Bank of Canada Benchmark Qualifying Rate

Effective July 22, 2019, the Bank of Canada 5-year Benchmark Qualifying Rate is 5.19%.

What you need to know

- The qualifying rate legislation was created to ease customer affordability in the event renewal interest rates are higher than the rate received at origination. The Bank of Canada publishes the Benchmark Qualifying Rate.

Qualifying Mortgage Rate Falls For First Time Since B-20 Intro

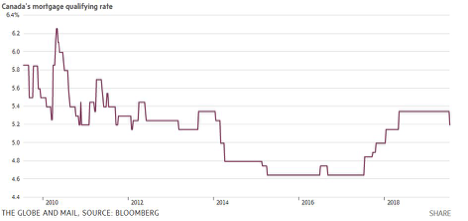

The interest rate used by the federally regulated banks in mortgage stress tests has declined for the first time since 2016, making it a bit easier to get a mortgage. This is particularly important for first-time homeowners who have been struggling to pass the B-20 stress test. The benchmark posted 5-year fixed rate has fallen from 5.34% to 5.19%. It’s the first change since May 9, 2018. And it’s the first decrease since Sept. 7, 2016, despite a 106-basis-point nosedive in Canada’s 5-year bond rate since November 8 (see chart below).

Five-Year Canadian Bond Yield

The benchmark qualifying mortgage rate is announced each week by the banks and “posted” by the Bank of Canada every Thursday as the “conventional 5-year mortgage rate.” The Bank of Canada surveys the six major banks’ posted 5-year fixed rates every Wednesday and uses a mode average of those rates to set the official benchmark. Over the past 18-months, since the revised B-20 stress test was implemented, posted rates have been almost 200 basis points above the rates banks are willing to offer, and the banks expect the borrower to negotiate the interest rate down. Less savvy homebuyers can find themselves paying mortgages rates well above the rates more experienced homebuyers do. Mortgage brokers do not use posted rates, instead offering the best rates from the start.

The benchmark rate (also known as, stress test rate or “mortgage qualifying rate”) is what federally regulated lenders use to calculate borrowers’ theoretical mortgage payments. A mortgage applicant must then prove they can afford such a payment. In other words, prove that amount doesn’t cause them to exceed the lender’s standard debt-ratio limits.

The rate is purposely inflated to ensure people can afford higher rates in the future.

The impact of the B-20 stress test has been very significant and continues to be felt in all corners of the housing market. As expected, the new mortgage rules distorted sales activity both before and after implementation. According to TD Bank economists in a recent report, “The B-20 has lowered Canadian home sales by about 40k between 2017Q4 and 2018Q4, with disproportionate impacts on the overvalued Toronto and Vancouver markets and first-time homebuyers…All else equal, if the B-20 regulation was removed immediately, home sales and prices could be 8% and 6% higher, respectively, by the end of 2020, compared to current projections.”

According to Rate Spy, for a borrower buying a home with 5% down, today’s drop in the stress-test rate means:

- Someone making $50,000 a year can afford $2,800 (1.3%) more home

- Someone making $100,000 a year can afford $5,900 (1.3%) more home

- (Assumes no other debts and a 25-year amortization. Figures are rounded and approximate.)

For a borrower buying a home with 20% down, today’s drop in the stress-test rate means:

- Someone making $50,000 a year can afford $4,000 (1.4%) more home

- Someone making $100,000 a year can afford $8,300 (1.4%) more home

- (Assumes no other debts and a 30-year amortization. Figures are rounded and approximate.)

Bottom Line: Almost no one saw this coming due to the stress test rate’s obscure and arcane calculation method (see Note below). This 15 basis point drop in in the qualifying rate will not turn the housing market around in the hardest-hit regions, but it will be an incremental positive psychological boost for buyers. It should also counter, in some small part, what’s been the slowest lending growth in five years.

Note: Here’s the scoop on why the qualifying rate fell. According to the Bank of Canada:

“There are currently two modes at equal distance from the simple 6-bank average. Therefore, the Bank would use its assets booked in CAD to determine the mode. We use the latest M4 return data released on OSFI’s website to do so. To obtain the value of assets booked in CAD, simply do the subtraction of total assets in foreign currency from total assets in total currency.”

The BoC explains further:

“Prior to July 15th, we were using April’s asset data to determine the typical rate as that was what was published on OSFI’s website. On July 15th, OSFI published the asset data for May, and that is what we used yesterday to determine the 5-year mortgage rate. As a result, the rate changed from 5.34% to 5.19%.” Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

Equifax to pony up nearly $1 billion in settlement

Equifax will pay up to US$700 million to settle with U.S. federal and state governments over a 2017 data breach that exposed the private information of nearly 150 million people, including thousands in Canada.

The settlement with the U.S. Consumer Financial Protection Bureau and the Federal Trade Commission, as well as 48 states and the District of Columbia and Puerto Rico, would provide up to US$425 million in monetary relief to consumers, a US$100 million civil money penalty, and other relief.

The breach was one of the largest ever to threaten private information. The consumer reporting agency, based in Atlanta, did not detect the attack for more than six weeks. The compromised data included Social Security numbers, birth dates, addresses, driver license numbers, credit card numbers and in some cases, data from passports.

“The consumer fund of up to US$425 million that we are announcing today reinforces our commitment to putting consumers first and safeguarding their data – and reflects the seriousness with which we take this matter,” said Equifax CEO Mark Begor.

Canada’s Office of the Privacy Commissioner concluded in April that the company fell short of their privacy obligations to Canadians, including poor security safeguards and holding information too long, but it did not level fines.

The privacy commissioner, which found that about 19,000 Canadians were affected by the breach, said the company entered into a compliance agreement and had taken steps to improve its security and accountability.

Equifax Inc. detected the attack on July 29, 2017 and contained it the following day. However, Equifax Canada wasn’t notified of the breach until just before the U.S. parent company publicly disclosed it on Sept. 7, 2017.

The breach occurred after hackers gained access to Equifax Inc.’s systems through a vulnerability the company had known about for more than two months, but had not fixed.

While Equifax Canada offered free credit monitoring to breach victims for at least four years, other protections didn’t match what was offered by the parent company, including credit freezes that restrict access to credit files.

The privacy commissioner also found that the transfer of information about Canadians to the U.S. without their knowledge was inconsistent with its obligations to obtain consent before disclosing personal information to third parties located in another country.

Equifax stock, which plunged 30 per cent in the days following the disclosure of the breach, have returned to levels where they traded before the incident.

Affected U.S. consumers may be eligible to receive money by filing one or more claims for conditions including money spent purchasing credit monitoring or identity theft protection after the breach and the cost of freezing or unfreezing credit reports at any consumer reporting agency.

All impacted consumers in the U.S. would be eligible to receive at least 10 years of free credit-monitoring, at least seven years of free identity-restoration services, and, starting on Dec. 31 and extending seven years, all U.S. consumers may request up to six free copies of their Equifax credit report during any 12-month period.

If consumers choose not to enrol in the free credit monitoring product available through the settlement, they may seek up to $125 as a reimbursement for the cost of a credit-monitoring product of their choice. Consumers must submit a claim in order to receive free credit monitoring or cash reimbursements.

“Companies that profit from personal information have an extra responsibility to protect and secure that data,” said FTC Chairman Joe Simons. “Equifax failed to take basic steps that may have prevented the breach that affected approximately 147 million consumers. This settlement requires that the company take steps to improve its data security going forward, and will ensure that consumers harmed by this breach can receive help protecting themselves from identity theft and fraud.”

The company said earlier this year that it had set aside around US$700 million to cover anticipated settlements and fines.

The settlement must still be approved by the federal district court in the Northern District of Georgia. By Canadian Press.

Everything Canadians need to know about the Capital One data breach

The recent data breach that was announced by Capital One Financial Corp. has affected about 100 million people in the United States and about six million people in Canada.

The hacker obtained unauthorized access to personal information of Capital One customers and those who applied for Capital One credit card products.

Capital One said in a statement that the person responsible has been arrested. The U.S. financial institution, which is one of the world’s largest issuers of credit cards, said more specific details on how this will impact customers will be shared over the next few days.

What do we know so far about how this will affect Canadians?

The different kinds of information breached

Information from applications for Capital One credit card products between 2005 and early 2019 makes up the largest set of data compromised.

Capital One said the breach includes names, addresses, postal codes, phone numbers, email addresses, dates of birth and income.

Aside from information found on credit card application forms, some credit card customer data was also involved. This includes credit scores, limits, balances, payment history, contact information and some transaction history from the last three years.

Approximately one million Social Insurance Numbers were compromised.

Capital One said that customer login credentials were not hacked.

How to know if your data has been breached

Capital One said in a statement that they will notify customers if their data has been compromised, and free credit monitoring and identity theft insurance will be offered to anyone impacted by the breach.

The company did not specify how customers will be notified, but said more information will be available within the next few days. Capital One said they will not be calling anyone about the breach. If anyone does receive a call, it’s a scam.

If anyone has provided personal information over the phone or clicked on fraudulent links over email or text, Capital One urges customers to call them immediately and change their online banking password

Capital One credit cards issued in Canada

Capital One offers Canadian customers various Capital One Mastercard credit card products including a cashback card for Costco Wholesale members.

Retailer Hudson’s Bay Co. also offers a Mastercard product where the credit itself is being offered by Capital One.

“There is no indication at this time that this issue impacts any of our businesses’ credit cards or card applications,” HBC vice president of corporate communications Nicole Shoenberg said in an email.

“Customers should feel comfortable shopping with us in stores and online.”

Costco Canada did not immediately respond to a request for comment about what impact the breach has had on their networks.

How to monitor your accounts in the meantime

Capital One encourages customers to monitor their accounts for suspicious activity. If anyone notices suspicious activity on their account, Capital One says to call the number on the back of their credit card.

Customers can also order a copy of their credit report from either Equifax Canada or TransUnion Canada. Either credit bureau can place fraud alerts on credit reports for up to six years. By Melissa Nennardo, CBC News.

Short-term rentals and Airbnb: What you need to know

What are the rules for Airbnb?

Every city will set its own rules for renting out all or part of a property on Airbnb or other short-term rental websites. In Toronto, for example, it is expected that only a principal residence will be able to be used for Airbnb. You can either rent out up to three of your bedrooms, or you can rent out the entire home, up to 180 days per year. You will also have to pay $50 to register the unit with the city and charge a four-per-cent tax.

Are guests considered tenants under the Residential Tenancies Act of Ontario?

This is not a simple answer. If you are living in a home or condominium and you just rent out rooms to guests on Airbnb, they are not tenants and can be treated as a guest and must leave when you ask them to leave. You do not have to use the Ontario Standard Form Lease. However, if they are renting your entire home, even for a few days, an argument can be made that they are in fact tenants and you need to sign the Ontario Standard Form Lease, which will govern the relationship. It will make no difference if this is a furnished apartment or not.

Can you evict a tenant to turn the unit into an Airbnb?

The likely answer to this is no in Ontario. While an eviction is possible if you are converting the unit to a commercial use, it is not permitted when the business will be for Airbnb. It will also likely not be possible to evict someone using the personal use family reason and then trying to rent all or part of the home on Airbnb before one year after the eviction. This could lead to penalties under the act.

Can you evict a tenant who is renting your unit on Airbnb without permission?

The answer is likely yes. This would be considered either an illegal sublet if no permission was granted in advance and a violation of the act, in that the tenant would be subletting for more money than they are paying in rent. However, the landlord would have to start eviction proceedings regarding any sublet within 60 days of finding out.

Will insurance cover any damage caused by guests?

Airbnb and similar sites offer insurance coverage, but it is recommended that you also inform your own insurance company if you are planning to rent it out, since the risk of damage will increase. For example, if the guest and owner privately agree to extend their stay without going through the short-term website, the website insurance policy will likely deny any claim. Further, if damage occurs that was not caused by the guest, the owner’s insurance claim to their own company will likely be denied if they were not advised about the new use of the property.

By Mark Weisleder

Economic Highlights

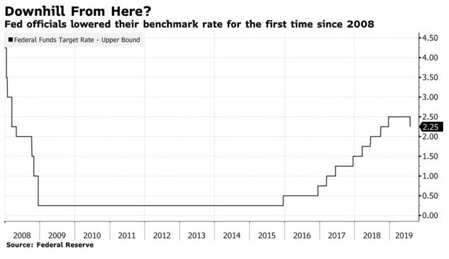

The Fed’s Quarter-Point Rate Cut Not the Start of Something Big

The Federal Open Market Committee (FOMC) cut the overnight target rate by 25 basis points as expected today. Chairman Jerome Powell, however, said it was designed to “insure against downside risks” rather than to signal the start of multiple rate cuts. President Trump called for “large” rate cuts on Twitter and has for months pressured the Fed to ease monetary policy. It is very unusual for the Fed to cut interest rates in the face of the continued strength in the US economy and the enormous declines in unemployment.

I cannot remember a reversal of policy with so little impetus. Indeed, the opening sentences of the FOMC statement are, “Information received since the Federal Open Market Committee met in June indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low.”

The White House pressure is without precedent to the point that Trump publically threatened to demote Chairman Powell if the Fed didn’t cut rates. He also proposes to fill vacant seats with known rate doves. This infringement on Fed independence is very dangerous for the credibility of the central bank. Moreover, it will likely weaken the US dollar if additional rate cuts follow quickly.

Consumer spending remains strong; however, a slowdown in business fixed investment was caused by the President’s insistence on generating trade tensions with China, Canada, the UK and other trading partners. The global economy has slowed because of this uncertainty. China’s economy has decelerated significantly, and manufacturing and agricultural exports to China have been particularly hard hit.

Another issue of concern to the FOMC was the low level of inflation. The Fed targets a 2% inflation rate. The Fed’s favourite inflation measure is now running at about 1.4%-to-1.6%.

Two Federal Reserve Bank governors voted against this action preferring at this meeting to maintain the prior target range. It was the first time since Powell took over as chairman in February 2018 that two policymakers dissented.

Today’s action was the first interest rate cut since the financial crisis began more than a decade ago. The Fed started to normalize interest rates from historically low levels in 2015 as the US economy was recovering and continued to raise the fed funds rate until December 2018. Normalization of monetary policy also included the gradual shrinking of the Fed’s balance sheet–selling bonds into the marketplace, slowly reducing liquidity. Today, the Fed stated it would cease this activity as of tomorrow, rather than the planned date in September.

Bottom Line: The Bank of Canada will not follow the Fed. Canadian interest rates are already below those in the US. While the target range for the US fed funds rate is now 2%-to-2.25%, the target overnight rate in Canada is 1.75%. Moreover, today’s real GDP report for May surprised on the high side, suggesting that GDP growth in the second quarter could be close to 3%. This is well above the Bank’s earlier estimate and justifies the Bank’s remaining on the sidelines.

By Dr. Sherry Cooper, Chief Economist, Dominion Lending Centres

More weight on rates

Some more weight has been added to the scale that is tipping in favour of an interest cut in the United States. Economic growth, in the U.S., slowed to 2.1% in the second quarter, down a full percentage point, from 3.1% in the first quarter.

A key factor in the slowdown is a 5.2% drop in exports. Many analysts see that as self-imposed pain brought on by the Trump administration’s trade fight with China. The dispute is also contributing to the slowdown in Europe, and elsewhere.

The drop in GDP growth is seen as additional ammunition for those targeting the U.S. Federal Reserve for a rate cut this week. However, there are prominent analysts who say a cut is not needed at this time. U.S. growth remains above the five-year average and unemployment is at 50 year lows.

Last week the European Central Bank held the line on its benchmark interest rate, but made it clear it intends to take steps to boost the Euro-Zone’s sagging economy. The ECB is signalling the distinct possibility of rate cuts and it is also looking at restarting its simulative bond buying program.

The Bank of Canada remains firmly on the sidelines. It is content with the country’s employment rate, inflation, and its current growth figures. By First National Financial.

![]()

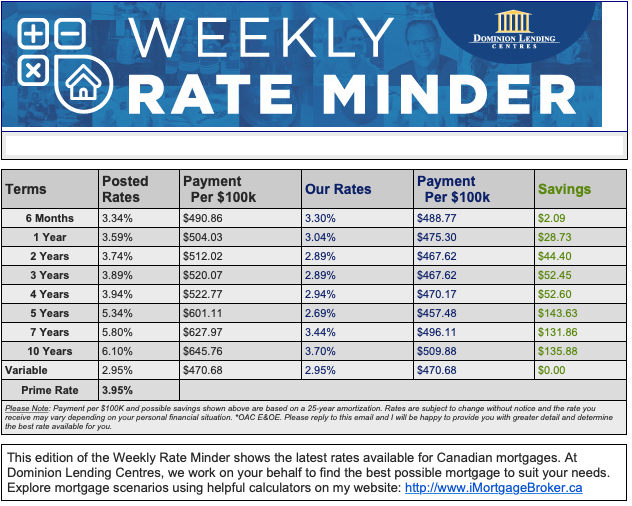

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval reduced to at 5.19% increasing the average mortgage qualification with about $10,000 – not any significant change when it comes to qualifying for home ownership. Fixed rates hold steady. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Mortgage Update – Mortgage Broker London

- So Where Is the Next House Price Bubble Brewing? (Bloomberg)

- Why this veteran builder thinks prefabricated homes are the way of Toronto’s future (The Star)

- Bank Of Mom And Dad Is Paying Canadian Millennials’ Rent: Survey (Huffington Post)

- Canadian Mortgage Growth Rises From Lows, But Still Not Quite Back To Normal (Better Dwelling)

- There are 246 cranes towering over the Toronto region as suburban condos take off (Livabl)

- Toronto home price gains will barely match inflation for next 2 years (Livabl)

- What’s the ballot issue in 2019? The high cost of living (CBC)

- Housing costs are foremost in the minds of young Canadians – poll (Canadian Real Estate Wealth)

- Mortgage stress tests may be in need of a ‘tweak’: RBC’s McKay (BNN Bloomberg)

- Housing scarcity forcing many Toronto residents to stay put (Canadian Real Estate Wealth)

- Alternative mortgage lenders gain ground, loans performing well (BNN Bloomberg)

- How does the latest Canadian housing downturn compare to past crashes? (Livabl)

- Canadian Mortgage Growth Rate, Weakest in More Than 25 Years (Point2Homes)

- Where are the buyers’ and sellers’ markets in Canada right now? (Real Estate Magazine)

- New Statistics Canada Data Displays Growth In Multi-Unit And Single-Unit Dwellings (Point2Homes)

- B.C. Is Home To The Fastest Cooling Real Estate Markets In Canada (Better Dwelling)

- Fewer housing options have Torontonians moving less, report says (The Star)

- Canadians have been using their homes like ATMs for years. Is that beginning to change? (Livabl)

- National Bank Of Canada: Don’t Take Real Estate Price Increase As A Sign Of “Vigour” (Better Dwelling)

- As Toronto housing stabilizes, bidding wars make a comeback (BNN Bloomberg)

- Toronto house prices are on the rise — again (The Star)

- As Vancouver housing struggles, home prices are increasing in these 6 BC markets (Livabl)

- Healthy Housing Starts for Canada (Point2Homes)

- Ontario Real Estate Association calls on Ottawa for relaxed mortgage rules (BNN Bloomberg)

- Canadian home prices hit decade low for growth (Livabl)

- Montreal homes are selling almost as fast as they’re listed (Livabl)

- Slowest lending growth in 25 years reveals the true impact of mortgage stress tests (Vancouver Sun)

- Don’t expect Canada’s housing market to catch fire again any time soon: RBC (Livabl)

- Alternative lenders increase share of slowing Canadian mortgage market: CMHC (BNN Bloomberg)

- The 7 hottest housing markets in Canada right now (Livabl)

- Housing affordability is so bad most Canadians are open to moving (Livabl)

- Canadian Household Borrowing Rates Have Nearly Fallen Back To Last Year’s Levels (Better Dwelling)

- Survey Reveals Canadians Have Mixed Feelings About The Real Estate Market (Building.ca)

- Home sales edge higher in June, with strong gains in Ontario, Quebec (CBC)

- Canada’s Weakest Housing Markets Now Include Toronto, Vancouver (Huffington Post)

- What it costs to rent a home across Canada (Livabl)

- Back from the brink: How Home Capital fought to win back confidence (BNN Bloomberg)

- Big Data Week Offers Clues on Canadian Rates and Economic Outlook (Bloomberg)

- House Prices Are Falling In 25 Canadian Communities ― Here’s The Scoreboard (Huffington Post)

- Amid affordability concerns, demand for Toronto condos intensifies (Canadian Real Estate Wealth)

- Feds should assess housing ‘broadly,’ revisit mortgage rules: ATB CEO (BNN)

- Toronto set for record apartment surge after rent control lifted (BNN)

- Bank of Canada Holds Rates Amid Heightened Trade Tensions (CMT)

- Loonie near 2019 high after central bankers take dollar on wild ride (BNN)

- First-Time Home Buyer Incentive doing little to help buyers break into Vancouver market (CityNews)