Industry & Market Highlights

CMHC 2018 Consumer Survey

CMHC’s 2018 Consumer survey provides insights to what consumers are doing in the mortgage and real estate industry.

MPC Mortgage Professionals Canada Q3 Housing Market Digest

Get third quarter housing market information for Canada and each region including resale market data, housing stats, employment trends and interests rates from the latest Housing Market Digests.

CMHC issues forecast for next two years

The Canada Mortgage and Housing Corporation forecasts a balanced market in the GTA through 2020, with fewer sales expected because of rising interest rates.

“As much as sales are going to come down slightly, we’ll see house price growth be more or less in line with inflation, not the double-digit kind we were accustomed to a few months ago,” said CMHC’s Manager of Market Analysis (Toronto) Dana Senagama. “We’ll likely see higher price growth in the downtown cores of some major GTA areas, like Toronto, Markham and Mississauga, where there are higher concentrations of condominiums.”

Resales will also dip through the end of 2020, added Senagama, due to rising mortgage rates.

The region’s low-rise housing market is forecasted to see a downturn primarily because of land scarcity. However, in suburban areas, like Peel, Durham and York Regions, there will be higher concentrations of single-family detached sales and listings, and that will slow price appreciation.

“There’s not enough serviceable land out there for low-rise homes for singles and townhomes,” said Senagama. “The vast majority of units under construction—about 55,000 of 71,000 units—are high-rise, and that means there are only a finite number of resources, both in terms of machinery and skilled labour. That’s going to affect delivery; the logistics won’t allow it.

“In terms of new construction, the story is going to be more and more condos, and that seems to be where the push is both in terms of policy shift in government and higher house prices dictating demand towards high-rise construction because low-rise is out of reach for first-time buyers, and when the average price is over $1 million, it’s not an easy entry point for any buyer.”

Through this year, Vancouver has born witness to softening home prices across all market segments, and that trend is expected to continue, according to CMHC.

“Over the next two years, we expect the resale market will be characterized by lower sales, higher inventories of homes for sale, and lower home prices compared with the recent market highs in the last two years,” said Eric Bond, CMHC’s principal market analyst for Vancouver. “With the resale market,

expect housing starts to decline in the Vancouver CMA over the next two years, and the majority of the decline will be in the multi-family segment, and specifically in high-rise.” By Neil Sharma.

Interest rate signs point up

As expected the Bank of Canada has boosted its trend-setting overnight rate by a quarter of a percent to 1.75%. It is the 5th hike since rate increases began in mid-2017. The bank rate is now above 1.5% for the first time since December 2008.

The central bank has also signalled its intention to continue raising rates. In the statement that accompanied the October 24th setting the Bank dropped the word “gradually” from its description of the pace of future increases.

That change has some market watchers forecasting that the BoC is planning a string of consecutive increases, which could start as early as December. The Bank also says its rate will have to rise to its “neutral stance” in order to keep inflation in check. Right now the Bank estimates “neutral” as being 3%. A “neutral” rate is one that is neither stimulating nor suppressing the economy.

The central bank also addressed one of its key concerns about the Canadian economy: the imbalance in the household debt-to-income ratio. It still stands at about 170%, or $1.70 of debt for every $1.00 of take-home pay. However, the Bank says those imbalances – while still elevated – are edging lower as Canadians make adjustments to earlier interest rate increases and tougher mortgage rules.

The Bank expects consumer spending to remain strong, but says it will be supported by rising wages and confidence rather than low interest rates and debt. By First National Financial.

Canadian Home Sales Weakened In October

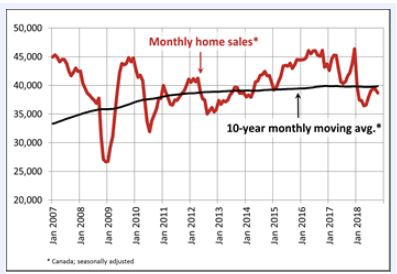

Statistics released today by the Canadian Real Estate Association (CREA) show that national home sales declined for the second consecutive month in October, edging back by 1.6% month-over-month (m/m) and down 3.7% from year-ago levels. Year-over-year sales in October are now about in line with their 10-year monthly average (see chart below). Existing home sales activity has picked up from levels early this year, but it is still considerably below the boom days of 2016 and early-2017 before the foreign purchase tax was introduced in Ontario (in April 2017), the new OSFI rules were implemented (in January 2018), and Bank of Canada tightening gained momentum.

Home transactions last month declined in more than half of all local markets, led by Hamilton-Burlington, Montreal and Edmonton. Although activity did improve modestly in many markets, it was offset by a decline in sales elsewhere by a factor of two. On a year-over-year (y/y) basis, sales were down in slightly more than half of all local markets as lower sales in Greater Vancouver and the Fraser Valley more than offset the rise in sales in the Greater Toronto Area (GTA) and Montreal by a wide margin.

New Listings

The number of newly listed homes edged down 1.1% between September and October, led by the GTA, Calgary and Victoria. The decline in new supply among these markets more than offset an increase in new supply in Edmonton and Greater Vancouver.

As for the balance between sales and listings, the national sales-to-new listings ratio in October came in at 54.2% — close to September’s reading of 54.4% and its long-term average of 53.4%. Based on a comparison of the sales-to-new listings ratio with the long-term average, about two-thirds of all local markets were in balanced market territory in October 2018.

There were 5.3 months of unsold inventory on a national basis at the end of October 2018. While this remains in line with its long-term national average, the number of months of inventory is well above its long-term average in the Prairie provinces and in Newfoundland & Labrador, where downward pressure on home prices is likely to continue. By contrast, Ontario and Prince Edward Island are the two provinces where the measure remains more than one standard deviation below its long-term average pointing to stable prices or modest gains. In other provinces, the number of months of inventory is closer to its long-term average and suggests that sales and inventory are well balanced.

Home Prices

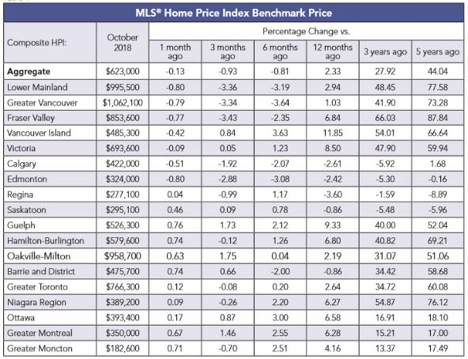

The Aggregate Composite MLS® Home Price Index (MLS® HPI) was up 2.3% y/y in October 2018 with similar gains posted in each of the three previous months.

Following a well-established pattern, condo apartment units posted the largest y/y price gains in October (+7.4%), followed by townhouse/row units (+3.9%). By comparison, one-storey single-family homes posted a modest increase (+0.6%) while two-storey single-family home prices held steady.

Trends continue to vary widely among the 17 housing markets tracked by the MLS® HPI. In British Columbia, home price gains have been diminishing on a y/y basis (Greater Vancouver: +1%; Fraser Valley: +6.8%; Victoria +8.5%; elsewhere on Vancouver Island: +11.8%). Vancouver’s market balance is the weakest in almost six years, and prices for both condos and single-detached homes are now falling outright (the former were previously sturdy).

By contrast, MLS® HPI benchmark price comparisons are improving on a y/y basis among housing markets in the Greater Golden Horseshoe (GGH) region of Ontario that are tracked by the index. Home prices were up from year-ago levels in Guelph (+9.3%), Hamilton-Burlington (+6.8%), the Niagara Region (+6.3%), the GTA (+2.6%) and Oakville-Milton (+2.2%). While home prices in Barrie and District remain slightly below year-ago levels (-0.9%), declines there are shrinking; if current price momentum persists, home prices in December are on track to turn positive compared to December 2017.

Across the Prairies, benchmark home prices remained below year-ago levels in Calgary (-2.6%), Edmonton (-2.4%), Regina (-3.6%) and Saskatoon (-0.9%).

Home prices rose by 6.6% y/y in Ottawa (led by a 7.4% increase in two-storey single-family home prices), by 6.3% in Greater Montreal (driven by a 9.8% increase in townhouse/row unit prices) and by 4.2% in Greater Moncton (led by a 12.4% increase in townhouse/row unit prices) (see table below).

Bottom Line

Housing markets continue to adjust to regulatory and government tightening as well as to higher mortgage rates. The speculative frenzy has cooled, and multiple bidding situations are no longer commonplace in Toronto and surrounding areas. The housing markets in the GGH appear to have bottomed. However, prices still look soggy at the higher end of the single-family home market.

The slowdown in housing markets in the Lower Mainland of BC accelerated last month as the sector continues to reverberate from provincial actions to dampen activity, as well as the broader regulatory changes and higher interest rates.

We are likely in store for a prolonged period of modest housing gains in the Greater Golden Horseshoe, stability or softening in British Columbia and further weakening in the Prairies, Albert, and Newfoundland & Labrador.

Montreal and Ottawa remain the areas of relative strength among the biggest cities. Sales dipped in both cities month-over-month in October, but they are both up a solid 11% from a year ago. In Montreal, we’ve seen some evidence that increased foreign buying activity is mixing with strong domestic fundamentals, pushing benchmark prices up 6.3% y/y. Ottawa has been boosted by a wave a federal government spending and hiring, with price growth similarly running at 6.6% y/y, though now softening from its recent high.

The Bank of Canada is expected to continue gradually tightening monetary policy. Residential mortgage credit growth has slowed to a 17-year low and, for the first time in a decade, borrowers will be refinancing 5-year fixed rate mortgages at higher interest rates.

Bank Of Canada Reports Dramatic Drop in Highly Indebted Borrowers

In a separate report, the Bank of Canada announced this week that the quality of new mortgage lending in Canada had improved markedly owing to tighter mortgage qualification rules and higher interest rates, both of which have pushed marginal buyers out of the market. This was Ottawa’s intention all along in its multiple initiatives to dampen the housing market over the past several years.

The share of new mortgages going to highly indebted borrowers–those with loan-to-income ratios of above 450%–dropped to 13% in the second quarter of this year, down from more than 18% last year. Hence, the Bank believes that there is strengthening resiliency in the financial system, aided in part by an improving economy that has prompted five rate increases since the middle of last year.

The Bank of Canada report on the mortgage market found that not only are the number of new mortgage borrowers declining, but the riskiest ones are being weeded out. The number of new uninsured borrowers considered highly-indebted fell by 39% in the second quarter from year-ago levels, with Toronto posting the most significant declines.

The Bank also commented that the tighter regulations have had one side effect–shifting market share away from the country’s six biggest banks to other institutions such as credit unions and private lenders, which they see as a potential new source of risk. The overall riskiness of new mortgages has decreased “because the proportion of risky borrowers has declined across cities,” the report found. “As well, the regional composition has shifted, with a somewhat larger share of new mortgages recently coming from areas outside Toronto and Vancouver.”

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

Economic Highlights

CMHC issues forecast for next two years

The Canada Mortgage and Housing Corporation forecasts a balanced market in the GTA through 2020, with fewer sales expected because of rising interest rates.

“As much as sales are going to come down slightly, we’ll see house price growth be more or less in line with inflation, not the double-digit kind we were accustomed to a few months ago,” said CMHC’s Manager of Market Analysis (Toronto) Dana Senagama. “We’ll likely see higher price growth in the downtown cores of some major GTA areas, like Toronto, Markham and Mississauga, where there are higher concentrations of condominiums.”

Resales will also dip through the end of 2020, added Senagama, due to rising mortgage rates.

The region’s low-rise housing market is forecasted to see a downturn primarily because of land scarcity. However, in suburban areas, like Peel, Durham and York Regions, there will be higher concentrations of single-family detached sales and listings, and that will slow price appreciation.

“There’s not enough serviceable land out there for low-rise homes for singles and townhomes,” said Senagama. “The vast majority of units under construction—about 55,000 of 71,000 units—are high-rise, and that means there are only a finite number of resources, both in terms of machinery and skilled labour. That’s going to affect delivery; the logistics won’t allow it.

“In terms of new construction, the story is going to be more and more condos, and that seems to be where the push is both in terms of policy shift in government and higher house prices dictating demand towards high-rise construction because low-rise is out of reach for first-time buyers, and when the average price is over $1 million, it’s not an easy entry point for any buyer.”

Through this year, Vancouver has born witness to softening home prices across all market segments, and that trend is expected to continue, according to CMHC.

“Over the next two years, we expect the resale market will be characterized by lower sales, higher inventories of homes for sale, and lower home prices compared with the recent market highs in the last two years,” said Eric Bond, CMHC’s principal market analyst for Vancouver. “With the resale market,

expect housing starts to decline in the Vancouver CMA over the next two years, and the majority of the decline will be in the multi-family segment, and specifically in high-rise.” By Neil Sharma

![]()

Mortgage Interest Rates

Prime lending rate increased to 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates are slowly increasing. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages very attractive.

|

Terms

|

Posted

Rates

|

Payment

Per $100k

|

Our Rates

|

Payment

Per $100k

|

Savings

|

|

6 Months

|

3.34%

|

$490.86

|

3.30%

|

$488.77

|

$2.09

|

|

1 Year

|

3.59%

|

$504.03

|

3.49%

|

$490.86

|

$13.17

|

|

2 Years

|

3.74%

|

$512.02

|

3.54%

|

$496.11

|

$15.91

|

|

3 Years

|

3.89%

|

$520.07

|

3.65%

|

$501.38

|

$18.69

|

|

4 Years

|

3.94%

|

$522.77

|

3.64%

|

$506.69

|

$16.08

|

|

5 Years

|

5.59%

|

$615.64

|

3.50%

|

$499.27

|

$116.37

|

|

7 Years

|

5.80%

|

$627.97

|

4.04%

|

$528.19

|

$99.78

|

|

10 Years

|

6.10%

|

$645.76

|

4.14%

|

$533.64

|

$112.13

|

|

Variable

|

2.95%

|

$470.68

|

2.85%

|

$465.58

|

$5.10

|

|

Prime Rate

|

3.95%

|

||||

|

Please Note: Payment per $100K and possible savings shown above are based on a 25-year ammortization. Rates are subject to change without notice and the rate you receive may vary depending on your personal financial situation. *OAC E&OE. Please reply to this email and I will be happy to provide you with greater detail and determine the best rate available for you.

|

|||||

Please Note: Payment per $100K and possible savings shown above are based on a 25-year ammortization. Rates are subject to change without notice and the rate you receive may vary depending on your personal financial situation. *OAC E&OE. Please reply to this email and I will be happy to provide you with greater detail and determine the best rate available for you.

This edition of the Weekly Rate Minder shows the latest rates available for Canadian mortgages. At Dominion Lending Centres, we work on your behalf to find the best possible mortgage to suit your needs.

Explore mortgage scenarios using helpful calculators on my website: http://www.iMortgageBroker.ca

![]()

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

•Toronto rental boom drives record-breaking sales in apartments (BNN Bloomberg)

•Homeowners worried about paying down debt as interest rates go up (CBC)

•Majority of first-time home buyers maxed out budgets: CMHC (BNN Bloomberg)

•A rise in Canadian home listings is finally giving buyers some choice (Livabl)

•First half of October brings rising home sales to the GTA: Report (Livabl)

•Home search giant Zillow adds Canadian listings to online marketplace (CBC)

•B.C. government moves ahead with speculation tax on vacant homes (CBC)

•Canadian home prices no longer among the fastest growing in the world: Knight Frank (Livabl)

•National Housing Market Flat in September, CREA Data Shows (Canadian Mortgage Trends)

•85% of Canadians won’t grow pot at home as property value concerns weigh, survey finds (BNN Bloomberg)

•Forget home sales — this metric foreshadows where the Canadian housing market is headed (Livabl)

•52% Of Canadians Less Likely To Buy Homes Where Legal Pot Was Grown: Zoocasa Study (Huffington Post)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.

Adriaan Driessen

Mortgage Broker

Dominion Lending Forest City Funding 10671

Cell: 519.777.9374

Fax: 519.518.1081

riebro@me.com

www.iMortgageBroker.ca

415 Wharncliffe Road South

London, ON, N6J 2M3

Lori Richards Kovac

Mortgage Agent & Administrator

Dominion Lending Forest City Funding 10671

Cell: 519.852.7116

Fax: 519.518.1081

loriakovac@icloud.com

415 Wharncliffe Road South

London, ON, N6J 2M3

Adriaan Driessen

Sales Representative & Senior Partner

PC275 Realty Brokerage

Cell: 519.777.9374

Fax: 519.518.1081

adriaan@pc275.com

www.PC275.com

415 Wharncliffe Road South

London, ON, N6J 2M3