Industry & Market Highlights

The next move: no move for BoC

The next rate setting by the Bank of Canada will be on March 6th and market watchers are not expecting any change.

Governor Stephen Poloz set a fairly dovish tone in his recent speech to the Chamber of Commerce of Metropolitan Montreal. Poloz called the bank’s current rate of 1.75%, stimulative because it is still below the rate of inflation, which is running at about 2.0%. And Poloz said the rate’s climb into the neutral range of 2.5% to 3.5% is “highly uncertain”.

A neutral policy rate is one which neither stimulates nor constrains the economy.

The central bank remains concerned about uncertainties that include the effects of higher interest rates on heavily indebted Canadians, stricter mortgage rules, how business investment proceeds in the current global trade environment and the current unexpected slump in the price of oil.

“We will remain decidedly data-dependent as the domestic and international situations evolve,” Poloz said.

Canada’s improving economy has allowed the BoC to raise rates five times since mid-2017, but there has been no movement since last October.

Many analysts now expect there will be no more than two, quarter-point increases in 2019, and then not until later in the year. The bank has no compelling economic reasons to move on rates and the next federal budget will be delivered on March 19th, less than two weeks after the next setting date. That alone would be enough to keep the bank from making any changes.

The campaign for the upcoming federal election, set for October 21st, will also hold the bank in check. By First National Financial.

Residential Market Commentary – The slide continues

We are now through the second January under the tougher, federal B-20 mortgage qualification rules and the housing market continues to cool.

The latest figures posted by the Canadian Real Estate Association show sales dipped 4.0% compared to a year ago, although sales climbed 3.6% month-over-month compared to December.

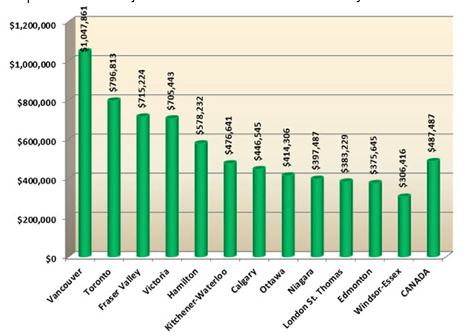

The national average price for a home dropped 5.5% compared to January 2018. It now stands at a little less than $455,000 for all types of housing. That number is, of course, heavily skewed by the high prices in Toronto and Vancouver. When those two markets are factored out the average price falls to about $360,000.

CREA says homebuyers are still adapting to the stricter mortgage rules. The association’s Chief Economist, Gregory Klump, cautions that the B-20 rules and previous tightening will have an effect on economic growth this year.

The number of homes that went on the market in January edged up 1.0% from December. When than modest increase is combined with the month-over-month rise in sales the ratio of new listings to sales tightened to 56.7%, from 55.3% in December. CREA says that falls within the long-term average and that more than half of all the markets it monitors are considered balanced. By First National Financial.

Residential Mortgage Quarterly Review – Q4 2018

The pronounced downturn in the country’s real estate market has not been enough to get the Canada Mortgage and Housing Corporation to lower the red flag it has been flying for the past nine quarters. The housing agency continues to see a high degree of vulnerability in the overall market.

High prices and the usual suspects

Overvaluation remains the key concern in Victoria, Vancouver, Hamilton and Toronto. The biggest, busiest and most expensive markets in the country continue to dominate the calculations.

The latest figures from the Canadian Real Estate Association show that prices are moderating. CREA reports a 4.9% decrease in the national average price in December, compared to a year earlier. The association is forecasting an overall decline of 4.2% for 2018, compared to 2017. But the association points out that most of that drop is compositional, based on lower sales of high priced homes in Vancouver and Toronto. When sales are weighted to compensate for the two most expensive markets in the country, the price decline comes in at about 1% for a national average of just under $489,000.

CMHC notes these falling prices, especially in British Columbia and Ontario, and says the markets are falling in line with economic fundamentals.

Policy headwinds

CREA continues to point to government policy and rising interest rates as the biggest drags on the housing market. The association is projecting an 11% drop in sales for 2018, and in its latest report shows a 2.5% decline between November and December.

As with CMHC, CREA points to the influence of Toronto and Vancouver on the overall numbers. Slowdowns in these two markets mask on-going improvements in Quebec, led by Montreal, and the Maritimes.

2019 looks a little brighter

Looking ahead to the rest of this year the realtors are a little more optimistic. CREA sees the national average home price gaining about 1.7% to just shy of $500,000. It is also forecasting a very modest decline in sales of about 0.5%.

CREA says economic fundamentals such as population, employment and wage growth remain favourable for the housing market. By First National Financial.

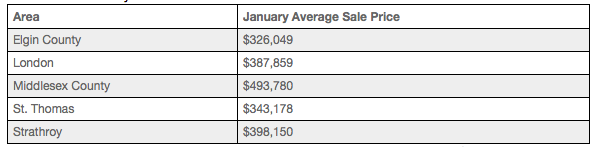

LSTAR’s News Release for January 2019 – Home sales off to a strong start

London and St. Thomas Association of REALTORS® (LSTAR) announced 525 homes* were sold in January, up 17.4% over January 2018. The number of home resales was higher than the 10-year average, with the second highest number of units sold in January since 2010.

“We’re starting to observe signs of movement toward more balance in the marketplace, based on the sales-to-new listings ratio,” said Earl Taylor, 2019 LSTAR President. “In January, the ratio was 60.9% across LSTAR’S jurisdiction. The Canadian Real Estate Association (CREA) says a ratio between 40% and 60% is generally consistent with a balanced market.”

Bucking the trend was St. Thomas, who saw a sales-to-new listing ratio of 80.3% in January, which CREA says represents conditions in the marketplace that favour sellers. St. Thomas also achieved a new high in the last 10 years with its average home sales price.

“In January, average home sales price in St. Thomas was $343,178, up 34% compared to January 2018,” Taylor said. “Going further back, that’s up 68.9% compared to January 2014 and up 86.7% compared to 10 years ago.”

Average home sales price made steady gains in the five major areas of LSTAR’s region. In London, the average sales price was $387,859 up 11.2% from last January, while it was $398,150 in Strathroy, an increase of 41.4% from January 2018.

“Looking at specific geographic areas, London North had an average of $477,615, up 18.1% from the same period last year,” Taylor said. “In London South (which also includes data from the west side of London) had an average sales price of $381,120 in January, up 6.6% compared to January 2018 and up 95.8% compared to just 10 years ago.”

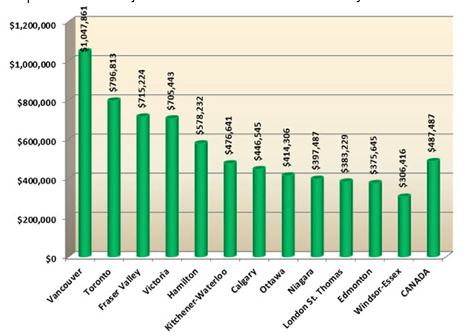

The following chart is based on data taken from the CREA National MLS® Report for December 2018 (the latest CREA statistics available). It provides a snapshot of how average home prices in London and St. Thomas compare to other major Ontario and Canadian centres. By LSTAR.

January Canadian Home Sales Improve

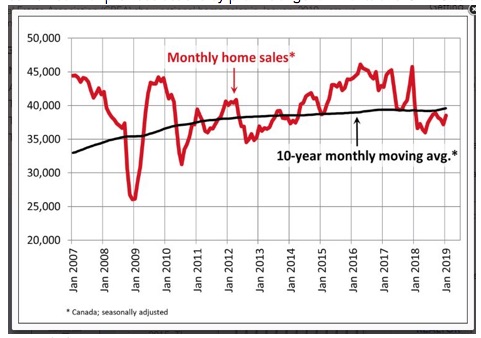

Statistics released today by the Canadian Real Estate Association (CREA) show that national home sales improved in January, climbing 3.6% from December ’18 to January ’19. Last year’s annual sales were the weakest since 2012.

As the chart below shows, national monthly home sales remain below their 10-year moving average and are decidedly lower than in the boom years of 2016 and 2017. Households are still adjusting to the tightened mortgage qualification rules introduced in January 2018. The number of homes trading hands was up from the previous month in half of all local markets, led by Montreal, Ottawa and Winnipeg.

Actual (not seasonally adjusted) sales were down 4% from year-ago levels and posted the weakest January since 2015. Year-over-year (y/y) sales were below the 10-year average for January on a national basis and in British Columbia, Alberta, Saskatchewan, Ontario and Newfoundland & Labrador.

Housing market conditions remain weakest in the Prairie region, and the Lower Mainland of B.C. Housing has been more fragile than the Bank of Canada expected, notwithstanding the tighter mortgage regulations combined with previous actions by provincial governments and CMHC to slow housing activity. The slowdown in housing has contributed meaningfully to the weakness in Canadian economic activity.

New Listings

The number of newly listed homes edged up 1% in January, led by a jump in new supply in Greater Vancouver and Hamilton-Burlington.

With sales up by more than new listings, the national sales-to-new listings ratio tightened to 56.7% compared to 55.3% posted in December. This measure of market balance has remained close to its long-term average of 53.5% for the last year.

Based on a comparison of the sales-to-new listings ratio with the long-term average, more than half of all local markets were in balanced market territory in January 2019.

There were 5.3 months of inventory on a national basis at the end of January 2019, in line with its long-term average. That said, the well-balanced national reading masks significant regional differences. The number of months of inventory has swollen far above its long-term average in Prairie provinces and Newfoundland & Labrador; as a result, homebuyers there have an ample choice of listings available for purchase. By contrast, the measure remains well below its long-term average in Ontario and Prince Edward Island, consistent with seller’s market conditions. In other provinces, sales and inventory are more balanced.

Home Prices

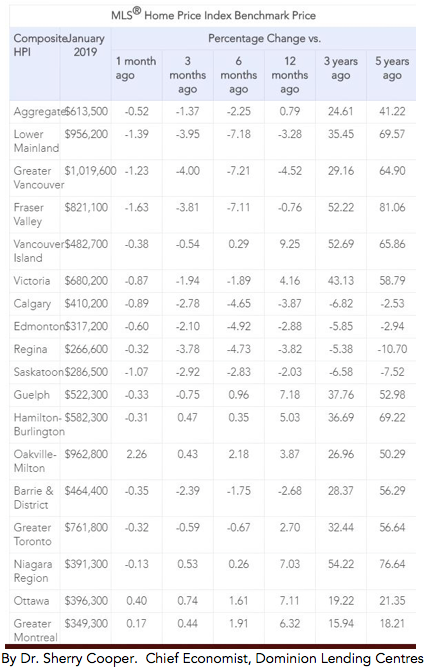

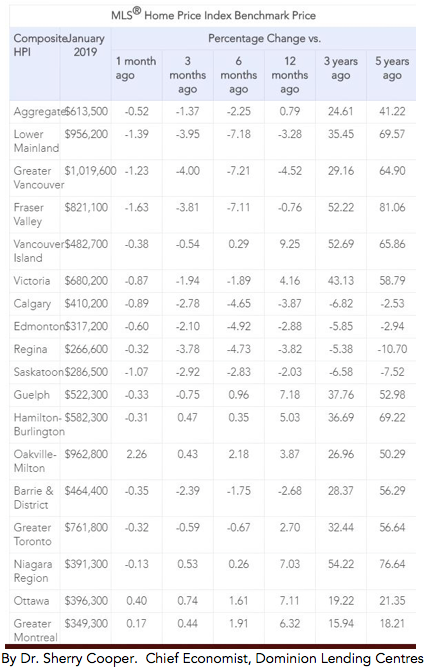

The Aggregate Composite MLS® Home Price Index (MLS® HPI) was up 0.8% y/y in January 2019 – the smallest increase since June 2018.

Following a well-established pattern, condo apartment units recorded the largest y/y price increase in January (+3.3%), followed by townhouse/row units (+1.5%). By comparison, two-storey single-family home prices were little changed (+0.1%) while one-storey single-family home prices edged down (-1.1%).

Trends continue to vary widely among the 17 housing markets tracked by the MLS® HPI. Results were mixed in British Columbia. Prices were down on a y/y basis in Greater Vancouver (-4.5%) and the Fraser Valley (-0.8%). By contrast, prices posted a y/y increase of 4.2% in Victoria and were up 9.3% elsewhere on Vancouver Island.

Among housing markets tracked by the index in the Greater Golden Horseshoe region, MLS® HPI benchmark home prices were up from year-ago levels in Guelph (+6.8%), the Niagara Region (+6.8%), Hamilton-Burlington (+6.4%), Oakville-Milton (+3.3%) and the GTA (+3%). Home prices in Barrie and District remain slightly below year-ago levels (-1.1%).

Among Greater Golden Horseshoe housing markets tracked by the index, MLS® HPI benchmark home prices were up from year-ago levels in Guelph (+7.2%), the Niagara Region (+7%), Hamilton-Burlington (+5%), Oakville-Milton (+3.9%) and the GTA (+2.7%). By contrast, home prices in Barrie and District remain below year-ago levels (-2.7%).

Across the Prairies, supply is historically elevated relative to sales, causing benchmark home prices to remain down from year-ago levels in Calgary (-3.9%), Edmonton (-2.9%), Regina (-3.8%) and Saskatoon (-2%). The home pricing environment will likely remain weak in these cities until elevated supply is reduced.

Home prices rose 7.1% y/y in Ottawa (led by a 9.5% increase in townhouse/row unit prices), 6.3% in Greater Montreal (led by a 9.2% increase in townhouse/row unit prices) and 1% in Greater Moncton (led by a 15.1% increase in townhouse/row unit prices). (see Table 1 below).

Bottom Line

The Bank of Canada meets again on March 6th and it is highly unlikely they will hike interest rates. The Canadian economy has been burdened with a weakened oil sector, reduced trade and a weak housing market. Although job growth has been stronger than expected, wage gains have moderated and inflation pressures are muted.

We are likely in store for a prolonged period of modest housing gains in the Greater Golden Horseshoe, stability or softening in much of British Columbia and further weakening in the Prairies, Alberta, and Newfoundland & Labrador.

Sluggish sales and modestly rising prices nationally are likely in prospect for 2019. While there will still be some significant regional divergences, there is no need for further policy actions to affect demand. Indeed, a growing chorus has been calling for lowering the mortgage qualification rate from the posted five-year fixed rate, currently 5.34%, to closer to the actual conventional rate, about 200 basis points lower.

Economic Highlight

Canadian jobs surge in January as jobless rate rises to 5.8%

January Data From Local Real Estate Boards

In separate releases, the local real estate boards in Canada’s largest housing markets released data this week showing home sales fell sharply in Vancouver, edged upward in Toronto and continued robust in Montreal. Overall, higher interest rates, the mortgage stress test and in the case of Vancouver, measures adopted a year ago by the BC and municipal governments still keep many buyers on the sidelines.

In Vancouver, home sales are in a deep slump, declining 39% year/year in January, though they were up 3% month/month. Sales in January were the weakest for that month since 2009–the depth of the financial crisis. Hardest hurt were sales of luxury properties.

The Vancouver benchmark price fell 4.5%, which was the most significant decline since the recession. The area’s composite benchmark price now has decreased by 7.7% since the cyclical peak in June 2018.

The number of listings rose sharply from a year earlier as sellers rushed to market fearing further price declines. In Vancouver, supply-demand conditions now favour buyers.

Toronto home sales edged higher in January, rising 0.6% year/year. Sales were up 3.4% compared to December 2018. The benchmark price rose 2.7% compared to January 2018. The condo apartment market segment continues to lead the price gains. Toronto area supply-demand conditions remain balanced.

Montreal saw a 15% year/year increase in sales last month. Demand remains robust as the number of active listings fell sharply. Benchmark prices of single-family homes increased 3% year/year, while condos prices rose 2%.

Montreal is now a highly desirable sellers’ market, which is especially true in the single-family home segment in direct contrast to the underperformance of that sector in the GVA and the GTA over the past year.

CMHC Says Overvaluation Decreasing But Housing Still ‘Vulnerable’

The Canada Mortgage and Housing Corporation (CMHC) said this week that the country’s overall real estate market remains ‘vulnerable’ despite an easing in overvaluation in cities like Toronto and Victoria in the third quarter of 2018. CMHC is using old data, as we already have numbers through yearend 2018 and preliminary data for January, all showing that overheating in Toronto and Vancouver has dissipated.

Many Calling for Mortgage Stress Test Review

Local real estate boards, mortgage professionals’ trade groups and some economists are calling for some relief on the stringency of the federal regulator’s mortgage stress test. According to Phil Moore, president of the Real Estate Board of Greater Vancouver, “Today’s market conditions are largely the result of the mortgage stress test that the federal government imposed at the beginning of last year. This measure, coupled with an increase in mortgage rates, took away as much as 25% of purchasing power from many homebuyers trying to enter the market.”

Economists at CIBC and BMO this week highlighted that the tightened qualification requirements for mortgage applicants had slowed activity measurably. While raising the qualification rate by 200 basis points might have made sense eighteen months ago, when housing markets were red hot in Vancouver and Toronto and interest rates were at record lows, we are in a very different place in the economic cycle today.

The Bank of Canada has raised the overnight benchmark policy rate by 75 basis points since the introduction of the new measures, which begs the question of whether 200 basis points is still the right number.

The Office of the Superintendent of Financial Institutions (OSFI) introduced the B20 rules in January 2018 aiming to thwart a credit bubble amid inflated household debt burdens and frothy housing markets. The new rules force people who want a new uninsured mortgage to demonstrate they can manage payments at rates two percentage points above what’s being offered by a lender. The new rules have been very effective in cooling household borrowing and reversing the gains in overheated housing markets.

Indeed, mortgage growth has shrunk to a 17-year low in Canada. Residential mortgage growth was posted at 3.1% in December from a year earlier, the slowest pace since May 2001, and half the growth rate of two years ago.

The slowdown in housing has had a material effect on the economy as a whole. Weakened economic growth has moved the Bank of Canada to the sidelines. While the Bank is now more cautious in jacking up the policy rate to a neutral level, the residential mortgage market is now–in a stress-test perspective–well into restrictive territory. For example, the Bank’s policy rate is at 1.75% (well below the 2.5% rate the BoC considers neutral), while posted mortgage rate used for stress testing is at 5.34%.

This week, OSFI defended the B20 rule suggesting that “The stress test is, quite simply, a safety buffer that ensures a borrower doesn’t stretch their borrowing capacity to its maximum, leaving no room to absorb unforeseen events.”

Canadian Job Market Surges in January

Statistics Canada released its January Labour Force Survey this morning showing employment increases of 66,800 versus expectation of merely a 5,000 job gain. The surge was led by record private-sector hiring and service sector jobs for youth. This is good news for an economy facing considerable headwinds in the oil sector, weakening housing activity, volatile financial markets and falling consumer confidence. If sustained, the strong employment data will ease some concerns about the length and depth of the current soft patch.

Even with the strength in job creation, the unemployment rate jumped 0.2 percentage points to 5.8% as more people looked for work–a sign of strength. This suggests there is more capacity in the economy before inflation pressures begin to mount–a big point for the Bank of Canada. Economic growth is now hovering around 1%, but the Bank of Canada expects it to recover to about a 2% pace in the second half of this year. The central bank will remain on the sidelines until it can verify that a rebound is occurring.

Wage gains remained depressed, a key indicator for the Bank. Average hourly wages were up 2% from a year ago, with pay for permanent employees up 1.8%.

Alberta, which has been flattened by slumping oil prices and production cuts, posted a second consecutive monthly decline in employment. Ontario led the job surge followed by Quebec.

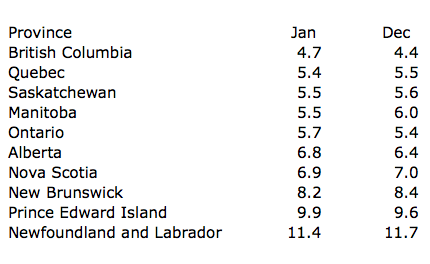

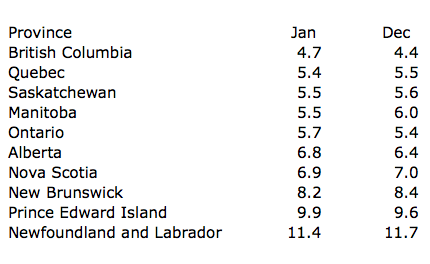

Provincial Unemployment Rates

(% 2019, In Ascending Order)

By Dr. Sherry Cooper. Chief Economist, Dominion Lending Centres

TREB joins chorus demanding B-20 repeal

The Toronto Real Estate Board says B-20 needs to be “revisited” because, in addition to stymieing eager and otherwise qualified buyers, it’s harming the Canadian economy.

The CEO of TREB credited the government for taking action on key housing files, but admonished one of its agencies for implementing a stress test that, combined with rising interest rates, is disastrous for both buyers and the economy.

“One area that needs to be revisited is the imposition of the OSFI-mandated two percentage point mortgage stress test,” John DiMichele said in a statement. “While we saw buyers return to the market in the second half of 2018, we have to have an honest discussion on whether or not today’s homebuyers are being stress tested against rates that are realistic. Home sales in the GTA, and Canada more broadly, play a huge role in economic growth, job creation and government revenues each year. Looking through this lens, policymakers need to be aware of unintended consequences the stress test could have on the housing market and broader economy.”

Mortgage growth hit a 17-year nadir last year—the influence of B-20 writ large—but could the problem be an incoherent bureaucracy rather than modified underwriting guidelines?

“The most important thing to consider with the stress test is the intentions are pure—and that’s to protect the financial system and the housing market,” said Elan Weintraub, director of Mortgage Outlet. “The problem comes in the disjointed way in which it was executed because you have three government agencies—the Ontario government implemented the foreign buyer tax, then the Bank of Canada increased interest rates five times, which is disconnected from OSFI implementing the stress test. Everyone wants a strong housing market, but you have three government agencies without integrated policy implementation.”

The mortgage industry is no stranger to policymakers’ whims, but a history of intervention could pave the way to slightly more consumer-friendly adjustments. Frances Hinojosa believes now that the Toronto and Vancouver metropolitan areas have cooled, OSFI could, at the very least, entertain revising B-20.

“There should be some consideration done by the government to make amendments to the B-20 rules that will still uphold prudent lending guidelines,” said the Tribe Financial managing partner. “If there are any amendments to make, I think they may extend amortizations, which would allow millennials and first-time buyers to become homeowners a little earlier so that they can secure their financial futures.”

In fact, Carolyn Rogers, OSFI’s assistant superintendent of the regulation sector, recently told Bloomberg that the government agency might review B-20 if market conditions change. However, she wouldn’t open the door to rescinding the stress test.

“OSFI monitors the environment on a continual basis and when we determine that adjustments to our standards and guidelines are warranted, we make them.” By Neil Sharma.

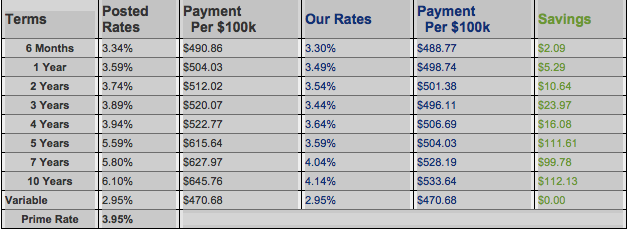

Mortgage Interest Rates

Prime lending rate is at 3.95%. The Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are on hold. Some lenders are offering special promotional rates to try and take more market share. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages more attractive.

Mortgage Update – Mortgage Broker London

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.