Industry & Market Highlights

Average home price in London, ON rises in November

Home prices in London, ON have risen in November, according to data from the London St. Thomas Association of Realtors (LSTAR).

LSTAR revealed that the average home price in London was $416,116 in November, up 10.6% compared to November 2018. Broken down by area, the average home price in London East was $357,796, up 18.6% from last November. In London South (which includes data from the west side of the city), the average home sales price was $424,900, up 12.2% compared to the previous year, while London North saw an increase of 1.9% over last November, with an average home sales price of $493,896.

“We had another solid month, demonstrating the robust marketplace all across the region,” said Earl Taylor, president of LSTAR. “There have been 9,658 home resales year to date, which is up 3.2% compared to the same period in 2018, and we’re on course to surpass last year’s total sales.”

The sales-to-new listings ratio in LSTAR’s jurisdiction was 90.7%, which the Canadian Real Estate Association (CREA) says favours sellers. A ratio between 40% and 60% is generally consistent with a balanced market. A ratio below 40% tends to favour buyers, while a ratio higher than 60% indicates marketplace conditions favouring sellers, according to CREA.

“Several regions saw sales-to-new listings ratios above 100%, including London East (105.6%) and Strathroy (107.1%),” said Taylor. “We’re still experiencing low inventory levels, which also continues to impact the average home sales price in all regions.” By Duffie Osental.

Buying or selling? Here’s what you need to know about new real estate rules

The Ontario government recently announced plans to change the rules in the real estate industry in Ontario. The proposed changes are fairly broad, and will impact several areas, some in particular will impact you directly as the consumer.

The Real Estate Council of Ontario (RECO), is mandated by the Government of Ontario to protect consumers who buy and sell their properties through brokerages registered to trade in Ontario. RECO is here to assist you with what these proposed changes mean to you as a consumer.

If you received this from your real estate salesperson, then that’s a good sign, because you are already talking to a real estate professional who has your interests as a consumer at heart.

What are the most important changes?

There are many important reforms in the legislation that will improve protection for Ontario’s buyers and sellers. Here are a few highlights:

- Adding clarity for buyers and sellers so that they know whether they are represented by a brokerage, or if they are self represented;

- Requiring new disclosures to buyers and sellers to support informed decisions;

- Additional regulatory powers that will give RECO more tools to get the worst offenders in the industry out of the business; and

- Making it easier for RECO to levy fines against real estate salespeople for certain violations of the legislation.

What won’t change is RECO’s mandate. We remain committed to protecting Ontario consumers, and the integrity of the marketplace.

I’m in the process of buying or selling, how does this impact me?

The current laws already offer robust protection for you as a consumer, and thousands of sales occur every month in Ontario with no problem at all. It is important that you understand exactly what duties your brokerage owes you, and what your responsibilities are too, under the arrangement that has been established.

Why did the government introduce this legislation?

It is usual that the Government reviews its laws on a regular basis to ensure that they remain up to date and relevant. The real estate industry has evolved in many ways since 2006 when the last significant changes were made, so it was time to revisit the laws. RECO is pleased that there are many proposed changes that enhance consumer protection, and we recognize that other changes will strengthen the business environment in the real estate industry, and also cut some of the red tape.

What happens next, and when do the new rules come into effect?

It can take a while for the rules and laws to change through the legislative process, so the simple answer is that there are several steps that need to take place before the rules actually change. It is also possible that the proposed rules may be amended through the process. The new rules could come into effect as early as 2021.

How can I stay informed?

RECO’s website is a great resource for staying up-to-date on developments with the Trust in Real Estate Services Act, 2019.

Share this link with your clients or download the PDF here.

National housing market now characterized by more balanced conditions

Despite a modest degree of vulnerability remaining, the Canadian residential market is now exhibiting “much narrow imbalances,” according to the federal housing agency.

A new quarterly report by Canada Mortgage and Housing Corp. stated that the average housing price nationwide ticked down by 0.6% annually during Q2 2019. Meanwhile, the population of young adults expanded by 1.9% during the same time frame, boosting the number of potential first-time home buyers.

For the third consecutive quarter, CMHC cited “moderate” risk for the national market. This was after around two and a half years of “high” risk ratings, The Canadian Press reported.

Breaking down by markets, Toronto has been moved from “high” to “moderate” risk, with prices declining by 0.8% and inflation-adjusted disposable income gaining 0.5% during the second quarter.

Hamilton was similarly moved from “high” to “moderate” vulnerability, while Vancouver, Calgary, Edmonton, Saskatoon, Regina, and Winnipeg all retained their “moderate” risk ratings.

“Low” risk markets include Ottawa, Montreal, Quebec, Moncton, Halifax, and St. John’s, CMHC noted.

Last week, the Crown corporation argued that stricter mortgage regulations are a major component of Canadian housing’s current stability. Low default rates and slower residential mortgage growth will also alleviate the worst effects of market weakness.

More importantly, these trends give credence to the Bank of Canada’s latest decision to hold its interest rates. Keeping rates flat would prevent a “resurgence” of credit, which has been previously cited by the central bank as a significant economic risk. By Ephraim Vecina.

Changes Are Coming to Tarion Warranty Corporation. How will they affect Ontario investors?

When it was released to the public in October, the Office of the Auditor General of Ontario’s Special Audit of the Tarion Warranty Corporation surprised few when it called out the non-profit for its ongoing failure in assisting homeowners in their warranty disputes with the province’s homebuilders.

The audit called Tarion to task over several areas of concern, from the corporation’s close relationship with the Ontario Home Builders Association to its unnecessarily tight schedule of deadlines, which have led to the denial of thousands of homeowner requests for help. Among some of the more damning information contained in the report, the Auditor General found that builders failed to fix defects under warranty in 65% of cases between 2014 and 2018, and that the compensation of Tarion’s senior management team depended on reducing operating costs – like those related to running Tarion’s call center.

The audit culminated in 32 recommended changes for Tarion, including:

- Discontinuing Tarion’s monetary sponsorship to the Ontario Home Builders Association

- Providing homebuyers more direct information on the importance of Pre-Delivery Inspections

- Conducting random audits of builders to ensure compliance

- Redefining “finished house” so a homeowner’s one-year warranty period begins only once the home meets this new definition

- Removing the two 30-day deadlines imposed on homeowners to file a complaint against their homebuilders

- Factoring builders’ poor warranty performances into licensing decisions

- Multiple protections for new-build homebuyers who have purchased units in projects that may be delayed or cancelled

Tarion’s response has been predictably agreeable, with the corporation pledging to work toward implementing the audit’s recommendations.

“[W]e are taking several positive steps in the journey to build a better warranty program for our stakeholders,” Tarion said in its response to the report. “This includes improvements to our dispute resolution tools, additional disclosure on the Ontario Builder Directory and implementing targeted pre-possession inspections to improve the quality of new homes across the province.”

But few see these recommendations having much of an effect on buyers of new product, largely because of Tarion’s laughable track record thus far in helping homeowners and the conflict of interest inherent in having homebuilders call most of the shots for an organization that is meant to hold them accountable.

“I personally think Tarion is one of the most broken systems for consumer protection that there ever has been. I think it’s an embarrassment to Ontario,” says Simeon Papailias of Royal LePage Signature Realty, who read the report shortly after its release. “The findings are right in line with everybody’s experience. Consumers absolutely are disgusted by Tarion.”

“I never had any faith in Tarion whatsoever, and I maybe have marginally more faith now that some changes have been made,” says David Fleming of Bosley Real Estate. “There are just not enough resources, and not enough interest among Tarion and the builders they represent, to go ahead and actually remedy the issues.”

There are also concerns that any costs associated with Tarion reforms incurred by Ontario builders could eventually be passed on to homeowners.

“If these changes are going to make things more expensive, they are going to pass on one hundred percent of the cost to the consumers,” Fleming says. “What’s the alternative? They’re going to make less money? Never. Unless people stop buying.”

Papailias says that new-build investors hoping to avoid a dispiriting encounter with Tarion need to take their pre-delivery inspections more seriously. “People don’t even show up at their pre-delivery inspections because they don’t think they’re relevant, and it’s the most relevant part of your Tarion warranty,” he says.

Cynicism will rain down on Tarion until meaningful reforms are enacted. But Papailias feels there are better days ahead for investors forced to playing the new construction game with Tarion as a teammate.

“They can no longer hide when everything has been outed.” By Clayton Jarvis.

Consumer debt blues brighten slightly

Interest rates are stable and look poised to fall. Inflation is in check. The unemployment rate is at historic lows. We are told wage growth is strong, and households appear to be reducing their debt-load.

Still, many Canadians are worried about making ends meet.

The latest quarterly survey by insolvency trustee MNP suggests 54% of Canadians have growing concerns about their ability to repay their debts. The survey also suggests Canadians have a shrinking amount of money left at the end of the month. Once all the bills are paid the average Canadian has $557.00 to spare. That is down more than $140.00 from the last survey in June. Nearly half of the respondents say they have less than $200.00 left at the end of the month. Of that group, almost one-third say they do not make enough money to cover all of their obligations.

The MNP survey – which tries to track people’s attitudes about their finances – also indicates Canadians are little more upbeat about their situations. Nearly a third say their finances are better than they were a year ago, up by three points. And a similar number say things are better than they were five years ago, a two point increase.

For a growing portion of respondents the future looks even brighter. Nearly 40% believe their debt situation will improve over the next year, up by three points. Half believe things will get better over the next five years, also a three point jump. By First National Financial.

5 things to know about Ontario’s new real estate act

The long-awaited changes to the real estate agent and brokerage community in Ontario just had its initial release, mostly to positive reviews from the industry. The draft bill to change the Real Estate and Business Brokers Act, 2002 has not yet been approved and contemplates further changes. The new act will be called the Trust in Real Estate Services Act, 2002. Here are the main points you need to know.

1. Real estate agents will be able to incorporate.

The real estate industry has been requesting this for years, so that real estate professionals could enjoy the same tax advantages of other professional groups such as doctors, lawyers and accountants. Incorporation should also provide extra protection from liability. Incorporation is not for everyone and once the rules are clarified, agents must discuss this with their own accountants to make sure that this is right for them. Still, great news.

2. No more customers, you are either a client or you are self-represented.

There has been a lot of confusion over the years in trying to explain to a member of the public as to whether they should become a client or customer of a real estate brokerage and the differences between the two. While there currently is a duty to be fair to customers, there was an extra level of care owed to clients. An agent can give advice to a client, not a customer. This is easier said than done. Under the proposed new rules, you are either a client of the brokerage, or you represent yourself. Makes it much simpler. Remember the old adage, “when you represent yourself, you have a fool for a client.” Applies in just about everything you do.

3. Multiple representation will still be permitted.

This is also great news for the industry. Real estate brokerages will still be able to represent both the buyer and the seller in the same deal. It is not clear whether the same agent will be permitted to act for both the buyer and the seller. This will also have to be reviewed more carefully when further clarification is provided.

4. Sellers may be able to disclose the highest price to a competing buyer.

It appears that in a bidding war, a seller may obtain the option to disclose to one of the other buyers the price that one of the buyers is willing to pay. This is currently not permitted today. Again, the actual language will have to be reviewed to determine the circumstances when this may occur.

5. Penalties are increasing if you break the rules.

It is proposed that fines to real estate agents and brokerages be increased to $50,000 for any agent to $100,000 for the brokerages if you violate the rules, including the REBBA 2002 Code of Ethics. This is just part of the new protections to give the public more assurance that real estate agents and brokerages are held to a higher professional standard.

By Mark Weisleder, REMOnline.com

Toronto unveils $23.4 billion housing plan

The City of Toronto has released a comprehensive housing blueprint to assist more than 341,000 households over the next decade.

The HousingTO 2020-2030 Action Plan provides 13 strategic actions that looks to address the “full continuum” of housing – including homelessness, social housing, rental housing, long-term care, and home ownership. Some of the highlights include a revised housing charter and the creation of a multi-sector land bank to support the approval of 40,000 new rental and supportive homes.

Implementation of the full plan over 10 years is estimated to cost governments $23.4 billion, with the city’s commitment through current and future investments being $8.5 billion.

Mayor John Torry said that he “will be working hard with the other orders of government to ensure the entire HousingTO Action Plan is fully funded”

“This has to be a priority — we have to come together to support households who are struggling to pay the rent and keep, or put a roof over their heads,” said Torry. “Ensuring that residents in our city have access to housing will benefit our entire city. It gives people the opportunity to meet their full potential and to participate in our city’s success. Together we can make a difference and make Toronto a place that anyone who wants to, can call home.” By Duffie Osental.

Economic Highlights

Housing and debt worries weigh on BoC

The Canadian economy continues to stubbornly support the Bank of Canada’s interest rate policy. Market watchers are pretty much unanimous in their projections that the central bank will stay on the sidelines, again, when it makes its rate announcement later this week.

The latest numbers from Statistics Canada show gross domestic product grew by 1.3% in the third quarter. That is a slow down, but it is a long way from anything that would trigger BoC intervention. Consumer spending and housing are seen as the main drivers of that growth.

Housing has recovered nicely from its sluggish performance earlier this year and it would seem that the market has made a soft landing. But the Bank continues to worry that lowering interest rates could spark another round of debt-fueled buying. In the Bank’s opinion, high household debt remains a key vulnerability for the Canadian economy.

Of course an interest rate cut would weaken the relatively strong Canadian dollar which is hampering the export sector, but the Bank has said it would like to see other methods used to encourage exports and business investment. Even lower interest rates and a weaker Loonie might not be enough to push through the international economic headwinds created by the current spate of tariff and trade wars that have slowed global growth.

Now the forecasters are looking as far ahead as the second quarter of 2020 before they see any interest rate activity. By then we should being seeing the effects of the U.S. presidential election campaign. By First National Financial.

Rate cut pressure eases for BoC

The Bank of Canada still has a clear path to an interest rate cut, but now there is less pressure to go down that route.

The latest inflation numbers from Statistics Canada showed a 0.3% increase from September to October, with the annual average inflation rate holding steady at 1.9%. Core inflation edged up slightly to 2.1% in October from 2.0% in September. Core inflation, which is what the Bank of Canada watches, strips-out the cost of volatile items like food and fuel. Mortgage interest costs and car insurance were two of the big drivers of inflation last month.

The other key influencer of Canadian interest rates also appears to have stabilized. The U.S. Federal Reserve says it does not expect to be dropping its benchmark rate again this year.

At the end of last month the Fed trimmed another quarter point off its policy rate dropping it into the range of 1.5% to 1.75%. The minutes of the Fed meetings – that were released at the same time – make it clear the Federal Open Market Committee (FOMC), which sets the rate, has little taste for further cuts. The U.S. central bank has dropped its rate three times in 2019.

The current president of the United States has been pushing for negative interest rates, a la Europe, but there is little evidence the tactic is getting the desired results there. By First National Financial.

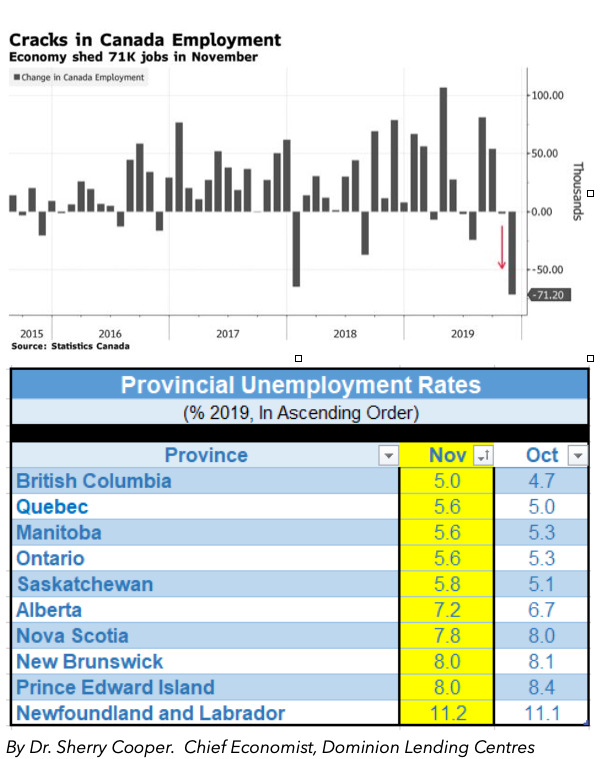

Huge Decline in Jobs in November As Jobless Rate Surges

One month does not a trend make. Statistics Canada announced this morning that the country lost 71,200 jobs in November, the worst performance in a decade. What’s more, the details of the jobs report are no better than the headline. Full-time employment was down 38.4k, and the private sector shed 50.2k. The jobless rate also rose sharply, up four ticks (the most significant monthly jump since the recession), to 5.9%. Hours worked fell 0.3%, and remain an area of persistent disappointment—they’re now up just 0.25% y/y, much more muted than the 1.6% annual job gain.

The one area of strength was wages, with growth accelerating to match a cycle high at 4.5% y/y. But wages tend to lag the labour market cycle, so if this weakness is the start of something bigger, wages gains are likely to slow.

The monthly moves were soft, no matter how you slice them. Both full-time (-38.4k) and part-time employment (-32.8k) were down. Similarly, private sector employment (-50.2k) led the way, but self-employment (-18.7k) and the public sector (-2.3k) also saw net losses.

Until last month, we saw a long string of robust job reports in what is usually a very volatile data series, so a correction is not surprising. But this report appears to be more than a statistical quirk and belies the Bank of Canada’s statements this week that the Canadian economy remains resilient. Employment is still up 26k per month in 2019 to date consistent with a 1.6% y/y gain, and most of that comes from full-time work. And some of the drop in November reflected a decline in public administration jobs retracing October’s gain that might have been related to the federal election. Nevertheless, the 0.4 percentage point uptick in the jobless rate is the largest since the financial crisis in early 2009, and manufacturing jobs were down more than 50k over the past two months.

By industry, job declines were widespread in the month, with only 5 of 16 major sectors posting improvement. Net losses were shared across both the goods and service sectors. Manufacturing (-27.5k) shed jobs for a second month, and notable declines were seen in public administration (-24.9k, likely a reflection of post-election adjustment) and accommodation and food services (-11k).

By region, Ontario and PEI were the only provinces to manage job growth last month, with all others deeply in the red. Quebec stands out, shedding 45.1k net positions in a second monthly employment decline and pushing the unemployment up to 5.6% (from 5.0%; the largest monthly increase in nearly eight years). Quebec’s jobless rate is now equivalent to that in Ontario. Things were not much better out west: Alberta and B.C. both lost 18.2k net positions. In the case of the former, this was enough to send the unemployment rate up half a point, to 7.2%. Ontario bucked the trend, adding 15.4k net positions, just shy of erasing the prior month’s drop. Still, the unemployment rate in the province rose to 5.3% (from 5.0%), as more people joined the labour force. (See the table below.)

Job growth slowed in the second half of this year. Over that period, the average monthly job gain has been a paltry 5.9k compared to an average monthly gain of 24.4k over the past year. For private sector employment, the equivalent figure flipped into negative territory (-4.3k) for the first time in more than a year.

Bottom Line: Today’s report means that the Bank of Canada will be keeping an even more watchful eye on the jobs report. The year-on-year pace of net hiring has decelerated for three straight months now, driven in large part by a slowing pace of private-sector hiring. It seems a safe bet that even if we see some recovery in the coming months, the substantial gains of recent years are unlikely to be repeated.

The Bank of Canada has been emphasizing Canada’s economic resilience in its recent communications. One month of soft jobs data will hardly break that narrative, but coming after a modest October, it is not hard to imagine a hair more worry about the durability of growth. The bigger question is whether this weakness persists, and more importantly if it feeds into consumer spending behaviour and housing activity, the Bank’s key bellwethers.

We continue to believe that the BoC will cut rates in 2020, owing mainly to Canada’s vulnerability to trade uncertainty. The loonie sold off sharply on the employment news, particularly so because of the stronger-than-expected labour market report released this morning in the US.

![]()

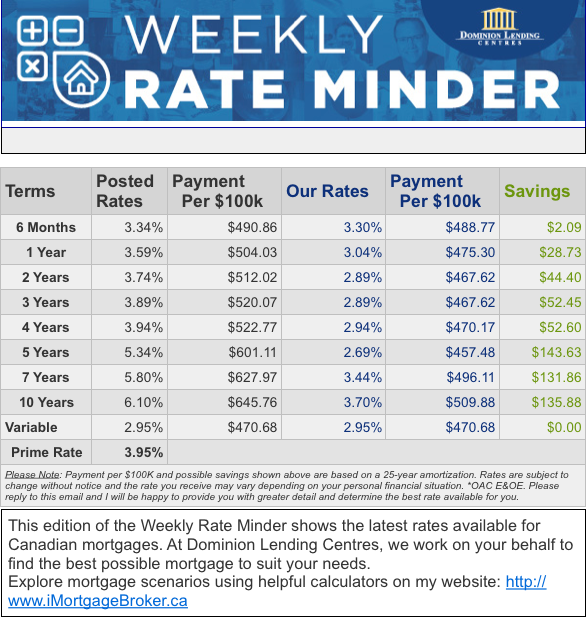

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is at 5.19%. Fixed rates are holding steady. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

![]()

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.