Industry & Market Highlights

Federal budget’s housing measures miss the mark

Incentives in the federal budget for first-time homebuyers crippled by soaring housing costs could worsen affordability woes.

“It’s all about increasing demand for housing without doing much to increase supply, and you don’t need to be an economist to know that if you increase demand without increasing supply, you’ll end up with higher house prices, which is the oppose of the intention,” said Sherry Cooper, Dominion Lending Centres’ chief economist.

Rather than encouraging more buyers to compete for inadequate housing inventory, Cooper believes construction inducements would have been more beneficial.

“The government could have done things to increase supply, like changing the rules around zoning and the Greenbelt to open up more land,” she said. “They could even subsidize housing construction or eliminate some of the red tape and other delays in construction. There are other things that could have been done to incentivize the construction of new housing.”

Instead, the federal government introduced the First-Time Home Buyer Incentive, in which the Canada Mortgage and Housing Corporation will provide first-time buyers up to 10% of the purchase price of a new construction home, and 5% of a resale. Beyond that, a crucial question remains unanswered.

“It remains unclear whether the government would take an equity position in the home or whether this would act as an interest-free loan,” said James Laird, president of CanWise Financial. “This is an important distinction because if the government is taking an equity stake in a home, the amount that the homeowner would have to pay would grow as the value of the home increases.”

Added Cooper: “It appears they’re calling it a shared equity mortgage, which means you pay off the loan when you sell the house. It may well be that you pay off 10% or 5% of the sale price as opposed to that of the purchase price, so we don’t know the details yet, but one needs to consider whether you’re also sharing appreciation—the equity you have in your home—when you sell it. Or, for that matter, even a loss.”

One of B-20’s biggest criticisms is that it’s burdened housing markets across the country with a remedy tailored for the Vancouver and Toronto markets. The budget’s First Time Home Buyer Incentive demonstrates the federal government is both aware of the misstep and committed to rectifying it.

“The government has also placed limits on the First-Time Home Buyer Incentive, including a maximum household income of $120,000, and alluded to putting a ceiling on the program’s qualifying home price,” said Laird. “These criteria demonstrate that this program is aimed at Canada’s small- and medium-sized housing markets, as opposed to major urban centres where many households will exceed the maximum income threshold.”

Still, other housing measures in the budget are confounding. The RRSP Home Buyers’ Plan increased the withdrawal amount to $35,000 from $25,000, however, Laird worries it’s short-sighted.

“This program modification will be helpful in getting Canadians into their first home but will also be a burden because the loan has to be repaid within 15 years, including a minimum of one-fifteenth per year,” he said. “This means that, in the years following their home purchase, a homeowner has the additional responsibility of repaying their RRSP.” By Neil Sharma.

First-Time Home Buyer Incentive reduces qualifying power

A major item from this week’s federal budget will further reduce, rather than enhance, affordability for first-time homebuyers.

The First-Time Home Buyer Incentive—in which the Canada Mortgage and Housing Corporation will provide up to 10% on the purchase price of a new build and 5% on a resale—caps household income at $120,000. The policy further states that “participants’ insured mortgage and the incentive amount cannot be greater than four times the participants’ annual household incomes.”

First-time buyers who think the incentive raises their qualifying power are in for a surprise. Under current qualifying criteria, including the stress test, buyers qualify for homes that are 4.5-4.7% their household income. By using the First-Time Home Buyer Incentive, they would reduce their qualification amount by 15%.

“The total a first-time homebuyer gets between their mortgage and the incentive they receive from the government can’t exceed four times their household income,” said James Laird. “This qualifying criteria is actually stricter than the regular qualifying criteria that exists today. I was surprised the policy itself was launched like this since that section of the budget is called ‘Affordability’ and it actually reduces affordability.”

According to calculations provided, a household with $100,000 of income that puts a 5% down payment on a home, totalling $23,994, qualifies for a $479,888 home. However, with CMHC insurance, that amount declines to $474,129 with a monthly mortgage payment of $2,265.

If the same household participating in the First-Time Home Buyer Incentive uses the maximum purchase price, it qualifies for $404,858. If it uses the minimum down payment of 5% at $20,242, the total mortgage amount becomes $400,000 with a $1,911 monthly mortgage payment.

“The number one issue facing first-time homebuyers is how much they qualify for, not the monthly payment after the home closes, and that’s what this is aimed at,” continued Laird. “They qualify for less if they use this program.”

That might not be the only problem with the First-Time Home Buyer Incentive. A similar program launched by British Columbia’s Liberal government was axed last March by the NDP after it was revealed that only around 3,000 homebuyers used it—far fewer than the expected 42,000.

“Given the evidence provided through one of the largest provinces in the country trying a program that didn’t work, I’m not sure what the federal government thinks will be different,” said Laird, adding that housing measures in the budget were spare on details.

“I was amazed that one of the key parts of their budget hadn’t been properly thought through and didn’t contain detail. I expect that before this program actually goes live, one, we’ll get more detail, and two, it will be amended to take care of this issue.”

Lower mortgage rates as bond yield inverts

The current decline in the bonds market is good news for Canadian fixed-rate mortgage borrowers with rates heading lower.

As the bond market yields invert – as they did Monday in Canada – the cost to banks of borrowing in the market declines, meaning they are able to finance mortgages at a lower rate and pass savings on to customers.

It’s not all good news though because the inverted yield, also seen in US bonds, is often a foreteller of weakening economic conditions and potentially recession.

However, this risk is likely to mean that the BoC will remain highly cautious of increasing interest rates.

An outlook from TD Economics’ Beata Caranci and James Orlando suggests that Canada may need “the real interest rate to remain close to or below zero for a long period” with the deleveraging process only just starting.

There is a growing cohort of investors and analysts that believe the BoC’s next move on rates will be a cut and that is proving good news for variable rate mortgage borrowers too.

Janine White, vice-president of Ratesupermarket.ca told CBC News that rates will climb in the next couple of years but “for the rest of 2019 the prediction is that the variable rate is going to be stable and maybe has a chance of coming down.” By Steve Randall.

Residential Market Commentary – Budget Help for House Hunters

The new federal budget certainly got the attention of house hunters, realtors and mortgage professionals. Unfortunately the announcement turned into a cliff-hanger and we will have to wait for the next episode to find out what is really going to be delivered.

The budget contains two key components aimed at addressing affordability concerns and making it easier for first-time buyers to get a home.

The first is a straight-forward expansion of the current “Home Buyer’s Plan” that allows the use of RRSP money for a down payment. The maximum amount of the RSP withdrawal has been bumped up from $25,000 to $35,000 – but the 15-year pay-back period is unchanged.

The second component is more complicated and some important details were left unexplained in the budget. The “First Time Home Buyer Incentive” amounts to an interest-free loan from Canada Mortgage and Housing Corporation. There are several conditions but it allows CMHC to take an equity stake in a qualifying mortgage. The money will be paid back to CMHC when the property is sold, or sooner if the owner choses.

The cliff-hanger is: how much money will go back to the housing agency. Does the homeowner pay back the amount borrowed, or does CMHC get a share of the increased value of the property? Conversely, if the property value drops does CMHC share in the loss, or is the owner still liable for the full amount of the original loan? The answers are supposed to come in the fall.

Several prominent economists point out, that neither program actually makes housing more affordable. They merely add to the options for taking on debt that will have to be repaid. By some calculations the FTHBI might even decrease the maximum amount a buyer can qualify for.

Mortgage professionals and realtors have their own concerns, particularly about the delay in getting the details delivered. They worry that leaving the announcement until the fall could hobble the spring buying season as house-hunters wait to find out if they will be able to benefit from the federal programs. By First National Financial.

Economic Highlights

Canadian mortgage rates are falling as bond yields slide lower

Yield on 5-year government debt has dipped below 1.5%, its lowest level since 2017. What’s bad news for some is good news for others, and Canadian mortgage-holders are the unexpected beneficiaries of some of the gloom that’s hovering over Canada’s economy.

Fixed mortgage rates have been falling precipitously in recent weeks, as the cost of financing those loans has gotten cheaper. Banks and other lenders get the money that they loan out in mortgages by borrowing it themselves on the bond market, and the yields on five-year bonds have been falling since May 2018.

A five-year Government of Canada bond was yielding just 1.45 per cent on Monday. That’s the first time the figure has been below 1.5 per cent since the summer of 2017.

Last week, the yield curve on long-term lending versus short-term inverted, a rare event that has an uncanny knack for predicting recessions. (For a longer explanation on what an inverted yield curve means, read this.)

Bond yields are heading lower largely because investors think the prospects for the economy are looking dim, so they expect interest rates to start moving lower.

Lower bond yields are generally “not a good sign from an economic standpoint,” says Janine White, vice-president of rate comparison website, Ratesupermarket.ca, “but it’s great for mortgage borrowers.”

That’s because cheaper financing costs are allowing the banks to cut their mortgage rates to try to entice borrowers.

Royal Bank has since cut that rate two more times, first by 10 basis points on March 1 and then by another 15 basis points on March 13. The bank’s five-year fixed rate is now at 3.49 per cent, and other lenders are indeed following suit.

TD Bank currently has a special five-year fixed rate of 3.49 per cent. Smaller lenders are even lower. Dominion Lending Centres is offering 3.29 per cent locked in for five years, while HSBC Canada has a special five year of 3.24 per cent at the moment.

Variable rates moving lower too

And it’s a similar story on the variable rate side — albeit for different reasons.

Unlike fixed rate mortgages which take their cues from the bond market, variable rate mortgages tend to move in conjunction with whatever the Bank of Canada is doing.

And investors are betting that the central bank will soon be moving its rate down, not up. Investors in financial instruments known as overnight index swaps are pricing in zero chance of a hike this year, but about a one-in-five chance of a cut by July, and up to a 44 per cent chance by September.

White says the variable-rate mortgage market is simply pricing in some of the negative economic indicators of late, including lower inflation and an anemic GDP number that showed Canada’s economy actually shrank to close out 2018.

“There’s an increased probability they will actually cut to try to fuel economic growth,” White said, of her expectations for Canada’s central bank.

One of the biggest shifts that occurred in our quarterly March forecast was the removal of any further interest rate hikes from our outlook.

And economists are predicting the same thing.

“One of the biggest shifts that occurred in our quarterly March forecast was the removal of any further interest rate hikes from our outlook,” TD Bank’s chief economist Beata Caranci said in a note on Monday. “We hit the stop button.”

Variable rates have not just stopped going up, they’ve shifted into reverse and gone down in some cases. Rates below three per cent are now common, both at the big banks and at alternative lenders.

The spring is always a key time in the mortgage markets. That’s because the lion’s share of home purchases happen in those months, so lenders try to compete as much as possible on rates to take as big a bite as they can of that business.

Given that, the sudden trend towards cheaper lending could well stick around for a bit, White says.

“Are we still going to be headed for interest rate increases in the next couple of years? Yes,” she says. “[But] for the rest of 2019 the prediction is that the variable rate is going to be stable and maybe has a chance of coming down.” By Pete Evans, CBC News.

![]()

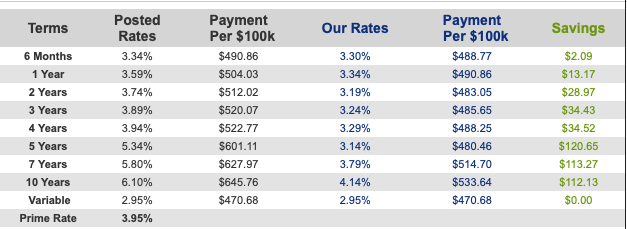

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates have dropped between 10-15 basis points in the last two week. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not significant enough spread between the fixed and variable to justify the risk for most.

| This edition of the Weekly Rate Minder shows the latest rates available for Canadian mortgages. At Dominion Lending Centres, we work on your behalf to find the best possible mortgage to suit your needs.

Explore mortgage scenarios using helpful calculators on my website: http://www.iMortgageBroker.ca |

![]()

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- Looking for a deal on a new home? Try these Canadian cities in 2019 (Livabl)

- More than 150,000 speculation tax declarations still outstanding (Vancouver Sun)

- A first-time buyer’s guide to purchasing a home as a new immigrant to Canada (Livabl)

- For North America’s Most Affordable Homes, Move to Calgary (Bloomberg)

- Toronto, Vancouver housing affordability in ‘crisis’ even amid national relief: RBC (BNN Bloomberg)

- Falling home prices not only in Vancouver, but also in markets around world (Vancouver Sun)

- Toronto’s condo boom is so big, the city has more cranes than New York, LA and Chicago combined (Livabl)

- Vancouver Condos See Biggest Decline In Prices And Sales Since 2009 (Better Dwelling)

- Toronto Condo Prices Reach All-Time High, Sales Drop To 6 Year Low (Better Dwelling)

- Signs point to lower Canadian mortgage rates this year (Livabl)

- Feds’ budget plan won’t do much for first-time homebuyers in Canada’s hottest markets (Ottawa Citizen)

- The Continued Cooling of Real Estate Markets across Canada (Point2 Homes)

- More Non-Resident Home Buyers in Canada, New Data Shows (Point2 Homes)

- The Canadian housing market will be busy this spring — just not for realtors (Livabl)

- Liberals’ Plan To Help Homebuyers Will Mean ‘Turbulence’ In Market, And Won’t Help Pricey Cities: Analysts (Huffington Post)

- This chart shows how far BC’s housing market has fallen since tougher mortgage rules were introduced (Livabl)

- 2019 Canadian budget fails to give first-time homebuyers the help they need, Toronto realtors say (Livabl)

- Canadian mortgage rates are falling as bond yields slide lower (CBC)

- 3 ways to change the mortgage stress test that will actually help Canadian homebuyers (Livabl) – featuring interview with Paul Taylor

- Mortgage Industry Reacts to Liberal Budget (Canadian Mortgage Trends)

- Trudeau’s New Housing Measures Could Mute Home Sales Until Fall (Bloomberg)

- Housing Is a Magnet for Money Launderers in Toronto: Study (Bloomberg)

- Budget’s real estate top-up could push up the price of cheaper homes: Don Pittis (CBC)

- Will federal plans to help first-time buyers make any difference in Canada’s ultra-expensive housing markets? (Livabl)

- Where are Canada’s best buyer’s markets right now? Check out this ‘Housing market scorecard’ (Livabl)

- How powerful lobbyists built big-ticket budget items (Macleans)

- Trudeau’s new housing measures could mute home sales until fall: RBC (BNN Bloomberg)

- Budget’s real estate top-up could push up the price of cheaper homes: Don Pittis (CBC)

- Shared equity mortgages, like those in federal budget, no cure-all for housing affordability woes (Vancouver Sun)

- What the 2019 federal budget means for you (CTV News)