London Mortgage Broker – Market Update

Market interest rates have fallen sharply since the coronavirus-led investor flight to the safety of government bonds. The 5-year government bond yield–a harbinger of conventional mortgage rates–now stands at 1.34%, down sharply from the 1.60+% range it was trading in before the virus became global news (see chart below)

This morning, one of the Big-Six banks finally reacted. TD cut its posted 5-year fixed rate to 4.99%. TD’s posted rate had previously been at 5.34%, making this a 36 basis point cut. Other banks had lowered their qualifying rate to 5.19% last July, leading the Bank of Canada to cut its 5-year conventional mortgage rate to 5.19%. This is the qualifying rate under the B-20 rule introduced on January 1, 2018.

On January 24, the Assistant Superintendent of OSFI’s Regulation Sector, Ben Gully, gave a speech at the C.D. Howe Institute suggesting that the B-20 qualifying mortgage rate historically would be no more than 200 basis points above contract rates. He said that OSFI chose the “best available rate at the time.”

He went on to say that for many years, the difference between the benchmark rate and the average contract rate was 200 bps. However, this gap “has been widening more recently, suggesting that the benchmark is less responsive to market changes than when it was first proposed. We are reviewing this aspect of our qualifying rate, as the posted rate is not playing the role that we intended. As always, we will share our results with our federal partners. This will help to inform the advice OSFI might provide to the Minister, as requested in the mandate letter to him.“

By keeping posted rates too high, the Big-Six banks have inflated the qualifying rate, making it more difficult than necessary to pass the stress test to get a mortgage. While TD’s rate cut is welcome news, its posted rate is still too high by historical standards. Given today’s average contract rates, the posted rate should be at least 20 bps lower still. Banks have a strong incentive to inflate their posted mortgage rate. For one thing, they are the basis for the calculation of big-bank mortgage penalties. Also, they are the minimum qualifying rate.

The posted rate does not appropriately reflect the state of the mortgage market as few borrowers would pay this rate. Interestingly, banks often move this rate in lock-step, or close to it, reflecting their dominant oligopolistic position in the marketplace.

If a couple of the other big banks follow TD’s lead, the Bank of Canada benchmark rate will be below 5% for the first time since January 2018 when the new B-20 rules were adopted. Lowering the stress test rate by 20 bps from 5.19% to 4.99% would require roughly 1.8% less income to qualify for a mortgage on the average Canadian home price (assuming a 20% downpayment), increasing buying power by 2%. This doesn’t sound like much, but it can have a meaningful psychological impact on already improving housing markets. The latest CREA data shows that the national average home price surged 9.6% year-over-year in December. A lower stress test rate would make a busy spring housing market even more active.

BOC Rate Decision Unchanged

Bank of Canada maintains overnight rate target at 1 ¾ percent

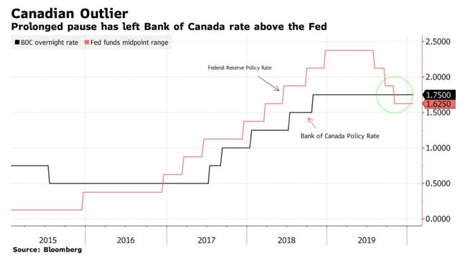

The Bank of Canada maintained its target for the overnight rate at 1 ¾ percent. The Bank Rate is correspondingly 2 percent and the deposit rate is 1 ½ percent.

Monetary Policy Report – January 2020

If the 2019 housing market could be summed up in one word, it would be “rebound” – most of Canada’s major urban markets saw sustained improvement in sales and price growth in the second half of the year, following the slump that plagued activity throughout 2017-2018. Now, as we look forward to 2020, the stage appears set for that upward movement to continue. How will that play out for buyers, sellers and mortgage borrowers? Let’s take a look at some of the most prevalent forecasts for the coming year.

Home sales are recovering from the stress test:

It’s no secret that the federal mortgage stress test, put in place by Canada’s banking regulator in January 2018, took a considerable bite out housing markets across the nation. The test requires insured mortgage borrowers to prove they could qualify for a mortgage at the Bank of Canada’s five-year benchmark rate – currently 5.19 per cent – while non-insured borrowers must qualify either at this rate or their contract rate plus two per cent, whichever is higher.

As a result, fewer buyers found themselves able to get A-level home financing, forcing them to either downsize their home purchase, seek alternative lending options, or sit out the market altogether. In all, Canada Mortgage and Housing Corp. reported the stress test dampened new mortgage lending to the slowest rate of growth in 25 years in 2018, at a pace not seen since the 2008 recession.

However, home buyers began to overcome these adverse effects in 2019; coupled with historically low mortgage rates, that led to a continued improvement in sales in the Greater Toronto and Vancouver areas, as well as a number of secondary markets.

Both CREA and CMHC are forecasting sales and price growth to continue steadily throughout 2020. The national association has called for a total of 530,000 transactions this year, an annual increase of 8.9 per cent, with the national average price climbing 6.2 per cent to $531,000.

“Overall, economic and demographic conditions will remain supportive of housing activity over the forecast horizon, halting the declines in starts, sales and average home prices that followed the highs of 2016-2017,” it states in its most recent Housing Market Outlook. Nationwide, CMHC expects 2020 sales to fall between 480,600-497,700 units, a year-over-year uptick of roughly six per cent. The average price will fall between $506,200-$531,000, up 5.6 per cent-6.7 per cent from this year.

The return of the seller’s market – at least, in Toronto:

While home sales steadily improved over 2019, the same can’t be said for the supply of new listings. According to CMHC, new supply shrank by -2.7 per cent year over year in November, resulting in a national sales-to-new-listings ratio of 66.3 per cent – well within sellers’ market territory. The total months of inventory – the length of time it would take to completely sell off all available homes for sale – currently sits at 4.7 months, its lowest level since 2007.

This was particularly notable in the Greater Toronto Area, where concerns of a supply-and-demand gap have grown over the past year. The end-of-year numbers from the Toronto Real Estate Board reveal the SNLR for the region was 81 per cent, indicating just under 20 per cent of all new listings brought to market were left unsold.

“Strong population growth in the GTA coupled with declining negotiated mortgage rates resulted in sales accounting for a greater share of listings in November and throughout the second half of 2019,” says Jason Mercer, TREB’s chief market analyst. “Increased competition between buyers has resulted in an acceleration in price growth. Expect the rate of price growth to increase further if we see no relief on the listings supply front.”

Cheap mortgages will stick around:

Overall, the BoC will take the same cautious stance it did in 2019; economic factors at home and abroad aren’t quite strong enough to warrant higher interest rates but are stable enough to prevent a rate cut. Avoiding a cut also leaves some wiggle room in case global trade and recession risks do materialize and the BoC needs to act.

Tension over U.S.-China trade relations, as well as growing unease in the Middle East, in particular, will inform the BoC’s careful approach.

Finally, there may also be relief on the way for those who continue to have their affordability hampered by the stress test. In a mandate to the federal Department of Finance, the Prime Minister’s Office has implored the finance minister to explore making the test more “dynamic”.

While it’s not certain what form these changes could take, there’s speculation that its higher-interest qualification hurdle could be reduced, or perhaps adjusted for borrowers with good credit. As well, they could remove the current requirement for borrowers to be re-stress tested when switching lenders, a measure that has drawn heavy criticism from the mortgage industry for discouraging consumer empowerment and competitiveness.

In all, it’s already shaping up to be a busy year for the real estate industry, and it will be interesting to see how growth clocks in within Canada’s major markets as the first year of a new decade unfolds. By REMonline.com. Penelope Graham

Residential Market Commentary – Stepping Away

One of the biggest influencers in the Canadian housing industry will be gone by the end of this year.

Evan Siddall, President and CEO of Canada Mortgage and Housing Corporation, has announced that he will not seek to renew his term. There is no firm date for his departure but Siddall’s current term is up at the end of 2020.

Siddall has been a polarizing figure since he was appointed to the job by the Conservative government of Stephen Harper in 2013. An outsider, with experience as an investment banker and advisor to the Bank of Canada, Siddall was brought-in to change CMHC’s relationship with the housing industry and give the agency a broader view of the economy.

The housing-driven, economic meltdown that started in the United States in 2008 was still top of mind for the Harper government, which was determined not to go down the same road. Mortgage heavy household debt remains a key concern for Canadian policy makers.

Siddall was disruptive. By turns he rubbed home builders, home sellers, mortgage professionals, and politicians the wrong way. He was a determined advocate for tougher mortgage rules and reducing housing’s influence on the economy. During his tenure CMHC went from insuring 43% of outstanding mortgages to just 29%; several types of mortgages were removed from CMHC’s insurance programs; default insurance fees and securitization fees increased.

Siddall is the second big name to announce he is leaving. Late last year Stephen Poloz, Governor of the Bank of Canada, announced that he will be stepping down at the end of his term, in June. By First National Financial LP.

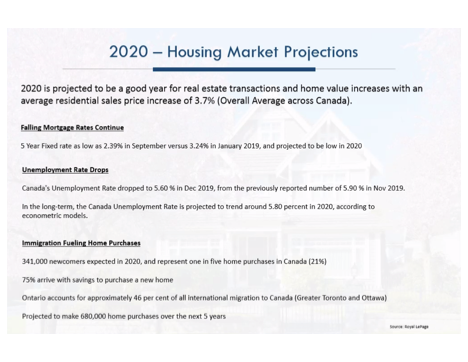

2020 Housing Market Projections

I attended a great program presented by NAS Nationwide Appraisal Serivces, Canada’s largest AMS Appraisal Management Company that acts as a third party intermediary linking mortgage originators and lenders for fulfillment of mortgage financing appraisal conditions.

Great speakers providing some good insight into what is being projected and predicted in the Residential Housing Market for 2020 based on market statistics. Thank you NAS!

Bank of Canada Holds Steady Despite Economic Slowdown

In a more dovish statement, the Bank of Canada maintained its target for the overnight rate at 1.75% for the tenth consecutive time. Today’s decision was widely expected as members of the Governing Council have signalled that the Bank still believes that the Canadian economy is resilient, despite the marked slowdown in growth in the fourth quarter of last year that has spilled into the early part of this year. The economy has underperformed the forecast in the October Monetary Policy Report (MPR).

In today’s MPR, the Bank estimates growth of only 0.3% in Q4 of 2019 and 1.3%in the first quarter of 2020. Exports fell late last year, and business investment appears to have weakened after a strong Q3, reflecting a decline in business confidence. Job creation has slowed, and indicators of consumer confidence and spending have been much softer than expected. The one bright light has been residential investment, which was robust through most of 2019, moderating to a still-solid pace in the fourth quarter only because of a dearth of newly listed properties for sale.

The central bank’s press release stated that “Some of the slowdown in growth in late 2019 was related to temporary factors that include strikes, poor weather, and inventory adjustments. The weaker data could also signal that global economic conditions have been affecting Canada’s economy to a greater extent than was predicted. Moreover, during the past year, Canadians have been saving a larger share of their incomes, which could signal increased consumer caution which could dampen consumer spending but help to alleviate financial vulnerabilities at the same time.

The January MPR states that over the projection horizon (2020 and 2021), “business investment and exports are anticipated to improve as oil transportation capacity expands, and the impact of trade policy headwinds on global growth diminishes. Household spending is projected to strengthen, driven by solid growth of both the population and household disposable income.” Growth is expected to be 1.6% in 2019 and 2020 and is anticipated to strengthen to 2.0% in 2021.

Inflation has remained at roughly the Bank’s target of 2%, and is expected to continue at that pace.

Also from the MPR: “The level of housing activity remains solid across most of Canada, although recent indicators suggest that residential investment growth has slowed from its previously strong pace. Demand remains robust in Quebec, where the labour market has been strong. In Ontario and British Columbia, population growth is boosting housing demand. In contrast, Alberta’s housing market continues to adjust to challenges in the oil and gas sector. Nationally, house prices have continued to increase and should strengthen slightly in the near term, consistent with the responses to the Bank’s recent Canadian Survey of Consumer Expectations.”

Bottom Line: The Canadian dollar sold off on the release of this statement and I believe there is a downside risk to the Bank of Canada forecast. Today’s release is a more dovish statement than last month, showing less confidence in the outlook. The Governing Council did express concern that the recent weakness in growth could be more persistent than their current forecast, saying that “the Bank will be paying particular attention to developments in consumer spending, the housing market, and business investment.” They also raised estimates of slack in the economy and dropped language about the current rate being appropriate.

According to Bloomberg News, today’s Governing Council comments “are a departure from recent communications in which officials sought to accentuate the positives of an economy that had been running near capacity and was deemed resilient in the face of global uncertainty. While Wednesday’s decision still leaves the Bank of Canada with the highest policy rate among major advanced economies, markets may interpret the statement as an attempt to, at the very least, open the door for a future move.”

Canada’s economy likely slows, but job numbers reassure

Canada’s economy slowed during the last quarter of 2019 as consumption and the housing market lost momentum.In October, GDP growth turned slightly negative and thousands of jobs were lost in November. However, employment bounced back by a reassuring 35,000 in December and our outlook for 2020 remains positive. We expect the economy to produce modest but solid growth during the year.

Temporary factors slowed the economy at the end of 2019

Canada’s real GDP fell by 0.1% in October, which signalled slower growth for the end of 2019. Employment, housing starts, manufacturing and retail sales were all weak.

However, some factors driving the slowdown were temporary, including strikes affecting General Motors and CN Rail.

Other factors were more unexpected. For example, building activity softened, which surprised most analysts. Housing should regain momentum as underlying demand remains strong amid solid demographic trends, low unemployment and rising household income.

Other sectors of the economy should also support growth in 2020. Exports will continue to be strong as the world economy improves. Business investment should also perform better, supported by more investment in the energy sector. Finally, the federal government will probably introduce new programs and reduce income taxes, which will stimulate the economy.

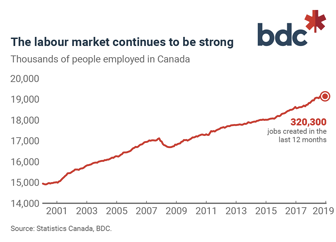

The job market made very solid gains in 2019

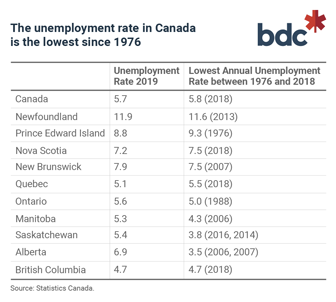

The rebound in the job market in December seems to indicate that November’s poor performance was due to temporary factors in what was a robust year of employment gains. Employment increased by 320,000 jobs, with 283,000 of those being full-time. The unemployment rate is now 5.7% in Canada, the lowest in the last 40 years.

Unemployment remains low in most provinces, with the notable exception of Alberta where the economy slowed down significantly in 2019 due to the troubled oil sector. Ontario (5.3%), Quebec (5.3%) and British Columbia (4.8%), the three largest provinces, have all benefitted from very low unemployment rates (see table 1).

These results are significant, not only because jobs provide opportunities for Canadians, but also because employment levels are one the best indicators of the health of the economy. These numbers show that Canada’s economy continues to perform well, and is actually, growing close to its potential.

Economic growth in Canada will be modest but solid in 2020

Despite the slowdown of the economy at the end of 2019, we believe the Canadian economy will continue to grow in 2020. The good performance of the job market will support consumption and the housing market.

Canadian exports should also continue to perform well because the U.S. economy is enjoying solid growth and the fortunes of the world economy are improving. We also expect stronger government spending to support growth in 2020.

What does it mean for entrepreneurs?

- The housing market will perform better in 2020, supporting the construction industry. Lumber manufacturers and building supplies wholesalers should benefit as well.

- As the global economy improves, demand for Canadian products and services will be solid in 2020.

- Labour shortages will remain an important challenge in many regions.

By BDC Business Development Bank of Canada.

Debt goes for a hike

As Canada rolled into the final quarter of 2019 debt levels went for a hike. The latest figures from Statistics Canada put the level of household debt to disposable income at 176%. Up from 175.4% reported in the previous quarter

For every dollar left after taxes and expenses Canadians owed $1.76 in debt. It was the first increase in a year and represents an annualized increase of 1.2%.

Mortgage borrowing was a big part of the increase. Bank of Canada figures show mortgage debt at institutional lenders hit a new high of $1.62 trillion in November, up 0.37% from October and 4.6% higher on year-over-year basis. Low interest rates and good employment numbers appear to be bringing Canadians back into the housing market.

Growing debt also means Canadians are using more of their money to service it. In the third quarter of 2019 the national debt service ratio hit an all-time high of 14.96%. That has triggered more concerns about bankruptcies and insolvencies. The Office of the Superintendent of Bankruptcies says nearly 136,000 Canadians had become insolvent by the end of November, a 9% annual increase. By First National Financial.

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is still at 5.19% but the pressure is on to see if other Banks and the BOC will follow suit now that TD Bank lowered its 5 year posted rate to 4.99%. Fixed rates are moving down slowly with lower bond yields. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalized your decision when you are certain you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients needs to ensure your best interest is protected. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!