower gasoline prices.”

- Efforts to contain the COVID-19 pandemic have “caused a sudden and deep contraction in economic activity and employment worldwide.”

- In financial markets, this has driven a “flight to safety and a sharp repricing of a wide range of assets” and has pushed down prices for commodities.

- One “early measure of the extent of the damage” was an unprecedented drop in employment in March, with more than one million jobs lost across Canada. Many more workers reported shorter hours, and by early April some six million Canadians had applied for the Canada Emergency Response Benefit.

- Fiscal programs, “designed to expand according to the magnitude of the shock,” will help individuals and businesses weather this shutdown phase of the pandemic, and support incomes and confidence leading into the recovery.

The Bank also reported that it is “temporarily increasing” the amount of Treasury Bills it acquires at auctions to up to 40 percent, effective immediately.

More new measures to support Canada’s financial system

The BoC also announced new measures to provide additional support to Canada’s financial system and ease pressure on Canadian borrowers including the development of:

- A new Provincial Bond Purchase Program of up to $50 billion to supplement its Provincial Money Market Purchase Program.

- A new Corporate Bond Purchase Program, in which the Bank will acquire up to a total of $10 billion in investment-grade corporate bonds in the secondary market.

The central bank promised both programs will be put in place in the coming weeks. The Bank also announced it is enhancing its Term Repo Facility to permit funding for up to 24 months.

As containment restrictions are eased and economic activity resumes, BoC believes that fiscal and monetary policy actions will help “underpin confidence and stimulate spending by consumers and businesses to restore growth.”

The Bank also released its Monetary Policy Report for April. During a related news conference, Stephen Poloz, Governor of the Bank of Canada noted that the Bank has so far “accumulated over $200 billion of new assets—amounting to about 10 percent of Canada’s GDP – in liquidity support for the economy.”

BoC’s next scheduled policy announcement is June 3, 2020 and in the ensuing period the Bank’s Governing Council noted that it “stands ready to adjust the scale or duration of its programs if necessary.” It further stated that all of its actions are “aimed at helping to bridge the current period of containment and create the conditions for a sustainable recovery and achievement of the inflation target over time.” By First National Financial.

Bank of Canada Stands Ready To Do Whatever It Takes

On the heels of a devastating decline in the Canadian economy, the Bank of Canada is taking unprecedented actions. With record job losses, plunging confidence and a shutdown of most businesses, this month’s newly released Monetary Policy Report (MPR) is a portrait of extreme financial stress and a sharp and sudden contraction across the globe. COVID-19 and the collapse in oil prices are having a never-before-seen economic impact and policy response.

The Bank’s MPR says, “Until the outbreak is contained, a substantial proportion of economic activity will be affected. The suddenness of these effects has created shockwaves in financial markets, leading to a general flight to safety, a sharp repricing of risky assets and a breakdown in the functioning of many markets.” It goes on to state, “While the global and Canadian economies are expected to rebound once the medical emergency ends, the timing and strength of the recovery will depend heavily on how the pandemic unfolds and what measures are required to contain it. The recovery will also depend on how households and businesses behave in response. None of these can be forecast with any degree of confidence.”

“The Canadian economy was in a solid position ahead of the COVID-19 outbreak but has since been hit by widespread shutdowns and lower oil prices. One early measure of the extent of the damage was an unprecedented drop in employment in March, with more than one million jobs lost across Canada. Many more workers reported shorter hours, and by early April, some six million Canadians had applied for the Canada Emergency Response Benefit.”

“The sudden halt in global activity will be followed by regional recoveries at different times, depending on the duration and severity of the outbreak in each region. This means that the global economic recovery, when it comes, could be protracted and uneven.”

Today’s MPR breaks with tradition. It does not provide a detailed economic forecast. Such forecasts are useless given the degree of uncertainty and the lack of former relevant precedents. However, Bank analysis of alternative scenarios suggests the level of real activity was down 1%-to-3% in the first quarter of this year and will be 15%-to-30% lower in the second quarter than in Q4 of 2019. Inflation is forecast at 0%, mainly owing to the fall in gasoline prices.

“Fiscal programs, designed to expand according to the magnitude of the shock, will help individuals and businesses weather this shutdown phase of the pandemic, and support incomes and confidence leading into the recovery. These programs have been complemented by actions taken by other federal agencies and provincial governments.”

The Bank of Canada, along with all other central banks, have taken measures to support the functioning of core financial markets and provide liquidity to financial institutions, including making large-scale asset purchases and sharply lowering interest rates. The Bank reduced overnight interest rates in three steps last month by 150 basis points to 0.25%, which the Bank considers its “effective lower bound”. It did not cut this policy rate again today, as promised, believing that negative interest rates are not the appropriate policy response. The Bank has also conducted lending operations to financial institutions and asset purchases in core funding markets, amounting to around $200 billion.

“These actions have served to ease market dysfunction and help keep credit channels open, although they remain strained. The next challenge for markets will be managing increased demand for near-term financing by federal and provincial governments, and businesses and households. The situation calls for special actions by the central bank.”

The Bank of Canada, in its efforts to provide liquidity to all strained financial markets, has, in essence, become the buyer of last resort. Under its previously-announced program, the Bank will continue to purchase at least $5 billion in Government of Canada securities per week in the secondary market. It will increase the level of purchases as required to maintain the proper functioning of the government bond market. Also, the Bank is temporarily increasing the amount of Treasury Bills it acquires at auctions to up to 40%, effective immediately.

The Bank announced new measures to provide additional support for Canada’s financial system. It will commence a new Provincial Bond Purchase Program of up to $50 billion, to supplement its Provincial Money Market Purchase Program. Further, the Bank is announcing a new Corporate Bond Purchase Program, in which the Bank will acquire up to a total of $10 billion in investment-grade corporate bonds in the secondary market. Both of these programs will be put in place in the coming weeks. Finally, the Bank is further enhancing its term repo facility to permit funding for up to 24 months.

The Bank will support all Canadian financial markets, with the exception of the stock market, and it “stands ready to adjust the scale or duration of its programs if necessary. All the Bank’s actions are aimed at helping to bridge the current period of containment and create the conditions for a sustainable recovery and achievement of the inflation target over time.”

This is exactly what the central bank needs to do to instill confidence that Canadian financial markets will remain viable. These measures are a warranted offset to panic selling. Too many investors are prone to panic in times like these, which has a snowball effect that must be avoided. As long as people are confident that the Bank of Canada is a backstop, panic can be mitigated. The Bank of Canada deserves high marks for responding effectively to this crisis and remaining on guard. Governor Poloz and the Governing Council saw it early for what it is, a Black Swan of enormous proportions.

As a result, Canada will not only weather the pandemic storm better than many other countries, but we will come out of this economic and financial tsunami in better condition. By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres.

![]()

Mortgage Interest Rates

The Bank of Canada’s target overnight rate is 0.25%. Prime lending rate is 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval is 5.04%. Changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%. Read the Government of Canada Department of Finance summary on Benchmark Rate for Insured Mortgages statement here.

Fixed mortgage rate movement has stabilized and levelled out in the past week as lenders get more familiar with a new normal during uncertainty. Variable rates have also responded the same way.

View rates Here – and be sure to contact us for a quote to help you find the lowest rate for your specific needs and product requirements.

Mortgage Update – Mortgage Broker London

Your Mortgage

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options and the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

We encourage you to follow guidelines from our public health authorities:

Middlesex Health Unit

https://www.healthunit.com/novel-coronavirus

Southwestern Public Health

https://www.swpublichealth.ca/content/community-update-novel-coronavirus-covid-19

Ontario Ministry of Health

https://www.ontario.ca/page/2019-novel-coronavirus

Public Health Canada

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Factual Statistics Coronavirus COVID-19 Globally:

https://www.worldometers.info/coronavirus/

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6