Industry & Market Highlights

First-Time Home Buyer Incentive

As of September 2nd 2019, Canadians interested in the First-Time Home Buyer Incentive can submit their applications for a shared equity mortgage with the Government of Canada.

The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens.

How it all works – Find full details here.

Government’s homebuying incentive called a cynical election ploy

The First-Time Home Buyer Incentive is a week old, but don’t expect skyrocketing demand for a program expected to help fewer Canadians than the number bandied by the federal government.

“If I’m a betting man, I’m going to suggest this thing has smaller uptake than the 100,000 number the government keeps waiving around,” said Robert McLister, mortgage editor of Rates.ca and founder of Ratespy.com. “In the majority of cases, you qualify for less—with a regular down payment, the typical borrower qualifies for 4.5 times their income, but now it’s capped at four times their income. Under the regular 5% down, vanilla CMHC mortgage, you can qualify for up to $60,000 more.”

The First-Time Home Buyer Incentive—in which the Canada Mortgage and Housing Corporation will provide up to 10% on the purchase price of a new build and 5% on a resale—caps household income at $120,000. The policy states that “participants’ insured mortgage and the incentive amount cannot be greater than four times the participants’ annual household incomes.”

According to calculations provided by Ratehub.ca, a household with $100,000 of income that puts a 5% down payment qualifies for a $479,888 home. This leaves a mortgage amount of $474,129 after down payment and the CMHC insurance premium. The household qualifies for a mortgage of 4.74 times their income.

If the same household elected to participate in the First-Time Home Buyer Incentive their maximum purchase price drops to $404,858, because this is the maximum they can afford while keeping the total between their mortgage and the government incentive below four times their income.

“The number one issue facing first-time homebuyers is how much they qualify for, not the monthly payment after the home closes, and that’s what this is aimed at,” said James Laird, co-founder of Ratehub.ca. “They qualify for less if they use this program.”

The program is suitable for homebuyers in markets with weak housing demand and economic fundamentals. McLister added that borrowers who use the First-Time Home Buyer Incentive, and plan on living in the home for around five years, could potentially save more on interest and default insurance premiums than they’d give back to CMHC.

“Who it’s not for is someone who plans to live there for a long time, especially in a housing market that’s hotter and has stronger fundamentals,” he said. “In that case, it could cost you more in the equity you give up than what you save on interest and default insurance premiums.”

So why was it introduced in the first place?

“If you’re running for election in the fall and one of the hottest button issues is housing affordability and you don’t do anything to help millennial voters, your odds of winning the election are lower,” said McLister. “So they have tried to appear like they’re coming to the rescue with a program that has very little impact.” By Neil Sharma

First-Time Home Buyer Incentive is live, but industry is skeptical

As Canadians enjoyed the Labour Day holiday, a new government scheme was officially launched that aims to help more people get on the housing ladder.

But the First-Time Home Buyer Incentive may not be the panacea for potential new entrants into Canada’s housing market that Justin Trudeau and his ministers hope.

Critics say that it will not make a widespread difference to the ability of first-time homebuyers to afford to follow their homeownership dreams.

With the program’s requirements for household earnings of a maximum $120,000 and a mortgage-to-income ratio capped at 4 times household income, the top-end of the homes that the scheme will help to buy is far short of the $826K average home price in Vancouver or $982K in Toronto.

“It’s a very narrowly-focused program,” Royal LePage President Phil Soper told Bloomberg. “It’s just not a big enough slot of the market to move it.”

100K borrowers or 5K?

CMHC, which is administering the program, estimates that it could help 100,000 first-time homebuyers but Mortgage Professionals Canada thinks the figure could be as low as 5,000 as potential buyers are dissuaded by giving up equity in their new home and mortgage insurance requirements.

“The government says it wants to make homeownership more affordable and accessible, but its actions say otherwise,” MPC chief economist Will Dunning told Bloomberg. “The proposals “to improve access are likely to have only small positive effects.” By Steve Randall.

Bank of Canada Interest Rate announcement

The Bank of Canada made their Interest Rate announcement on Wednesday, September 4th and maintained its target for the overnight rate at 1 ¾ percent. The Bank Rate is correspondingly 2 percent and the deposit rate is 1 ½ percent. View the full press release HERE.

Economic Highlights

Bank of Canada reveals latest interest rate decision

The Bank of Canada resisted pressure from investors by declining to signal it will soon follow global peers in easing monetary policy.

At a decision Wednesday, policy makers left interest rates unchanged for a seventh straight meeting and said stronger than expected growth, as well as inflation on target, means current levels of stimulus are where they should be. That’s despite the escalating trade war between China and the U.S. undermining global economic momentum.

The Bank of Canada’s reluctance to signal a greater willingness to cut rates — which makes it an outlier as counterparts around the world ease policy — may come as a surprise to some investors and analysts who had expected more dovish language and some easing later this year. The Canadian dollar rose after the statement.

“This is a bit more hawkish than we anticipated,” said Brett House, deputy chief economist at Bank of Nova Scotia. It’s “not a clear change in bias. It doesn’t close the door on an October cut, but it doesn’t set up an October cut either.”

Wednesday’s narrative underlined trade risks and reiterated that Canadian growth is likely to slow in the second half of this year — all of which suggests policy makers are far from confident about the economic outlook and could be keeping the door open for increasing stimulus if things worsen.

Global Easing

But the net effect of the statement is a continuation — at least explicitly — of the central bank’s reluctance to show its hand on whether it plans to join other central banks like the Federal Reserve in easing policy, preferring instead to wait for more concrete signs of weakness before moving.

“In sum, Canada’s economy is operating close to potential and inflation is on target. However, escalating trade conflicts and related uncertainty are taking a toll on the global and Canadian economies,” the central bank said in its statement. “In this context, the current degree of monetary policy stimulus remains appropriate.”

The Canadian dollar rose 0.4% to C$1.3280 per U.S. dollar at 10:09 a.m. Swaps trading suggests investors are fully pricing in a cut by December, with strong odds of a second by this time next year. That’s still less than the four rate cuts priced by the Federal Reserve over that time.

“The Bank of Canada is stalling but it will eventually be peer-pressured into interest-rate cuts,” Frances Donald, chief economist at Manulife Investment Management Ltd., told BNN Bloomberg.

Waiting too long is a risky strategy that could backfire if policy makers are late to recognize spillover effects on businesses and households, particularly since the country’s outlier status on policy could fuel gains in the Canadian dollar.

Bank of Canada officials said they will pay close attention to “global developments and their impacts on the outlook for Canadian growth and inflation.”

The case for cheaper money isn’t as compelling in Canada as it is elsewhere. A strong run of economic data affords the Bank of Canada opportunity to resist — as it has so far — the dovish turn in global policy.

Interest rates also remain stimulative in real terms, and borrowing costs have already declined sharply in the country because of falling global bond yields — a development the Bank of Canada cited in its statement. But escalating tensions between China and the U.S. are getting tougher to overlook. Trump’s tariffs on imports from China have already become a major reason behind global factory weakness.

The Bank of Canada characterized Canadian second quarter growth of 3.7% annualized as “strong” but noted some of the strength was probably temporary and pointed out that consumption spending was unexpectedly soft. By Bloomberg News, Theophilos Argitis.

![]()

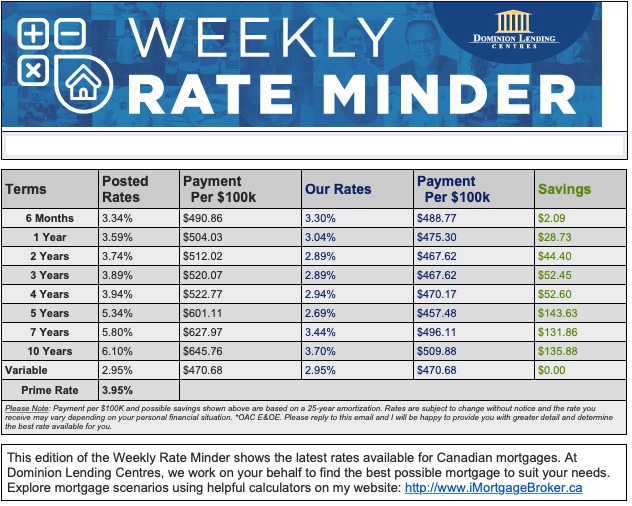

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval is 5.19%. Fixed rates are hold steady. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

![]()

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- The bank of mom and dad will lend — and even issue mortgages (Global News)

- Canadian Real Estate Near Bottom Of Global Rankings, But Maybe Not For Long (Huffington Post)

- Canadian Mortgages Pick Up, But Not Nearly As Much As HELOCs (Better Dwelling)

- Odd: Canadian Mortgage Credit Growth Is Rising, While Consumer Growth Falls (Better Dwelling)

- The Toronto housing market has made a ‘near-perfect landing’ (Livabl)

- Toronto home sales jump 13.4% in August as supply shrinks (BNN Bloomberg)

- Why these market experts say Canadian interest rates will be cut this fall (Livabl)

- Canadians keep borrowing despite mounting payment costs (Canadian Real Estate Wealth)

- Ottawa’s homebuyer plan not a big help in Canada’s pricey markets (Vancouver Sun)

- Renovating existing homes can accommodate newcomers better than building new rentals (Vancouver Sun)

- Ontario first time home buyers are the most pessimistic in the country (The Star)

- Is It Worth It To Buy A Condo In Canada Anymore? New Book Warns Of Risk Of Collapse (Huffington Post)

- This big bank economist says Canadian mortgage borrowers have a ‘rare opportunity’ (Livabl)

- These markets get the most help from Canada’s homebuyer incentive (Livabl)

- Canadian Mortgage Growth Picks Up, But Is Still The Slowest In Over 20 Years (Better Dwelling)

- Could your client use the new first-time buyers incentive? (REM Online)

- Trudeau’s Homebuyer Plan Offers Little Solace in Canada’s Pricey Markets (BNN Bloomberg)

- Why the Bank of Canada won’t fight a recession till there is one: Don Pittis (CBC)

- Here’s what you need to know about the First-time Home Buyer Incentive (CTV)

- Canadian home prices are set to rise, but by how much? (Livabl)

- Canadian Real Estate Prices Return To Growth After Brief Decline (Better Dwelling)

- The Biggest Housing Changes in Canada in the Last 4 years (Point2Homes)

- “Ghost” Homes Across Canada: A Decade of Change in 150 Cities (Point2Homes)

- Toronto New Condo Prices Rise, While Detached Losses Get Bigger (Better Dwelling)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.