The Government of Ontario announced it is reducing the list of businesses classified as essential and ordering more workplaces to close, to prevent the spread of COVID-19. The updated list of essential businesses does include real estate agent services, which the Government has grouped under Financial Services.

In his news conference today, Premier Ford said unnecessary industrial construction will stop, and new starts in residential projects will stop. There will also be higher scrutiny at critical construction sites, such as new hospitals, roads and bridges. The closure will take effect as of Saturday, April 4, 2020 at 11:59 pm.

Check out the full news release for more details.

Again, this is NOT business as usual. LSTAR urges its Members to practise social distancing and use all the tools available to support clients and close transactions remotely, following the guidelines from Public Health Authorities. By LSTAR 2020 President Blair Campbell.

March home sales remain steady

London and St. Thomas Association of REALTORS® (LSTAR) announced that 866 homes exchanged hands in March, an increase of 6.9% compared to March 2019. Units sold are on par with the 10-year average.

“For the first quarter, home sales in 2020 are at 2,170, 12.3% ahead of 2019,” said 2020 LSTAR President Blair Campbell. “But with the COVID-19 pandemic affecting all businesses, there is an expectation the marketplace will be impacted in the coming weeks and months. We’ll have to wait and see what this means for LSTAR’s jurisdiction, based on data for the upcoming monthly cycles.”

“First I want to stress that LSTAR’s highest priority during this challenging time is the safety and well-being of its Members and staff,” Campbell said. “We continue to urge members to practice social distancing and follow the guidelines set by our public health authorities. It is not business as usual.”

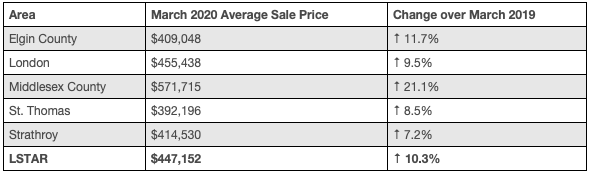

Compared to a year ago, the overall average home price experienced an increase of 10.3%, rising to $447,152 in March. This average sales price includes all housing types, from single detached homes to high rise apartment condominiums. Across the five major areas of LSTAR’s region, average home sales price continued to increase. The following table illustrates last month’s average home prices by area and how they compare to the values recorded at the end of March 2019.

“Looking at average prices in London’s three main geographic areas, London East saw the biggest gain compared to March 2019,” Campbell said.

The average home price in London East was $393,661, up 20.8% from the same time last year, while London North increased 1.4% over to $527,231. In London South (which contains data from the west), the average home price was $458,666, up 13.8% over March 2019. St. Thomas saw an average price of $392,196, an increase of 8.5% from last March.

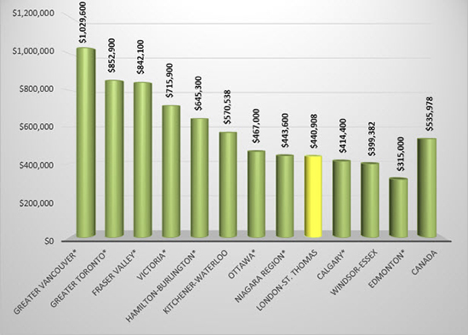

The following chart is based on data taken from the CREA National Price Map for February 2020 (the latest CREA statistics available). It provides a snapshot of how home prices in London and St. Thomas compare to some other major Ontario and Canadian centres.

According to a research report[1], a total of $67,425 in ancillary expenditures is generated by the average housing transaction in Ontario over a period of three years from the date of purchase.

“This means that our March home sales would bring more than $58 million back into the local economy throughout the next few years,” Campbell said. “The business of real estate affects many facets of the economy, so we’ll be monitoring the impacts of the COVID-19 pandemic.” By LSTAR London St. Thomas Association of Realtors.

Area realtors brace for pandemic’s impact despite solid month in March

Homes sales in the London region held their own in March despite the COVID-19 pandemic, but that could change in the coming months, warns the president of the local realtors association.

A total of 866 homes were sold last month, a figure on par with the 10-year average and 52 more than in March 2019, the London and St. Thomas Association of Realtors (LSTAR) says.

But the threat of the coronavirus looms large in the forecast, threatening to derail what was shaping up to be a strong year for the region that also takes in Strathroy, St. Thomas and parts of Elgin and Middlesex counties – though not enough to bring a dramatic drop in home prices.

“Unfortunately, it may not be the banner year that we were hoping,” said Blair Campbell, LSTAR’s president.

“The longer the COVID-19 situation goes on, the more likely that that banner year goes out the window.”

Including March sales figures, area realtors sold 2,174 homes in the first quarter of 2020.

That’s 232 more homes sold than in the same period of 2019, a year that ended up being only the third time in which annual sales topped 10,000, leading to the early optimism for 2020.

The stronger-than-expected numbers for March, coming amid social distancing rules and the shutdown of schools and non-essential businesses to slow the spread of the virus, are a reflection of what until now has been a sizzling hot real estate market, Campbell said.

“The coronavirus hit us mid-month and we were full steam ahead prior to that,” he said.

“We had lots of people that were mid-transaction who felt the need to really act quickly, so I think that’s where the numbers are coming from.”

April will likely be a different story, Campbell said.

“I think we will see, particularly next month, really what that impact” of the coronavirus is, he said.

“I think it’ll impact the total activity, the number of sales.”

Though March numbers don’t reflect it, there are other signs of how the coronavirus is already changing the market.

Open houses across the city have been cancelled and a growing number of showings are being done virtually. Urged to avoid in-person showing, realtors are following strict sanitation on viewings deemed necessary.

“It’s not business as usual, that’s for sure,” said Melissa Laprise, a Century 21 realtor.

“Considering what we’re going through right now, virtual tours are becoming a very, very utilized tool.”

Regardless, Laprise also anticipates a slow April, traditionally one of the strongest months for home sales.

“A lot of clients are holding off until this is clear.”

Nationally, social distancing measures could see resales plunge 30 per cent to a 20-year low and the first nationwide drop in prices since 2009, RBC says.

Campbell, however, wasn’t sure that will be the case in the London region, where the average resale price increased in March to $447,000, a 10.3 per cent jump from March 2019.

“I think what we’ll see is likely a stabilizing and a slowdown in total activity, both on the supply and demand side, so that should keep prices as an equilibrium,” he said, adding he expects the market to rebound in the fall and next year.

“It’s not that people don’t want to buy and sell homes. It’s just much more difficult to do that while staying in your own home.” By Jonathan Juha, With files from Bloomberg.

Canadian housing market recovery may begin by early summer: RBC

Canada’s spring house hunting season — typically the busiest time of the year for home transactions — will be effectively cancelled this year.

The strict social distancing measures that are critical to the fight against COVID-19 will make it all but impossible to follow through with the activities that the conventional home sales process necessitates

That’s the takeaway for the near term Canadian housing picture from RBC Senior Economist and housing market expert Robert Hogue from a thought leadership piece published earlier this week.

“We expect realtors to suspend open houses and cut any private showings to a bare minimum,” he wrote. “There will be plenty of reasons for sellers to wait and see as well. A shock like this one is an inauspicious time to get full value for a property. We expect for-sale inventories to shrink, which will further contribute to stall activity.”

While the outlook for the spring months is bleak, Hogue delivers some much appreciated optimism about a timeline for a housing market recovery. This message is you shouldn’t expect activity to resume overnight, but RBC is currently “penciling in” an early summer “restart.”

Of course, as with all things during this uncertain period, the exact timing is highly dependent on the duration of the COVID-19 crisis and how soon the strict measures are lifted or gradually relaxed.

“We think the recovery will come in stages — taking buyers up to a year to regroup and rebuild confidence amid high unemployment,” wrote Hogue.

Even in an optimistic recovery scenario, Canadian home sales will take a huge hit on the year, with Hogue projecting a nearly 30 percent dive as sales reach a 20-year low at the national level. But looking to 2021, the economist sees a massive sales surge on the horizon when the “temporary shock” of the pandemic sits comfortably in the rearview mirror.

“Exceptionally low interest rates, strengthening job markets and bounce-back in in-migration will generate substantial tailwind. We project home resales to surge more than 40% to 491,000 units in 2021,” wrote Hogue. By Sean Mackay.

Site closed: No new residential construction in ON after April 4

Speaking from Queen’s Park on Friday afternoon, Ontario Premier Doug Ford announced a halt to all residential construction in the province. As of 11:59 p.m. on April 4, the only projects allowed to continue will be those single-family, semi-detached and townhouse properties which have secured either footing or above-grade structural permits. Renovations to residential properties that were initiated prior to April 4 will also be permitted.

While the announcement was hardly unexpected considering the surging number of COVID-19 infections in the province, it comes at one of the worst possible times for Ontario home buyers. Demand for properties, both new and old, continues to be driven by rapid population growth, while active inventory is at record lows in community after community.

“If construction projects are delayed for four or five months, maybe the market will absorb that, and maybe we won’t feel a shock,” says Bosley Real Estate’s David Fleming. “But if you’re talking every single project that was supposed to be started is now delayed six, eight months – or let’s say that it takes longer to start up again after [builders] are given the green light – I do think that in the future you could have that period where you’re expecting the volume to come onto the market – and it doesn’t – and prices go up as a result.”

The question most prospective home buyers may be turning over in their minds is whether the higher prices associated with lower supply will be overpowered by the dip in prices most are expecting in the coming months. According to PSR Brokerage’s president of pre-construction and development, Ryan Yair Rabinovich, the price drops many are hoping for may not materialize.

Resale buyers, he says, unless they’re forced to by their own financial circumstances, are unlikely to sell if home prices fall, especially those who survived the global financial crisis of only a decade ago.

“2008 and 2009 is still fresh in many real estate owners’ minds,” he says. “They realize that it wasn’t actually as bad, and it didn’t take as long to recover, as people initially thought it would take.”

For new product, the likelihood of lower prices is even less likely, as developers are under severe pressure for their projects to remain profitable.

“Ninety-five percent of developers in the GTA use construction loans from banks,” Rabinovich explains. “Banks won’t lend a single dollar toward construction if you don’t have the minimal profit margin in a project.”

While he hopes that construction projects will be allowed to fire up in eight to 12 weeks, Rabinovich says shuttered projects will still face the same scaling-up challenges they dealt with before the COVID-19 crisis, which will only add to the delays.

“It’s not something where Ford unlatches the lock on this thing, and the next day you have all your trades on site. It requires a lot of coordination and lot of time,” he says.

With new construction projects often taking anywhere between four and six years to complete, the effects of the construction halt are impossible to gauge. But one thing is certain: anyone in Ontario who complains about “all the cranes in the sky” today will be feeling their absence soon enough. By Clay Jarvis.

Landlords learn to navigate rent payment uncertainty during COVID-19 crisis

While April 1st has historically been a day reserved for practical jokes and gags, in 2020, there’s little to laugh about, especially when the rent is due.

The first day of April this year was not only when Canada surpassed 9,000 confirmed cases of COVID-19 nationwide, but the first of many months in which tenants and landlords will likely face rent payment difficulties. With the forced closure of non-essential businesses across Ontario, alongside layoffs and reduced staff hours, thousands of residential and commercial tenants have seen their source of income shrink or evaporate entirely. As tenants continue to grapple with forced unemployment, landlords of all sizes must also find the right approach to payments in the weeks and months to come.

“It looks like April seems to be okay, for now,” said Nawar Naji, a Toronto real estate investor and broker with Chestnut Park Real Estate. “The issues are possibly with May and June. As more companies lay off, more people go on EI, I think there will be more issues down the line.”

Naji has four residential tenants, along with clients who have tenants of their own. For April, Naji explained that rental payments don’t appear to be an issue, but some of his tenants have expressed concerns about rent as the shutdown drags on. In the weeks and months ahead, he plans to take a customized, one-on-one approach to his tenants’ rental payments.

“We’re going to talk to them the second, third week of April and see where everybody is at,” said Naji.

For Mark Kenney, President and CEO of Canadian Apartment Properties Real Estate Investment Trust (CAPREIT), tenant payment issues are not a new concept. The ongoing coronavirus crisis has left some tenants within CAPREIT’s 65,000 rental units mired in financial uncertainty, but for those who are facing difficulties, Kenney says that most of them have been open to working on an arrangement with property managers.

“Our compassion hasn’t changed,” said Kenney. “We’ve always, since our inception, made payment plans if somebody has economic disruption, and the pandemic, it’s not the first time people have experienced economic disruption, it’s just on a bigger scale.”

Payment solutions with landlords have varied, ranging from portional monthly payments — in which the remainder of the rent is paid later in the year — to using the tenant’s last-month deposit sum. Greenrock Real Estate Advisors (GREA), a Toronto-based property management and real estate services company with multiple rental buildings, developed a rental assistance program that allows their tenants to use their last month’s rent deposit as a credit towards their regular payments, either in portions or in full.

“GREA is also cognisant of the financial hardships its residents may face during this time,” GREA stated in a press release. “While our three levels of Government have promised various measures of support, it will take time for these relief funds to be disbursed.”

Amid forced closure, commercial tenants are also experiencing rental payment uncertainty, with restaurants and small businesses being among the most vulnerable. The federal government has offered up to $40,000 in interest-free loans to small businesses and not-for-profit organizations in response to COVID-19, though some business owners have argued that this would tack on more debt than many companies can bear. To provide relief, some larger commercial landlords have granted rent deferral options. Ivanhoé Cambridge confirmed to Livabl that it would be providing deferral solutions to certain Canadian retail tenants on a case-by-case basis.

While some landlords have been able to negotiate rental payments with their tenants, others have not been so empathetic. Governments across the country have intervened to varying degrees, with British Columbia banning most evictions during the pandemic and Ontario closing the Landlord and Tenant Board.

“Landlords can still give eviction notices, however, landlords are encouraged to work with tenants to establish fair arrangements to keep tenants in their homes, including deferring rent or other payment arrangements,” reads the Ontario.ca website.

However, there are exploitive outliers.

“I heard a story about a landlord who was coming up with a loan program to tenants, charging them interest. It’s disgusting,” says Kenney. “All landlords are not the same. We shouldn’t be painted with one brush. And all tenants aren’t the same, and they shouldn’t be painted with one brush. I think it’s really important that people exercise compassion and decency.”

Kenney, who said that he is vehemently against evictions right now, believes that more leadership needs to come from the government to protect tenants from landlords, such as those who could issue large rent increases on new construction units in the current environment.

Meanwhile, there have been calls for rent strikes by housing activists, such as Parkdale Organize, who advised residents not to pay rent on April 1st so tenants can “make the reasonable and responsible choice to keep the money they need to live in these uncertain times need support,” according to the Keep Your Rent webpage.

Both Kenney and Naji shared concerns about a possible rent strike’s impact on landlord mortgage payments. Kenney explained that while eligible homeowners can defer mortgage payments, some tenants feel that they don’t need to meet rental obligations, even if they’re still working. He is worried about the 80 percent of small landlords across Canada who are not protected by income from a large volume of units.

“Everybody’s got to pay their obligations and if there’s circumstances where people can’t pay rent or can’t pay a mortgage then they need to work it out together as a team, because we’re all in this together,” said Naji. By Michelle McNally.

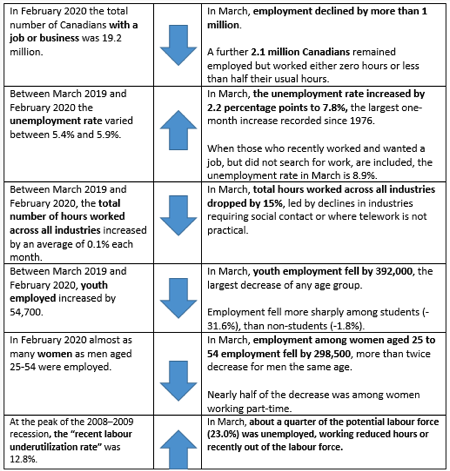

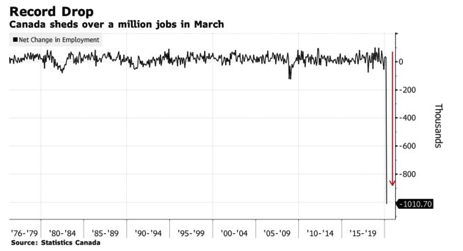

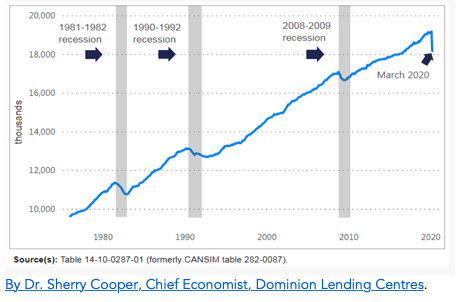

Employment in Canada collapsed in March, with over one million jobs lost, wiping away over three years of job creation in a single month and highlighting the economic pain the coronavirus pandemic has swiftly delivered. The decline in jobs in Canada, on a proportional basis, was steeper than in the U.S. The record plunge was anticipated after officials here revealed that in the span of roughly a month, 5 million people, about 20% of the country’s labour force, have applied for emergency income support. This reflects Canada’s relatively rapid widespread implementation of social distancing.

The sharp increase in unemployment initially caught policymakers by surprise, prompting them to shift their response toward wage subsidies in order to prevent across-the-board layoffs. About 70% of direct stimulus spending is now targeted at keeping workers on payrolls.

The net number of new jobs plunged by 1.01 million from February, the largest decline in records dating back to 1976, Statistics Canada said Thursday in Ottawa. The jobless rate surged from 5.6% in February to 7.8% in March.

Actual hours worked declined by 14% from a year ago, and 15% from the previous month, both records.

The March Labour Force Survey (LFS) results reflect labour market conditions during the week of March 15 to 21. By then, a sequence of unprecedented government interventions related to COVID-19—including the closure of non-essential businesses, travel restrictions, and public health measures directing Canadians to limit public interactions—had been put in place. These interventions resulted in a dramatic slowdown in economic activity and a sudden shock to the Canadian labour market. Today’s data might just be a preview of even worse numbers ahead as the economy heads for its deepest downdraft since the Great Depression.

As bad as these numbers are, Statistics Canada said they do not fully measure the size and extent of the impact of COVOD-19 on Canadian workers and businesses. Additional measures are required to do that which include the number of Canadians who kept their job but worked reduced hours, and the number of people who did not look for work because of ongoing business closures. Of those who were employed in March, the number who did not work any hours during the reference week (March 15 to 21) increased by 1.3 million, while the number who worked less than half of their usual hours increased by 800,000. These increases in absences from work can be attributed to COVID-19 and bring the total number of Canadians who were affected by either job loss or reduced hours to 3.1 million.

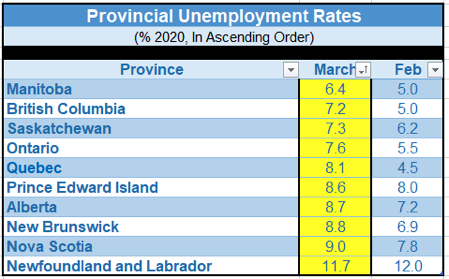

The unemployment rate increased in all provinces except Newfoundland and Labrador and Prince Edward Island. The largest increases were in Quebec (+3.6 percentage points to 8.1%), British Columbia (+2.2 percentage points to 7.2%) and Ontario (+2.1 percentage points to 7.6%). See the table below for the jobless rate in each province.

In March, the number of people who were out of the labour force—that is, those who were neither employed nor unemployed—increased by 644,000. Of those not in the labour force, 219,000 had worked recently and wanted a job but did not search for one, an increase of 193,000 (+743%); because they had not looked for work and they were not temporarily laid off, these people are not counted as unemployed. Since historically the number of people in this group is generally very small and stable, the full monthly increase can be reasonably attributed to COVID-19.

Employment decreased more sharply in March among employees in the private sector (-830,200 or -6.7%) than in the public sector (-144,600 or -3.7%).

The number of self-employed workers decreased relatively little in March (-1.2% or -35,900) and was virtually unchanged compared with 12 months earlier. The number of own-account self-employed workers with no employees increased by 1.2% in March (not adjusted for seasonality). Most of this increase was due to an increase in the healthcare and social assistance industry (+16.7%), which offset declines in several other industries. At the onset of a sudden labour market shock, self-employed workers are likely to continue to report an attachment to their business, even as business conditions deteriorate.

The service sector was hardest hit, with almost all of the 1 million decline in employment concentrated in that category. The largest employment declines were recorded in industries that involve public-facing activities or limited ability to work from home. This includes accommodation and food services (-23.9%); information, culture and recreation (-13.3%); educational services (-9.1%); and wholesale and retail trade (-7.2%).

Smaller employment declines were observed in most other sectors, including those related to essential services, such as health care and social assistance (-4.0%). Employment was little changed in public administration; construction; and professional, scientific and technical services. Surprisingly, employment in natural resources rose despite the collapse of oil prices in March.

Females were also more likely to lose jobs than their male counterparts. Among core-aged workers, female employment dropped more than twice that of men, which might reflect the dominance of males in the construction industry, which was in large measure considered essential work in March. The private sector was responsible for a majority of the losses with employment dropping by 830,200.

Bottom Line: The chart below shows the unprecedented magnitude of the drop in employment last month compared to other recession periods, but this is not your typical recession. This was a government-induced work stoppage to protect us from COVID-19; to flatten the curve of new cases so that our healthcare system could better accommodate the onslaught of critically ill patients. While these are still early days, the data suggests that Canada’s early and dramatic nationwide response to the pandemic has been the right thing to do. We only need to look as near as the United States, where shutdowns were piecemeal, tentative and late. The number of COVID-19 cases is more than 22 times larger in the US than in Canada, while the population is only ten times the size.

To be sure, economic growth in the second quarter will be dismal. The economists at the Royal Bank have just posted a forecasted growth rate of an unprecedented -32% in Q2 and a jobless rate rising to 14.6%. They see a bounceback of +20% growth in the third quarter, although it will take until 2022 until Canadian GDP returns to its pre-pandemic level. Underpinning this forecast is the assumption that the economy will be in lock-down for about 12 weeks, with activity only gradually returning to normal after that.

According to the Royal Bank report, “Home resales are expected to fall 20% this year. Job losses, reduced work hours and income, as well as equity-market declines, will keep many buyers out of the market. Governments and banks have policies in place to help owners through this tough patch which should limit forced-selling and a glut of properties coming onto the market. But that doesn’t mean prices won’t come under downward pressure. As in many other industries, we expect the recovery in housing will be gradual. Low interest rates will be a stabilizing force, though it will take a rebound in the labour market as well as a pickup in immigration before sales really accelerate. Our view is that most of the recovery will occur in 2021.”

Policymakers have been extremely aggressive in providing income and wage supports. The central bank is unlikely to reduce interest rates below the current overnight rate of 0.25%, but the BoC will continue large-scale purchases of government bonds, mortgage-backed securities (along with CMHC), bankers’ acceptances and commercial paper–reducing the cost of funds for the banks and improving liquidity in all markets. “All told, the government support measures add up to 11.5% of GDP making the entire package one of the largest of the developed countries.”

Residential Market Commentary – March limps away

As the old saying goes, March comes in like a lion and goes out like a lamb. For Canada’s housing market, that is all too true this year. And the country’s two biggest markets make it abundantly clear.

The Canadian Real Estate Association reported strong year-over-year sales gains of 26% coming out of February. The Toronto Region Real Estate Board clocked-in with a 49% y/y increase for the first 14 days of March. But then COVID-9 entrenched itself as a bitter reality and things slumped.

Government imposed shutdowns and the implementation of social distancing have pretty much ended open houses and any face-to-face meetings with clients for both realtors and mortgage brokers. Real estate boards across the country have banned such interactions or are strongly recommending against them.

The Toronto-area market plunged in the second half of March, with sales falling to 16% below year ago levels. The month ended with a 12% gain over March of 2019. By comparison, February ended with a 44% increase over a year ago. A rough calculation by one of the big banks puts March activity at 23% below February.

The country’s other hot market, Vancouver, experienced a similar second half collapse in March, but came out of the month with a 46% increase in sales activity. That number is tempered, though, by a particularly weak March, last year.

Market watchers expect a continuing slowdown as the COVID-19 outbreak worsens and anti-virus measures intensify. They caution that property values will likely come under increasing downward pressure and that extremely light activity will make the market vulnerable to erratic price moves. By First National Financial.

Ellis and McKenzie address COVID-19’s impact on borrowers and markets

On Friday afternoon, April 3, 2020, First National’s Jason Ellis, President and Chief Operating Officer, and Scott McKenzie, Senior Vice President of Residential Mortgages, participated in a special webinar dedicated to sharing insights into current conditions in Canada’s mortgage markets and efforts the company is making to assist mortgage brokers and their clients through this difficult time. Here are the key takeaways beginning with Jason’s synopsis of interest rate changes between January and March.

Bank debt, mortgage backed securities and asset-backed commercial paper were well bid and generally trading at relatively narrow spreads to open 2020. Toward the end of January 5-year Canada Bonds were trading around 1.5%, a 5-year fixed rate mortgage was approximately 2.89%, the Bank of Canada overnight rate was 1.75%, the prime rate was 3.95% and adjustable rate mortgages were generally offered at discounts to prime of as much as 1%.

As the reality of the pandemic began to play out, 5-year bond yields fell to as low as 35 basis points in intra-day trading and, with that, fixed mortgage rates also fell to as low as 2.39%. In March, the Bank of Canada cut rates by 50 basis points on three separate occasions.

The Bank of Canada’s overnight administered rate is now just 25 basis points, the lowest since the global financial crisis when the overnight rate was cut 425 basis points between December 2007 and May 2009.

The prime rate has followed the Bank of Canada rate lower, from 3.95% in January 2020 to 2.45% today. But fixed mortgage rates, which did drop briefly to 2.39%, have moved back up to 2.84% today, leaving them effectively unchanged despite the fact that underlying Government of Canada bond yields are 100 basis points lower.

There is a common misconception that 5-year fixed mortgage rates are inextricably linked to 5-year Government of Canada bond yields and that cuts to the Bank of Canada’s overnight rate always result in lower 5-year fixed mortgage coupons. Although the five-year Canada bond yield does act as the base from which other rates are set including 5-year mortgages, the reality is there is not a one-to-one relationship.

Today, spreads on bail-in funds Schedule I banks use to fund mortgages have increased and spreads on mortgage backed securities (“MBS”) that non-bank lenders like First National use for funding have also increased. Effectively, the traditional relationship between mortgage coupons and government yields has broken down and as a result, the coupon on mortgages is higher than it would be otherwise.

A similar phenomenon has taken place for adjustable rate mortgages which are traditionally thought of as being linked to the prime rate. Behind the prime rate, bank and non-bank cost of funds more closely follow the CDOR or the Canadian Dollar Offered Rate. CDOR is an index which references the market where asset backed commercial paper and Banker’s Acceptances (“BAs”) are generally traded. Normally there is a relationship between prime and CDOR that is predictable and stable. However, in this environment, bank clients are drawing down on their committed lending facilities. In order to meet demand for cash, banks are issuing Banker’s Acceptances. This supply of BAs has put pressure on the demand side and yields have increased. The normal relationship between CDOR and other rates like prime is now broken and lenders have been required to eliminate the discount from prime to normalize the relationship between mortgage coupons and the cost of funds. As it costs lenders more to borrow, they must charge more to lend.

Market data show that home purchases declined in the last two weeks of March, and while volume reductions are likely to continue, it’s not possible to predict by how much or for how long.

Government Responses

Because this is more of a main street problem than a Bay Street problem, the government’s response to these economic conditions has been extraordinary – faster and bigger than anything we have ever seen. Some of the responses include the re-introduction of the Insured Mortgage Purchase Program which was first used during the liquidity crisis. It began at $50 billion but was quickly upsized to $150 billion. The Canada Mortgage Bond program has been increased from $40 billion to $60 billion. And the Bank of Canada is now purchasing Canada Mortgage Bonds in the secondary market and has introduced both a Banker’s Acceptance purchase program and a Commercial Paper purchase program along with a Term Repo Purchase Facility with an expanded set of eligible collateral including MBS.

While the government is spending a great deal of money funding initiatives like the Insured Mortgage Purchase program, it is buying triple A-rated securities at extremely elevated spreads and financing those purchases through the issuance of risk-free government debt at materially lower yields. As a result, the government stands to earn significant net interest margin by providing this liquidity. This will ultimately help finance many of the government’s fiscal initiatives.

Despite all of these actions, including unprecedented help for consumers, the market response has been surprisingly muted. To be clear, the programs have been critical in providing liquidity and creating ceilings on spreads in BA, commercial paper and MBS markets. The programs have provided a critical stabilizing effect and spreads have narrowed from their widest levels. However, there is a long way to go before the markets return to anything close to normal conditions.

Mortgage Deferrals

Mortgage deferrals, when granted, continue to incur interest. The deferred interest from a deferred payment is capitalized to the principal of the mortgage at the prevailing coupon rate. Some market commentators have been unfairly critical of this approach. For clarity, mortgage payment deferrals are not financed by a government program. The financial burden falls on the mortgage lenders. Banks and non-bank lenders alike fund mortgages with other debt including covered bonds, deposit notes, commercial paper, and mortgage backed securities. The monthly interest and in some cases principal on these debt instruments must still be paid even while the payments on underlying mortgages are deferred.

At maturity, borrowers with an approved deferral of payment from First National will be offered a rate to renew and their mortgage will be rolled seamlessly into a new term. This should be comforting for those who find themselves in a renewal situation while facing temporary financial hardship related to COVID-19.

Borrowers will not be expected to repay the deferred interest at the time of renewal. Because the deferred interest is capitalized, it will be paid out over the remaining amortization period unless the mortgage is discharged at the end of the term.

If a borrower is granted a deferral by First National, the mortgage will not be reported as “in arrears.” Similarly, if a borrower misses a payment before being granted a deferral, that mortgage will also not be reported to credit rating agencies as “in arrears.”

Mortgage insurers have asked lenders to use deferrals as the way of helping borrowers facing issues rather than entertain other measures such as extending amortization periods. By First National Financial.

Purchasing power to further weaken as small businesses fold

Canadian purchasing power will significantly decline in the near future as nearly one-third (32%) of small business owners admitted that they are not sure they will reopen after the COVID-19 crisis, according to a new study.

The recent survey by the Canadian Federation of Independent Business (CFIB) also found that on average, small businesses lost around $160,000 due to the fiscal and economic ravages of the pandemic.

A separate poll has warned that 47% of Canadians cannot afford to miss even just one day of work as they have neither back-up funds nor benefits. Another 23% also fear that they might lose their current jobs, the Financial Post reported.

“The income level of these people is simply not going to be there, so the question is how can governments respond to it,” pollster John Wright said.

CFIB president Dan Kelly hailed the federal government’s announcement of a wage subsidy – which will be at a maximum of $847 per week – as a vital component of keeping the small business sector liquid.

“Putting in place a 75% wage subsidy was terrific news and we are already hearing from business owners who have delayed layoffs as a result,” Kelly told BNN Bloomberg in an interview.

Fully 68% of the respondents to the CFIB surveyed welcomed the subsidy.

“Stress among business owners is very high and it’s critical that the wage subsidy and other measures are accessible to as many businesses as possible to avoid a flood of permanent closures in the weeks and months to come,” Kelly added. By Ephraim Vecina.

Mortgage Interest Rates

On April 2nd the Bank of Canada’s target overnight rate dropped a third time since the health and economic crisis and is now 0.25%. Prime lending rate is now down to 2.45%. What is Prime lending rate? The prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers. The Bank of Canada overnight lending rate serves as the basis for the prime rate, and prime serves as the starting point for most other interest rates. Bank of Canada Benchmark Qualifying rate for mortgage approval lowered to 5.04% adding on average another $10,000 in increased borrowing capacity, but changes to the mortgage qualifying rate is coming into effect April 6, 2020: Instead of the Bank of Canada 5-Year Benchmark Posted Rate, the new benchmark rate will be the weekly median 5-year fixed insured mortgage rate from mortgage insurance applications, plus 2%.

Banks/Lenders started raising fixed rates due to market volatility and and liquidity concerns. Discounts on variable rates have also been reduced now at Prime plus. Bond markets are not operating as normal and lenders cost for hedging funds has become more expensive also affecting rates.

View rates Here – and be sure to contact us for a quote as rates are moving faster than can be updated.

Mortgage rates to climb further as institutional lenders react to increased risk

Greater risk on the part of financial institutions is the major element driving the recent sharp increases in mortgage rates for new loans, Dominion Lending Centres chief economist Sherry Cooper said.

“These disruptive forces of COVID-19 have markedly reduced the earnings of banks and other lenders and dramatically increased their risk,” Cooper wrote in an analysis recently published by DLC’s online portal.

“That is why the stock prices of banks and other publically-traded lenders have fallen very sharply, causing their dividend yields to rise to levels well above government bond yields,” she added. “Thus, the cost of funds for banks and other lenders has risen sharply despite the cut in the Bank of Canada’s overnight rate.”

The economic shockwaves emanating from the pandemic have proven disastrous, with industry players bearing the brunt of the impact so far.

“The banks are having to set aside funds to cover rising loan loss reserves, which exacerbates their earnings decline,” Cooper explained. “An unusually large component of Canadian bank loan losses is coming from the oil sector. Still, default risk is rising sharply for almost every business, small and large–think airlines, shipping companies, manufacturers, auto dealers, department stores, etc.” By Ephraim Vecina.

Your Mortgage

If you have concerns about your mortgage and the rapidly changing market, please contact us to discuss your needs, concerns and options in detail to protect your best interest.

Ensure that your current mortgage is performing optimally, or if you are shopping for a mortgage, only finalize your decision when you are confident you have all the options and the best deals with lowest rates for your needs.

Here at iMortgageBroker, we love looking after our clients’ needs to ensure you get all the options and the best deals and best results. We do this by shopping your mortgage to all the lenders out there that includes banks, trust companies, credit unions, mortgage corporations & insurance companies. We do this with a smile, and with service excellence!

Reach out to us – let us do all the hard work in getting you the best results and peace of mind!

We encourage you to follow guidelines from our public health authorities:

Middlesex Health Unit

https://www.healthunit.com/novel-coronavirus

Southwestern Public Health

https://www.swpublichealth.ca/content/community-update-novel-coronavirus-covid-19

Ontario Ministry of Health

https://www.ontario.ca/page/2019-novel-coronavirus

Public Health Canada

https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

Factual Statistics Coronavirus COVID-19 Globally:

https://www.worldometers.info/coronavirus/

https://gisanddata.maps.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6