Industry & Market Highlights \

CMHC’s First-Time Home Buyer Incentive Falls Short of Expectations

The Canada Mortgage and Housing Corporation held an official announcement yesterday to release details of its First-Time Home Buyer Incentive (FTHBI).

While officials reiterated how this shared-equity program will help young middle-class Canadian buyers, there were scant new details beyond what has previously been confirmed since the program was first announced in the March budget.

A Recap of the FTHBI First-Time Home Buyer Incentive

- CMHC will contribute 5% of a down payment for the purchase of an existing home, or 10% for the purchase of a new build

- The mortgage must be default insured

- The applicants’ household income must be less than $120,000

- No monthly payments are required, and this amount can be paid back at any time, or upon the sale of the house

- CMHC shares in both the proportionate gains or losses in home value

- The insured mortgage plus incentive cannot be more than four times the participants’ household income (roughly a $565,000 maximum purchase price for someone making a 15% down payment)

- The program will be available to buyers on September 2, 2019

- The government anticipates 100,000 first-time buyers will take advantage of the program over the next three years at a cost of $1.25 billion.

It was also confirmed on Monday that participants would have to repay CMHC’s 5% or 10% contribution within 25 years, or when the property is sold. The incentive amount could also be repaid at any time prior to that and would not be subject to prepayment penalties.

In all cases, the incentive amount would have to be paid back at current fair market valuation, which would be determined by CMHC using an independent appraisal.

Jean-Yves Duclos, the Minister of Families, Children and Social Development, which oversees the CMHC, said the biggest benefit for first-time buyers is that the incentive would reduce monthly mortgage payments.

“The First Time Home-Buyer Incentive is designed to benefit those who need more assistance with housing costs, middle-class Canadians,” Duclos said. “Thanks to mortgage payments that are more affordable, many families will have hundreds of dollars more each month in their pockets.” Duclos said a family buying a $500,000 house through the incentive would save up to nearly $300 a month in interest payments. CMHC provided a full breakdown of potential savings here.

But Will it Work?

There had been many skeptics of the program since it was revealed three months ago, and yesterday’s official announcement did little to quell the criticism.

The key argument is that while the program is aimed to assist young first-time buyers who have been priced out of the most expensive markets, buyers in Toronto and Vancouver will be hard-pressed to find a property under $500,000.

“We think it’s definitely going to have very regional application,” said Paul Taylor, President and CEO of Mortgage Professionals Canada. “In the two most expensive cities, where we would suggest first-time homebuyers need the most support, this solution is not really going to do that.”

On Twitter, CMHC President and CEO Evan Siddall responded by saying: “No program is going to work as well in higher priced markets. Using 2018 data, 2,300 homebuyers would have qualified in Toronto and 1,100 in Vancouver. Around 25% of home sales in Toronto in 2018 were for homes under $500K and 17% in Vancouver.”

Others point out that buyers would actually be able to qualify for a larger mortgage if they don’t use the FTHBI because of the program’s restriction to those with a mortgage less than or equal to four times their total gross income.

“A qualified borrower making $60,000 a year and putting 5% down, for example, could afford a roughly $269,000 home with a regular default-insured mortgage, but only $253,000 using the FTHBI,” wrote RateSpy.com’s Rob McLister. “That, the ~$565,000 maximum purchase price and the need to cough up a chunk of your home value gains are what will limit the FTHBI’s appeal, especially in our biggest cities.”

Siddall has publicly said the CMHC spent months tailoring a “Goldilocks” design so that the program would help some first-time buyers, but not enough to impact the housing market to an extent that would contribute to rising prices.

Adam Vaughan, a Toronto MP and Parliamentary Secretary to the Minister of Families, Children and Social Development, responded to a question about the program’s application in a high-priced city like Toronto.

“Buying a new home in Forest Hill (is), probably unlikely,” he said. “Buying a home here in Mississauga, absolutely a possibility. And on transit lines, it gets you to jobs right across the GTA.” By Steve Huebl.

The affordability fight

A new report out of the University of British Columbia says millennials – who make up the bulk of the highly coveted first-time buyer cohort – are still wildly priced out of the housing market.

The report, titled “Straddling the Gap”, says 25 to 34 year-olds are stuck between high home prices, rising rents, stagnant wage growth and the threat of rising interest rates. It says that – over the next decade, on a national basis – average home prices would have to drop by more than $220,000 (about half their current value), OR wages would have to increase by more than $93,000 a year (about double their current level) in order for housing to be affordable.

In a hot market, like Vancouver, prices would need to drop by about 75%, OR wages would need to increase by about 400%.

Over the past 40 years the home-price-to-income ratio has risen from about 4 to 1, to more than 10 to 1. Millennials are facing 13 years of saving in order to accumulate a 20% down payment, according to the report. Their parents and grandparents typically had to save for just four years.

The UBC report comes as the City of Montreal is finalizing a proposed by-law that, the mayor says, will address affordability concerns. The Montreal market has been picking up steam. According to CMHC, sales are outpacing new listings and there is evidence of overheating.

Montreal mayor Valérie Plante is worried rising prices are forcing people off the island and into the suburbs. A recent study shows 24,000 people left Montreal for outlying neighbourhoods between July 2017 and July 2018.

Montreal’s new by-law would force developers to set aside as much as 20% of new units for affordable housing, social housing or family-sized units. The law is set to take effect 2021. By First National Financial.

Ontario passes legislation to cut red tape, ease housing crisis

The Ontario government has passed legislation which aims to tackle the province’s housing crisis.

The More Homes, More Choice Act will cut red tape, helps keep costs predictable, and encourages new and innovative solutions to housing design, construction, and ownership.

“Our government wants to put affordable home ownership in reach of more Ontario families, and provide more people with the opportunity to live closer to where they work,” said Steve Clark, Minister of Municipal Affairs and Housing. “That’s why we consulted widely and acted swiftly to face the housing crisis we inherited head on. This legislation will make it easier to build more homes, more quickly, giving people more housing options and helping to bring prices down.”

The Act will also support more housing near transit links to help cut commutes, and with greater scope to build secondary units there should also be positive impact on the rental market.

The Act has been welcomed by Tim Hudak, CEO of Ontario Real Estate Association who said action is critical.

“For the first time in our lifetime, home ownership is on the decline across the country: there is simply not enough supply to meet demand. The Canadian Dream of home ownership has been slipping out of reach for thousands of families, millennials, and new Canadians,” he said.

The association has been calling for bold action for several years and Hudak says that the Act’s inclusion of many of its ideas are key to tackling the housing crisis.

“Ontario REALTORS ® applaud Steve Clark, Minister of Municipal Affairs and Housing and the Ford government for their leadership in helping create the next generation of Ontario home owners,” he added. By Steve Randall.

Millennials need a major home price drop or sharp wage increase

Despite some lower prices recently, many young Canadians are still far from able to afford to buy a home according to a new report.

Generation Squeeze says that in many cities there would have to be a major drop in home prices or a significant rise in wages to enable millennials to enter the housing market.

For example, Vancouverites would need their typical full-time wages to increase to $200,400 or four times their current level; or house prices would need to fall by three-quarters (a $795K drop) to make homes affordable (based on CMHC’s measure of households spending no more than 30% of their pre-tax earnings on housing.)

Across Canada, a wage increase to $93,400 a year, almost double current levels; or a home price drop of around half ($223,000) would be required.

“Despite recent nominal declines in housing prices compared to previous years, the gap between the cost of owning a home and the ability of younger Canadians to afford it is at critical levels. If housing markets are levelling out, they remain untenably high,” said Dr. Paul Kershaw, lead author of ‘Straddling the Gap: A troubling portrait of home prices, earnings and affordability for younger Canadians’, and founder of Generation Squeeze.

The report says it now takes a typical young person 13 years to save a 20% down payment on an averaged priced home in Canada, compared to the five years it took when today’s aging population started out as young adults around 1976.

NHS needs extending

Generation Squeeze is calling on the federal government to expand the National Housing Strategy from the current pledge to support 530,000 of the most vulnerable Canadians, to an estimated 1.2 million who are in core housing need.

“A second phase of the National Housing Strategy must be launched to ensure all Canadians can afford a good home — whether renting or owning — by addressing failures in the broader housing market,” said Kershaw.

Generation Squeeze is also calling for the government to embrace “Homes First” as a guiding principle, with policy targets that would ensure that home prices don’t grow faster than local earnings. By Steve Randall.

Financial Service Regulatory Authority of Ontario

On June 8, 2019, FSRA Ontario assumed the regulation of our sector from FSCO. CMBA Ontario is looking forward to being our members’ voice, with continued collaboration with FSRA.

We encourage our members to embrace the initiatives FSRA is taking on in the upcoming year.

There will be a public consultation announced in the coming weeks on Non Conforming High Risk Syndicated Mortgage Investments.

CMBA will be providing feedback to FSRA and we welcome comments from you!

FSRA is committed to the betterment of the industry, and are open to receiving feedback from you. Should you have any comments or concerns, please provide it directly to FSRA

Please continue to watch the FSRA website in the coming weeks for more info as well as our newsletter and social media outlets. By Canadian Mortgage Brokers Association Ontario

Feds announce $10M for RCMP to fight money laundering after ministers’ meeting

The federal government has announced $10 million to help the RCMP prosecute money laundering after a special meeting in Vancouver of Canada’s finance and justice ministers to discuss the pervasive problem.

Finance Minister Bill Morneau says the ministers discussed the importance of prosecuting money launderers and the new funds will help co-ordinate information and hold criminals accountable.

Morneau says the ministers discussed making corporate ownership of real estate more transparent through beneficial ownership registries, though there was no final commitment from provinces on the topic.

He says Ottawa cannot simply create a framework for such registries, because there are issues around privacy and regulation, but he heard around the table that everyone was willing to take the next steps.

The federal government promised $160 million to help fight money laundering in the federal budget and Organized Crime Minister Bill Blair says Canada is building a new capacity to respond, investigate and prosecute the problem.

Ontario has requested federal funding on par with British Columbia to fight money laundering, but Blair says they didn’t discuss specific allocations of resources at the meeting. By The Canadian Press

Economic Highlights

Market Commentary

Before we discuss current events, I’ll answer some reader mail. Mikail Alcott, Potato Sprouting Advocate and Knitting Coach asks “How do you approach a typical day as a Treasury Guy?”

Think big, think positive, never show any sign of weakness. Always go for the throat. Buy low, sell high. Fear? That’s the other guy’s problem. It’s either kill or be killed. You make no friends and you take no prisoners. One minute you’re up half a million in soybeans and the next, boom, your kids don’t go to university and they’ve repossessed your Bentley.

The Basics

It’s been a volatile week as the market sorts through strong Canadian data contrasted with the dovish Fed tone in the US.

5 year GoC bonds are trading at 1.37% with yields as low as 1.28% on Tuesday (on dovish Euro Central Bank chatter and post Raptor parade fatigue) and as high as 1.40% on Wednesday (following strong inflation data)

10 year GoC bonds are trading at 1.48% after touching a low of 1.38% on Tuesday morning and high of 1.49% Tuesday.

Despite the fact that we’re finishing the week off the lows in terms of yield, it’s worth reminding you that just a few months ago, both 5 and 10 year yields were about 50bps higher at 1.90% and 2.00% respectively.

Inflation

On Wednesday morning, reports showed that Canadian inflation quickened in May as the year over year consumer price index (“CPI”) jumped to 2.4% compared to 2.0% last month and median economist forecasts of 2.1%. Core inflation, the measure most closely watched by policy makers, rose 2.1%, the highest level since February 2012. Core inflation allows the Bank of Canada to ‘look through’ temporary changes in total CPI and focus on the underlying trend. Predictably, bonds sold off and yields moved higher by about 7 basis points following the news.

Monetary Policy

Later on Wednesday afternoon the US Federal Open Market Committee (“FOMC”) held their regularly scheduled policy meeting. The Fed held rates steady, as most expected, but raised the prospect for as many as two potential rate cuts later this year. Uncertainty amid intensifying trade tensions and muted US inflation make the cuts plausible if not probable. The overall tone of the Fed’s comments were sufficiently dovish to more than reverse the earlier inflation led rally and bonds yields promptly retreated 8-9 basis points.

The Bank of Canada has kept its key interest rate at 1.75% since October last year and there are mixed opinions about what the Bank will do this year. Wednesday’s inflation report (and continued strong employment data) may help the bank resist the temptation to follow the Fed’s dovish tone.

For newer readers, when monetary policy makers are ‘dovish’ it means they favour a looser or more accommodating policy because, on balance, they want to stimulate the economy. This is accomplished most commonly by lowering interest rates. When Treasury Guy is dovish it means he favours ordering another round because, on balance, he wants to stimulate conversation.

Securitization

On Monday June 10th Laurentian Bank followed on the heels of Merrill’s NHA MBS issue the previous Friday and issued a $340 million pool of single family residential mortgages at GoC +52. 5 year term Residential MBS spreads have been pretty steady and pools have been trading in the range of +48 to +53 for the last 18 months.

On June 13th, Canada Housing Trust priced the regular 5 year CMB issue. The $5.5 billion re-opening of the June 2024 maturity date was priced at GoC+33.5 compared to GoC+36.5 when the bond was first issued in March.

On June 14th RBC brought their eighth CMBS issuance from Real Estate Asset Liquidity Trust (“REAL-T”) since its return to market in 2014. The $446 million issue of sequential pay certificates featured $185 million 3.5 year and $202 million 8.2 year AAA notes with 13% credit support in the from subordinate certificates. The AAA notes were issued at spreads of +107 and +162 respectively. Strong investor support ensured the transaction priced inside initial guidance. Spreads are comparable to those on the last REAL-T issuance in July of 2018.

On Wednesday, RBC launched a $750 million 3-year floating rate covered bond. This is RBC’s seventh covered bond in the Canadian market but first since 2016 (most covered bond issuance happens in Europe). The deal was upsized to $1.25 billion on strong demand and priced at CDOR+14.

Commodities

Let’s head on over to commodity corner for a visit. West Texas Intermediate (WTI) has moved higher after Iran shot down a US military drone this week. This comes on the heels of the recent tanker attacks. What a time to be alive! WTI is now trading around $57.15 per barrel. That’s down from $75 back in October but still up from the low of $27 set back in February 2016. It sounds pretty cheap when you consider that a barrel of Mountain Dew would run you $158.

Gold has also moved sharply higher this month and is trading at a 5 year high of $1,397 per ounce as investors turn to gold (and ammunition) to protect them from a gloomy economic outlook.

Other News

A European Union court has ruled that Adidas’ three stripe pattern lacks a ‘distinctive character’ and declared the trademark invalid. Too bad. I was hoping to trademark my new line of Treasury Guy apparel with a simple circle. The ruling that three parallel equidistant stripes of equal width is generic probably hurts my case. I guess the lesson here is that you should keep your logos sufficiently complicated. Maybe I’ll call the SCTV Logos Galore people for help.

On Wednesday, our Co-founder and CEO Stephen Smith was inducted in to the Canadian Business Hall of Fame. Also inducted was Claude Lamoureux, best known for his role as the CEO of the Ontario Teachers’ Pension Plan. Claude ended his speech with a simple piece of advice I’d like to share. “When faced with a difficult decision in business, choose the path that helps you sleep well, not the one that helps you eat well.”

On that note, I’d like to offer a piece of my own advice. If it’s the weekend, then make the decision that helps you drink well. Once it hits your lips, it’s so good! By First National Financial, Jason Ellis.

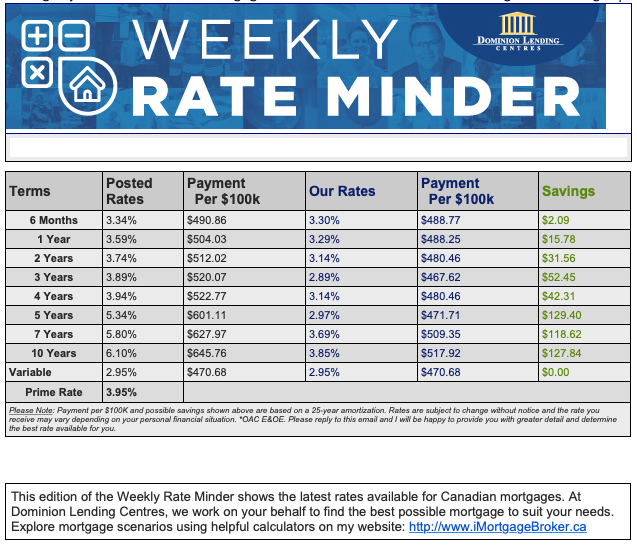

Mortgage Interest Rates

Prime lending rate is 3.95%. Bank of Canada Benchmark Qualifying rate for mortgage approval remains at 5.34%. Fixed rates have dropped between 5-10 basis points in the last two weeks. Deep discounts are offered by some lenders for variable rates making adjustable variable rate mortgages somewhat attractive, but still not a significant enough spread between the fixed and variable to justify the risk for most.

Other Industry News & Insights

Roundup of the latest mortgage and housing news.

From Mortgage Professionals Canada.

- First-Time Home Buyer Incentive to Launch This September (Point2Homes)

- Canadian Housing Market Poll Finds 2/3 Are ‘Concerned’ With Where Things Are Headed (Huffington Post)

- Toronto area new home sales surged 94% annually in May (Livabl)

- Canada’s housing market is more vulnerable than the US’s if a recession hits (Livabl)

- They cook Toronto’s food, and build its houses — but can they afford to live here? (The Star)

- Documentary “Push” explores worldwide affordable housing crisis (Real Estate Magazine)

- Why are Toronto condo sales finally slowing down? (Livabl)

- The CREA’s Recent Statistics Reveal Canadian Home Sales Increased In May 2019 (Building.ca)

- Is Canada’s First-Time Home Buyer incentive a ‘bridge to nowhere’? (Livabl)

- Interest rate cut could put Canadian housing back in bubble risk territory: BMO (Livabl)

- Development offers 8% returns on down payments (Canadian Real Estate Wealth)

- Canadian HELOC Debt Pushes Past The $300 Billion Mark For The First-Time (Better Dwelling)

- Opinion: Will the First-Time Home Buyer Incentive really help you buy a home? (Tricity News)

- Canadian ‘inflation is back’ as rate rises most since October (BNN Bloomberg)

- Low interest rates the new normal: BMO CEO Darryl White (BNN Bloomberg)

- Canada’s annual inflation rate hits seven-month high, analysts dismiss rate cut possibility (Reuters)

- Canada home prices notch first gain in nine months: Teranet (Reuters)

- Housing Market Continues Slow Recovery in May: CREA (Canadian Mortgage Trends)

- Government lays out fine print of new CMHC program that could contribute 10% to price of first home (CBC)

- Canada’s First-Time Home Buyer Incentive Could Backfire, U.K.’s Experience Shows (Huffington Post)

- Expect Canada’s hardest-hit housing markets to ‘stabilize’ through the rest of 2019 (Livabl)

- Federal government to own equity share in new first-time home buyers program (Daily Hive)

- Housing Market Picks Up Steam in Canada After Slow Start to Year (Bloomberg)

- This is where Canadian home sales and prices are moving in 2020: forecast (Livabl)

- Average wages in Canada need to double for millennials to afford a house: study (Daily Hive)

- What a recession would mean for Canada’s housing market (Livabl)

- Dirty money: it’s a Canadian thing (Maclean’s)

- Canada Has Never Had More Homes Under Construction At The Same Time (Better Dwelling)

- ‘Pretty cheap money’: Canadian mortgage rates falling to their lowest level in 2 years (CBC)

- Canada’s mortgage stress tests are broken: economist (Livabl)

- Toronto’s housing market is having a ‘spring awakening’ (Livabl)

There is never a better time than now for a free mortgage check-up. It makes sense to revisit your mortgage and ensure it still meets your needs and performs optimally. Perhaps you’ve been thinking about refinancing to consolidate debt, purchasing a rental or vacation property, or simply want to know you have the best deal? Whatever your needs, we can evaluate your situation and help you determine what’s the right and best mortgage for you.